Every investor always considers a number of different indicators before putting their money on the line, and market capitalization is one of the most important metrics you can think of. However, within the crypto world, market capitalization is not quite the same as it is in the stock market, for instance. In this article, we’ll dive into the topic of crypto market capitalization, what investors should know about it, and whether it should be a determining factor when doing your investing.

What is Cryptocurrency Market Capitalization?

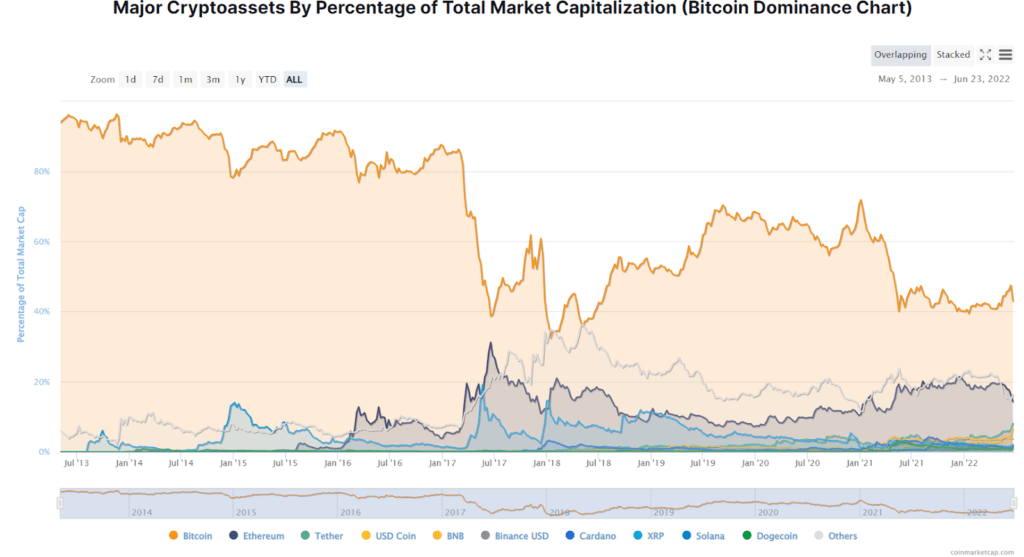

Market capitalization refers to the total dollar value of all the shares of a company’s stock — or, in the case of cryptocurrency, of all the coins that are currently in circulation. Usually, the bigger the market cap of a particular cryptocurrency, the more dominant position it has on the market. That is the reason why market capitalization is commonly used as one of the most important indicators for ranking cryptocurrencies and making decisions on whether to invest in them or not.

The market cap of a cryptocurrency is calculated by the current price multiplied by the circulating supply, so the formula looks like this: Market capitalization = current price x circulating supply.

Let’s take Bitcoin as an example and calculate its current market capitalization: it has a circulating supply of 19,074,206.00 coins and a current price of $21,503 per coin (as of 22.06.2022). So, $21,503 x 19,074,206 = $410 billion. It’s worth noting that cryptocurrencies can have both “circulating supply” and “fully diluted supply” at the same time. The first one refers to the coins that have already been minted, and the latter one refers to the coins that will eventually be minted in the future. The most commonly circulating supply is the one that is used to calculate market capitalization.

Since cryptocurrencies in general and Bitcoin in particular are notorious for their volatility, their market capitalization fluctuates along with their market price. However, you do not have to calculate a particular cryptocurrency’s market cap every time you need it, since you can always check it on the CoinMarketCap website, which can provide you with different metrics and data about thousands of crypto projects.

Even though market capitalization provides valuable insight on the performance and overall sentiment regarding a cryptocurrency project, some inexperienced investors might confuse the market cap with money inflow.

For example, if someone spends several million dollars to purchase a cryptocurrency with a price of $5, he or she has every chance of increasing the price to $10 per coin. That is, if this cryptocurrency has an estimated market cap of $500,000,000, it will grow beyond one billion dollars. However, does that mean that the market cap got a money inflow of half a billion dollars? Certainly not, since money inflow comes with an increase of liquidity and volume. So, why then is crypto market capitalization important?

Why does market cap matter?

