Despite BTC’s dominance in the crypto market (around 40% of total market capitalization), there are other coins, so-called altcoins, worth looking into when considering investing or trading in crypto.

Currently, there are almost 10 000 digital assets that are listed on CoinMarketCap alone, not to mention the projects that are still in the development stage or are still awaiting to be listed on CMC.

Today, we will be covering all you need to know about altcoins!

What are Altcoins?

Alternative coins, or “altcoins,” refer to any type of cryptocurrencies other than Bitcoin. They started to appear on the crypto market shortly after Bitcoin’s introduction as an alternative to the most well-known cryptocurrency.

We can divide all altcoins into three main categories plus one sub-category: tokens that are part of existing blockchains (e.g. Ethereum, Binance Coin); altcoins that represent layer 2 solutions for the existing blockchains (e.g. Polkadot, Polygon); tokens of decentralized applications, or dApps (e.g. Uniswap, Sandbox); and meme coins that, in some sort, can be seen as a separate category in the whole altcoin market (e.g. Dogecoin, Shiba Inu).

Let’s take a look at some of the altcoin’s representatives:

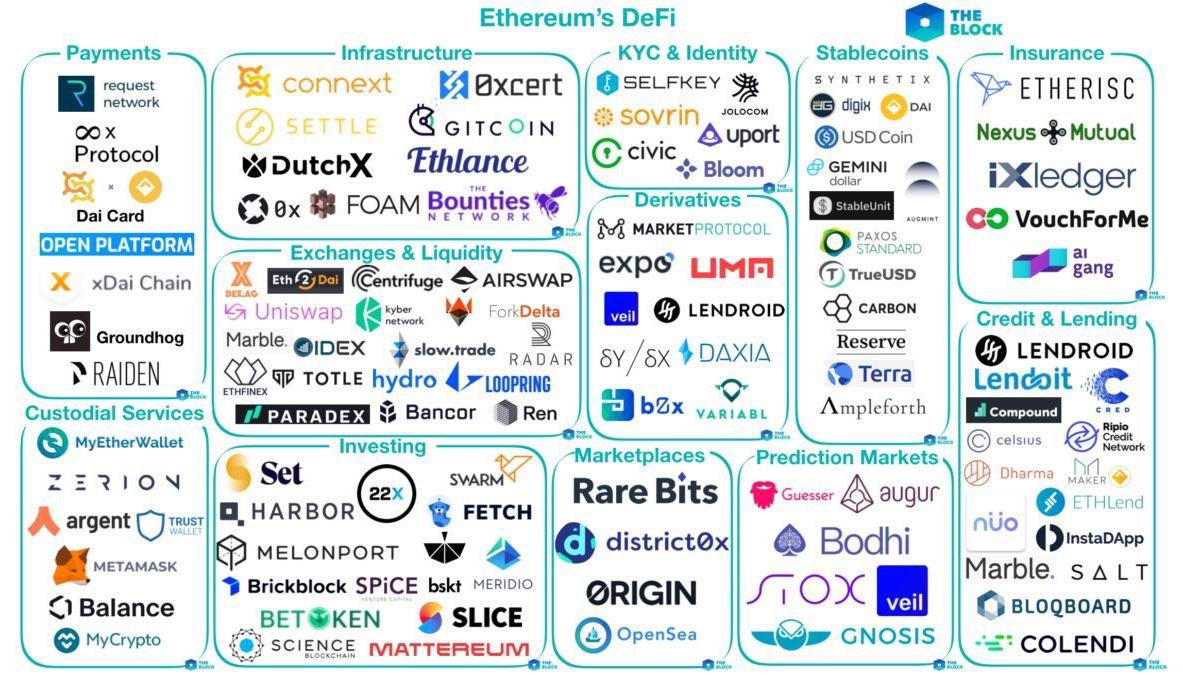

Ethereum (ETH) was brought to life along with completely new blockchain network technology that gives an opportunity to anyone who knows how to code to deploy smart contracts and develop their own decentralized applications, or dApps. Nowadays, Ethereum is considered as Bitcoin’s main competitor, and a recognized king of altcoins: currently, there are more than 3,000 dApps that are built on the Ethereum platform, from decentralized exchanges (e.g. Uniswap) to stablecoins (Tether) and GameFi projects (Axie Infinity).

The project known as Litecoin or LTC, was created solely to resolve the main BTC issue – to increase the number of transactions and their speed. Both Bitcoin and Litecoin use a proof-of-work consensus mechanism, however Litecoin can handle more transactions because of its shorter block generation time.

