What is Dow Theory?

In the realm of crypto trading, where volatility reigns supreme, traders are in constant pursuit of innovative strategies that can provide them with a competitive edge. The adoption of Dow Theory, originally developed for traditional stock market analysis, has emerged as a promising approach in this regard. By leveraging the timeless principles of Dow Theory, traders can gain valuable insights into market trends, reversals, and investor sentiment in the digital asset space. In this article, we explore the practical implementation of Dow Theory in crypto trading, highlighting its potential to revolutionize decision-making and maximize profitability in the fast-paced and unpredictable world of cryptocurrencies.

Dow Theory is a widely recognized technical analysis framework developed by Charles H. Dow, the founder of the Wall Street Journal, in the late 19th century. It provides traders and investors with a systematic approach to analyzing market trends and making informed trading decisions. While Dow Theory was originally designed for analyzing stock markets, its principles have been adapted and applied to other financial markets, including cryptocurrencies.

The theory is built on the premise that market price movements reflect the collective actions and sentiments of all market participants. It suggests that by studying the price action, volume, and trends, traders can gain valuable insights into market dynamics and potentially predict future price movements.

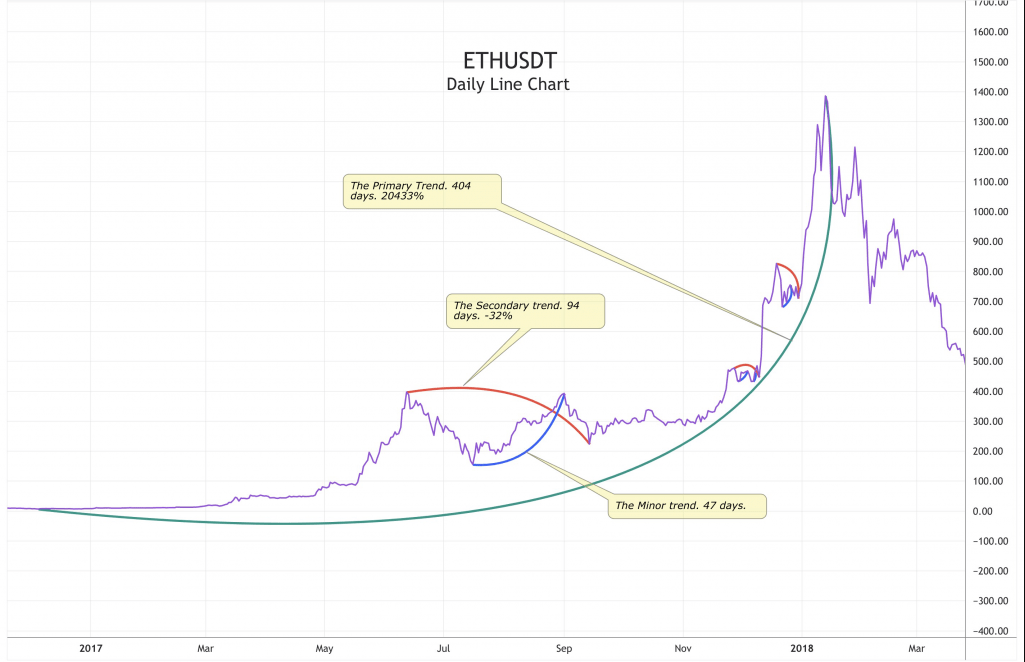

One of the fundamental concepts in Dow Theory is the recognition of three primary trends: the primary trend, the secondary trend, and minor trends. The primary trend represents the long-term direction of the market and can last for months or even years. It reflects the overall sentiment and underlying forces driving the market. The secondary trend is a countertrend movement that corrects the primary trend but does not reverse it. It is a temporary price movement that often presents opportunities for traders. Minor trends refer to short-term fluctuations within the primary and secondary trends and are usually of shorter duration.

Another key aspect of Dow Theory is the concept of confirmation. It suggests that the movement of multiple market indices or averages should confirm the direction of the primary trend to validate its strength. For instance, in stock markets, the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) should both exhibit similar price movements to support the validity of the trend.

Volume analysis is another important component of Dow Theory. It considers trading volume as a means to validate trends. Higher trading volume during price advances suggests increased buying pressure and confirms a bullish trend, while lower volume during price declines may indicate waning interest and potential weakness in the trend.