The market cap first and foremost serves as an indicator of a cryptocurrency’s stability and market position. That means, the bigger the market cap, the more stability you can expect from an asset, and vice versa — the smaller the market cap, the less stable an asset is. By looking at cryptocurrencies’ market capitalization, investors can compare their value, see what kind of potential growth they might expect from them, and whether it is safe to invest in them.

For example, when a bear trend comes and the market starts bleeding, cryptocurrencies with small market capitalization suffer and lose their value much more than those currencies that are represented in, say, the Top 10 by market capitalization. Moreover, sometimes those assets with low market capitalization might get hit so hard that they cannot recover, and their price never goes back to the previous levels.

On the contrary, when the market goes through a bullish trend, those small-cap currencies can potentially grant you hefty gains, in case they’ll attract attention and investors’ money, and eventually grow in price.

So, does all that mean that small market cap coins should be used for day trading and large market cap coins should be seen as a long-term investment? Let’s take a closer look at what you should do with coins that have different market capitalizations.

What are market cap categories?

When looking at cryptocurrencies in order to find the right ones for investment and trading, you should remember that there is a sort of hierarchy of coins by market capitalization, specifically we can highlight three main categories: large capitalization, mid capitalization and small capitalization crypto. So what do they all mean?

- Large-cap cryptocurrencies refer to major cryptocurrencies with a market capitalization of more than 10 billion dollars, for instance Bitcoin, Ethereum or Ripple. These kinds of digital assets, even though being volatile just as any other cryptocurrency on the market, still should be seen by investors as a lower risk, long-term investments, since they have high liquidity and trading volume, demonstrated track-record of surviving through bearish trends and extreme market fluctuations, as well as history of success and investors’ trust. All that means that these kinds of cryptocurrencies can stand their ground even when the turbulence on the market comes in full force and panic selling kicks in.

- Mid-cap cryptocurrencies refer to the digital assets which have a market capitalization between 1 billion dollars to 10 billion dollars (e.g. Polkadot, Polygon, Litecoin). They represent more risk, and are less safer than cryptocurrencies with large capitalization, however they can potentially provide more profit. These kinds of cryptocurrencies might suit both purposes, be that long-term investment or short-term one.

- Small-cap cryptocurrencies are the ones that have a market capitalization lower than one billion dollars. Basically, every cryptocurrency that goes after the CoinMarketCap’s Top 50 by market cap falls under this segment.

These are the coins that are called “high-risk, high-reward” cryptocurrencies, since they both can be destroyed by significant price swings or, on the other hand, can deliver a hefty profit, since some of them might be undervalued or haven’t gained enough attention yet. These kinds of currencies might serve best for shorting, since they usually do not cost much and their price may fluctuate significantly throughout the day.

Certainly, even major and well-known cryptocurrencies with large capitalization like Bitcoin or Ethereum can be quite volatile. Only during this month Bitcoin went from the level of $32,000 down to $17,700, and now, as of June 23rd, it is trading at a price of $20,900. Its market capitalization went down from 567 billion dollars on June, 1st to 381 billion dollars on June, 22st.

