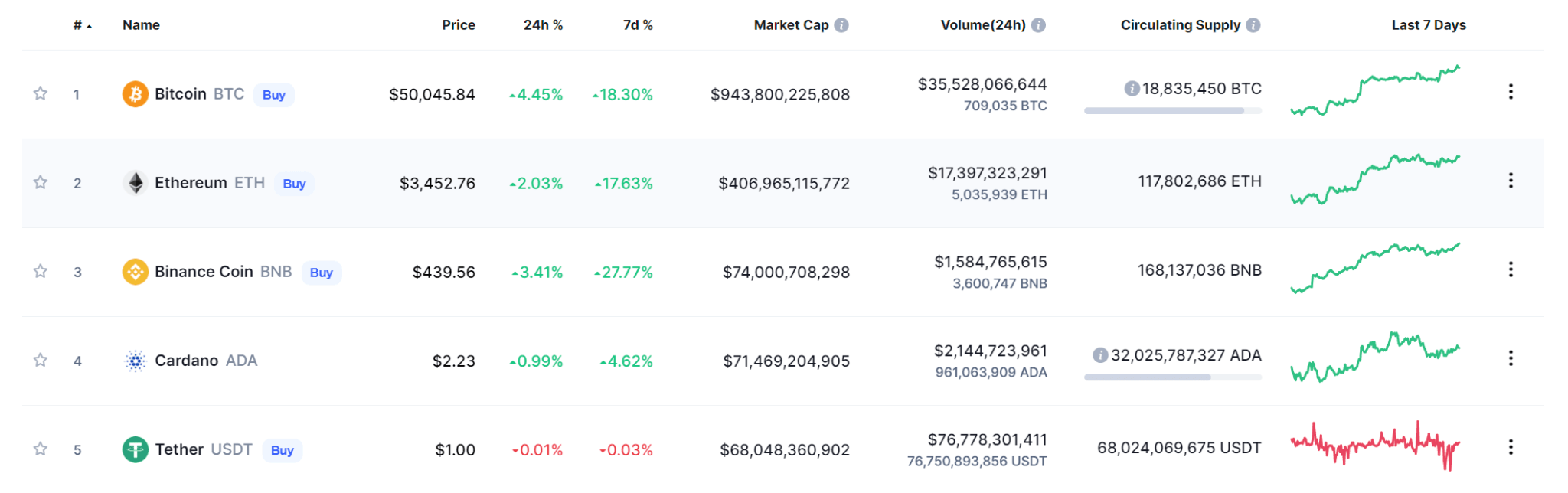

Ethereum is a blockchain platform with its own coin (ETH), which is now number two in the world with a market capitalization of over 400 billion dollars (as of 08.10.2021). When referring to cryptocurrencies, it is usually meant to be either Bitcoin or Ethereum, thus making them equal, but in reality, the difference between these two assets is enormous. Yes, they are both decentralized, both built on blockchain technology, and these two digital currencies made the world of crypto famous, mainstream even to ordinary people. However, there are more differences between Bitcoin and Ethereum than there are similarities.

What is Ethereum?

Ethereum was originally created to give everyone who knows how to code an opportunity to develop their own decentralized applications, or dApps. In fact, the Ethereum platform has become so popular among developers that it now dominates the dApp space, leaving other platforms dragging behind. So when talking about Ethereum, we mean the whole ecospace that goes far beyond just a cryptocurrency.

It took several years for the Ethereum platform after its initial launch in 2015 to gain its popularity and momentum. Both 2017 and 2018 were the years when multiple projects on this platform were constantly ripening, like so many cherries on a tree, through Initial Coin Offerings (ICOs). Anyone could participate in a ‘big and promising project’ by sending ETH to the developers. The demand for ETH was enormous at that time, driving the price sky high. Unfortunately, in 2018, that bullish trend on ICOs faded out completely, due to the fact that so many projects ended up being scams that swindled hundreds of millions of dollars, and the Ethereum coin price dropped hard, from 1400 USD to 80-100 USD, thus losing more than 90% of its value.

Nevertheless, Ethereum managed to live through the bearish trend and was able not only to restore, but also to strengthen its previous positions. However, it wouldn’t be possible to do that if Ethereum was just a regular cryptocurrency. So what makes it so special?

Peculiarities and analysis

With the introduction of smart contracts — the foundational technology and the key element of Ethereum platform — the entry into the crypto industry became open literally for anyone who is willing to create any application of their own, be that online game or finance, or something else — you name it. This feature of the Ethereum platform allowed it to bypass any kind of third party and centralized authorities, and it became one of the reasons why ETH is the number two cryptocurrency in the world. The question is, why has the Ethereum platform become so popular for dApp development?