By incorporating Dow Theory into their analysis, traders seek to identify the current market trend, anticipate potential trend reversals, and make informed trading decisions based on these insights. While the theory was originally designed for stock markets, its principles can be adapted to different financial markets, including cryptocurrencies, by taking into account the unique characteristics and dynamics of each market. Traders who successfully implement Dow Theory can potentially enhance their trading strategies and increase their chances of achieving consistent profits.

Market trends in Dow Theory & The 3 phases of primary trends

In Dow Theory, market trends refer to the directional movements of the market over time. These trends help traders identify the prevailing sentiment and overall market direction. Dow Theory recognizes three primary trends: the primary trend, the secondary trend, and minor trends.

- Primary Trend: The primary trend represents the dominant and long-term direction of the market. It can last for months or even years and set the overall trajectory of the market. The primary trend reflects the underlying forces, such as economic factors, investor sentiment, and market cycles, that drive the market in a particular direction. In a bullish primary trend, prices generally rise over an extended period, while in a bearish primary trend, prices tend to decline. Identifying and aligning with the primary trend is crucial for long-term investors and trend-following traders.

- Secondary Trend: The secondary trend, also known as a reaction or countertrend, is a temporary price movement that corrects the primary trend without reversing it. Secondary trends typically occur within the context of the primary trend and can last from a few weeks to several months. In an uptrend, a secondary trend represents a temporary pullback or correction, providing an opportunity for traders to enter or add to existing positions at more favorable prices. Conversely, in a downtrend, a secondary trend may consist of short-term rallies or bounces, which can be used by traders to sell or establish short positions.

- Minor Trends: Minor trends are short-term fluctuations within the primary and secondary trends. They are smaller in scale and often caused by noise, market sentiment shifts, or short-lived factors. Minor trends can be more challenging to identify and may require a shorter time frame for analysis. While less significant compared to primary and secondary trends, minor trends can still provide trading opportunities for short-term traders who aim to profit from these smaller price movements.

The three phases of primary trends, as outlined by Dow Theory, are:

- Accumulation Phase: The accumulation phase marks the beginning of a new bullish primary trend. During this phase, informed investors and institutions start accumulating positions, taking advantage of undervalued prices. The market generally shows sideways or downward movement as selling pressure from early investors subsides and buying pressure gradually increases.

- Advancing Phase: The advancing phase represents the core of a bullish primary trend. It is characterized by consistent upward price movement and increasing volume. Positive news, improving fundamentals, and growing investor optimism contribute to the upward momentum. This phase is often accompanied by broad market participation and strong buying interest.

- Distribution Phase: The distribution phase signals the end of a bullish primary trend and the transition to a potential bearish trend. During this phase, informed investors start to distribute their holdings, taking profits and reducing their exposure to the market. Price consolidation, increased volatility, and declining trading volume may be observed. Distribution often occurs gradually, and traders need to monitor signs of weakness or potential trend reversal.

Source: Bybit Learn

Understanding the different phases of primary trends can assist traders in identifying the current stage of the market cycle, assessing the prevailing sentiment, and making strategic trading decisions. It’s important to note that these phases are not strictly defined timeframes and may vary in duration depending on the market and other external factors.

How do I implement the Dow Theory in Crypto?

Implementing the Dow Theory in the realm of cryptocurrencies involves applying its principles to analyze price movements, trends, and volume dynamics. Here’s a step-by-step guide on how to implement the Dow Theory in crypto trading:

- Identify the Primary Trend: Start by determining the primary trend in the cryptocurrency market. Look for long-term price movements and assess whether the overall direction is bullish or bearish. This can be done by analyzing historical price data, chart patterns, and trend lines. For example, if the market has been consistently experiencing higher highs and lower lows over an extended period, it suggests a bullish primary trend.

- Confirm the Primary Trend: Seek confirmation of the primary trend by analyzing multiple cryptocurrencies within the same category or sector. For instance, if you are trading altcoins, compare the price movements of different altcoins to see if they align with the primary trend identified in step one. When multiple cryptocurrencies within the same category exhibit similar upward or downward movements, it provides stronger confirmation of the primary trend.

- Identify Secondary Trends: Within the primary trend, watch for secondary trends or countertrends. These are temporary price movements that correct the primary trend but do not reverse it. Look for price pullbacks or rallies that deviate from the overall primary trend. These secondary trends can present opportunities to enter or exit positions at favorable prices. Technical analysis tools such as support and resistance levels, Fibonacci retracements, or moving averages can help identify potential reversal or continuation points.

