They talk about it, they trade it, and the only question left to answer is whether you’re ready to jump in. NFTs have mesmerized the whole crypto community with their innovation and success. But what is it, and is it really for you?

What is an NFT token?

According to the Ethereum foundation that has basically invented the concept, NFT token stands for non-fungible token. Non-fungible is an economic term that you could use to describe things that are not interchangeable for other items because they have unique properties.

Fungible items, on the other hand, can be exchanged because their value defines them rather than their unique properties. For example, ETH or dollars are fungible because 1 ETH / $1 USD is exchangeable for another 1 ETH / $1 USD.

We’lWe’ll talk more about NFT types later, but to give you an example, in theory, literally anything unique and valuable could be turned into an NFT token so that later you could buy/sell/transfer it around the world in a cyberspace that supports it. Property items, collectibles – virtual or material, votes, tickets, medical records, tweets, items of supply chain, cars, paintings, artifacts in video games and many more.

Explore the NFTs for Rookies series by the Collector Club to gain a comprehensive understanding of the current happenings in the NFT ecosystem.

Sounds awesome? It does. But at a time, despite its beautiful mythology, NFTs are not all butterflies and rainbows and still have their problems. Do you remember Sheldon Cooper’s Sword of Azeroth? Right after acquiring it, he teleportedand started selling it on eBay. This artifact could have easily been an NFT. And Sheldon could have easily possessed, used and even sold it in an NFT marketplace. But, unfortunately, the NFT concept is still young, and doing so is still impossible. And not even because Blizzard, creators of World of Warcraft, have recently said no to NFT. In terms of technological evolution, it’s hard to create something that is compatible with everything.

For now, what’s really special about NFTs is that an NFT token has only one official owner at a time and can be tracked or transferred on the blockchain of its origin. How exactly is it being transferred, though? When it comes down to physical assets, say, a painting, how are you going to transfer that on the blockchain?

Well, if you’ve bought a painting, naturally, in the physical world, you have to transfer that from one place to another. And that’s a part of the problem NFTs present us with. They typically contain a link to an address of a provider, or a website where the digital property is hosted, and, in reality, people only pay for having their wallet address etched into a database, which means “owners” still have to rely on other people when it comes to, say, delivering physical objects. Yes, that is the problem. On the bright side, though, you still can transfer the piece of information about the ownership of this property in the virtual world of blockchains. Every time a smart contract is closed, the blockchain rewrites the state of the system, so that everyone across the globe can see that the downership is now yours. Neither third parties nor physical borders play a role in this scenario.

On which blockchain can you track those NFTs, then? Although the initial NFT frenzie was indeed kicked off on Ethereum as an EIP-721 token standard, now you can mint these tokens all you want on other chains, too. Flow, Tezos, Zilliqua, Solana, Binance Smart Chain, Near, Polygon etc. have presented this functionality to the public.

Now, what exactly can those blockchains do with NFT functionality? Let’s investigate!

Top NFT projects

If you’re quite a regular Joe Bloggs, scrolling the Reddit and Twitter feeds around after-work hours in the comfort of your lonely apartement, you’ve probably never heard about NFT projects or have heard only about the most interesting ones. It’s OK, most of us have also heard about NFTs only because of the very hyped collections, as in CryptoPunks, Bored Ape Yacht Club, and even CryptoKitties, famous not only for colorful images of cats but also for clogging Ethereum back at the time – that’s how popular this early NFT project was a few years ago.

But not everybody really knows that NFTs are not only about apes looking like unshaved rock stars from the Rolling Stone cover, or breeding card cats in the tamagotchi style. They – NFTs, not cats – can also be applicable for authentication of important documents, such as diplomas and certificates; in real estate for buying and selling it; for medical records and identity verification; in intellectual property, patents and licensing; supply chain, gaming industry, voting, metaverse, etc. And since there are about a total of 360,000 NFT owners holding around $2.7 million in NFTs according to Financial Times, let’s take a look only at the most widespread usages at the moment.

Collectibles

The most popular use case for NFT tokens, as of 2022, is, hands down, creating and tracking collectibles on the blockchain. It made NFTs famous last year, burst into our collective consciousness for good and became the talk of the town.

