For more than a decade now, crypto and blockchain technology have continued to conquer hearts and minds all across the globe. Some people think that this is just the beginning, and blockchain technology will transform not only various types of businesses but also our everyday lives as well.

In this article, we will look at the top five crypto and blockchain predictions for 2030 and try to see for ourselves if crypto really is going to change our world forever.

Prediction 1. Bitcoin will cost one million dollars

The very first cryptocurrency Bitcoin (BTC) still has the largest market capitalization in the crypto market, and it seems like it will stay that way in the near future. But what about the distant future?

You’ve probably heard and read numerous forecasts and price predictions for Bitcoin’s next week, next month, or next year’s time periods. However, some experts go even further and predict Bitcoin’s future up until 2030.

Not so long ago, entrepreneur and founder of MicroStrategy Michael Saylor announced perhaps one of the most iconic Bitcoin’s forecasts ever: “If Bitcoin is not going to zero then it’s going to a million.” You might think that it was based on emotions and such predictions should not be taken seriously. Or should they?

Back in January 2022, ARK Invest analyst Yassine Elmandjra published a report, saying that

“The price of a single bitcoin could exceed $1 million by 2030… The future of Bitcoin looks bright” and that “8% of Bitcoin’s circulating supply is now held by ETPs, corporations, and nation states — a sign of maturing institutional adoption”. He is not the only one who thinks that way.

CoinLoan founder and CEO Alex Faliushin agrees with ARK Invest’s report, and he believes, that “In 2030, it could be very realistic that BTC will reach $1,000,000 per BTC, given that many funds are just starting to pay attention to it and many can’t even hold it on their balance sheet due to regulations”.

Mark Basa, HOKK Finance’s Managing Director, is also extremely bullish about Bitcoin’s future and he thinks that we might see Bitcoin to reach $1 million in the next eight years. He says that “A whole new generation of young people are going to be introduced to easier ways to buy bitcoin and interact with crypto… If they learn about bitcoin, and how it’s really their money, they are going to opt out of investing in the most common stocks and look at an asset that just keeps growing and growing due to its limited supply and decentralized nature.”

Arthur Hayes, former CEO of BitMEX also thinks that Bitcoin will rocket sky high up to $1 million, but that will happen not only due to “HODL culture”, but also due to a giant pivot in political and economic policy that we all might face soon enough.

According to Hayes, there are quite a few factors that can push Bitcoin’s price that high, naming: U.S. and EU attempts to reduce dependency on Russian energy and food; Inflation which was already at 40-year highs before the conflict in Ukraine started; Disruption to supply chains and China’s switch to “storable commodities, gold and Bitcoin” to save their assets amid Russia’s freezing of hundreds of billions of dollars worth of its offshore assets by the West.

Hayes argues that Russia’s isolation by the EU will result in the political turmoil between European countries, and in the end it will lead to the disintegration of the European Union.

Hayes says that “As the union disintegrates, money shall be printed in glorious quantities in a pantheon of different local currencies. Hyperinflation is not off the table. And again, as European savers smell what the rock is cookin’, they will flee into hard assets like gold and Bitcoin. The breakup of the EU = $1 million Bitcoin.”

So for now it seems like Bitcoin is destined to grow in price, the only difference lies in the factors that can push it to sky high. One thing can be said for sure – Bitcoin is not going anywhere, and for now there are no reasons to believe that it will be overthrown from its position as a king of cryptocurrencies.

Prediction 2. We all will live in Metaverse

It is hard to argue that the last two years made the words “NFT” and “Metaverse” so famous that even people who don’t interact with crypto whatsoever have heard them at least a dozen times. And that is hardly surprising, considering how many corporations and businesses have embraced that technology.

In the last few years, brands like Nike, Adidas, Burberry, Coca-Cola and many more have launched NFT projects and/or digital goods that are functional in third-party metaverses.

However, some brands go even further and started creating their own metaverse.

Companies like Meta (ex-Facebook), Disney, Apple, Amazon and many other corporations are either working on their own metaverse right now, or planning to do so in the near future. So does that mean that by 2030 we can expect every major business to be presented in their own Metaverse?

Eran Elhanani, co-founder of gaming and metaverse ecosystem GamesPad, believes that “Most companies will have a presence in multiple metaverses”. He expects that most businesses will build out a presence, whether selling retail e-commerce or enterprise products. Elhanani says that “The bigger ones [companies] will most likely have a presence in multiple big [metaverses] just like having stores in many cities.”

