Seasoned traders often use crypto screeners to pull up detailed information on trading pairs of their interest. But what is a crypto screener, and how does it work? Let’s take a look at the definitions and the most popular solutions!

What is a crypto screener?

Сrypto screener is basically a table with real-time data on a trading pair, usually on a particular exchange or in some aggregated version. The most common data presented in the cryptocurrency cryptocurrency screener includes: current rate (price), price change, market cap, trading volume, technical chart patterns, technical rating, indicators like Bollinger Bands, MACD, RSI, and more. But keep in mind that different screeners might include different settings and parameters.

Take a look at some popular crypto screeners and choose one that fits you the best in order to look for investment opportunities right in time.

Top 5 crypto screeners

TradingView Screener

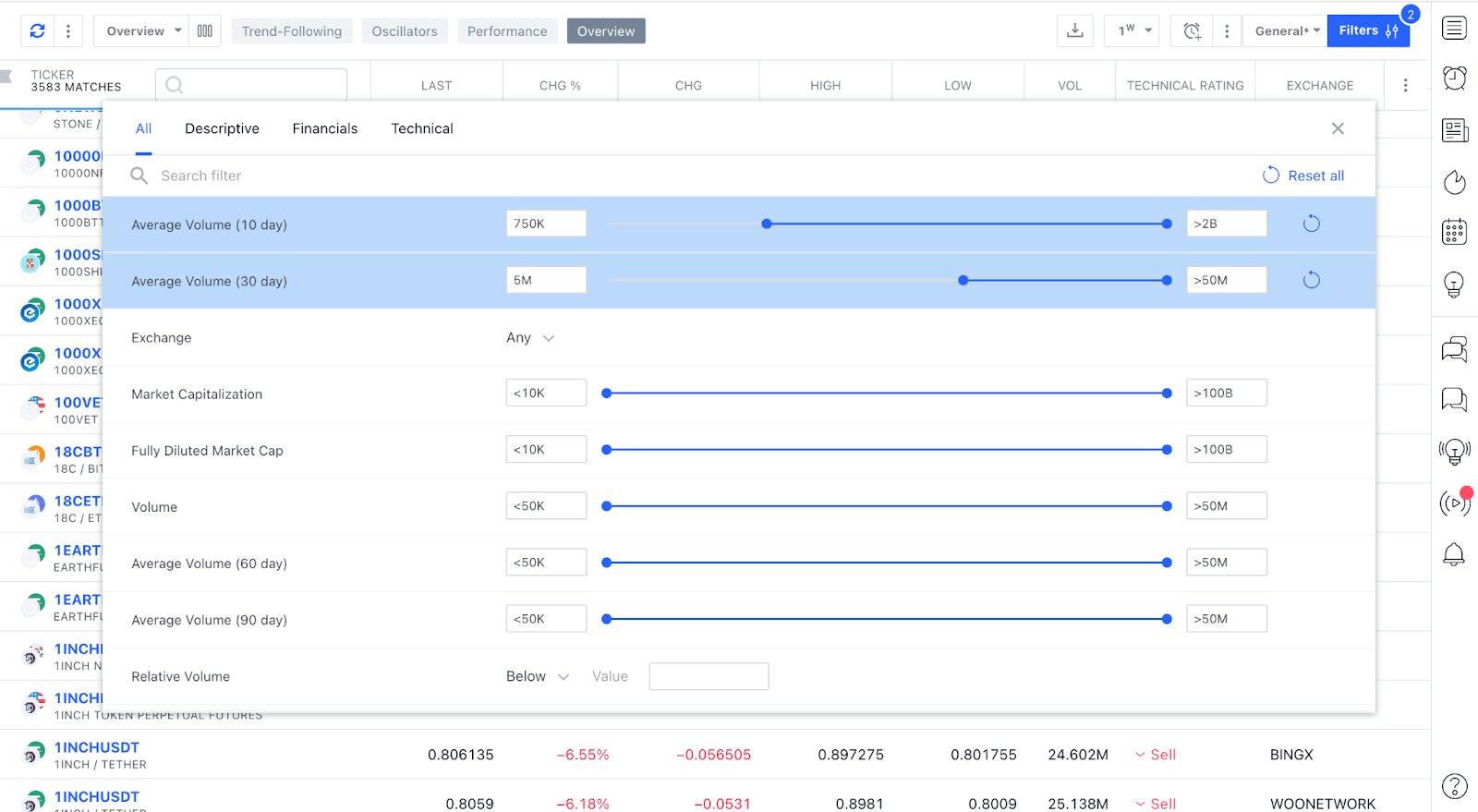

Image Courtesy TradingView. Filter interface

A social network for traders and a web service offering a wide range of tools for technical analysis, TradingView was founded by Stan Bokov and Andrew Kirillov in 2011 and is now registered in New York. It has offices in London, and subsidiaries in Moscow, St Petersburg and Rostov-on-Don.

If you want to learn how to use TradingView crypto screener, simply go to the home page of the service, choose Products, and then, Screeners. TradingView crypto screener offers a rich functionality and a lot of data. The control desk of the screener consists of Overview, Performance, Oscillators, and Trend-Following tabs. The service allows you to save customized screens after you’ve adjusted all the settings, and sends to you signals/alerts when the market changes.