ETH Protocol. Open-Source platform

“Codify, decentralize, secure, and trade just about anything” — this is an official quote of the Ethereum Foundation, a non-profit organization dedicated to supporting Ethereum and related technologies. Ethereum was the first platform that was dedicated to such a motto. That is true: using the Ethereum platform allows you to reduce the time you need for programming by introducing a development interface, and that helps to deploy your project fast. Moreover, the fact that the developers can monetise their dApps helped to create a large community of people who are now committed to making the Ethereum ecosystem imposing and better.

Ethereum platform has a great asset that makes developers life easier — Ethereum Virtual Machine. This unique system can help you to deploy your dApp more effectively by providing development kits, application templates and other convenient tools so you could launch your dApp regardless of the underlying coding language. To put it simply, with the assistance of the EVM you do not need to develop a whole new blockchain for every new dApp. Such a developer-friendly system just couldn’t stay unnoticed for a long time, and new developers continue to choose the Ethereum platform over others. Moreover, it does not stand still and strives for continuing evolution. Currently, it’s undergoing an upgrade known as Ethereum 2.0 that has already attracted investors’ attention. The changes and possible impact it can bring will be discussed in more detail further in the article.

Network effect. Community. Dapps

The Ethereum network effect is more about technology, rather than simply money-making: if Bitcoin is usually seen as “digital gold”, then Ethereum is seen as “digital oil”. The reason why Ethereum is called like that is because of its versatility and multitasking, and unlike Bitcoin that has only one function, Ethereum should be seen as a ledger.

A platform with such wide ambitions like Ethereum has all that is needed for the formation of a strong and loyal community of developers. Its network effect is focused on the extension and cultivation of the ecosystem, the deployment of the dApps, and the improvement of the decentralized financial system.

Currently, there are more than 3,000 dApps that are built on the Ethereum platform. If we take a closer look at them, we can find literally any kind of application one can imagine: Uniswap and Sushiswap are two of the most well-known decentralized exchanges; Tether stablecoin is one of the Top 5 cryptocurrencies by market capitalization; Axie Infinity, online game that allows you to earn cryptocurrency for playing it; and many, many more. The constantly increasing number of developers that decide to join the Ethereum platform make the ecosystem more diverse, friendly, and better functioning by deploying their dApps, which in their term bring aboard smarter tools, better code, and, most importantly, new knowledge.

Moreover, some of the decentralized applications utilize their own utility tokens that coexist with the dApp itself — Uniswap’s token UNI is one of the examples.

Limitations and weaknesses

With all the advantages and positive sides the Ethereum platform has, one might ask if it can be labeled as ideal? Well, certainly not, as it sure does have some disadvantages and its own weaknesses.

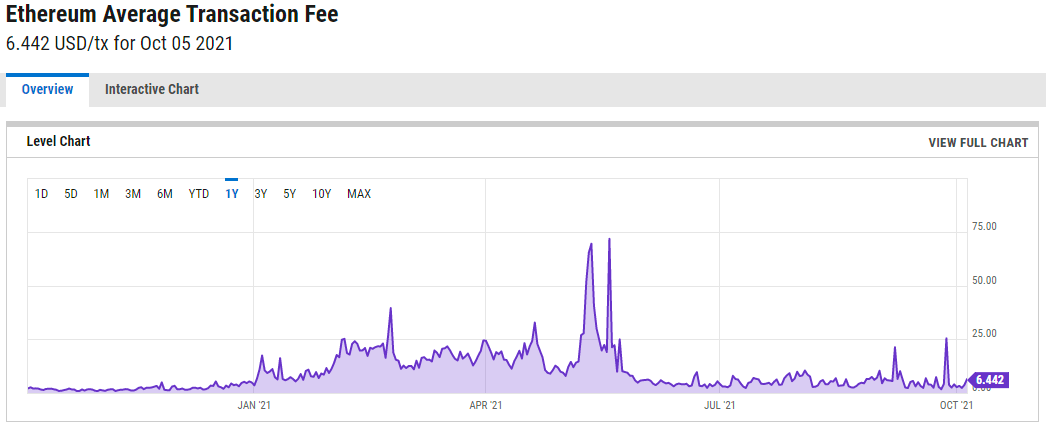

One of the downsides of the popularity of Ethereum is that its network is highly congested and users have to pay very high “gas” fees when making a transaction.

During this year alone there were periods when transaction fees have reached an absurdly high level of almost 75 dollars. Such fee spikes can push away not only potential investors, but also dApps developers as well. However, during this August, Ethereum saw a London hard fork, which is expected to reduce the gas fees up to 20% in the long run.

