Ripple’s goal is to replace SWIFT in the near future. Can you imagine that? And we are not making this up. These are the words of Ripple co-founder, Chris Larsen, who believes that the technology behind Ripple would be a viable alternative to the traditional financial system. So what’s so special about Ripple and how much can it cost in the future? Let’s find out!

What is Ripple? Short history and overview

First, it is important to distinguish XRP from Ripple: XRP is the cryptocurrency that was developed by Ripple Labs — a technology company that designs financial products; Ripple is the name of a digital payment network, on which XRP is functioning.

Ripple Labs was founded in 2012 by entrepreneur Chris Larsen and programmer Jed McCaleb and, at first, was known as OpenCoin. From the very beginning the main idea was about creating a new and unique payment network for financial transactions. XRP was deployed in the same year, and its initial purpose was to serve as an intermediate mechanism during the process of exchange between two networks or currencies. In 2013 OpenCoin changed its name into Ripple Labs.

Ripple is a peer-to-peer and open-source decentralized platform that allows the seamless transfer of any type of money, from traditional fiat currency like dollars and euros to cryptocurrencies like bitcoin. Ripple does not have mining; instead, it uses a consensus mechanism through a number of bank-owned servers in order to confirm transactions. Speaking of the latter ones, ripple transactions use less energy than other cryptocurrencies (e.g., Bitcoin) and are confirmed in merely seconds.

The vision of Ripple Labs can be called, at the very least, ambitious: Ripple is on a quest to revolutionize the world’s payment systems via their platform, so they could replace the existing SWIFT system. In their opinion, the current banking system is slow and lacks transparency, and it needs to be rebuilt in order to get rid of barriers and limitations. To do that, they have created RippleNet and Ripple Ledger.

Ripple’s view on payments. Internet of Value

Ripple believes that the traditional banking system is filled with drawbacks and limitations. The current financial infrastructure represents an obsolete, slow, and expensive system that is already out of date. That is why Ripple has introduced its own vision called “the Internet of Value.”

This vision’s core idea is about exchanging value as quickly as information in our era of the Internet, when it takes merely seconds to transfer data from one person to another. It is not appropriate when it can take 3-5 days and dozens of dollars to make an international payment in the US.

With the concept of “the Internet of Value,” a transaction that contains value — any kind of value, be that money, intellectual property, stocks, or cryptocurrency — can happen instantly, just like how people send emails to each other. To make this happen, Ripple believes the application of blockchain technology must continue on a global scale. Moreover, the competition between blockchains must be put to an end since “the Internet of Value” can become a reality only when there are industry standards and a homogeneous blockchain ecosystem.

Ripple does its share by supporting Interledger Protocol (ILP), a non-profit organization that stands for promoting innovation, web and creativity by advancing open payment standards and technologies that seamlessly connect global society. In theory, ILP for “the Internet of Value” can become something like what the protocol HTTP became for the internet — a unified technology that became a global standard for online information exchange.

RippleNet and Ripple Ledger. Peculiarities and details

In order to understand what’s so special about Ripple and XRP, it is crucial to look closer at their payment system, called RippleNet.

RippleNet constitutes a global network of banks in which customers can transfer and receive payments via Ripple technology. RippleNet, unlike most other blockchains, does not use proof-of-stake or proof-of-work protocols; instead, it uses a consensus protocol in which designated servers validate account balances and transactions within the system. Ripple connects payment providers, banks, exchanges, and corporations through RippleNet so that all of them can have one frictionless experience when transferring finances globally.

The list of use cases is really astonishing: international bill pay, e-Invoicing, real-time cashpooling, international supply chain payments and more.

At first, Ripple had a series of products: xCurrent, xRapid and xVia. xCurrent enabled payment processing between banks; xRapid stood for a pool of liquidity that banks could have access to so they could transfer funds easily; xVia stood for a global payment transaction system. However, in 2019 Ripple changed their terminology and now offers only one product, and that is RippleNet.