TradingView accumulates information from Binance, Bitstamp, Bittrex, Coinbase, Gemini, Bitfinex, Kraken, Poloniex, HitBTC, and you can filter out the information based on the most popular indicators, such as Average True Range (ATR), the Relative Strength Index (RSI), the Ichimoku Cloud, the Moving Average Convergence/Divergence (MACD), and the Exponential Moving Average (EMA).

CoinMarketCap Screener

Image Courtesy CoinMarketCap. Filter interface

If you’re a crypto enthusiast, there’s no way you have not heard about CoinMarketCap, one of the best crypto screeners for day trading and other cryptocurrency trading types showing, not only but above all, market capitalization for each coin. Founded by Brandon Chez in May 2013, the company was acquired by Binance Capital Mgmt in April 2020 and now offers a range of products, including a crypto screener.

There’s a number of filters you can apply while using this screener: Category, Algorithm, Platform, Industry, and this one additional filter you can see on the pic up above with detailed settings.

Under the Category tab, you can sort out Derivatives, Atomic Swap Projects, CeFi and DeFi tokens, stablecoins, and a dozen more categories. Do you have a certain algorithm in mind? The Algorithm tab will allow you to choose between PoS, PoW, Hybrid, DPoS, Ethash, and many other algorithms. You can also pick out an ecosystem, such as Polkadot, Avalanche, Solana, and an industry, from hospitality through games to philanthropy. In order to apply technical indicators, however, you will need to open a special tab, which will eventually link you to a TradingView functionality.

CoinMarketCap lists more than 16,000 cryptocurrencies, and provides information about the coin’s trading history and fundamentals. More than 300 million users visit the website on a monthly basis.

