What is futures grid trading and where can you execute your grid trading automated strategy? Futures grid trading is something more experienced traders normally go for, but even beginners can do it when in the right place.

What is Grid Trading?

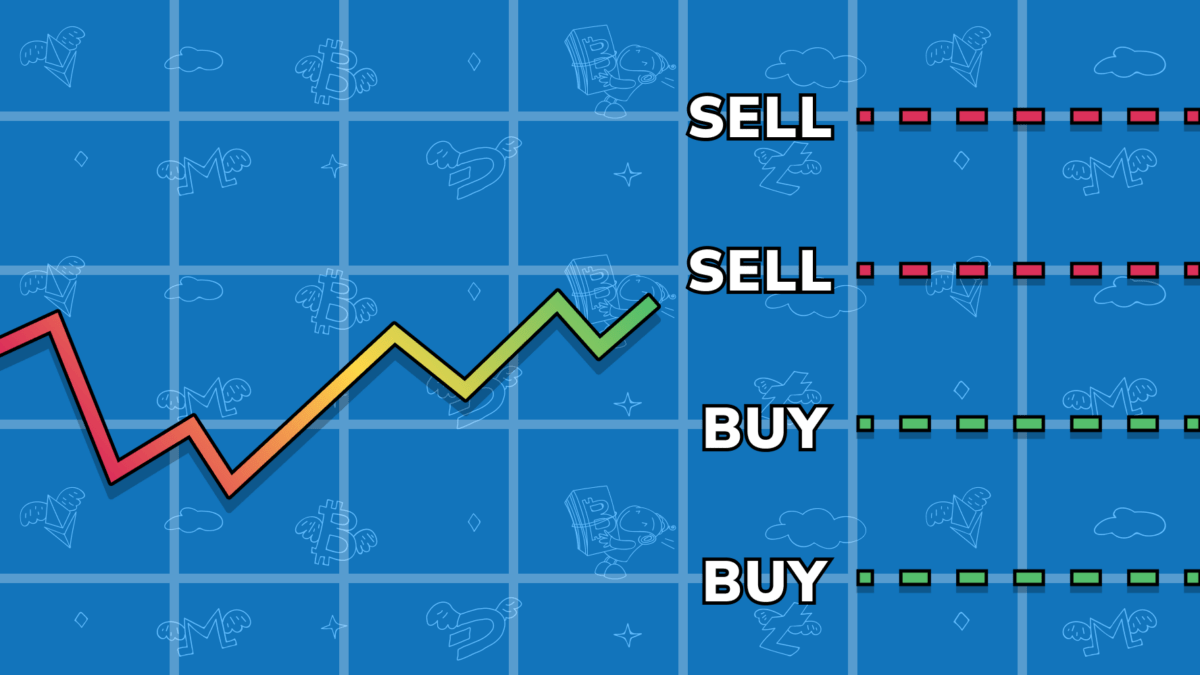

Made popular by forex traders, grid trading involves creating orders above and below a set price (often called reference price or reference line), forming a grid of orders at incrementally increasing and decreasing prices. In other words, multiple predetermined price levels are set, so when the price touches those levels, buy or sell orders get executed. That said, the grid is made up of both long and short positions, which inhabits a certain level of protection. And the basic idea is that any losing trades can be offset by the profitable ones.

With grid trading, there’s no need to choose which order to place, a buy order or a sell order. Instead you can set buy and sell orders simultaneously, and depending on the conditions in the market, either this or that order will be executed. This works the best in ranging markets, also known as sideways markets. However, grid trading is also suitable for uptrends and downtrends.

Grid Trading Example

The scenario on the pic up above looks pretty optimistic in terms of the grid trading strategy, but let’s stay optimistic temporarily for educational purposes.

While setting up this strategy, traders normally start with deciding on the reference price, in our case, the gray line. The first, second, third and fourth buy orders get placed incrementally as the price of the coin drops and touches each of the red lines. Then, the price moves below the pre-set lowest level, however, no more buy orders are set. As the coin starts to climb back and the price reaches one and a half grid length from the price where we placed the first buy order, the first sell order gets placed.

Usually, the orders are placed at even levels. For example, if you’re about to trade BNB, you may set buy orders at every $5 below the current market price of BNB, and sell orders every $5 above BNB’s current price.

What is Futures Grid Trading?

Futures Trading

Let’s do a quick recap just to make sure we’re on the same page here, and then, you’ll get an explanation of what futures grid trading is. So, what are crypto futures and how to trade crypto futures?