For now, major corporations see the Metaverse as a way to expand their reach to customers. But what about us, common folks? Well, some experts predict that by 2030, we all will be living in the metaverses – some way or another.

Melanie Subin, a director at The Future Today Institute in New York City says that “By 2030, a large proportion of people will be in the metaverse in some way”. According to her, most people will simply use it “only to fulfill work or educational obligations,” she said, and others “will live the majority of their waking hours ‘jacked in.’”

Using a “blend of physical and behavioral biometrics, emotion recognition, sentiment analysis, and personal data,” the metaverse will be able to create a customized and enhanced reality for each person, she said.

In fact, these predictions are hardly surprising: according to Precedence Research, the global metaverse market was valued at $51.69 billion in 2021, and it is estimated to surpass around $1.3 trillion by 2030. So even though it is hard to tell if we are all going to live in a Matrix-like universe by 2030, it is safe to say that the expansion of the metaverse will continue to affect every aspect of our lives.

Prediction 3. Full transition to Web 3.0

To put it simply, Web 3.0 is essentially the next generation of the internet. Web3 is supposed to operate as a “trustless” model, meaning you do not put trust in a single third party entity that ensures operability and controls the web service, but rather only in the underlying algorithm. Certainly, that does not fully exclude all the risks, but it can presumably minimize them.

We’re still getting to its fruition, let alone dominance, so for now, Web 3.0 should be seen more like a vision of a new, more advanced version of the internet where power and control will be transferred from corporations and big tech companies into users’ hands. However, by 2030, the situation might drastically change.

A report from Emergen Research concluded that “The global Web 3.0 market size is expected to reach USD 81.5 Billion in 2030 and register a revenue CAGR of 43.7% during the forecast period… The technology is changing how businesses operate and Internet users interact with digital worlds, and the primary objective is to create more intelligent, connected, and open websites. Increasing digitization across majority of sectors is expected to further result in traction of Web 3.0 and drive market revenue growth”

So does that mean that by 2030 we will witness a full transition from Web 2.0 to Web 3.0? Well, Web 3.0 is still being developed, but some of the basic traits of the next generation of the web, like NFTs, Dapps, machine learning, artificial intelligence, and the Metaverse, are already conquering the market. So perhaps Web 3.0 will not replace the current Web 2.0, but it has a great chance of fixing many of the issues that the current internet has, such as centralization, security, big tech’s dominance, modern payment systems, and so forth.

Prediction 4. Blockchain ID for everyone

We all got used to carrying our passports and other IDs in our wallets and pockets. However, this custom might become a relic sooner rather than later.

According to Verified Market Research, Blockchain Identity Management Market size was valued at $142.7 million in 2021 and is projected to reach $41,700 billion by 2030, growing at a CAGR of 87.9% from 2023 to 2030.

By 2030 or maybe even sooner, we might see the rise of blockchain identities. If you look at this idea from the side, blockchain can help to improve systems by solving current identity issues, just to name a few:

- Privacy and efficiency

- Reducing the risks of security breaches

- Theft of private information

- Decentralization and thus more transparency

The main benefit of the blockchain identity system is that individuals always have control of their personal data. An individual determines which of his or her personal data is shared, who can see it, and so forth. And certainly, instead of numerous paper documents, blockchain ID can use a single mobile application.

The concept of blockchain ID is based on the principle of self-sovereign identity (SSI), an approach to digital identity that gives users control over their personal data which allows them to share selected information service providers instead of their entire identity.

SSI means that the interacting parties know they can trust each other because they can see the key information in question. And blockchain-based digital ID could make this a reality.

John Jordan, executive director of the Government of British Columbia’s Digital Trust Service, which already implements blockchain-based ID systems for citizens and local businesses, says that “This is significant because currently there isn’t a way for businesses online to interact with contractual trust in a peer-to-peer way that isn’t intermediated by a third-party login service. Blockchain presents the opportunity to have confidential friendships and business partners on a foundation of trust.”

The main problem with such IDs might lie in their adoption. At least, that’s what Joseph Weinberg, the co-founder of the Shyft Network, believes in. He says that “Firstly, it’s the implementation. Governments aren’t technology companies. They’re not the fastest in the world at implementing most things. That’s just the function of how a government works. The fastest way for people to adopt and adapt to any new technology at a national or global level is a forced requirement, which seems harder to implement since there is a suite of privacy problems that governments juggle. Secondly, it’s controlled. Once identity and digital technologies are embedded in a society, they never leave.”