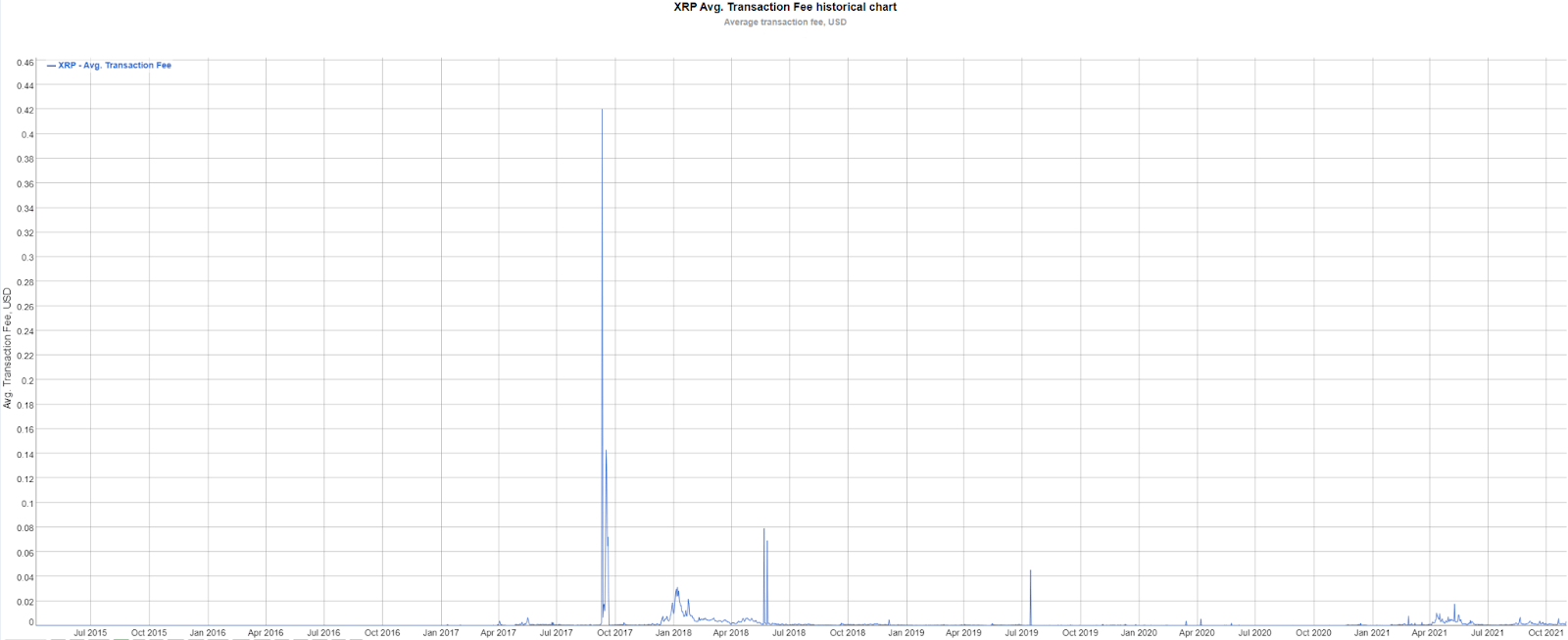

If we look at the fee chart, we can see that the Ripple transaction cost differs from those that cryptocurrency enthusiasts are used to seeing. When fees on the Bitcoin or Ethereum blockchains can sometimes reach $50-70 per transaction, the average Ripple fee is less than $0.01. There were a few spikes in the past, but they never went beyond half a dollar. All of that became possible due to the XRP Ledger, a decentralized public blockchain that stands out for its efficiency and speed.

Ripple Ledger runs differently than other blockchains. For instance, blockchains that are based on proof-of-work protocol are heavily dependent on those validators that have the most advanced hardware and cheapest energy source, since they are the ones who choose which transaction to execute. This kind of verification is slow and expensive.