What kind of collectibles can you find out there? The most popular examples are sports and art collectibles. We’ll talk about sport first and then slowly transition to art.

With sports, a lot of NFT tokens are focused on exclusivity in a closed club format. The owners of these NFTs can come together for VIP meetups, parties and events. NFT tokens like that are normally minted in a format of passes or sports trading cards with players depicted on them. A good example is the Fanzone project.

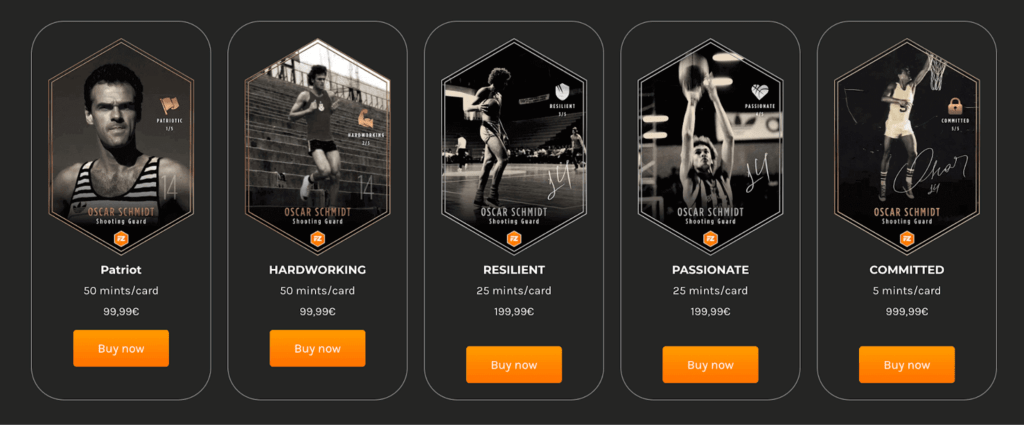

Image Property of Fanzone

From the Fanzone website, you can buy, for instance, a collection of NFT tokens with a legend of basketball, Oscar Shmidt, where every card symbolizes his most valuable characteristics: patriot, hardworking, resilient, passionate, committed.

But there are, of course, other interesting examples. NBA TOP Shot is a magazine of NFT collections with the most vivid sports moments presented in the form of short videos. One of such NFT tokens says, “No matter the age, situation, or defensive coverage, Los Angeles Lakers forward LeBron James makes the game of basketball look effortless. James showcases his world-class athleticism by sneaking backdoor on a cut, turning teammate Malik Monk’s lob into a reverse alley-oop slam to send the crowd into a frenzy. James racked up a 30-point, 12-rebound, five-assist performance on January 19, 2022.”

Do you want more real-life NFT token cases and NFT purchases? One NFT collection you might find interesting is The Swaggy Stallion Collection.

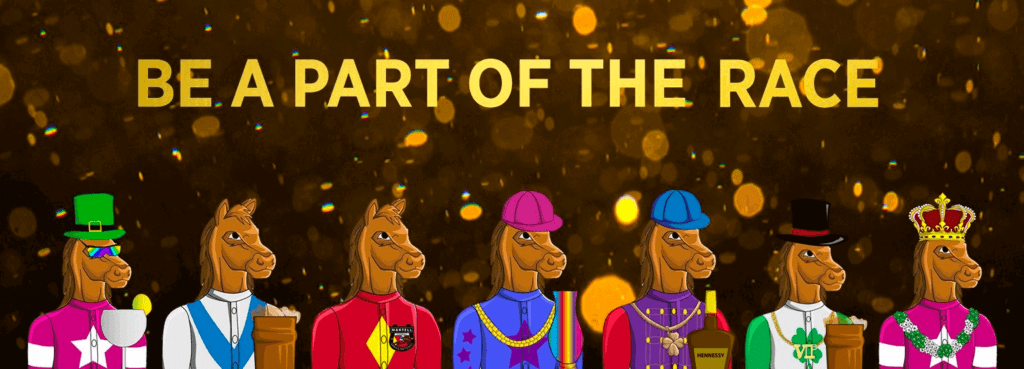

Image Property of NFT Horse Club

No, it’s not the famous Bo Jack Horseman, it’s a collection of NFT horses, where owing one NFT horse represents owning a racing horse. The website of the game says that their 3D game will offer many benefits such as prize money and a share of stakes for other punters putting bets on horse characters.