Ether, just like most other coins, still tends to mirror Bitcoin price action. Yes, even though it is the number two crypto in the world, its price is somewhat linked to the Bitcoin market’s behavior. It is unclear if this trend will change in the future, or if the whole crypto market is forever chained to Bitcoin’s price fluctuation.

Even though the Ethereum platform is still the most popular one for deploying smart contracts and developing dApps, some of the other platforms might become a serious competitor in the future. Binance Smart Chain, for instance, has already proved itself as a much cheaper platform for smart contracts; Cardano has a peer review system, which can become a real threat to Ethereum in case Cardano’s smart contracts appear to be better; Polkadot allows app developers to create a blockchain of their own, so-called “Parachains”, that can communicate with other blockchains.

Ether mining is not eco-friendly, since its networks consume a formidable amount of energy. So, if you want to mine enough ETH to make it worth your while, you need to have a really huge amount of computing power to process validating transactions. However, with the upcoming Ethereum 2.0 upgrade, the situation might change for the better.

ETH 2.0. When will it happen and how important is it?

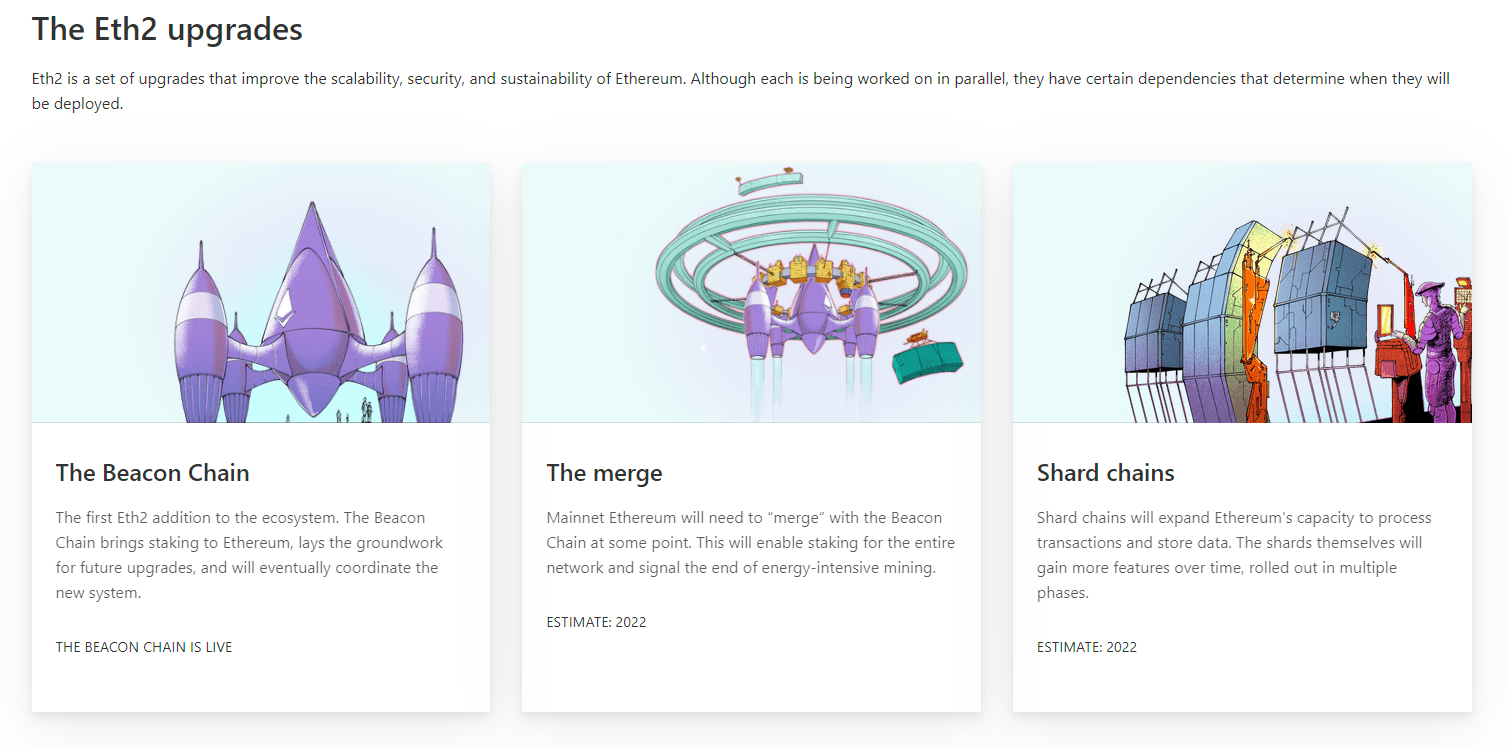

As already mentioned above, ETH 2.0 is an upcoming major Ethereum network upgrade. It will allow Ethereum to grow and will add more efficiency, security and speed. The question is, why is it so important, and what kind of impact will it have?