The situation with the Ripple Ledger is different: it relies on a consensus mechanism, and thus no single party can be in control. Anyone can download its validation software, but it maintains what it calls “unique node lists” that users are free to select to verify their transactions based on which participants they think are least likely to swindle them. Ripple picks the validators for this list and makes up six of the validation notes, but the users may disagree with this list and hypothetically remove the validators that Ripple has chosen and form their own list of trusted validators.

When new transactions happen, the validators update their ledgers every three to five seconds and make sure they match other ledgers. In case something does not add up, the validators figure that out collectively. With this kind of approach Ripple can efficiently validate transactions: what takes minutes and dozens of dollars for Bitcoin, takes seconds and merely pennies for XRP.

Community and partnerships

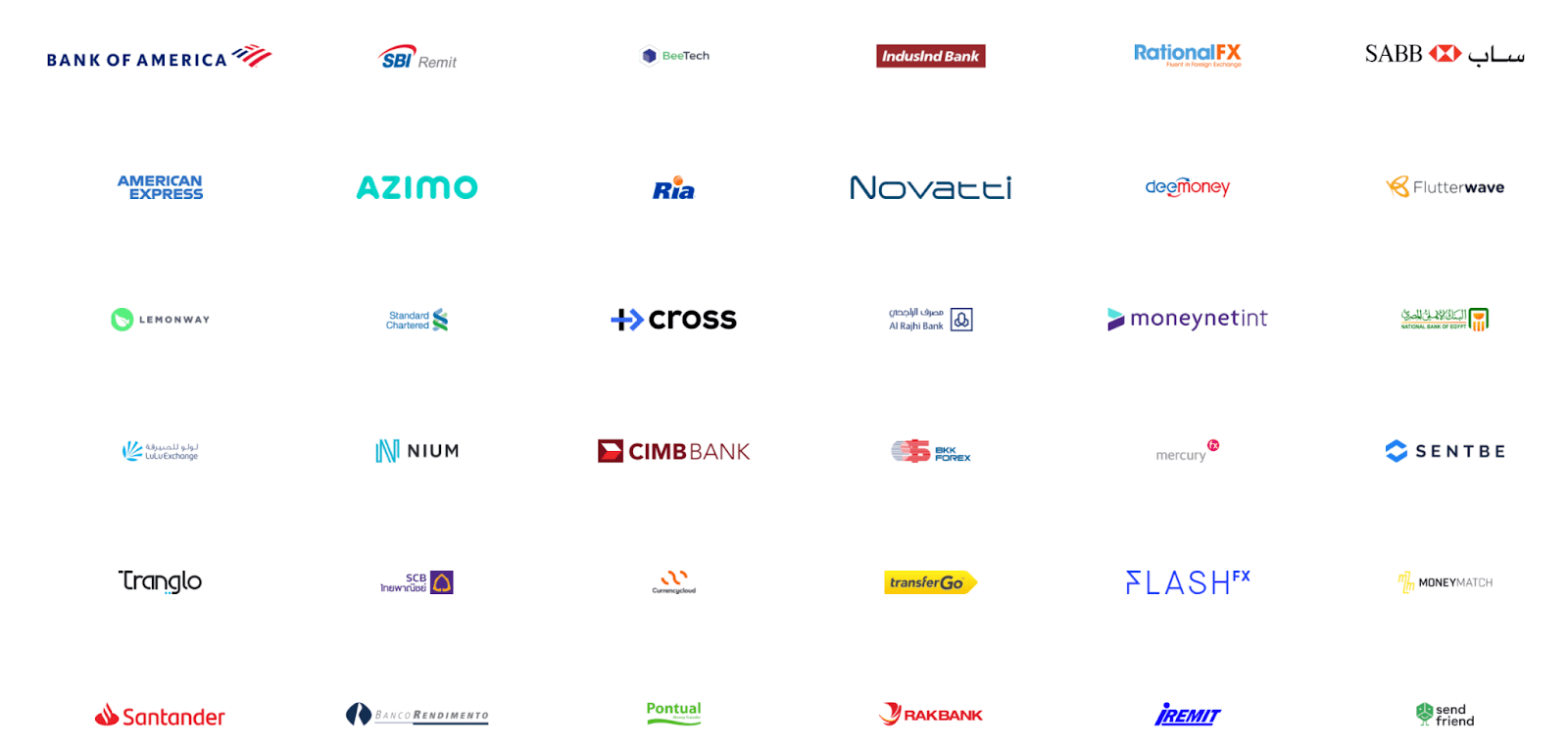

The list of institutions, banks, and companies that Ripple collaborates with and has partnerships with is really impressive. Among their customers are Bank of America, American Express, MoneyGram, Royal Bank of Canada and many, many more. The number of their institutional customers is in the hundreds, and their technology is used in over 55 countries worldwide.

Every week we can see news of some major financial organization making an alliance with Ripple. For instance, a couple of weeks ago, Ripple partnered with Qatar National Bank to improve cross-border payments, and some time after, it announced it was joining forces with the Digital Pound Foundation to help in the development of the digital British pound. Ripple is truly doing their best to spread their technology and turn their vision of “the Internet of Value” into a real-life case.

They’ve set their goal to partner with mission-driven fintech, universities and NGO’s to “create greater economic fairness and opportunity for all”, as they put it themselves. To be more specific, they want to make approximately 1.7 billion unbanked people have access to basic financial services, and make their lives more secure and affordable. In addition, Ripple is working on achieving a zero-net emissions future, and that is why they also partner with multiple “green” institutions and foundations to build a sustainable world.