altFINS Screener

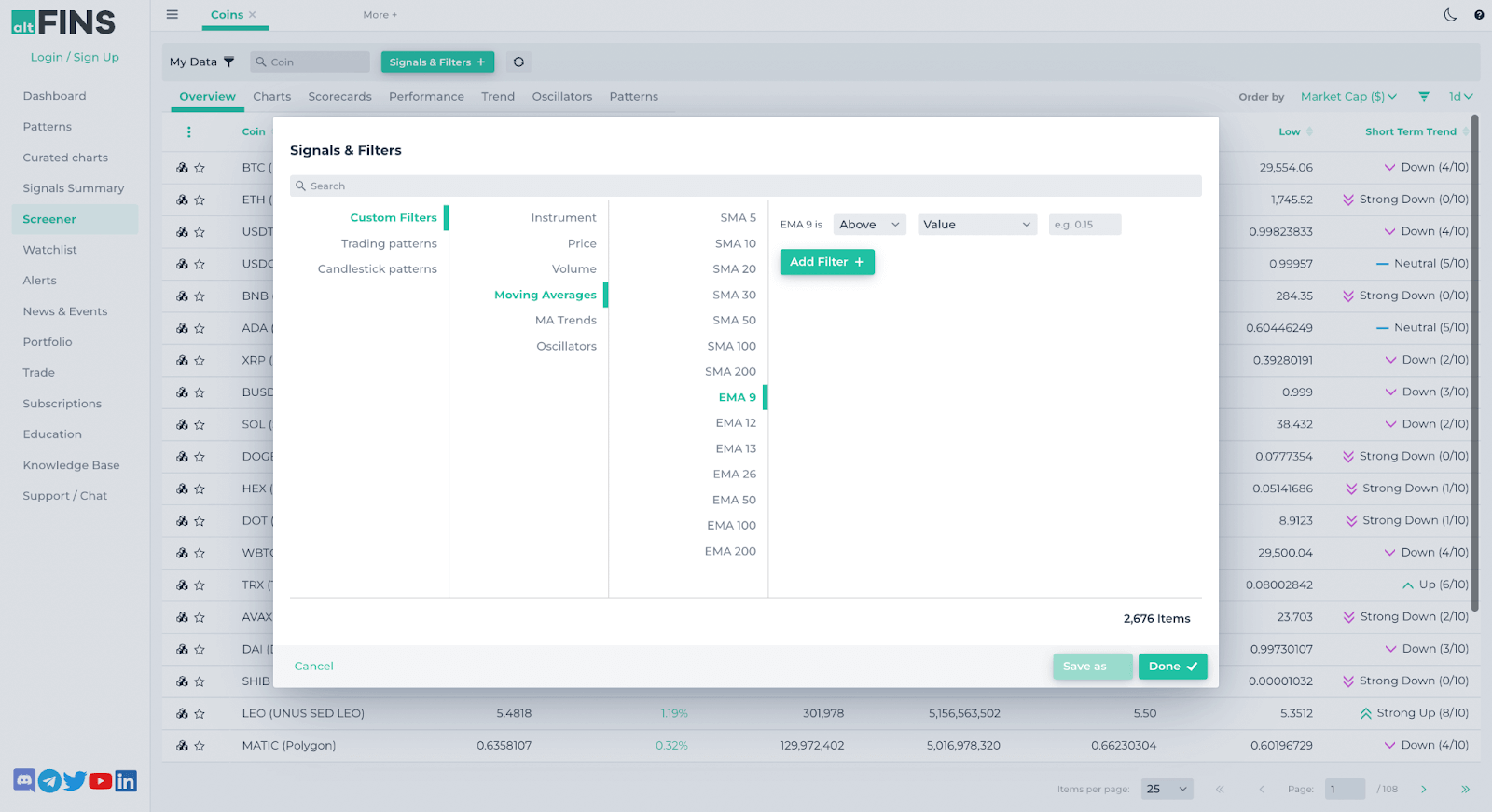

Image Courtesy altFINS. Filter interface

Launched by Richard Fetyko, who had been previously working on Wall Street for 14 years, altFINS offers to its users a quick performance summary of their portfolio, alerts, a watchlist, grid charting, patterns, a dashboard, and, last but not least, screener. The real-time d ata mined from the most popular tech-analysis tools, MA, EMA, MACD, RSI,, OBV, Bollinger bands, Ultimate oscillator, Stockastic, etc., can be found in the screener from this Slovak company.

That is, altFINS offers seven different perspectives to look at the market: Overview, Charts, Scorecards, Performance, Trend, Oscillators, Patterns.

Are you wondering how to use the crypto screener? Under the Overview tab, you will find all the basic information about the coin: change in price and volume over different time-frames, market cap, a short-term trend, etc. The charts will showcase RSI and SMA tech indicators for the most popular coins. Scorecards are demonstrating short-term, medium-term, and long-term trends together with the oscillator rating. Performance is a one-line overview of the coin’s price over different time-frames. Trend is an overall metric for buy or sell on different investment horizons. Oscillators are a collection of different indicators suggesting you to buy, sell or stay neutral. And Patterns are the patterns the market is currently seeing. Sounds fun? Be prepared, though, that some of the features are hiding behind the subscription firewall.

altFINS pulls up information from 18 exchanges, including Binance, KuCoin, Coinbase, Bitfinex, Poloniex, Huobi, and more.

