In the world of cryptocurrency trading, where market volatility reigns supreme, having a reliable and effective trading strategy is crucial. One such strategy that has gained popularity among traders is the Wyckoff Method. Developed by Richard D. Wyckoff, a prominent stock market trader in the early 20th century, the Wyckoff Method is a powerful tool that can be applied to analyze and predict price movements in the crypto market. In this article, we’ll delve into the key principles of the Wyckoff Method and how they can be utilized in the exciting world of cryptocurrencies.

What is the Wyckoff Method?

The Wyckoff Method is based on the concept of analyzing the market through the lens of supply and demand dynamics. It aims to identify accumulation and distribution phases, which can offer valuable insights into future price movements. The method emphasizes the study of price and volume, focusing on the interplay between smart money (large institutional investors) and the general public.

Accumulation and Distribution

Accumulation and distribution are two key phases in the Wyckoff Method.

During the accumulation phase, smart money quietly accumulates assets at lower prices, often creating a range-bound market. This phase is characterized by decreasing selling pressure and signs of increasing buying interest. Traders who are able to identify accumulation patterns can position themselves for potential future price increases.

On the other hand, the distribution phase occurs when smart money begins selling their accumulated holdings to the general public. This leads to an increase in supply and a potential price reversal. Traders who recognize distribution patterns can prepare for potential price declines.

Wyckoff’s price-volume relationship

The Wyckoff Method emphasizes the relationship between price and volume.

According to Wyckoff, the volume should confirm price movements. In an ideal accumulation phase, for instance, the price should consolidate or remain within a relatively narrow range while the volume diminishes. This indicates a decrease in selling pressure and a potential shift in control from buyers to sellers. Once the accumulation is complete, the price should break out of the range with an increase in volume, indicating the potential for an upward trend. Similarly, in the distribution phase, a decrease in price accompanied by an increase in volume could signal an impending downtrend. Traders who observe these price-volume dynamics can make more informed trading decisions.

Wyckoff’s Four Market Phases

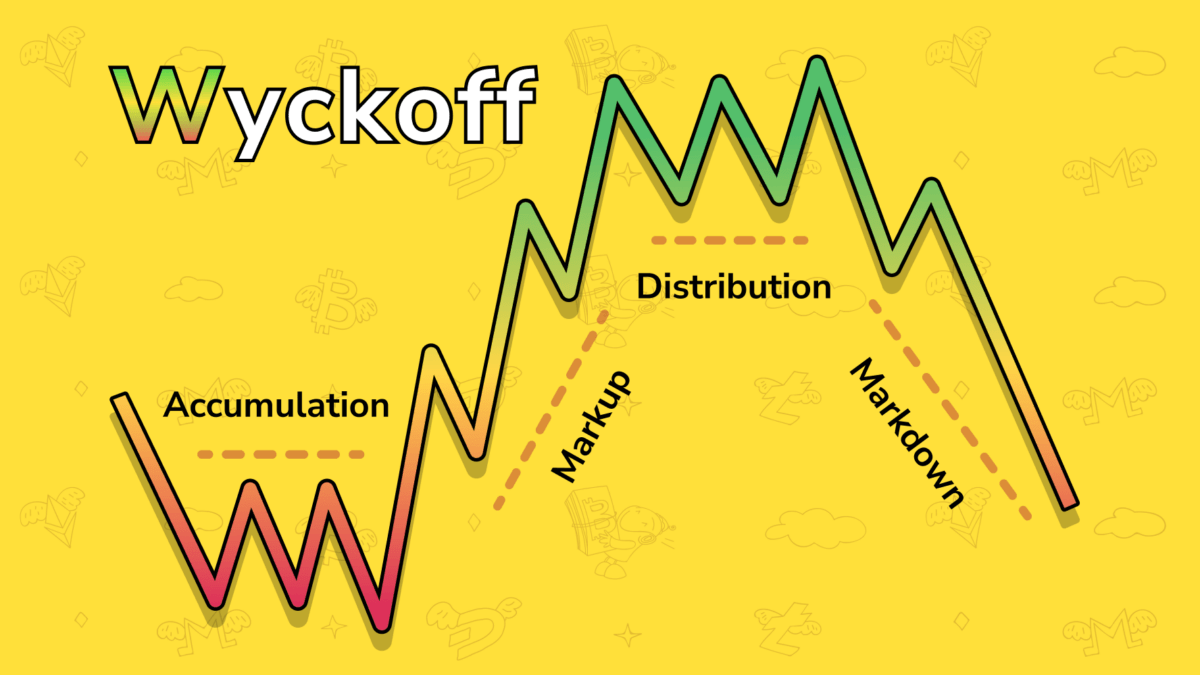

To better understand market behavior, Wyckoff categorized the market into four distinct phases:

- Accumulation: This phase marks the smart money’s accumulation of assets. During this phase, prices tend to be range-bound, with buying interest increasing and selling pressure diminishing. Traders who recognize the signs of accumulation can position themselves for potential future price increases.