Most importantly, the Ethereum network will move from a proof-of-work protocol to a proof of-stake one. That means the need for energy-intensive mining drops off, since staked Ethereum will secure the network.

This is a much more eco-friendly method, and it is believed that this upgrade will reduce network congestion and increase transactions per second by creating new chains. Let’s look at these two protocols in detail.

Proof of work protocol stands for requiring a vast amount of computer engineering that is contributed by miners around the globe while solving math “puzzles”. Those who become the first ones to complete this task are rewarded with a certain amount of ETH. Since ETH mining became so popular, the Ethereum network has become very congested, facing bottleneck issues and thus sending fees sky high.

Proof of stake, unlike proof of work, does not require a network of miners who solve the puzzle via their computer power. Instead, it requires a network of investors. These “stakeholders” contribute their ETH to a staking pool. Thus the name ‘proof of stake’: this act of contribution is called “staking”. Certainly, you do not do it for free — investors who stake their ETH earn a reward in proportion to the size of their stake. Moreover, the more you stake and the longer you keep your ETH in the pool, the more rewards you will get. It is worth mentioning that staking is open to literally anyone who is willing to participate.

This transition is believed to solve the problem of congested networks and thus extremely high fees. However, what will happen with those who have already invested in ETH 1.0? Will they have to transit all their ETH manually?Fortunately, there is no reason for concern. The investors won’t need to do anything on their own, since this upgrade will not affect their funds. Two types of Ethereum blockchains are going to coexist until the time when Ethereum 1.0 merges with the Ethereum 2.0 blockchain.

There is no specific date for the ETH 2.0 upgrade yet. The official website says it will happen in the year of 2022, but no details have been revealed yet, so theoretically, there is a chance that the merge might take even longer than expected.

What will happen with mining ETH 1.0? Is it still worth it?

In the long run, ETH will move away from mining: proof of stake protocol, remember? However, things may not be so grim for the miners — not in the near future at least. According to the documentation that was issued prior to the Casper update, which is a part of Ethereum 2.0 upgrade, mining will be possible until the transition period ends. That means, miners still have months ahead before the blockchain merge.

By the time this happens, it won’t be possible to mine ETH anymore. So for those who do that now, the only option will be to move to other altcoins mining — like Ethereum Classic, which has no plans to switch for proof of stake protocol.

According to Coin Price Forecast, Ethereum Classic price will grow in the future. We can expect it to reach $105 in 2023 and go beyond the $150 level in 2025. So this altcoin might be worth looking at for those crypto enthusiasts who’re planning to continue mining.

All in all, the answer to the question whether it is still worth mining ETH is pretty clear: in case you are already doing it, then you still have time to finish it up and decide what to do next; if you haven’t started it yet, then you should probably give up this idea, and think about staking ETH, which is already possible.

How will the Ethereum 2.0 upgrade impact the price?

We already know that the crypto market bleeds red almost every time the Bitcoin price goes down. The opposite happens when the Bitcoin chart is all green. For the most part Ethereum, just like other coins mirrors the Bitcoin, although it is not that heavily dependent.

At the time of writing, ETH price is around $3,500, and investors are curious how the upcoming upgrade is going to change the ETH price.

Since it is still unclear when exactly ETH 2.0 upgrade will come in full power, it is safe to say that the price for ETH will not see huge spikes in the next few months. This kind of uncertainty may discourage a lot of investors from staking, thus decreasing the hype for ETH 2.0 and making its price growth more steady over time.

However, it is clear that due to hardcore Ethereum enthusiasts its price will eventually see a new All-Time High — it just won’t happen in a day, but probably it will take months, maybe more than even a year. Ethereum 2.0 is definitely a long-term play. So what will be the main factors that can impact ETH price?

First and foremost, the Ethereum 2.0 upgrade will make Ethereum more versatile, secure and scalable. What that means is that we can expect more DeFi projects and a new renaissance for dApps.

Second factor is staking. The more popular it will become, the more ETH will be unavailable for purchase since they’re all staked, and that can impact price heavily.

