Gap trading has become a popular strategy among crypto traders, offering a way to capitalize on significant price disparities within the dynamic cryptocurrency market. Market gaps, characterized by notable differences between closing and opening prices, present unique profit opportunities for astute traders.

This article serves as a concise guide to mastering gap trading in cryptocurrencies, focusing on effective strategies for profiting from market gaps. We will explore the fundamentals of gap trading, highlight different types of gaps specific to the crypto market, and provide practical techniques for identifying and leveraging gap trading opportunities.

By understanding the factors influencing gap formation and implementing disciplined execution, traders can enhance their chances of success in the fast-paced world of cryptocurrency trading. Whether you’re an experienced trader or a newcomer exploring the crypto market, this article will equip you with valuable insights to master the art of profiting from crypto market gaps. Let’s dive in and unlock the potential for profitable trading in the exciting realm of cryptocurrencies.

What Is a Gap?

In the context of financial markets, a gap refers to a significant price difference or discontinuity between the closing price of an asset and its subsequent opening price. It represents a price level at which no trading activity occurred during a particular time period, causing a visible “gap” in the price chart.

Gaps can occur in various financial instruments, including stocks, commodities, and cryptocurrencies. They are typically observed when there is an imbalance in supply and demand or when unexpected news or events occur outside of regular trading hours. As a result, when the market reopens, the price of the asset jumps to a new level, creating a gap on the price chart.

Gaps are categorized into four main types:

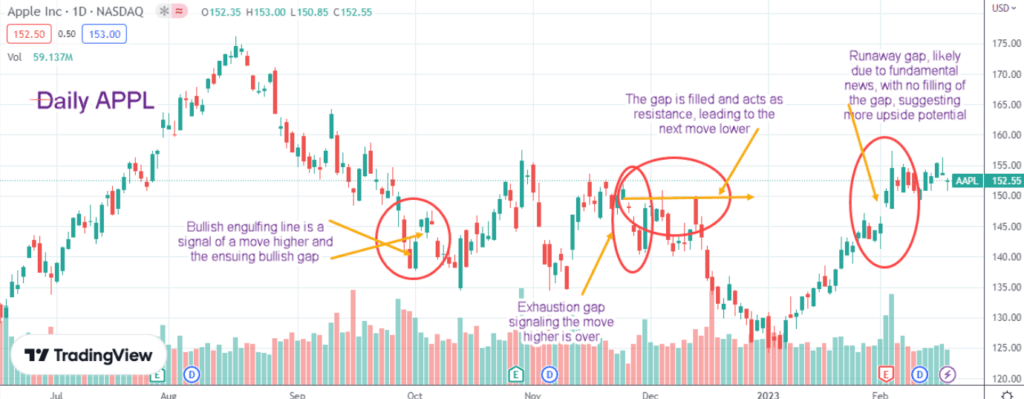

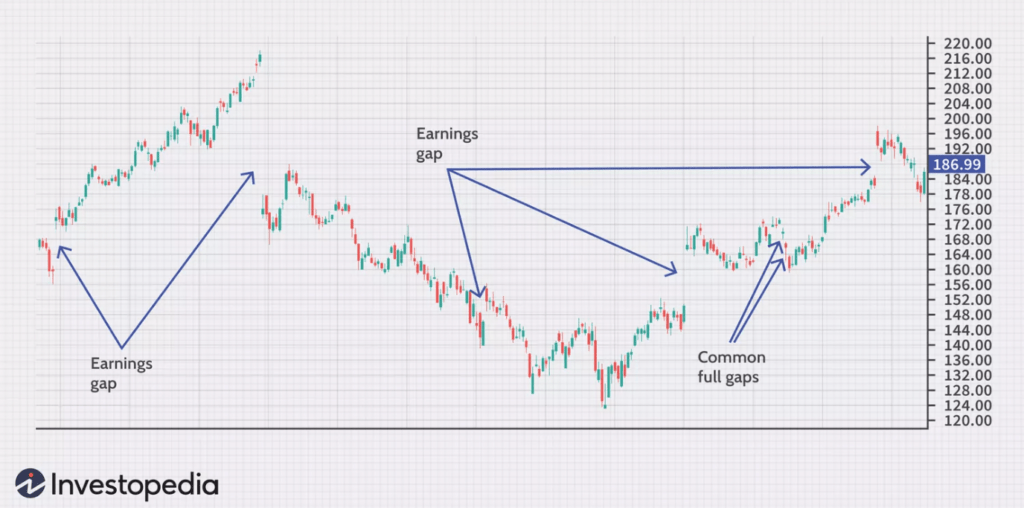

- Common Gap: This is the most frequent type of gap and tends to occur within normal price patterns. It often arises due to different news announcements or some events. Common gaps are typically filled relatively quickly as market participants react to news or events.