- Markup: Following accumulation, a markup phase occurs, characterized by a strong upward price movement. This phase is driven by increased buying interest and often leads to significant price appreciation. Traders who identify the markup phase can take advantage of the upward momentum.

- Distribution: After the markup, the distribution phase begins, where smart money starts to sell their holdings to the general public. This phase is characterized by increasing selling pressure and often leads to price reversals or downtrends. Traders who identify distribution patterns can prepare for potential price declines.

- Markdown: The final phase is the markdown, where prices decline as supply exceeds demand. This phase can be characterized by strong selling pressure and can present opportunities for traders to short or sell assets. Traders who recognize the markdown phase can take advantage of potential downside movements.

Applying the Wyckoff Method to Crypto Trading

To apply the Wyckoff Method to cryptocurrency trading, traders need to study price charts, volume indicators, and patterns. By identifying accumulation and distribution phases, traders can position themselves for potential profitable trades. Additionally, understanding the market phases can help traders determine the overall trend and adjust their strategies accordingly. Here are some practical steps to apply the Wyckoff Method to crypto trading:

- Study Price Charts: Analyze historical price charts of cryptocurrencies using candlestick charts or line charts. Look for patterns that resemble Wyckoff accumulation or distribution formations, such as range-bound price movements, consolidations, or breakouts.

- Volume Analysis: Pay attention to trading volume during different phases of the market. During accumulation, volume should decrease as prices consolidate. During distribution, volume should increase as prices show signs of reversal. Look for volume spikes or divergences that indicate shifts in market sentiment.

- Confirming Indicators: Utilize supporting technical indicators to confirm Wyckoff patterns. Trend lines, moving averages, and oscillators like the relative strength index (RSI) can provide additional insights into market trends and potential reversals.

- Understand Market Sentiment: Cryptocurrency markets are heavily influenced by market sentiment and speculative behavior. Stay updated on news, social media trends, and community sentiment to gauge the overall market sentiment. It’s important to align the Wyckoff analysis with the prevailing sentiment for more accurate predictions.

- Risk Management: Implement proper risk management techniques, such as setting stop-loss orders and managing position sizes. No strategy guarantees success, so it’s crucial to protect your capital and be prepared for potential losses.

Wyckoff Accumulation and Distribution: Trading Strategies

Now that we have a clear understanding of the Wyckoff Accumulation and Distribution method, let’s explore some trading strategies that can be employed using this approach.

1. Breakout Trading Strategy

One popular strategy based on the Wyckoff Accumulation and Distribution method is the breakout trading strategy. Traders using this strategy wait for the price to break out of the accumulation or distribution pattern, indicating a potential trend reversal or continuation.

To implement this strategy, traders can set entry orders above the resistance level for a bullish breakout or below the support level for a bearish breakout. Stop-loss orders should be placed on the opposite side of the breakout level to manage risk effectively.

2. Pullback Trading Strategy

Another strategy that aligns with the Wyckoff Accumulation and Distribution method is the pullback trading strategy. This strategy involves waiting for the price to pull back to a significant support or resistance level after a breakout.

Traders utilizing this strategy can enter trades in the direction of the breakout when the price retraces to a predetermined level. This strategy aims to capitalize on favorable risk-reward ratios by entering trades at more favorable prices within the overall trend.

3. Volume Analysis Strategy

Volume analysis is a crucial aspect of the Wyckoff Accumulation and Distribution method. By analyzing trading volume during the accumulation and distribution phases, traders can gain insights into the intentions of market participants.

High volume during breakouts or breakdowns confirms the validity of the price movement, while low volume during consolidation periods suggests a lack of conviction. Traders can incorporate volume indicators or examine volume patterns to make informed trading decisions.

Supporting Tools and Indicators

While the Wyckoff Method primarily relies on price and volume analysis, traders often use supporting tools and indicators to enhance their analysis. These may include trend lines, moving averages, the relative strength index (RSI), and other technical analysis tools. These tools can provide additional confirmation or insights into market trends and potential reversals. However, it’s important to avoid relying solely on these indicators and use them in conjunction with the principles of the Wyckoff Method.

Conclusion

The Wyckoff Method offers a valuable framework for analyzing price and volume dynamics in cryptocurrency trading. By understanding the principles of accumulation and distribution, as well as the four market phases, traders can gain insights into potential trends and make informed trading decisions. However, it’s important to remember that no strategy guarantees profits, and traders should exercise caution, conduct thorough research, and employ proper risk management techniques when utilizing the Wyckoff Method in the highly volatile world of cryptocurrencies.

FAQ

What is the Wyckoff Method?

The Wyckoff Method is based on the concept of analyzing the market through the lens of supply and demand dynamics. It aims to identify accumulation and distribution phases, which can offer valuable insights into future price movements.

What is Wyckoff’s price-volume relationship?

According to Wyckoff, the volume should confirm price movements. In an ideal accumulation phase, for instance, the price should consolidate or remain within a relatively narrow range while the volume diminishes.