For a prospective crypto trader choosing the exchange to trade on is always a step into the void with a giant leap of faith. And although decentralized exchanges (DEXes) are closer to the main idea of cryptocurrency — elimination of a single point of failure, centralized crypto exchanges are still cornering the cryptomarket. They are more user-friendly and provide a much wider range of trading options and tools. But what is even more important, they enjoy higher liquidity and allow for interactions with fiat currencies.

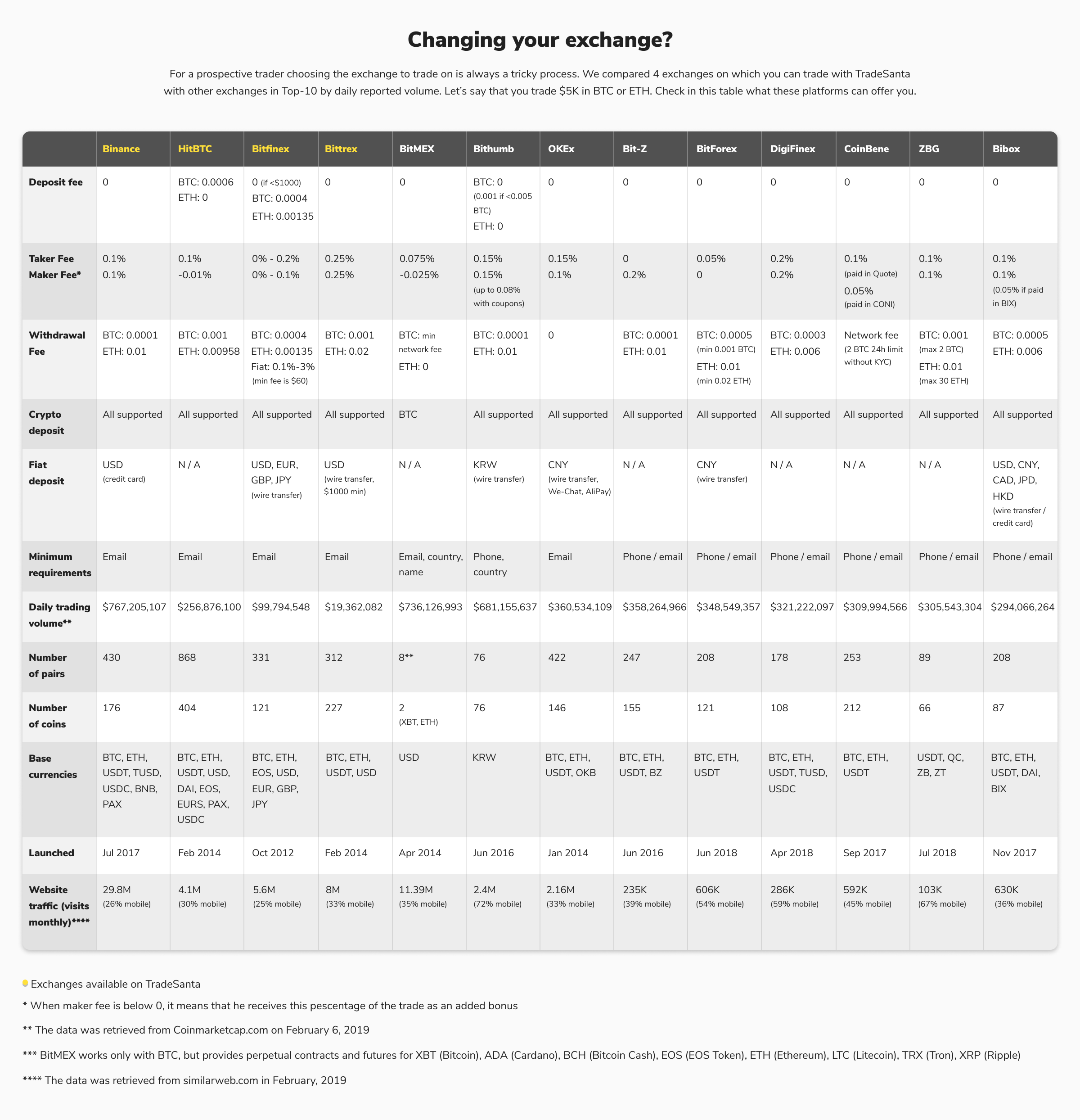

We compared 4 cryptocurrency exchanges on which you can trade with TradeSanta with other exchanges in Top-10 by daily reported volume. Let’s say that you trade $5k in BTC or ETH. Let’s take a look at what these platforms can offer you.

