Scalping cryptocurrency trading can be a low-risk, high-reward strategy if you have the right tools and knowledge. To help you learn how to scalp trade cryptocurrency, we’ve put together a list of the most important factors to consider, as well as some of the best scalping indicators, trading bots, and tips.

This is a guest post by author and crypto trader Sasha Dokukin. TradeSanta makes every effort to ensure the accuracy of the data on this website but is not responsible for any errors or omissions. You acknowledge that you are using all information at your own risk. The appearance of third-party tools and hyperlinks on this blog article does not constitute an endorsement, guarantee, warranty by TradeSanta. Do conduct your own due diligence before deciding to use any third-party services.

- What is scalping

- How scalping is different in crypto

- How Does Scalp Trading Generate Profit?

- Scalping trading strategy: why & how to use it

- When is the best time to start scalping?

- Disadvantages of Scalping

- Technical Side Of Crypto Scalping

- Best Cryptocurrency Scalping indicators

- Our crypto Scalping trading tips

- Conclusion

- Scalping FAQs

What is Scalping

Scalping is a trading style characterized by creating many small trades very quickly to make small profits in the hope of summing them up at the end. Compared to swing traders, who usually go with a more significant profit holding an asset for a while, scalping strategies include quick small and consistent profits that may add up in substantial gains overtime at the end of the trading day.

When it comes down to scalp trading, the trades usually last from a couple of minutes to a few hours. Scalpers rely heavily on Technical Analysis and use charts with a one or 5-minute timeframe. This crypto trading style requires a lot of focus and attention, and we don’t recommend it for everyone.

How Scalping is Different in Crypto

The cryptocurrency market’s volatility is good for scalp trading as constant price movements open a lot of opportunities. However, many traders opt for scalping Bitcoin (BTC) as a middle ground between volatility and reliability. If you go for scalp trading in crypto and choose altcoins, make sure the coins you choose have high liquidity. Professional traders always stress the importance of having an exit strategy and sticking to your plan, especially when it comes down to crypto trading. And it can’t be any more true for scalpers.

How Does Scalp Trading Generate Profit?

Scalpers rely on their instincts to make decisions. Each trader develops a personal system. Traders trade frequently and take 5–10 minutes to make a move.