Third factor is that ETH 2.0 will become more eco-friendly thanks to proof of work protocol. Since measures to fight climate change are now a mainstream topic in mass-media and governments agenda, the fact that number two cryptocurrency is even more environmentally safe than Bitcoin will surely work in Ethereum’s favor.

Nevertheless, let’s not forget that some things can go wrong and the ETH price might change, although in the opposite direction.

If some of the aspects of the upgrade go wrong, it can undermine the credibility of Ethereum. Not to mention that it is still unknown when the upgrade will be finished, and the potential investors won’t wait forever.

Also, don’t forget about the overall crypto market volatility: the implementation of Ethereum 2.0 upgrade is unlikely to change it.

What are the biggest companies that invest in ETH?

It’s no secret that hundreds of major hedge funds and tech giants put their money in crypto. Some of them go even further, establishing alliances and cooperation with Ethereum Foundation in order to use Ethereum blockchain for their use.

Microsoft is one of such tech giants. They have considered the Ethereum blockchain to be secure and reliable to the extent that they’d come up with a decision to use the Ethereum blockchain to combat piracy.

Another tech giant that decided to use Ethereum’s blockchain is Amazon. Earlier this year, Amazon announced that users of Amazon Managed Blockchain, a service that people use for joining public networks and creating scalable private networks of their own, now support Ethereum network. However, even major banks do not resist the crypto’s increasing popularity anymore.

A few months ago, The European Investment Bank issued its first ever digital bond on Ethereum blockchain. Moreover, the sale was led by one of the most known world banks of Goldman Sachs, Societe Generale and Santander.

JPMorgan, UBS and Mastercard have also decided to keep up the pace and invested $65,000 in ConsenSys — a leading developer for the Ethereum blockchain network.

Mike Dargan, Group Chief Digital and Information Officer for UBS explained that move to make the bank be ready for the future and for the potential benefits of its client.

Executive vice president of digital asset products at Mastercard, Raj Dhamodharan, has mentioned that “Ethereum is a key infrastructure on which they plan to build payment and non-payment apps to power the future of commerce”.

This is merely just a tip of the iceberg. In fact, the list of the companies, banks and hedge funds that implement Ethereum blockchain or invest their funds in its technology can go on and on. Truly, Ethereum has a very impressive support.

ETH price prediction 2021. What will be the maximum and minimum price?

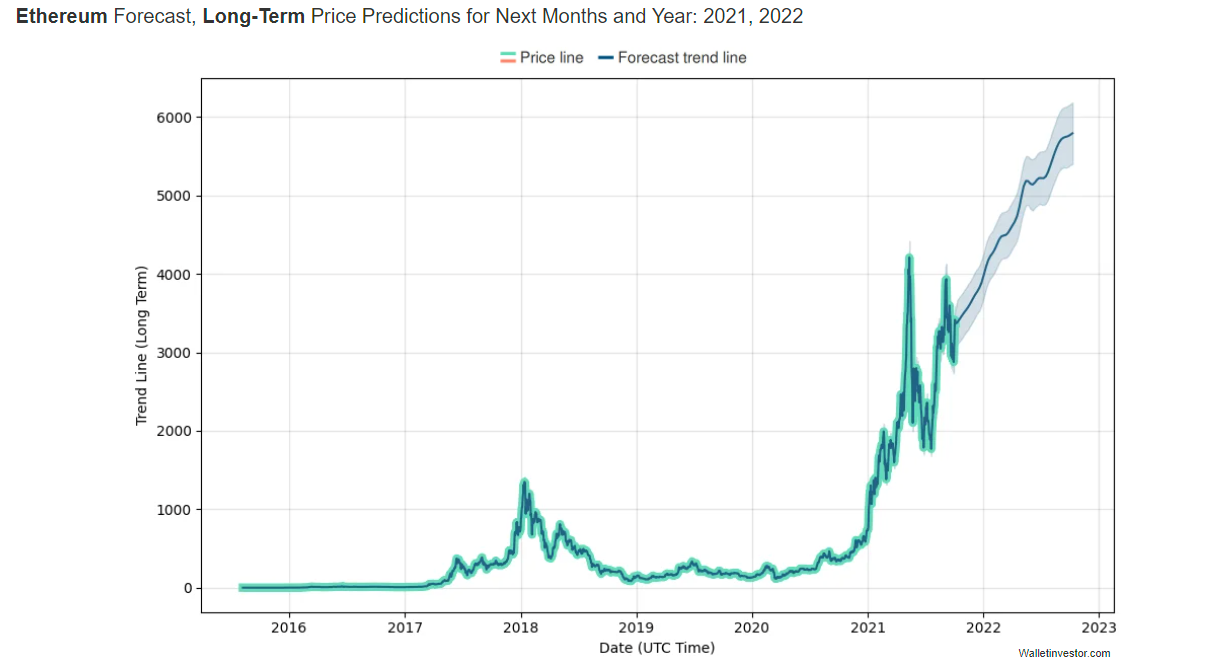

Since the Ethereum 2.0 upgrade is not happening this year, we can expect that the ETH price will fluctuate alongside Bitcoin and the overall crypto market. WalletInvestor predicts growth for ETH in 2021, breaking a $4,000 level later this year, then dropping below to $2,000 and bouncing back to 4,000. Potential forecast for ETH price after 2021 looks promising as well, according to WalletInvestor.