- Breakaway Gap: Breakaway gaps usually occur at the beginning of a new trend or when a significant technical or fundamental development takes place. They represent a strong shift in market sentiment and often indicate a breakout from a consolidation phase. Breakaway gaps tend to have a higher probability of not being filled in the near term.

- Runaway Gap: A runaway gap typically appears within an established trend and signifies a strong and sustained price movement in the direction of the trend. Unlike common gaps that tend to get filled relatively quickly, runaway gaps often remain unfilled for an extended period of time. Runaway gaps are usually seen as a sign of significant market momentum and can indicate the continuation of the prevailing trend. Traders may interpret a runaway gap as a signal to stay with the trend and potentially add to existing positions.

- Exhaustion Gap: Exhaustion gaps often appear near the end of a trend or a prolonged price move. They indicate a final surge of buying or selling pressure, signaling a potential reversal or a pause in the prevailing trend. Exhaustion gaps can be seen as a warning sign that the market may be reaching a point of saturation.

Understanding and analyzing gaps can be a useful tool for traders and investors. They provide insights into market sentiment, offer potential entry or exit points, and can contribute to the development of trading strategies. Traders often monitor gaps to assess their potential for being filled or to identify opportunities for gap trading strategies.

Why do gaps appear?

Gaps can appear in financial markets due to various reasons, including:

- Important News: One common reason for gaps is the release of significant news or events that impact the market. These could include earnings reports, economic data releases, geopolitical developments, or other market-moving announcements. When the market reopens, new information can cause a gap between the closing and opening prices.

- Market Sentiment Shifts: Gaps can also occur when there is a sudden shift in market sentiment. This can happen due to changes in investor confidence, market expectations, or broader economic factors. For example, a positive news event or a sudden surge in buying interest can cause a gap-up in prices, while negative news or selling pressure can lead to a gap-down.

- Trading Halts or Suspensions: Sometimes, gaps can arise when trading in a particular asset is halted or suspended for a period of time. This can happen due to regulatory actions, corporate events like mergers or acquisitions, or other operational reasons. When trading resumes, the opening price may be significantly different from the previous closing price, resulting in a gap.

- Technical Factors: Gaps can also be influenced by technical factors and patterns on price charts. For example, a breakout from a consolidation phase or a breach of key support or resistance levels can trigger a gap. These gaps may be seen as a reflection of strong buying or selling pressure and can indicate potential shifts in market dynamics.

What Happens When a Gap Is Filled?

When a gap is filled, it means that the price of an asset has moved back to the level at which the gap was created, essentially closing the price disparity that existed. The filling of a gap can have different implications depending on the type of gap and the prevailing market conditions. Here are a few scenarios that can occur when a gap is filled:

- Normal Price Action: In the case of a common gap, which is a relatively frequent occurrence, the filling of the gap is considered a normal part of price action. As market participants react to the news or events that caused the gap, buying or selling pressure may push the price back towards the previous day’s closing level. This can be seen as a natural correction in response to the initial gap.

- Support or Resistance Confirmation: Sometimes, a filled gap can provide confirmation of support or resistance levels. If the price fills a gap and bounces off from that level, it may indicate that the gap level has become a significant support or resistance area. Traders often monitor such price levels to assess future price movements and potential trading opportunities.

- Trend Continuation or Reversal: In certain cases, the filling of a gap can signal a continuation or reversal of the prevailing trend. For example, if a breakout gap is filled quickly and the price continues to move in the same direction, it suggests a continuation of the trend. On the other hand, if a gap is filled but the price fails to sustain above or below the gap level, it may indicate a potential trend reversal or a period of consolidation.

- Market Sentiment Assessment: The filling of a gap can also provide insights into market sentiment and investor behavior. If a gap is quickly filled, it may indicate that market participants have absorbed the news or events that caused the initial gap and have taken a relatively neutral stance. Conversely, if a gap remains unfilled or takes a longer time to fill, it may suggest a stronger and more persistent sentiment in the market.

It’s important to note that not all gaps are necessarily filled. Some gaps may remain unfilled for extended periods or indefinitely, especially in cases of breakaway gaps or exhaustion gaps.