SEC vs Ripple lawsuit

However, not everything is so bright and shiny in the Ripple world. It’s been almost a year since the Securities and Exchange Commission (SEC) filed a lawsuit alleging Ripple Labs had violated securities laws when they didn’t register XRP as a security. To be more specific, the SEC’s complaint alleges that Ripple has been raising funds since 2013 through selling its digital asset, XRP, via unregistered securities offerings to investors in the USA and worldwide.

It is hard to say if the lawsuit caught Ripple Labs by surprise, but it is safe to say that this particular case will add more confusion in on-going debate of whether the cryptocurrencies should be treated as commodities, or securities or maybe something else. Ripple Labs does not agree that XRP should be seen as security and thus thinks they rightfully issued and sold XRP without SEC’s registration. More confusion is added by the fact that other cryptocurrencies like Ethereum or Bitcoin are treated like commodities and do not need to be registered as securities.

The SEC claims that the Ripple and XRP cases are different, since Ripple used XRP as funds for their business, and with that, XRP should be seen as a security and not a commodity.

It is still hard to say with 100% certainty who will win in court. However, some experts believe that Ripple might end up being a winner: John Deaton, the founder of Crypto-Law.us, and Josh Mitts, a securities law professor at Columbia University, are among them.

This case is still in the process, and it might take several more months before we hear the final verdict. What can be said for sure is that the outcome of this case has all the potential to shape the final view on cryptocurrency and put a decisive end to the subject of how cryptocurrencies should be treated. Moreover, it is safe to say that we can expect the outcome to have an impact on the whole cryptocurrency market, one way or another.