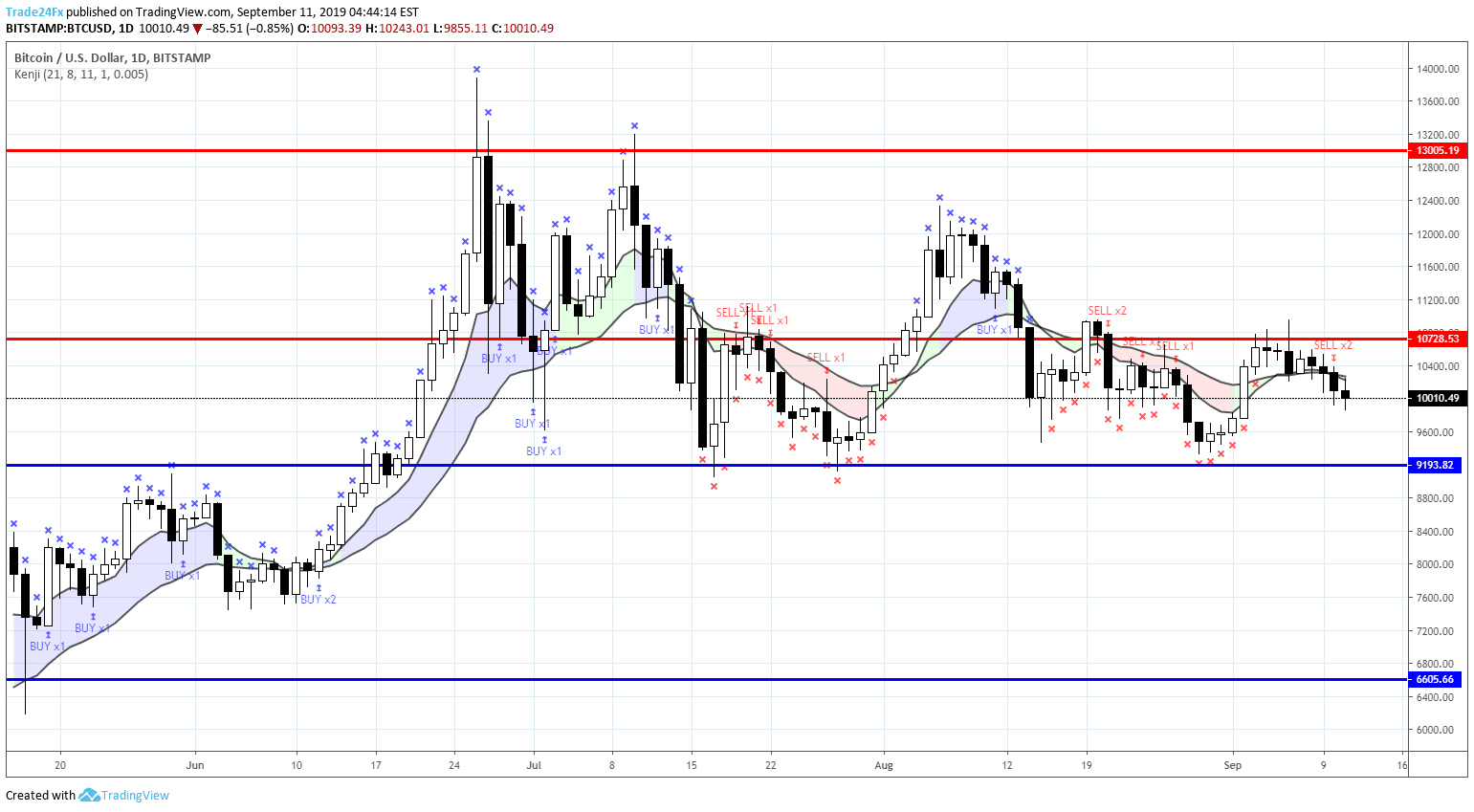

Scalpers trade manually or with automated systems and programs. Before making a move, manual traders should use charting tools like TradingView to analyze market volatility.

Scalping Trading Strategy: Why & How to Use It

Every scalper must have a thorough understanding of their scalping strategies. That is why it is best to stick to a single strategy to avoid unnecessary decisions and failures. Any crypto trader can use these four popular scalp trading strategies right away, from beginner to advanced.

Crypto Range Trading

The range is a price movement between two consistent price levels, high and low, over time. When crypto traders trade ranges, they often go long and short at different times, depending on where the price is in the range.

When a trader has determined the best trading range, they attempt to manually enter positions by buying at support and selling at resistance levels. Scalpers also use limit orders to long (buy-in) crypto at a lower entry price within the range and when the market reaches the support level in a favorable direction.

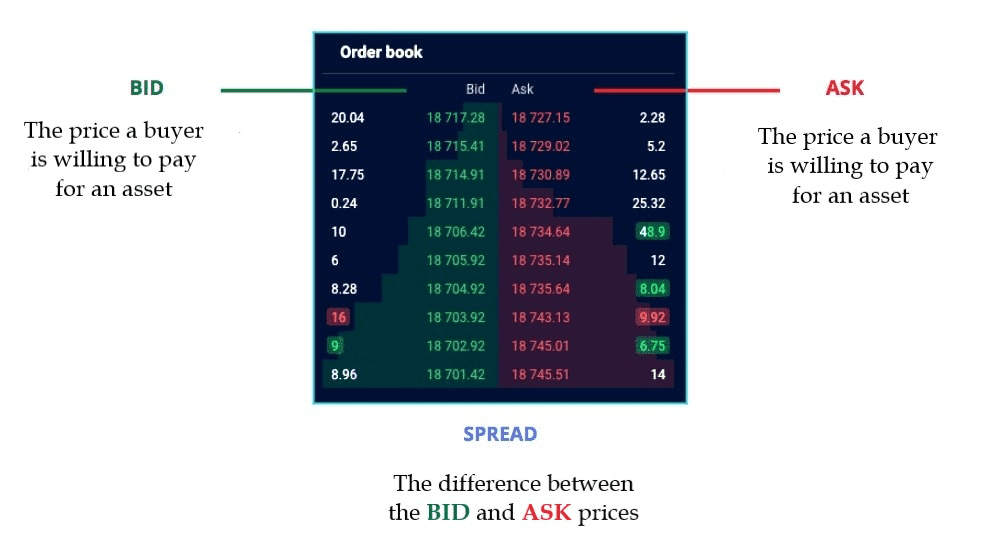

Bid-Ask Spread

Bid-ask spread is the difference between the asking and bid prices. It helps scalpers open a position at the bid or ask price and then close it quickly — a few points lower or higher — to profit. The bid-ask spread can occur in one of two ways:

- Wide Bid-Ask Spread:

When the asking price is higher than usual, while the bid price is significantly lower. - Narrow Bid-Ask Spread:

When there are more buyers than sellers, the asking price is lower, and the bid is higher than usual. Scalpers use this strategy to increase the buy-in frequency and thus balance out the selling pressure.

Arbitrage Strategy

Crypto Scalping Strategy

Arbitrage occurs when a trader makes money by buying and selling the same asset in different markets at different prices. An arbitrage scalper essentially does both at the same time. There are two types of arbitrage trading: spatial arbitrage or pairing arbitrage. A spatial arbitrage trader can simultaneously open long and short positions on different exchanges. The trader is hedging against various trend fluctuations in this way. On the other hand, pairing arbitrage is limited to a single platform. Traders profit from changes in a trading pair, such as shorting the main crypto in the USD/BTC pair to reduce risk.

When is the Best Time to Start Scalp Trading?

The best time frame for scalp trading should be between 5 and 30 minutes charts. The smaller the time frame, the more possible trade setups there are. It’s important to note that this is entirely dependent on the scalping strategy you choose.

The allure of crypto scalping! Within a single day, you can accumulate several profitable trades with significant cumulative profits.

Disadvantages of Scalping

Scalping can be a highly profitable trading strategy, but it does have some disadvantages. And the most significant is transaction costs. The high trading fees in some exchanges can significantly reduce overall profits. Also, scalpers need much mental strength to cope with the fast-paced and high-pressure crypto scalping routine. Finally, this requires sticking to your scalp trading strategies and avoiding trading with emotions.

Technical Side of Crypto Scalping

Crypto traders usually go with 5-second charts when it comes down to scalp trading. The number of trades might reach one hundred. Scalpers usually rely on multiple indicators to execute a trade. The most important is the Relative Strength Index (RSI), Bollinger Bands, and Moving Averages. Scalpers also plot support and resistance levels to place a trade.

Best Cryptocurrency Scalping Indicators

The five best scalping strategy indicators should be learned by traders who want to master the art of scalping:

- Moving Average (MA):

Using the MA to determine where an asset’s price is moving is a great way to get a sense of where it’s going. You can use it in any other trade, reducing the size of your trading windows. SMA stands for the arithmetic moving average, calculated by adding the most recent closing prices and then dividing the price by the number of periods. Exponential Moving Average, or EMA, is another useful indicator that gives traders more weight to recent prices. In contrast, the Simple Moving Average (SMA) gives equal weight to all values. The EMA indicator is considered one of the best indicators for scalping because it responds more quickly to recent price changes than to older price changes. - Support and Resistance:

Knowing where the resistance and support levels are located can help you execute quick scalp trades. Breaks in these levels should be avoided at all costs, as they can easily result in a loss of profits. - SAR:

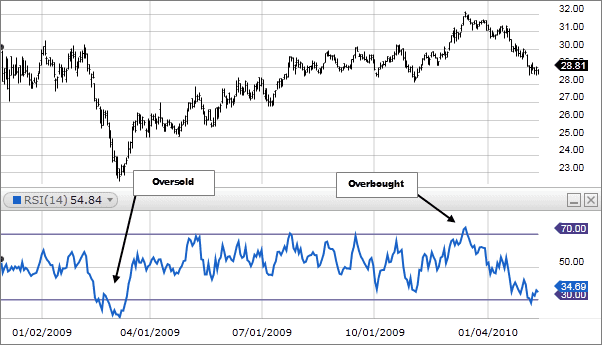

The Parabolic Stop and Reverse or SAR indicator is another excellent indicator that shows a price action trend. During an upward trend, the SAR scalping indicator displays chart points below the price. The indicator displays chart positions above the price during a downward trend, signaling traders that prices are retracting. The SAR indicator helps traders determine an asset’s short-term future momentum and when and where to place a stop-loss order. It’s most effective when markets are trending in the same direction. - Relative Strength Index (RSI):