While it looks like a win-win situation both for businesses and individuals to have a blockchain ID, it might be a challenge for governments to introduce this technology to their citizens. Moreover, such methods might not be popular, especially in democratic countries.

Prediction 5. All countries will issue their own digital currency

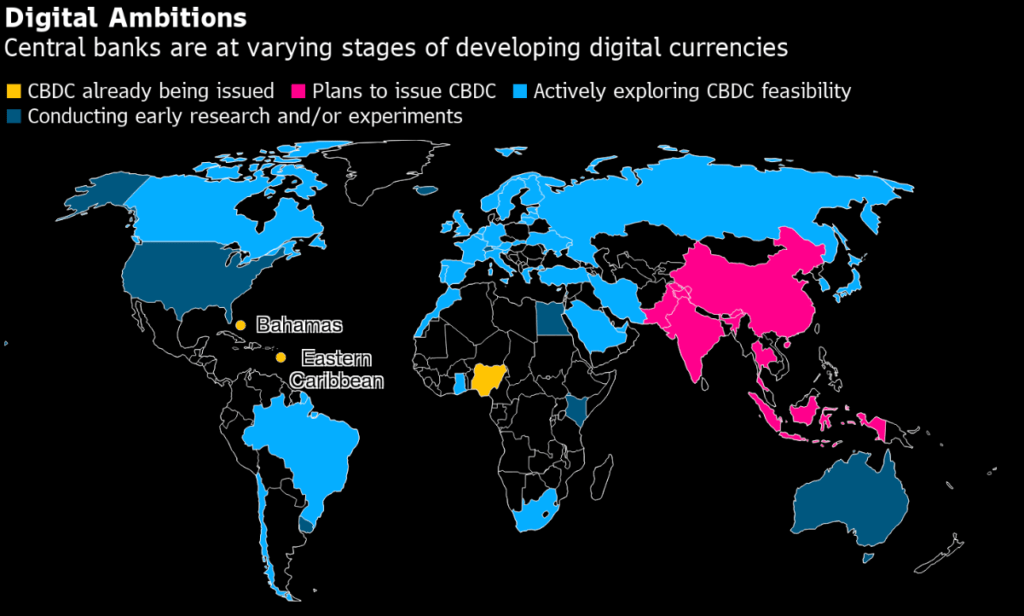

The rise of cryptocurrencies and digital assets not only have sparked an interest from the governments all across the globe, but also made them work on issuing their own Central Bank Digital Currencies (CBDC) – and each of them have their own reasons to do so.

Some countries create their own CBDC in effort to minimize the potential threat from existing cryptocurrencies. China’s digital Yuan and Nigerian eNaira are just one of those examples.

However, countries like Canada, South Korea, Japan and The UK who are also planning to issue their own CBDC in the near future want to provide an alternative electronic payment method and increase financial inclusion. The USA is not yet in that list, however the Federal Reserve is exploring the technology and might implement it to digitize the dollar in the future.

According to the Central Bank Digital Currency Tracker, there are 11 countries who have already launched their CBDC, 33 countries that are actively developing their own digital currency, and 39 countries that are researching the technology and its pros and cons.

In fact, we can expect at least three to five countries to completely replace their national currencies with CBDCs by 2030, according to Dutch fintech-focused non-profit think tank dGen report devoted to geopolitical trends. The report does not reveal the names of the countries, but the think tank hints that China and Sweden might be among these countries.

Deutsche Bank also conducted their own research on CBDCs, concluding that “There is a clear move towards a cashless society (as a mean of payment) and CBDCs is set to progressively replace cash. The question is no longer «if» but «when» and «how».

Issuing their own digital currencies while restricting or even forbidding the use of existing cryptocurrencies allow countries to have their own small and entirely controlled digital world and avoid the decentralized and unregulated nature of crypto.

It seems like this trend will continue to gain momentum, and maybe we will see countries fully switch to digital currencies and give up on cash completely.

Final thoughts

While some of the aforementioned predictions may actually happen even before 2030, others won’t happen until later. Blockchain’s revolution has just begun, and the more companies that adopt Blockchain technology, the sooner we will witness the revolutionization of business processes and our everyday lives.

Up until then, we still have enough time to prepare ourselves for the future that will inevitably come.