Ripple price forecast 2021 and 2022

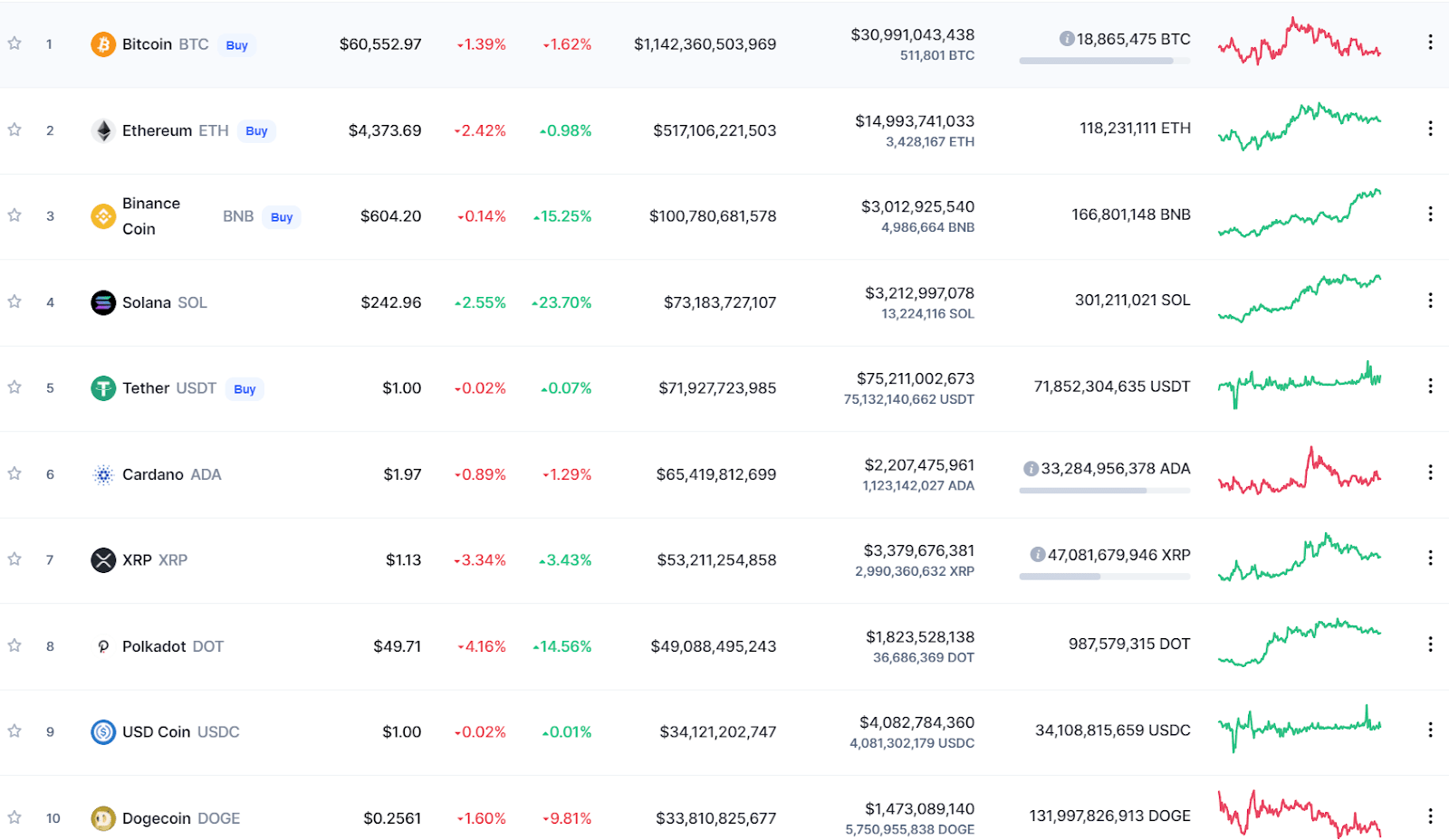

Currently, XRP is in the TOP 10 cryptocurrencies with a market cap of more than $53 billion and has a price of $1.13 per coin (as of 06.11.21). Since Ripple is stuck with its SEC’s lawsuit, theoretically it could have negatively affected the price, but in reality we see that Ripple continues to build alliances and partnerships with different institutions and organizations and even went from $0.22 to $1.13 mark in 2021. Thus, we can assume that Ripple’s reputation as well as faith in XRP hasn’t suffered much damage.

The Economy Forecast Agency (EFA) predicts XRP price to stay around $1.30 till the end of 2021. However, in the beginning of 2022 we might see it grow up to $1.50-1.60, then a correction might follow and by June the price might be around $1.30 per coin. By the end of 2022, XRP has the chance to return to its initial price of $1.30, just like it would be at the end of 2021.