Ease of access

Account setup

Every exchange starts with a login process, and whether it is easy and how fast the KYC is, determine the very first user’s impression. On all the reviewed platforms nothing is required to start but an e-mail or phone number. Then you’ll receive a confirmation code in SMS or e-mail to verify you’re human and you’re all set. It’s just that easy.

Still, we’ll all agree that security is every crypto exchange’s top priority, so in order for your account to be secure Binance, DigiFinex, CoinBene, ZBG, and Bibox require Google Authentification to be set up as well. BitMEX and Bithumb exchanges will also ask you to indicate your country explicitly to comply with all legal restrictions.

But such registration isn’t full KYC-verification yet. On most of the exchanges, full KYC process is optional, but some platforms welcome verified users with enriched functionality and fewer withdrawal restrictions. On many others, interactions with fiat currency are allowed only for verified users. Another dividing criterion is the trading or balance amount — the bigger it is, the more features the crypto exchange is willing to offer you.

Deposit options

There’s no surprise that all platforms support deposits in cryptocurrency as this is quite a simple process both technically and for the user. When it comes to fiat currency, there are more legal and technical complications for an exchange. However, seven out of thirteen exchanges analyzed accept fiat deposits, mostly through wire transfer. Binance and Bibox allow fiat deposits through the credit card and OKX is the outlier with WeChat pay and AliPay support.

Four support USD deposits (Binance, Bibox, Bitfinex, and Bittrex), OKX and Bitforex accept only Chinese Yen, and Bithumb fiat deposits can be made exclusively in South Korean Won. This leaves us with only two multi-currency fiat deposit options — Bitfinex and Bibox, with the former concentrated on European markets and Japanese Yen, and the latter focusing on the Asian region.

You can also read reviews from Crypto Head regarding cryptocurrency exchanges.