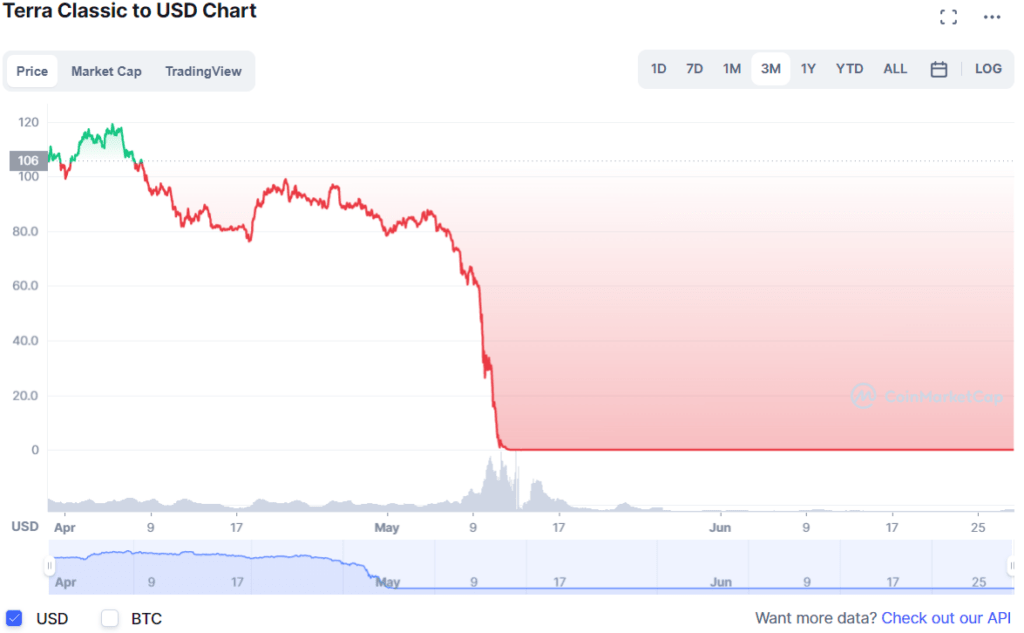

Another example is Terra’s LUNA and UST case. Terra LUNA was in the top 10 projects by market capitalization, with a price of more than $80 per LUNA coin just several weeks ago. As of today (28.06), LUNA’s price equals $0.00008 per coin. That happened due to Terra Protocol’s algorithmic stablecoin UST has lost its peg to the United States Dollar, and instead of $1 it costs around $0.05 (as of 28.06). The dust hasn’t settled yet, and we still don’t know all the reasons for sure why this happened, but the result is devastating, to say the least: Terra LUNA market capitalization dropped from $23 billion to $541 million in just five days.

Is market cap the best way to measure cryptocurrency’s future?

Market capitalization is definitely an important indicator and a useful metric when studying the crypto’s value, potential growth, and overall stability in the market. However, market capitalization alone cannot provide you with a full picture of a given crypto’s project, and you must also take some other indicators into account when considering investing your funds. So what other indicators along with market cap you should look at?

Circulating supply

The total quantity of coins or tokens that are in circulation and available to the general public is known as the circulating supply. Contrary to the total supply, which is constant and never changes, circulating coins and tokens can be burned, mined, or generated by the development team.

The price of a digital asset might go up if there are fewer coins or tokens in circulation. Remember the basic economics: a product’s value increases with its scarcity.

Liquidity

Liquidity refers to the measurement of how easily a coin can be bought or sold. A crypto project with high liquidity always has tight bid-ask spreads, which allow you to sell a coin at the current market price. On the contrary, in an illiquid market it is always a challenge to sell an asset, at least at a current price, since no trader is willing to make such a deal.

Hash rate

Hash rate means the overall computational power that is used to execute transactions on a proof-of-work (PoW) cryptocurrency network (e.g. Bitcoin, Ethereum, Dogecoin), and it also indicates the network’s viability.

The hash rate determines how motivated miners are to mine currency for profit and how secure the network will be. On the other hand, a declining hash rate indicates that investors and miners are losing their interest in a cryptocurrency.

Active addresses

The term “active addresses” refers to the number of active blockchain addresses in a certain period of time. You should count all of the sending and receiving addresses during a predetermined time period in order to calculate it. When you do that, you’ll be able to detect if interest in a certain coin is waning or gaining momentum by seeing if the number of active addresses is decreasing or increasing.

Utility and Tokenomics

Potential demand for a cryptocurrency can be increased in the future by a project’s overall usefulness. A project that has a realistic use case is much more likely to succeed, draw more investors, and grow in terms of value over time.

On the other hand, tokenomics refers to the project’s underlying economy. Will a project’s tokenomics encourage individuals to buy, hold, sell for a profit, and then buy the dip later? Try to answer these questions before diving into a project.

In addition to the abovementioned metrics and indicators, it might also be useful to check a project’s roadmap, its whitepaper and media presence. Even though market capitalization is a vital factor, it shouldn’t be separated from other indicators and metrics when choosing a crypto project for investing or trading.

FAQ

What is crypto market capitalization?

Market capitalization refers to the total dollar value of all the coins that are currently in circulation. Market Cap = Current Price x Circulating Supply.

Some cryptocurrencies can have both “circulating supply” and “fully diluted supply”. The first one refers to the coins that have already been minted, and the latter one refers to the coins that will eventually be minted in the future.

Why does market cap matter?

Market cap first and foremost serves as an indicator of a cryptocurrency’s stability and market position. That means, the bigger the market cap, the more stability you can expect from an asset, and vice versa – the smaller the market cap, the less stable an asset is.