CoinGecko Screener

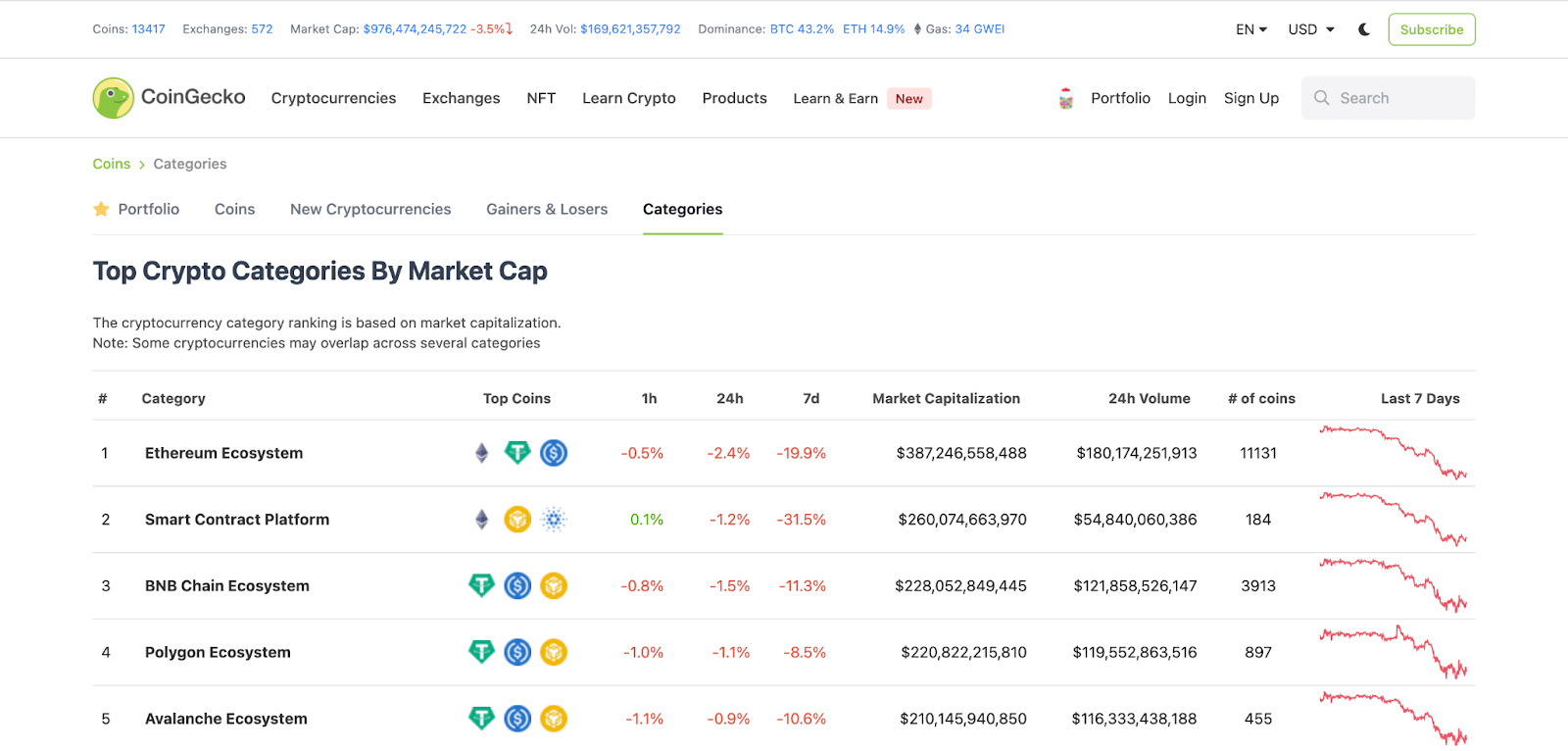

Image Courtesy CoinGecko. Categories interface

CoinGecko was launched in 2014 by TM Lee and Bobby Ong, two friends from Kuala Lumpur, Malaysia. It was simply a market tracker at first, but then started adding features, such as a quarterly cryptocurrency report, mobile apps, podcast, portfolio tracker, and an advanced terminal for live on-chain price charts.