The Economy Forecast Agency is even more optimistic regarding ETH’s future price. According to them, ETH price can go above $5,000 level in November 2021 and experience a slight drop by the end of 2021, returning to $4,800. They also do not think that ETH price will go below a $3,000 level like WalletInvestor does. Deltecbank is more conservative about Ethereum’s short-term price forecast. In their opinion, we can expect ETH price to be around $3,200-3,300 by the end of the year. However, Deltecbank also predicts that ETH price will go beyond $4,000 level in 2021, but then the numbers will return to mean.

ETH maximum and minimum price prediction 2022-2025

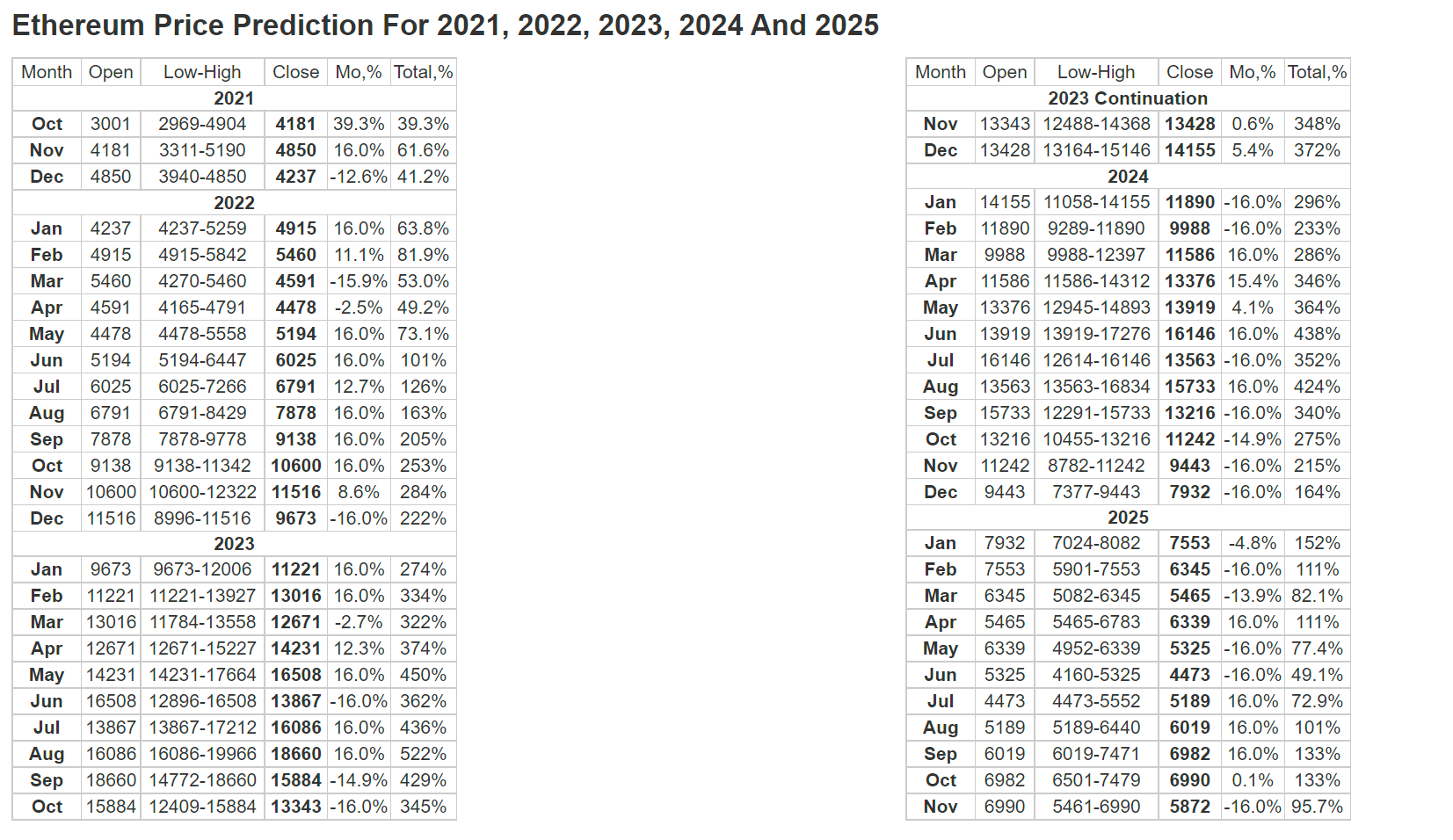

The Economy Forecast Agency (EFA) is very bullish about ETH price prediction. In their opinion, ETH value is destined to grow and constantly break ATH level throughout the period of 2022-2025.