Fees

Deposit Fees

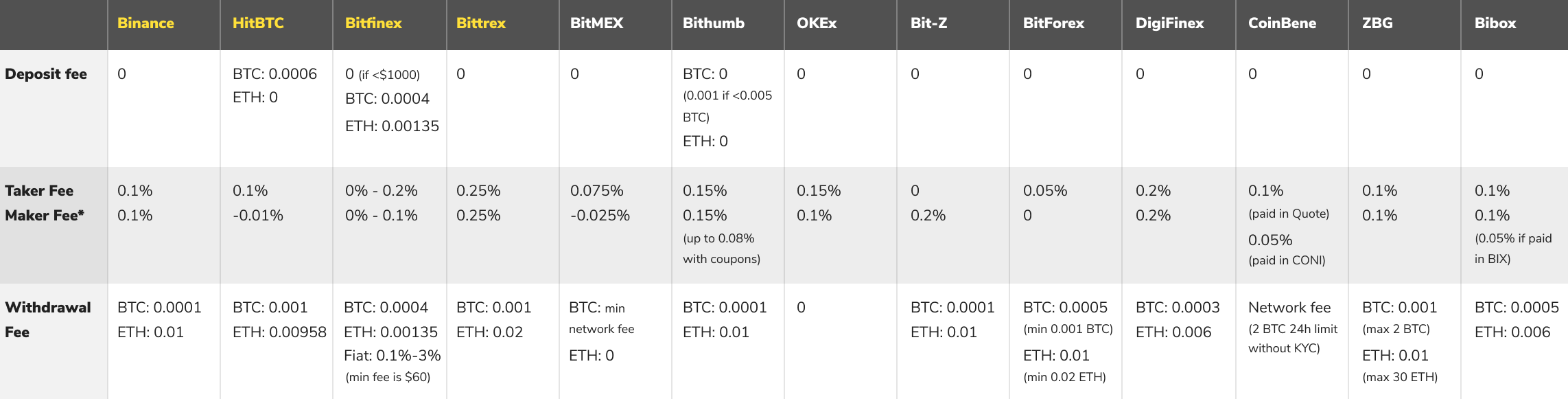

Most of the platforms don’t charge deposit fees for any supported currency regardless of the amount, except for Bithumb, Bitfinex, and HitBTC. On the first two crypto exchanges, there is only a ‘small deposit fee’ (i.e. it is charged when your deposit is below a certain threshold). HitBTC charges a fixed deposit fee for BTC — only one out of more than 400 supported cryptocurrencies.

Trading Fees1

The majority of the cryptocurrency exchanges analyzed have fixed trading fees not distinguishing buyers and sellers, with the smallest one is 0,1% on Binance, CoinBene, ZBG, and Bibox. On some of them, fees can be reduced using the platform tokens or coupons.

Other platforms (BitMEX, OKX, Bit-Z, BitForex, HitBTC, and Bitfinex) offer makers and takers different fee schedules, often polar from one exchange to another. For instance, on BitForex and BitZ, the one who places the order isn’t charged with anything. Meanwhile, on HitBTC, BitMEX, and OKX it’s the taker who pays the fee, and maker can even receive a certain percentage of a trade. BitZ also offers special fee discount for registered market makers.

Overall, on such platforms Maker and Taker fees often depend on the contract type, trading volume and currency. In the table below, you can check the fees which you will be charged with if trading $5000 equivalent in BTC or ETH on all the exchanges reviewed.

Withdrawal fees

Withdrawal is always a tricky part when it comes to crypto trading on an exchange. There are two basic lines of behavior the exchanges tend to adhere to: either charging a fixed amount of the currency in action or offering a zero platform fee or minimum blockchain network fee with timely withdrawal limits like BitMEX, OKX, and CoinBene. Most of the other platforms have elaborated coin-dependent withdrawal fee structure with withdrawal minimum (like this of BitForex). From those the cheapest option for Bitcoin withdrawal is provided by Binance (0.0001 BTC) and for Ethereum — by Bitfinex (0.00135 ETH).

Fees

Tools and options

When it comes to what an exchange can offer you, there are several criteria by which you can choose the perfect one: the number of pairs and coins supported, base currencies and platform tools.

Supported crypto

Being one of the oldest exchanges in review (second only to Bitfinex), HitBTC has the biggest amount of base currencies (9) as well as the highest number of crypto markets and coins supported among all crypto exchanges. Binance and OKX are the next largest in terms of the number of pairs but even combined they can’t surpass HitBTC on this metric. Bitfinex and Binance have the second biggest number of base currencies — 7, with four fiat currencies available on the first exchange, and the second supporting several tethered ones.

Tools

Apart from standard functionality of exchange, most of the platforms offer some special features such as futures trading (BitMex, OKX, Bitforex), tools for advanced traders, P2P lending services, and price alerts. Some have their own incentives programmes with referrals, trading rewards, token voting, and other community activities.