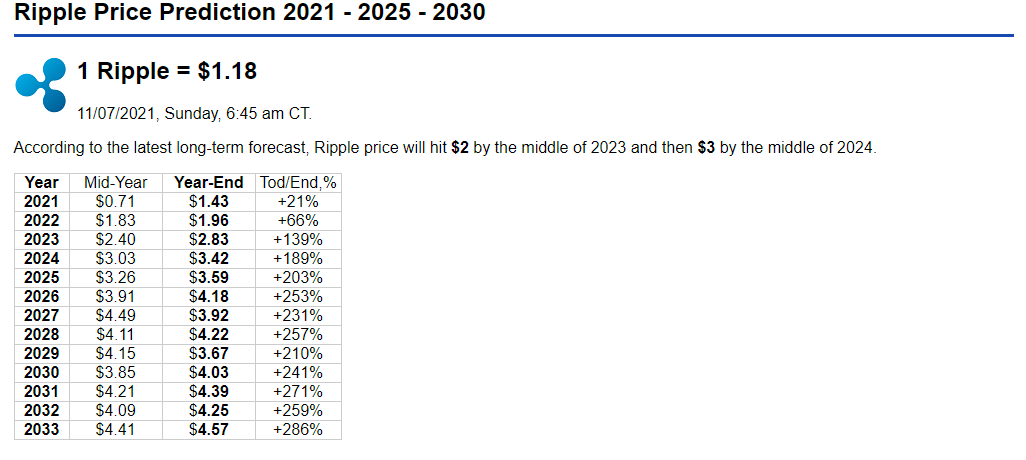

Coin Price Forecast predicts XRP cost to stay at the level of $1.38 by the end of 2021 without any major changes. The beginning of 2022 promises to start with the price of $1.77 per XRP coin and by the end of 2022 we might see it go up to $1.90.

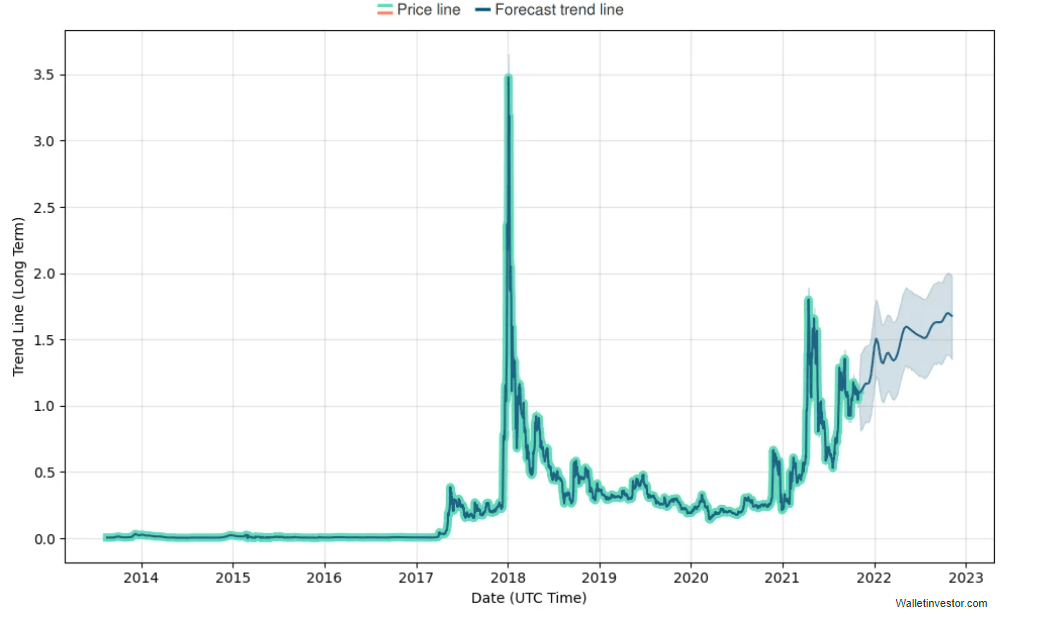

According to WalletInvestor, the average price of XRP by the end of 2021 can be expected to be at around $1.46 mark. Throughout the 2022 we probably might see a steady growth for XRP price, and it has a chance of reaching a $1.7 mark by October. By the end of 2022, XRP might reach a $2.00 level and still continue its climb.