In 2022, ETH lowest level will be around $4,000, and it has every chance to go beyond $10,000 per coin. The year of 2023 will be even more prosperous for Ethereum, as we might witness it going from $10,000 up to $18,000 and then correcting itself at the level of $13,000. In 2024, they predict ETH price to fluctuate from $14,000 to $10,000 levels, then grow back to $16,000 and drop lower than $10,000 by the end of the year. However, the EFA predicts 2025 to be grim for ETH, as it will start with around $8,000 and drop heavily down to the level of $4,400 per coinm and then bounce back to fluctuate around $6-7,000 by the end of the year.

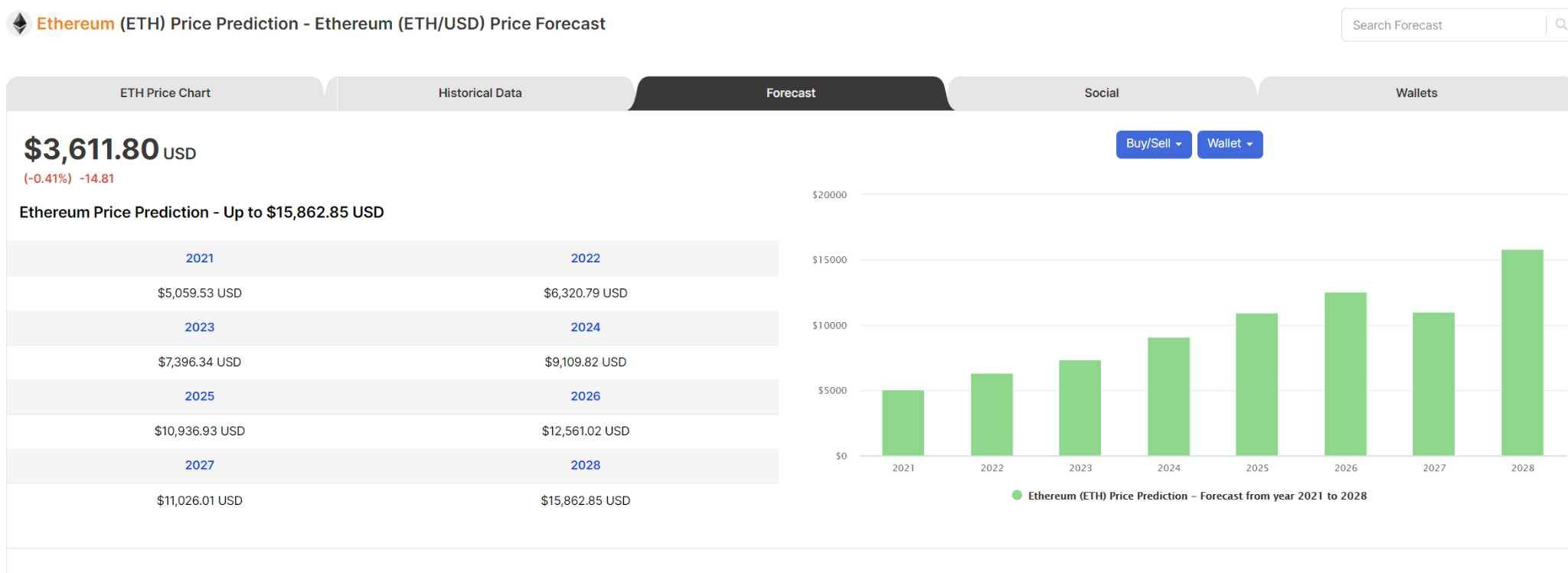

The Digital Coin forecast is almost as optimistic as the EFA prediction. They expect steady growth for ETH from the end of 2021 and break the level of $6,000 in 2022. In 2023, it is predicted that its price will be around $7,400 and go beyond $10,000 in 2025. Digital Coin also does not believe that the price of Ethereum will be downward in future.