As to the art NFT industry, to say the least, there are a few interesting examples of digital art collections out there, and the combination of the price tag for each NFT with the contents of some collectibles will probably blow your mind, so maybe just google Merge by Pak on Nifty Gateway and have this experience. The auction for Merge took place in December 2021 and fetched US$91.8 million. 28,983 collectors have obtained ownership of 312,686 NFTs.

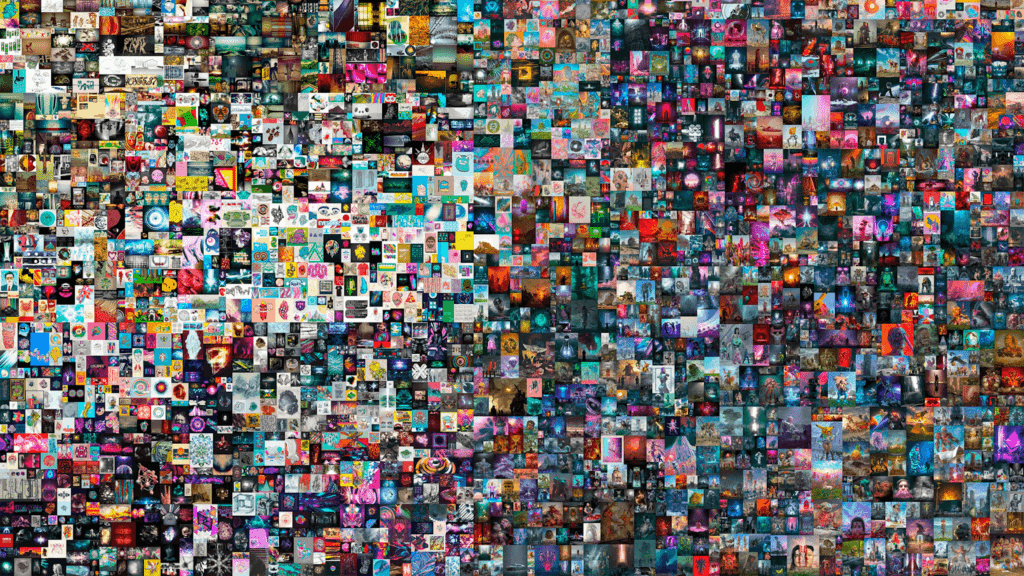

But that’s, of course, not all. There is a plenty of digital artwork, such as Cool Cats, Crypto Punks, and one other interesting NFT example – Everydays: the First 5000 Days, by Beeple (real name Mike Winkelmann).

The Everydays: The First 5000 Days by Mike Winkelmann NFT. This image is the property of Сhristies.

In May 2007, Beeple set out to create and post a new work of art online every day and never skipped a day for the next 5000 days or 13-and-a-half years. The picture up above is a digital collage of all those images.

In 2021, the artist turned the collage into an NFT token, and Christie’s auctioned and sold it for $69.3 million (38525 ETH).

This is, of course, worth mentioning not only because it became the most successful NFT sell-off the world has ever seen. It also created a snowball effect throughout mainstream media, and brought the term “NFT” into households around the world. The Everydays was purchased by a Singapore-based programmer Vignesh Sundaresan, a cryptocurrency investor and the founder of the Metapurse NFT project, so – long live the programmers.

Metaverse

Ah, where should this story even start? Definitely not in Mark Zuckerberg’s imagination, who, however, brought the concept of metaverse back to the public attention in 2021 rebranding Facebook as Meta. The term originated back in the 1993 sci-fi novel Snow Crash and basically means a combination of interconnected cyberspaces focused on social connection, as well as web 3.0, VR, AR, 3D and the internet of things. Now metaverse is also a “buzzword”, just like an “NFT”. And just like NFTs, metaverses still have a lot of challenges to overcome. That’s the reason why, technically, at the time being, they still look like low-budget video games from the 90s with a lot of glitches and lags. People, however, are interested in the idea and invest in the future versions of metaverses.