Now it’s one of the largest screeners in the niche – with more than 79 filters, also known as “categories”, to sort through. The categories include different types of ecosystems, such as Ethereum, Avalanche, Fantom ecosystems, lending and borrowing projects, DeFi and CeFi platforms, NFT tokens and many more.

The broader categories include gainers and losers, as well as new cryptocurrencies. Once one of the categories is chosen, you can browse different projects based on their change in price over the period of 1 hour, 24-hours, and seven days, as well as 24-hour volume, and market cap.

The service tracks 400+ exchanges, 8,000+ coins, 50+ sectors and categories, and allows you to set personalized price alerts with large market movement alerts.

Quantify Crypto Screener

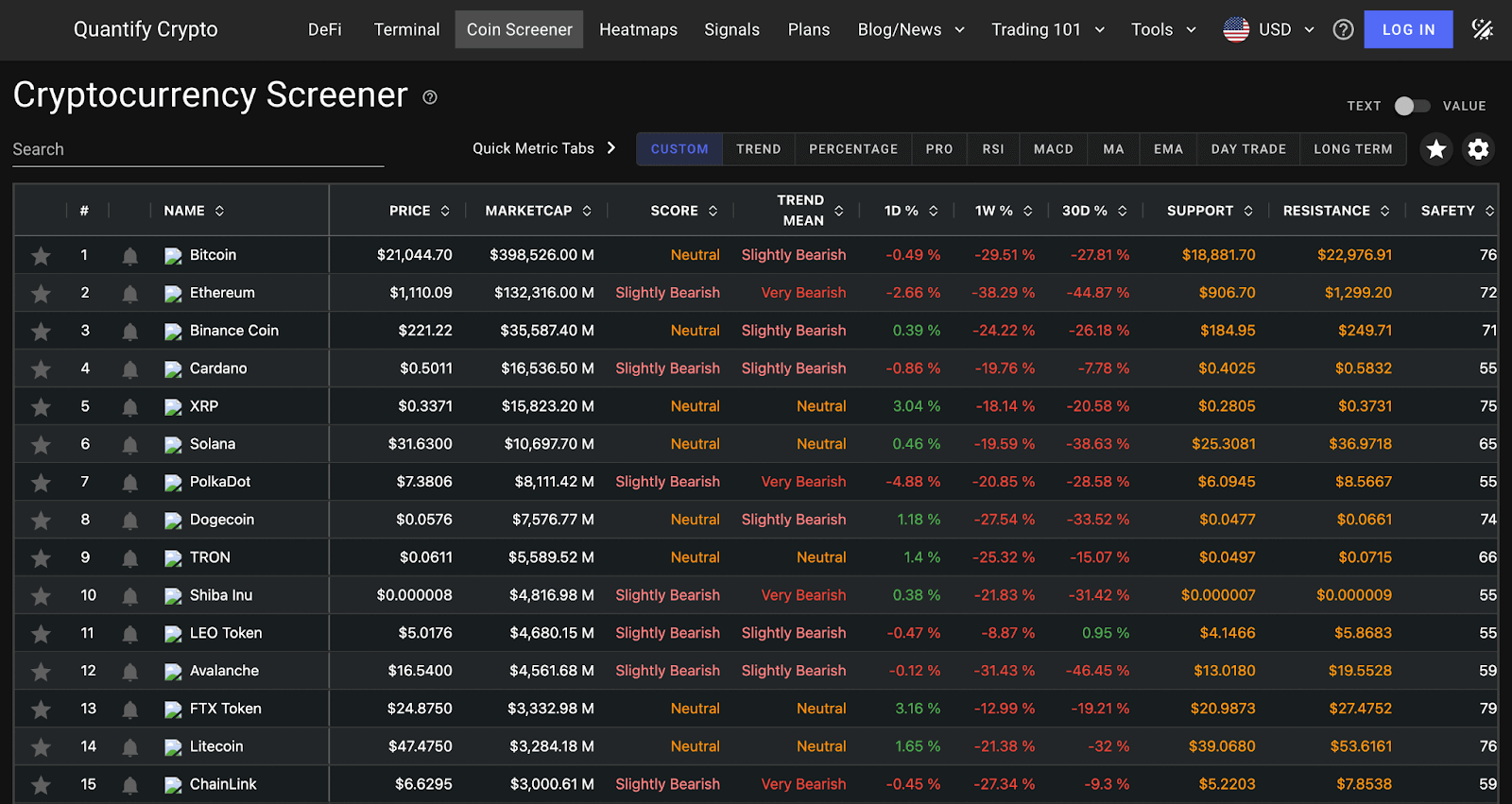

Image Courtesy Quantify Crypto. Coin screener

Registered in Delaware, US, Quantify crypto coin screener is a cryptocurrency website with technical analysis for traders. It offers a range of products including DeFi Portfolio Tracker, Terminal for signals, metrics and trends, Heatmaps, Signals and, of course, Coin Screener with a customizable and interactive layout.

The screener displays multiple coins and timeframes on a single screen, plus each column can be sorted by preferred metric tabs: Custom, Trend, Percentage, Pro, RSI, MACD, MA, EMA etc. Under the Custom tab, customized settings can be adjusted and saved depending on your preferences. In general, the screener provides you with a detailed display of technical metrics helping you focus on potential entry and exit points.

QuantifyCrypto analyzes only 250 coins, which is not much, let’s say, compared to CoinMarketCap, but these coins dominate the market and cover more than 90% of the total cryptocurrency market cap.

How to use crypto screeners in TradeSanta

Did you, by the way, know that in TradeSanta, you can also use signals from one of the best crypto screeners, TradingView screener?

These signals can be used for the bot to open the position.

If you want to go short, choose Sell or Strong Sell. With “Sell”, the bot will enter the market when the signal is either Sell or Strong Sell. With “Strong Sell”, the bot will only enter the market when the signal is Strong Sell.