Ripple price forecast 2023-2025

Coin Price Forecast predicts that 2023-2025 will be bullish years for XRP. At the beginning of 2023, the price can be expected to be $2.40 per coin, and the end of the year can grant us the price of $2.83 for XRP, thus the increase might be around 140%. According to them, both 2024 and 2025 will be the years of constant growth for XRP, and the price can go up from $3.03 at the beginning of 2024 to $3.59 by the end of 2025.

The Economy Forecast Agency (EFA) is more bearish regarding XRP price, and they predict a constant drop in the price throughout the period of 2023-2025. The starting price in 2023 is predicted to be around $1.20-1.40 per coin, and it might reach a $1.55 level by April. However, after that the price might go down and drop to $1 or even less by the end of 2023.

Wallet Investor prediction is as bullish as Coin Price Forecast. In their opinion, the first three months of 2023 will bring us the XRP price fluctuation from $1.80 to $2.00 per coin. However, starting from the end of April and until the end of 2023 XRP will constantly grow, and its price has all the chances to go up to $2.6 level. The first half of 2024 is promising to be stable for XRP, and we can expect its price to be around $2.5-$2.7. Starting from September, Wallet Investor predicts XRP price to start growing again, and by the end of 2024 it might break a $3 level. The average price for XRP in the year of 2025 is expected to stay above the $3 mark, adding little by little every month and climb up to the level of $3.7 per coin by the end of the year.

Ripple price forecast 2030

It is always difficult to make such long-term forecasts. However, some experts believe that Ripple’s future is bright.

Economy Watch believes since XRP has so many real-world use cases, XRP’s future is promising and the trust from investors is very strong. They also predict that Ripple’s technology can somewhat change the current SWIFT system, and XRP is the best alternative to it so far. In case Ripple wins the lawsuit against the SEC, this fact can also bring enormous attention to the coin.

Coin Price Forecast upholds the same opinion regarding Ripple. In the period of 2028-2032 XRP would rise from $5.27 to $6.61, and has all the chances to continue its growth.

Still, most of the experts agree on the opinion that the upcoming verdict in the Ripple vs. The SEC lawsuit will play a major role in XRP price formation, and all we can do for now is wait.

Does XRP have a future worth investing in?

The fact that Ripple is still involved in a lawsuit with the SEC may have eroded investor confidence in XRP.Still, it looks like it never happened, and you also shouldn’t be too quick to judge here. In case Ripple comes out as a winner, it might send the price of XRP sky-high, since that would not just mean Ripple’s win, but cryptocurrency victory in general. In addition, the fact that the list of partnerships continues to increase almost on a daily basis shows that major institutions and organizations see Ripple’s technology and XRP in particular as a worthwhile investment.

Moreover, even in the worst-case scenario it is hard to assume that XRP would end up going into oblivion regardless, since Ripple has already recommended themselves as a trustworthy and reliable company which has a particular goal and vision for the future of the current financial system.

FAQ

What will XRP be worth by 2025?

Coin Price Forecast predicts that 2023-2025 will be bullish years for XRP. At the beginning of 2023, the price can be expected to be $2.40 per coin, and the end of the year can grant us the price of $2.83 for XRP, thus the increase might be around 140%.

How much will XRP be worth in 5 years?

According to them, both 2024 and 2025 will be the years of constant growth for XRP, and the price can go up from $3.03 at the beginning of 2024 to $3.59 by the end of 2025.