Do you remember what a futures contract is in the traditional stock market? If you know what it is, it will be easier for you to understand the nature of crypto futures. In traditional markets, futures are normally derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. In practice, non-financial commodities such as grains, livestock and precious metals most often use physical settlement – when not rolled over the next trading period. As to futures with underlying financial instruments, they usually get settled in cash. But whatever an underlying asset of the futures contract is, the first thing that normally differentiates probably all the futures from stocks in traditional markets is that they have a settlement date. Not always. But it’s a common situation.

Trading Crypto Futures

What is trading crypto futures, then? Well, with crypto futures, the situation is somewhat similar. Crypto futures are also derivative financial contracts and they also function with an underlying asset as a basis. The underlying asset, however, is neither grain nor an index, but a digital coin, such as Ether, XRP or LTC, etc.

Made famous by BitMEX, at the very core, crypto futures are a form of commitment, too. You either commit to buying or selling the asset on the predetermined date – delivery futures. Or you trade a perpetual contract entering an ever-lasting bet on the price. With this bet, two parties wager upon the future price of the underlying asset, when they go long or short. If they go long, they’re betting on a price advance. If they go short, they’re anticipating a drop. So when at a settlement hour/date, the price drops, longs pay to shorts. And when the price rises, shorts pay to longs.

That said, when buying or selling perpetuals on such platforms as Binance Futures, you basically buy or sell a bet. And the low price for participation in these bets is not the only reason why crypto futures trading is popular.

With different leverage ratios offered, you don’t even need to match the total value of the contract with your funds. Instead, you just need enough money to secure a contract with a comparatively smaller equity stake. All it takes is an initial margin, usually 5% of the amount you’re playing with. And when the position is open, a so-called maintenance margin level, often 10%.

Now, let’s finally talk about how trading crypto futures works when applied to the grid strategy. Basically, instead of buying or selling delivery or perpetual contracts manually, the automated strategy will systematically place buy and sell orders at pre-set intervals within a pre-set price range. In other words, when the contract’s price reaches a pre-planned point in the grid, the corresponding order will get executed.

An example of futures grid trading

Say, with trading futures on Binance, as soon as a price drops, a buy limit order is placed together with the sell limit order at an even level above the reference price. When the price bounces back and starts touching the sell levels, a sell limit order is placed and gets executed, thus, bringing you profits.

How to set up a Futures Grid Trading strategy?

Find the right exchange

Are you interested in trying futures grid trading? First of all, you need to actually look for grid trading strategies on the exchange you have an account with. And if it is in the likes of Binance, ByBit or Bitget, start learning all about the playground on a trading venue of your choice.

Use a third-party service

Also you can give a try to third-party services, such as TradeSanta, in order to launch the bot on the exchange. The advantage here is sometimes the interface you might be more attuned to, no need to log into your account on the exchange every time you want to check on your bot and a marketplace where you can copy the most profitable grid trading strategies.

But the general rule of thumb is that, no matter where you trade, you will have to set up certain parameters before launching the futures grid trading bot.

Set up the parametres

So, what are these parameters? Normally, the upper limit price or the highest price expected; the lower limit price aka the lowest price expected; a number of grids or the maximum number of buy/sell orders assigned to the grid, grid spacing, leverage, and risk-management features such as trigger/stop loss/take profit levels for the advanced settings.

You may take a look at what the setting up process for a futures grid bot looks like on TradeSanta.

This is the first screen that pops up once you start placing your bot. While setting up a take-profit target with TradeSanta, you basically define a profit in % that you want to make with the futures grid bot. The upper limit price and the lower limit price values in this case are already built-in in this parametre. So you don’t have to think about that.

As to the step of extra orders, this indicates by what percentage should the price drop/rise for the extra order to be executed. So, basically, this is grid spacing. You’ve probably guessed already: max count of extra orders means the maximum number of extra orders the bot can execute in a row, a number of orders assigned to the grid.

The advanced settings on the pic above suggest that you want to utilize risk-management tools, are ready to add your own technical analysis and agree that the bot will enter and exit positions based on the signals from the TradingView screener.

On platforms like TradeSanta besides setting the grid trading bot on your own you can also mirror trading strategies of other experienced traders based on the bot’s performance. But it’s highly recommended to actually learn what you’re doing before copying/mirroring someone. So, be brave but cautious and have a nice trading session!

Ask all the questions on TradeSanta’s social media platforms: Facebook, Telegram, or Twitter!

FAQ

What is futures grid trading?

Futures grid trading is a process of trading crypto futures contracts based on the pre-set automated strategy called grid trading.

How does a futures grid bot work?

Within a grid of pre-placed price levels, when a price drops, a buy limit order is placed together with the sell limit order at an even level above the reference price. When the price bounces back and starts touching the sell levels, a sell limit order is placed and gets executed, thus, bringing you profits.