How to Trade the Gap in Crypto

Trading the gap in the crypto market can be a strategy employed by traders to capitalize on the price disparities that occur when a gap forms. Here are some steps and considerations to keep in mind when trading the gap in crypto:

- Identify the Gap: Start by identifying the presence of a gap on the price chart. Look for a significant price difference between the closing price and the subsequent opening price. Different types of gaps, such as breakaway gaps or exhaustion gaps, may require different trading approaches.

- Assess the Gap Type and Context: Understand the nature of the gap and its potential implications. Consider the catalysts behind the gap formation, market sentiment, and the prevailing trend. This assessment will help determine the appropriate trading strategy.

- Confirm the Direction: Determine the direction in which you expect the price to move to fill the gap. This can be based on technical analysis indicators, chart patterns, or fundamental factors influencing the cryptocurrency in question.

- Entry and Exit Points: Establish clear entry and exit points for your trade. Some traders prefer to enter as soon as the market opens after the gap, while others wait for a pullback or confirmation of a breakout. Define your risk tolerance and set stop-loss orders to protect against adverse price movements.

- Monitoring and Adjustment: Continuously monitor the price action and market conditions as your trade progresses. Be prepared to adjust your strategy if necessary. If the price moves in your favor and the gap begins to close, consider taking partial profits or trailing your stop-loss to lock in gains.

- Stay Informed: Stay updated with the latest news and events that may impact the cryptocurrency market. Market-moving news can create gaps, and being aware of such developments can help you anticipate potential trading opportunities.

Gap Trading Strategies and Tips

When it comes to gap trading strategies, here are some popular approaches and tips that can help you navigate the market more effectively:

- Gap Fading Strategy: This strategy involves taking a contrarian approach, assuming that the gap will be filled and the price will revert back to its pre-gap level. Traders employing this strategy would take positions in the opposite direction of the gap, aiming to profit from the price correction. It’s important to use appropriate risk management techniques, as gaps may not always get filled.

- Gap Continuation Strategy: This strategy involves assuming that the gap represents a strong momentum or breakout move and taking a position in the same direction as the gap. Traders employing this strategy aim to profit from the continuation of the trend initiated by the gap. It’s crucial to confirm the underlying trend and employ proper risk management tools to avoid potential reversals.

- Gap Reversal Strategy: This strategy assumes that the gap signals an exhaustion of the prevailing trend and a potential reversal. Traders employing this strategy would take positions against the direction of the gap, aiming to profit from the price reversal. Confirmation through technical indicators or chart patterns can be helpful in identifying potential reversal points.

- Volume Analysis: Analyzing the trading volume accompanying the gap can provide valuable insights. Higher volume often suggests stronger market participation and increases the likelihood of the gap being sustained or extended. Conversely, low volume may indicate weak market conviction, raising the potential for a gap reversal or fill.

- Support and Resistance Levels: Consider the presence of support and resistance levels in the vicinity of the gap. These levels can influence price behavior and serve as potential profit targets or stop-loss levels. Taking into account key technical levels can improve trade management and risk-reward ratios.

- Timeframe Considerations: Gap trading strategies can vary based on the timeframe you are trading. Shorter timeframes may be suitable for quick gap fills or intraday trades, while longer timeframes can be employed for gaps that take more time to close or for swing trading strategies.

- Pre- and Post-Gap Analysis: Analyze the price action and market conditions leading up to the gap and after it is filled. This analysis can provide insights into the overall market trend, potential reversals, and subsequent price movements. Understanding the context surrounding the gap can enhance your decision-making process.

- Practice Risk Management: As with any trading strategy, risk management is crucial in gap trading. Determine your risk tolerance, set stop-loss orders, and consider position sizing accordingly. Additionally, be aware of the potential for “runaway gaps,” where the price accelerates further in the direction of the gap, leading to larger-than-expected losses if not managed properly.

Final Thoughts

In conclusion, gap trading offers traders an opportunity to profit from significant price disparities in the market. By understanding the types of gaps, analyzing their causes, and implementing effective strategies, traders can potentially increase their chances of success. It is important to manage risks, set clear entry and exit points, and stay informed about market conditions. Gap trading requires patience, discipline, and continuous learning to navigate the complexities of the market. With practice and experience, traders can harness the potential of gap trading and aim for consistent profitability.

FAQ

What is gap trading in crypto?

A gap is a big price difference between the closing and opening prices of an asset. It’s like a blank spot on the price chart where no trading happened.

What occurs when a gap gets filled?

When a gap is filled, it means the price of an asset has returned to where the gap began, closing the price gap. What happens next can vary based on the gap type and market conditions.