- Analyze Volume Patterns: Volume analysis plays a crucial role in Dow Theory. Analyze the trading volume accompanying price movements to gauge the strength of the trend. In an uptrend, increasing trading volume during price advances suggests higher buying pressure, indicating a healthy and sustainable trend. Conversely, declining volume during price declines in a downtrend may indicate weakening interest and a potential trend reversal.

- Adjust for Cryptocurrency Market Dynamics: Keep in mind that the cryptocurrency market has unique characteristics compared to traditional markets. Factors such as increased volatility, 24/7 trading availability, and market sentiment driven by news and regulatory developments should be considered when applying the Dow Theory to crypto. Also, be aware of the impact of major crypto-specific events like hard forks, token releases, or exchange listings on price movements.

- Use Technical Indicators and Chart Patterns: Utilize technical indicators and chart patterns that align with the principles of Dow Theory to support your analysis. For example, moving averages, trend lines, and oscillators can help identify trend confirmations, reversals, or overbought or oversold conditions.

Let’s expand on the example of implementing Dow Theory in cryptocurrency trading:

Suppose you are analyzing the cryptocurrency market and have identified a bullish primary trend based on a long-term uptrend in prices and positive market sentiment. You observe that Bitcoin (BTC), one of the leading cryptocurrencies, has been steadily increasing in value over the past several months, displaying higher highs and higher lows.

To confirm the primary trend, you analyze other major cryptocurrencies, such as Ethereum (ETH) and Ripple (XRP). You will also find that these cryptocurrencies are also experiencing similar upward price movements, indicating a broader bullish sentiment in the market. This confirmation strengthens your confidence in the identified primary trend.

As the market progresses, you notice a secondary trend, which is a temporary price correction within the primary trend. For example, Bitcoin experiences a price pullback after a significant rally. Utilizing technical analysis tools, you identify a key support level, such as a previous price resistance that has now turned into support.

Now, closely monitor the price action around this support level. If the price of Bitcoin bounces off the support level and resumes its upward movement, it provides a potential buying opportunity in line with the primary trend. This could signal that the secondary trend is ending and the primary trend is set to continue.

To further confirm your analysis, you analyze the trading volume accompanying the price movements. In a healthy uptrend, you expect to see increasing trading volume during price advances, indicating higher buying pressure and market participation. If you observe a surge in trading volume as Bitcoin bounces off the support level and resumes its upward trajectory, it further strengthens the validity of the primary trend.

Considering the unique dynamics of the cryptocurrency market, you adjust your analysis for factors such as increased volatility and news-driven sentiment. You stay updated with the latest developments in the crypto space, including regulatory announcements, technological advancements, and market trends specific to cryptocurrencies.

Additionally, you utilize technical indicators and chart patterns that align with Dow Theory principles. For example, you may employ moving averages to confirm the trend direction, trend lines to identify key support and resistance levels, and oscillators like the Relative Strength Index (RSI) to identify overbought or oversold conditions.

With a comprehensive understanding of the primary trend, secondary trend, volume analysis, and technical indicators, you can make more informed trading decisions. For instance, you might decide to enter a long position on Bitcoin when it bounces off the identified support level with strong volume confirmation, anticipating a continuation of the primary bullish trend.

Conclusion

Implementing Dow Theory in cryptocurrency trading provides a systematic approach to analyzing market trends and making informed trading decisions. By applying the principles of Dow Theory, such as identifying the primary trend, confirming it through multiple cryptocurrencies, analyzing secondary trends, and considering volume patterns, traders can gain valuable insights into the market dynamics of cryptocurrencies.

However, it is important to note that implementing Dow Theory in cryptocurrency trading requires adaptability and consideration of the unique characteristics of the crypto market, such as high volatility and the impact of news events. Traders should also integrate risk management strategies and continually evaluate their trading decisions based on evolving market conditions.

By incorporating Dow Theory into their cryptocurrency trading strategies, traders aim to align themselves with the prevailing market sentiment, identify potential trend reversals, and improve their timing for entering or exiting positions. While no trading approach can guarantee success, the application of Dow Theory can provide a framework and a disciplined approach to analyzing market trends in the dynamic world of cryptocurrencies.

FAQ

What is Dow Theory in crypto?

Dow Theory is a widely recognized technical analysis framework developed by Charles H. Dow. It helps identify trends, confirm them across multiple cryptocurrencies, and analyze volume patterns, giving traders valuable market insights.

How do you trade with Dow Theory?

In Dow Theory, market trends refer to the directional movements of the market over time. These trends help traders identify the prevailing sentiment and overall market direction. Dow Theory recognizes three primary trends: the primary trend, the secondary trend, and minor trends.