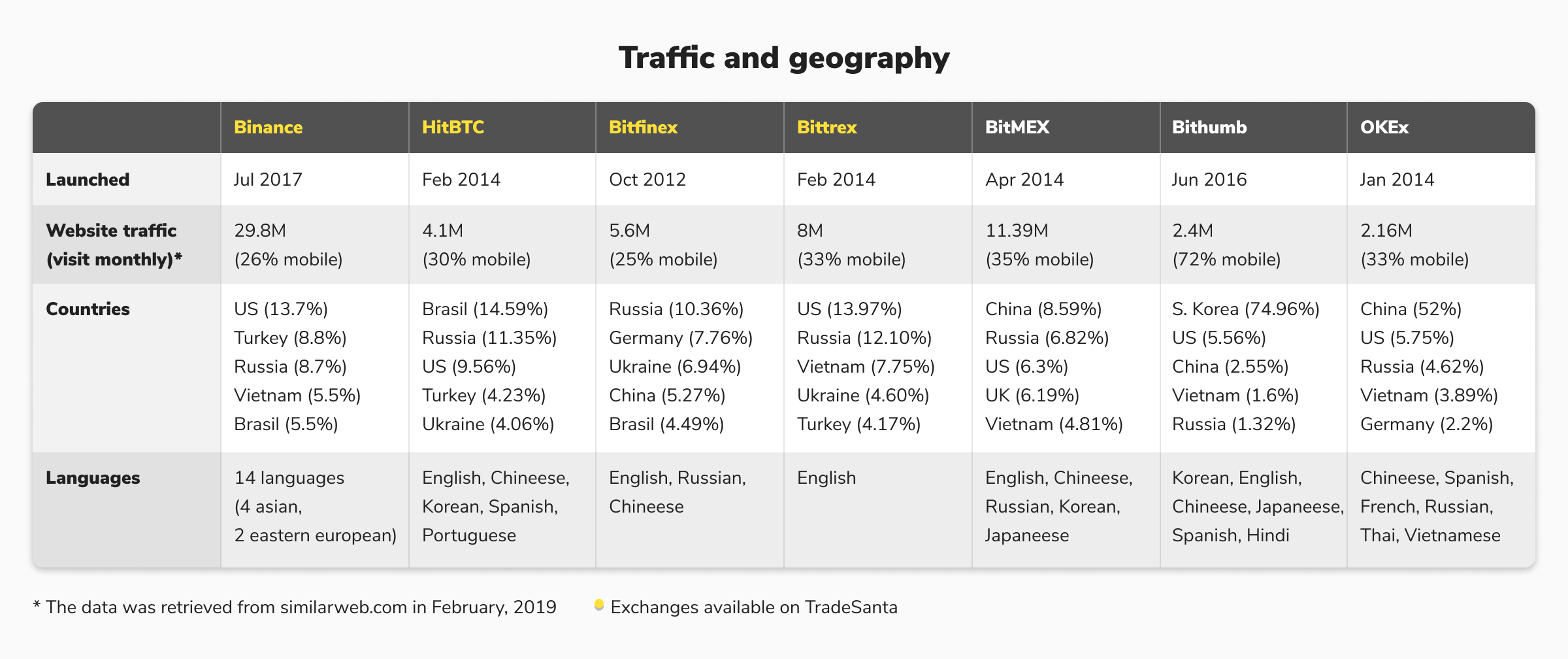

Popularity2

Being launched less than two years ago, Binance is undoubtedly the most popular cryptocurrency exchange with 29.8M visits monthly from all over the world. The second most popular exchange is BitMEX, attracting 11.39M visits monthly with 35% of traffic being mobile without any official smartphone apps launched. However, it’s Bithumb who can pride itself as the most mobile-friendly exchange, since 72% of the 2,4M monthly traffic comes from mobile devices.

Among the most visited exchanges, Binance is again one of the leaders in terms of geographical reach and languages supported. Bithumb’s traffic is overwhelmingly localized in the Republic of Korea and more than half of the OKX visits come from China. BitMEX enjoys the most even geographical distribution, while the others get the highest number of visits mostly from US, Russia, and China.

1. When Maker fee is below 0, it means that he receives this percentage of the trade as an added bonus.

2. The data was retrieved from similarweb.com in February, 2019

You can learn more about exchanges on this crypto news platform – Newsbit

FAQ

How to choose a cryptocurrency exchange?

Here are a few factors to look into before choosing one:

1. Ease of Access

2. Fees

3. Tools and features

4. Popularity

What crypto exchange has the lowest fees?

The list of crypto exchanges with the lowest fees includes Binance, HitBTC, Bithumb, OKEx, Bitfinex