ETH price prediction 2030

It may not be easy to predict ETH coin futures for such a long-term forecast. Anything can happen by that time, and we definitely can expect that something for ETH itself will change. However, some of the experts even go that far and predicts ETH future for 2030.

Finder’s Ethereum prediction report contains 42 forecasts from different crypto experts regarding ETH future. The average projection for the ETH price in 2030 is $71,763.

Pedro Febrero, a head of blockchain at RealFevr is so bullish on ETH to the extent he believes it can reach $1,000,000 by 2030.

Martin Fröhler, CEO of crypto trading platform Morpher believes ETH can close 2030 with a price of $200,000 per coin. Trade the Chain co-founder Ryan Gorman and BitBull Capital COO Sarah Bergstrand also predict ETH a bright future by hitting a $100,000 level by 2030.

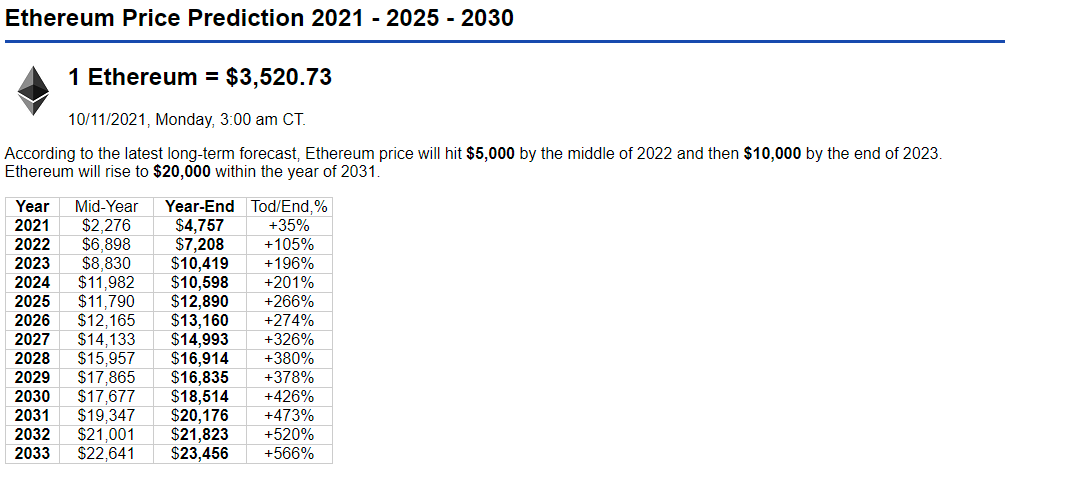

Coin Price Forecast is being more pessimistic when it comes to ETH long-term forecast. In their opinion, its price can be around $17,000 or $18,000 per coin.

Since the crypto market is very volatile, it is sometimes difficult to predict the price for the next week, not to mention the price prediction for a 9 year-term. Still, what can be said for sure is that most of the crypto experts believe that Ethereum is here to stay and feel positive about its future.

Is ETH a good investment? Is it too late to invest?

Well, it is still definitely an opportunity to consider taking in mind the future upgrades and development. Certainly, this can’t be in any case a financial advice or purchase incentive. However, the upcoming important upgrade, the support from the major tech giants and banks, and multiple predictions and forecasts on ETH price to rise significantly in the future can actually speak into it.

Ethereum technology has wide adoption among different types of businesses, and it is reasonable to say that this trend will probably continue in the future. According to forecasts it seems that ETH hasn’t reached its full potential yet. Moreover, there are options open for you: in addition to investing/hodling or trading you can stake ETH and earn from that. In the case of ETH, it has a good potential for growth in the long-term.

FAQ

What is Ethereum?

Ethereum was originally created to give everyone who knows how to code an opportunity to develop their own decentralized applications, or dApps. In fact, the Ethereum platform has become so popular among developers that it now dominates the dApp space, leaving other platforms dragging behind. So when talking about Ethereum, we mean the whole ecospace that goes far beyond just a cryptocurrency.

How will the Ethereum 2.0 upgrade impact the price?

Since it is still unclear when exactly ETH 2.0 upgrade will come in full power, it is safe to say that the price for ETH will not see huge spikes in the next few months. This kind of uncertainty may discourage a lot of investors from staking, thus decreasing the hype for ETH 2.0 and making its price growth more steady over time.

Is ETH a good investment?

The upcoming important upgrade, the support from the major tech giants and banks, and multiple predictions and forecasts on ETH price to rise significantly in the future can actually speak into it.