This logic applies for the long bot. If you want to go long, choose Buy or Strong Buy. With “Buy”, the bot will enter the market when the signal is either Buy or Strong Buy. With “Strong Buy”, the bot will only enter the market when the signal is Strong Buy.

TradingView Screener signals are available for users with Advanced and Maximum plans on TradeSanta.

Do you want to add the signal to your TradeSanta bot? Follow this guide.

Summary

So, what is a crypto screener? They can become a nice tool to help your daily trading activities if you’re looking for new investment opportunities. With its multiple filters, such as price, market capitalization, volume, performance, signals and more, screeners help you make the right choice at the right time.

There are multiple solutions out there, but, more or less, all of them have something in common. The best crypto screeners present you with the information about trends, volume, change in price and, of course, signals to buy or sell the asset.

These signals can be very valuable not only when you trade manually, but also when you’re doing automated trading with TradeSanta and spending much time away from the screen.

Because TradeSanta can receive a signal from TradingView screener, its bots can enter the market when the conditions are playing out in your favor.

That is, hopefully, now you’ve stopped asking yourself what are screeners in cryptocurrency trading and understand the theory. But, of course, if you want to learn how the crypto screener works in practice, the only way, probably, is to try and buy a coin using it.

If need to quickly calculate your trading profits, convert one cryptocurrency to another, or check the potential earnings of your mining hardware, you might want to check a list of crypto calculators that will help you solve this problem.

Do you want to start right now? Just log into your account on TradeSanta and start creating a bot.

Keep track of all the news and ask all of your questions on our socials: Facebook, Telegram, or Twitter!

FAQs

What is the best crypto analysis website?

There are a few: TradingView Screener, CoinMarketCap Screener, altFINS Screener, etc. The best crypto screeners present you with the information about trends, volume, change in price and, of course, signals to buy or sell the asset.

What are the best settings for crypto screeners?

The settings depends on the screener. For example, on CoinMarketCap you can apply Category, Algorithm, Platform, Industry, and other filters.