This indicator is for determining trade entrance and exit points. If the RSI is greater than 70, the position should be sold less than 30. It’s a great idea to buy at that point. - MACD Indicator:

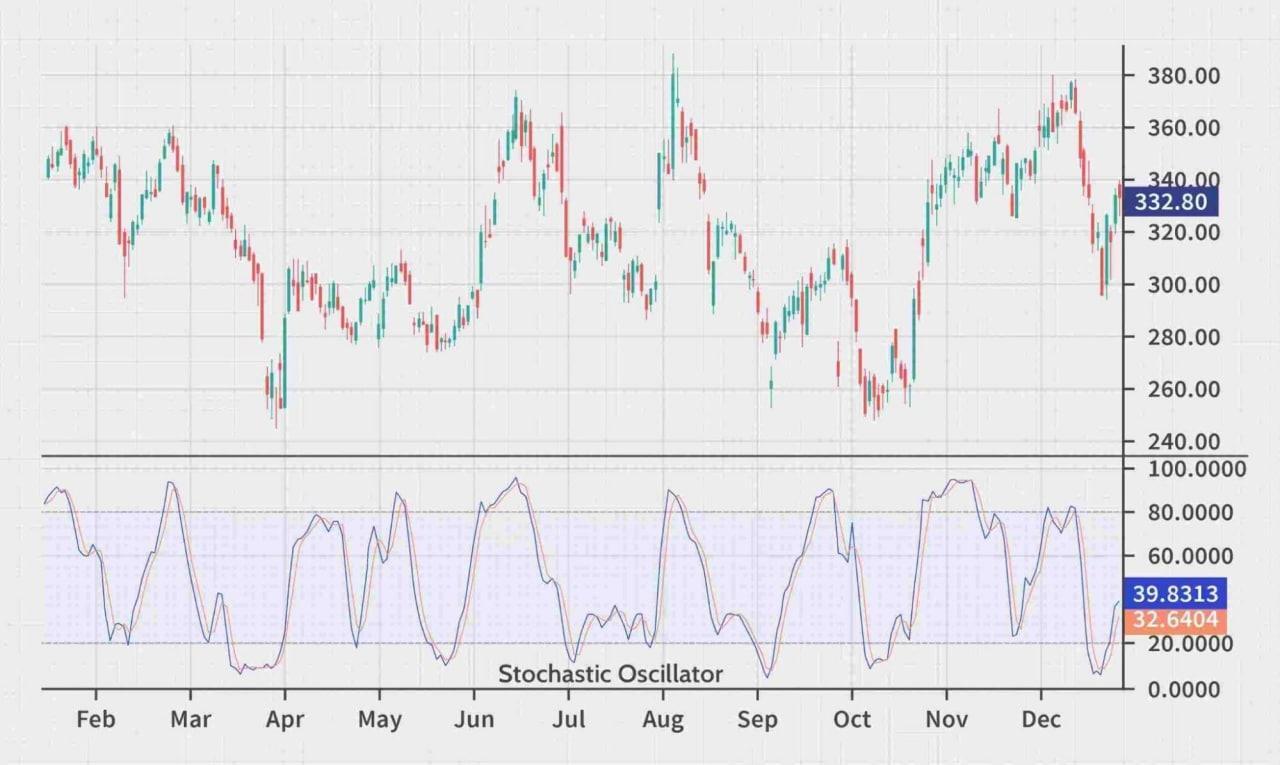

Moving Average Convergence Divergence, or MACD, the indicator is another popular trading indicator. The MACD indicator primarily depicts the relationship between two price-moving averages, calculated by subtracting the 26-day EMA from the 12-day EMA, with the 9-day EMA set as the MACD default setting or signal line to mark buying and selling triggers. - Stochastic Oscillator:

Another popular indicator for crypto scalp trading is the Stochastic Oscillator indicator. It is based on the simple premise that price moves ahead of momentum. As a result, traders use this scalping indicator to get signals of actual movement before it happens. The indicator also assumes that an asset’s closing price trades at the higher end of the trading day’s action price. Despite its complexity, traders regard the Stochastic Oscillator indicator as one of the most reliable tools for buying and selling.