The Sandbox game is one of the GameFi projects in which the entire game universe and in-game content is created and maintained by the players. It has its own token SAND, that can be used by players within the game and which facilitates transactions on the platform.

Polkadot or DOT, in its turn, represents a next-generation blockchain protocol that enables cross-blockchain transfers of any type of data or asset, not just tokens. Besides, interoperability protocols like Polkadot can process multiple transactions in parallel, thus solving the issue of the so-called bottleneck that happens on legacy networks that process transactions one by one.

Meme coin Shiba Inu or SHIB, originally created as “Dogecoin Killer” (and Dogecoin was originally the first ever meme coin in crypto space) and which was perceived as a simple joke at first, has transformed from a simple meme coin into its own unique ecosystem. Currently, Shiba Inu holds its ground in the list of Top 15 cryptocurrencies by market capitalization

As of April 2022, Bitcoin and Ethereum combined represent nearly 60% of the whole crypto market share. That leaves more than 40% of the whole market to be occupied by various altcoins.

The altcoins have created their own market, which is very attractive to those investors and traders who can see financial and technological potential in them.

Types of Altcoins

The altcoin market is truly diversified and has various types of projects that differ from each other in features, functionalities, and consensus mechanisms. Let’s take a look at the most popular types you can find on the crypto market:

Stablecoins

Stablecoins can be seen as an island of tranquility in the highly volatile crypto market. Their value is pegged to some much less volatile asset, be that other cryptocurrencies, fiat currencies, or precious metals. They do, however, experience price fluctuations sometimes, but never exceed a narrow range. Stablecoins like Tether, Binance USD, or Dai can be considered by those investors who would like to store their funds in cryptocurrency but are not willing to take any risks of losing their value.

Utility Tokens

A utility token refers to a crypto token that is used within a specific crypto ecosystem. They can be used for a variety of purposes, be it paying for transactions, minting, raising interest for a product, redeeming rewards, purchasing services, and so on. To put it simply, utility tokens are needed to provide the inner functionality of an ecosystem.

One of the most well-known blockchains is Ethereum has its own utility token, Ether. It is used within the Ethereum ecosystem for paying service fees (“gas fee”), minting currencies, NFTs, and computational services. In addition to that, the Ethereum network has lots of other projects that, in turn, provide their own utility tokens: UniSwap (UNI), Chainlink (LINK), MakerDao (DAI), and so on.