As concepts, NFTs and metaverse go hand in hand because while being in a metaverse, you can purchase NFTs. Here’s a real-life example. A famous rapper Snoop Dogg has bought Death Row Records, and now the label will produce a lot of legacy items, valuable memorabilia, music tracks to individually buy and sell on the Gala Games blockchain marketplace.

The only problem is the price. Snoop released his new album “B.O.D.R. (Bacc on Death Row)” as a “stash box” of NFTs, priced at $5,000 each.

The list of the most famous decentralized and centralized metaverses where you can use NFTs includes but is not limited to Decentraland, Meta, The Sandbox, Roblox, and more. A lot of brands such as Louis Vuitton, Gucci, Burberry, Adidas, Nike, Toyota, Nissan, Volkswagen have already invested in some of them and built showrooms – by performing the process called “buying virtual land”.

In general, real estate sales on the four major metaverse platforms reached $501 million in 2021, according to BrandEssence Market Research.

Other NFT types

Now, there are many possible use cases for NFTs, so let’s take a look only at some projects, already successful and with the crashing trading volume. These ones below were selected using CoinMarketCap crypto screener and with the focus on something totally different than the hyped-up projects mentioned above.

Theta Network, current market cap: $1.4 billion, niche: video streaming

Theta Labs is a blockchain-based video streaming platform. It has recently teamed up with Sony to launch 3D NFTs available through Sony’s Spatial Reality Display (SRD). Sony and Theta are releasing an NFT called The Tiki Guy which is a 3D Tiki Mask. Only 10 of these NFTs are minted and specifically made for viewing in the virtual reality world.

Sony’s Spatial Reality Display (SRD) is a monitor that lets people perceive things in 3D without using traditional 3D accessories. It is a tablet-like device that displays three-dimensional visuals in semi-physical augmented reality and permits users to view and manipulate 3D objects without the use of glasses or other accessories. The NFTs launched by Theta and Sony will be viewable and manipulable on the SRD in mixed reality 3D, without the assistance of eye accessories.

Chiliz, current market cap: $605.3 million, niche: sports betting

Chiliz (CHZ), a digital currency for sports tokenization and blockchain-based fan engagement, has announced an integration with Chainlink, a decentralized oracle network which enables minting Non-Fungible Tokens (NFTs). Chiliz’ team have explained that they need NFTs for fan voting and rewards on their app Socios.com.

The company has developed partnerships with some of the biggest sporting institutions in the world: FC Barcelona, Manchester City, Juventus Turin, and Paris Saint-Germain. And now, with the NFT integration, players engage with their fans by issuing limited edition NFTs and other perks that are associated with crypto and blockchain technology. New NFTs are minted as they happen based on key moments in live matches and then they are dropped to the wallet of fan token holders who correctly predict the outcome of the game.

STEPN, current market cap: $510 million, niche: fitness and wellness

STEPN is a move-to-earn (M2E) app allowing users to make passive income by engaging in regular physical activities. The app allows you to tokenize your act of walking or running and then, in the app’s marketplace, buy or sell artifacts for the currency you’ve earned.

To start earning, though, you have to purchase the NFT sneakers first from the app’s marketplace.

How to create an NFT token?

Now, be honest and tell the truth: you’re intrigued and are already thinking about creating your NFT token, aren’t you? Let’s see what you can do about it. These days, with the NFT frenzie running around, it is really not very hard to mint an NFT. The real present question is, do you have something to turn into an NFT?

It can be literally everything, and yet, the best option for now is probably digital art. So, say, the problem is solved, you have something to nftize. Now what?

If you’re 100% sure that you want to mint an NFT token, simply choose the platform to market it on and then, follow the guidelines of this platform. Right, you don’t have to be a coder to do it, and it will take you a few minutes maximum.

Where can you trade NFTs?

Some of the top NFT marketplaces include OpenSea, Axie Marketplace, Rarible, SuperRare, Foundation, Nifty Gateway, Mintable, etc. You will have to research the best NFT marketplace for your product, though, because some of those marketplaces have a niche nature.

For example, OpenSea is the best place for art, music, domain names, virtual worlds, trading cards, collectibles, sports, and utility, Rarible is a great fit for art, metaverse, domains, photography, music, games, sports, and SuperRare is a place for art only.