Our Crypto Scalping Trading Tips

Before you start scalp trading your favorite cryptocurrencies, here are some following pointers to help you figure out what to do:

- Start with a demo account.

A crypto demo account or scalping tutorial is an important tool for any trader to gain some user experience with trading tools, especially first-timers. We recommend that you use a demo account to watch the market and make simulated trades with virtual money. - Practice with lots of demo scalp trading

You should practice your crypto scalping strategies and trade confidently before moving on to a live account because there is no risk to your own money. - Pay attention to fees and costs.

Different crypto exchanges have various fees for different types of traders. So taking the time to research your options is essential. While scalp trading has a reputation for being expensive due to the high frequency of trades, some of the best exchanges offer fairly low crypto trading fees. - Get additional resources & education

If you’re new to crypto investing or scalping, it’s also worth looking for any additional tools or educational resources offered by your exchange. You could learn a lot from a crypto training course, videos or webinars, a Bitcoin scalping blog, or even a community forum. Binance, for example, has a fantastic crypto academy, while BitMEX provides a trading community via social media platforms and scalping forums such as Telegram and Reddit. If you prefer non-digital resources, there are many crypto and scalping books available for purchase online. - Get used to Bots & Charts

Without the extensive application of chart indicators and, in many cases, auto trading robots, such as TradeSanta, your crypto scalping strategy will fall short. Scalping is a high-intensity trading strategy based on speed, so any tools that can help you speed up your strategy will be helpful. You’ll have to experiment with several indicators and analysis tools to find the one that works best for you. Remember that while trading bots can be useful tools, they do not guarantee absolute success.

Scalping FAQs

What is Crypto Trading Scalping?

Scalping in crypto is a low-risk trading strategy that involves taking small, frequent profits. A scalper often closely monitors the price of a specific asset and takes advantage of fluctuations. The cryptocurrency market’s volatile nature makes scalping strategies very popular type of crypto trading. But if you simply want to invest your your future profits in crypto, maybe another trading strategy would be a better fit for you.

Which Cryptocurrency is Best for Scalping?

Your trading strategy and risk profile will determine which cryptocurrency is best for scalping. Beginners will usually choose Bitcoin over other altcoins because it is less volatile and thus more stable. You can use various indicators or a Bitcoin scalper bot or EA to automate your trades.

How Much Should You Risk When Scalping?

While no one wants to lose even 1% of their account balance on a single trade idea, it’s also a good idea to review the max exposure to your total account balance.

According to the 5% rule, you must never risk more than 5% of your total account balance across all trades no matter what your trading strategy is. If you lose more than 5% in a single day, it’s probably best to halt trading and resume when the market favors your strategy.

Is Scalping Better than Day Trading?

Scalpers are capable of handling stress, making quick decisions, and acting on them. What trading style is best for you depends on your timeframe. The average scalper makes hundreds of trades per day and stays glued to the markets, but swing traders make fewer trades and checks in less frequently.

Which is More Profitable Scalping or Swing Trading?

Swing traders make fewer but riskier trades which yields more profit. Scalping strategies require more action and the notion that small gains are easier and safer to catch than significant gains. Scalpers make a smaller profit from each trade despite but they make many trades to compensate.

Conclusion

Whether you’re using a 1-minute or 5-minute crypto scalping strategy, the quality of your crypto bot should be a top priority. The crypto bot and your exchange influence the platform’s dependability, the fees you pay, and the resources you have access to.

If you’re new to crypto scalping, be aware of the risks and take advantage of any demos or tutorials available. Above all, ensure that you fully comprehend your charting indicators, signals, and trading bots.

FAQ

What is Scalping?

Scalping is a trading style characterized by creating many small trades very quickly to make small profits in the hope of summing them up at the end.

How Scalping is Different in Crypto?

The notorious volatility of crypto assets is good for this trading strategy as constant price movements open a lot of opportunities for scalp trading in crypto. However, many traders opt for scalping Bitcoin (BTC) as a middle ground between volatility and reliability. In general, scalping strategies might become a great fit for crypto.

When should you set up a stop-loss?

Unlike a limit order, which aims to profit from the current trends, a cryptocurrency trader will use a stop loss order to limit potential losses to no more than they are able to take on.