To make the right choice, don’t forget to also research some market data and take a look at the trading volume of each of those NFT platforms. As of writing, the top three NFT trading marketplaces are X2Y2 ($23,41M), OpenSea ($17,44M), and LooksRare ($5,71M).

How to trade NFTs?

To sell NFTs or buy NFTs is not that difficult, and very much like trading on eBay.

As an owner of an NFT, you normally have two ways to trade them. On OpenSea, for example, you can choose between a Fixed Price and a Time Auction. With the Fixed Price, everything is pretty clear. Choose a price, a duration period, and, if you want, reserve an item for a specific person. Hype up some additional interest using your social media – nobody has forbidden that yet!

With the Time Auction, you can sell NFTs either to the highest bidder or with a declining price, which is the process when the price falls until someone purchases your NFT. Again just choose a duration period and wait for somebody to start bidding. When the price goes lower than the initial price, you can choose to accept the offer. If and when the token is trading higher than the minimum price determined by the marketplace, it will automatically be sold to the highest bidder when the auction period is over.

NFT marketplace fees

Depending on the marketplace, the fees, as you understand, will be different, so make sure to check those fees before starting a trading process. Thus, you will secure yourself against unpleasant surprises!

Here is a table with the NFT marketplaces mentioned in this article and their commissions:

| NFT trading platforms | Commission | Fees in | Royalties |

| OpenSea | 2.50% | ETH / MATIC / KLAY | 0-10% |

| Nifty Gateway | 5.00% + $0.30 on secondary sales | ETH | 0-100% |

| Rarible | 2.50% buyer + 2.50% seller | ETH | 0-100% |

| Foundation | 15.00% | ETH | 10.00% |

| SuperRare | 3.00% buyer + 15.00% seller | ETH | 10.00% |

| Axie | 4.50% seller | ETH | – |

To sum up

Yee-haw, now you know how to start NFT trading. But, most importantly, you now know if the whole thing is, actually, worth your time and effort.

First and foremost, an NFT token is something unique and valuable because it has only one owner at a time. Everything unique can become an NFT token: a digital asset, a medical record, and even your cat that you might want to register on a blockchain some day – not a crypto cat, your real-life, flesh-and-blood cat.

Where can you start with NFT trading? Millions of dollars are invested in sports betting, video streaming and lifestyle apps, with the teams of those projects having integrated the NFT technology already. So maybe it’s time for you to start researching some of those projects?

There’s a lot of criticism around the niche, though, because digital assets are indeed perfectly reproducible and therefore easy to pirate. So, be careful. It’s definitely worth a shot if you’re an artist exhibistioning your work on Behance already and if you have a massive amount of followers. In this case, NFT trading is a perfect way to monetize your success.

In all the other cases, such as when you’re asking yourself whether to trade or not to trade NFTs, the question remains open for discussion, and isn’t a community of traders like yourself a great way to discuss this question?

We’re TradeSanta, such a community, and we’re always looking for ways to accumulate our earnings without spending too much time in front of the screen. We’re one click away, and we want to know what you think of NFTs. Jump in!

Facebook, Telegram, or Twitter

FAQ

How to trade NFTs on OpenSea?

On OpenSea, for example, you can choose between a Fixed Price and a Time Auction. With the Fixed Price, everything is pretty clear. Choose a price, a duration period, and, if you want, reserve an item for a specific person. Hype up some additional interest using your social media – nobody has forbidden that yet! With the Time Auction, you can sell NFTs either to the highest bidder or with a declining price, which is the process when the price falls until someone purchases your NFT.

Use cases of Non-Fungible Tokens (NFTs):

Theta Network, current market cap: $1.4 billion, niche: video streaming

Chiliz, current market cap: $605.3 million, niche: sports betting

STEPN, current market cap: $510 million, niche: fitness

How NFTs, or non-fungible tokens, function?

In theory, literally anything unique and valuable could be turned into an NFT token so that later you could buy/sell/transfer it around the world in a cyberspace that supports it. Property items, collectibles – virtual or material, votes, tickets, medical records, tweets, items of supply chain, cars, paintings, artifacts in video games and many more.