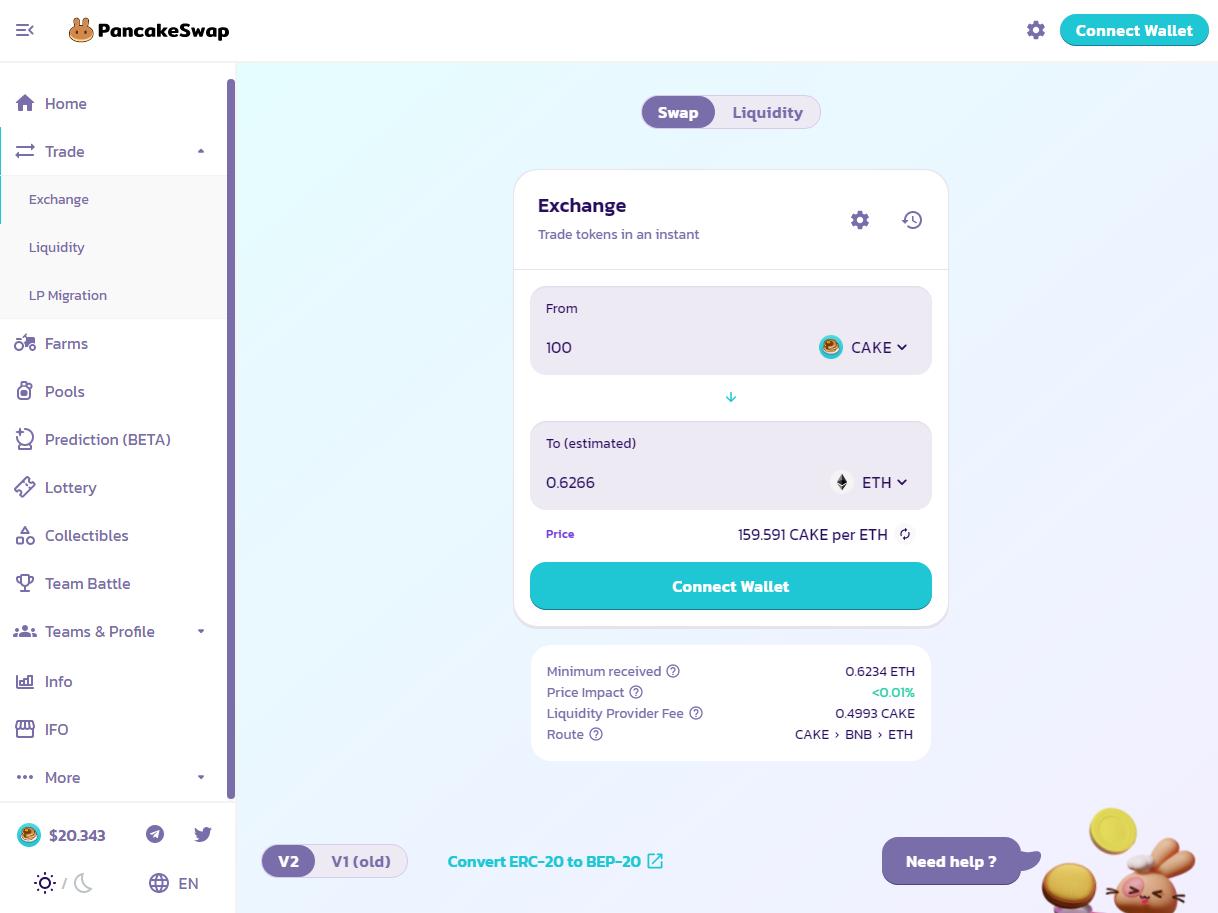

Another example is Binance Smart Chain, or BSC. It has its own utility token, BNB, and there are numerous dApps on this blockchain, like PancakeSwap (Cake) and Venus (VAI), or GameFi projects like CryptoBlades (SKILL) or Mobox: NFT Farmer (MOBOX).

Mining-based coins

Mining-based coins refer to the kind of cryptocurrencies that use mining to verify transactions and add more coins into circulation. Miners use the power of computer networks to solve complex mathematical equations and in return they receive rewards in the form of cryptocurrency. Mining is usually performed with a use of CPU (processor-based), GPU (video card-based) or via ASIC (application-specific integrated circuits).

The most well-known mining-based cryptocurrency is Bitcoin, however altcoins can be mined as well, such as Monero, Litecoin, Zcash and so forth.

Forks

To put it simply, forks refer to a split in the blockchain network, either Bitcoin or Ethereum. Since this is open source software, the code is freely available to the community. That being said, anyone who knows how to code and wishes to make improvements to the existing software can do that and then propose this updated and improved version of the blockchain network to the public. There are two types of forks that exist in the crypto space: soft forks and hard forks.

A “soft fork” refers to a backwards-compatible, upgraded version of the existing blockchain. Soft forks are used when the community wants to add some new functions and features.

A “hard fork” happens when radical changes are made within the software, and the new version is no longer backward-compatible. When a hard fork is done, a blockchain splits into two versions, a new one and an already existing one. This is the moment when a completely new cryptocurrency is created, with its own set of rules, functions, and features.

Hard forks like Bitcoin Gold, Bitcoin Cash, and Ethereum Classic are examples of hard forks.

Meme coins

Meme coins speak for themselves: they are a type of altcoin that is driven by the community and not much else. Certainly, you may say that Bitcoin does not have many features either, but that would be a half-truth. Starting in 2009, Bitcoin was the first cryptocurrency ever presented to the public, and its value and market capitalization were gained over years. Plus, Bitcoin’s value comes straight from the basic economic fundamentals like scarcity and investors’ trust.

Meme coins, in their turn, pop up on the crypto market by the dozens every single day, have zero functionality, and do not have anything to offer to serious investors. The majority of them perish on the same day they were born. Even those who survive their 15 minutes of fame and continue to exist are usually motivated solely by their community and hype.

Nevertheless, some of the meme coins, such as Dogecoin and Shiba Inu, have achieved major success. So even meme coins can sometimes end up being the “next big thing.”

Investing in altcoins. Peculiarities and details

Before you start trading and investing in altcoins, you should always DYOR (do your own research) and try to answer a few questions first: Does this altcoin have use cases? What kind of technology and features does it have? Is the dev team reliable and experienced? How many investors does it have and how did it go through the previous bear trends? And, most importantly, does this particular coin have a future?

Investing in altcoins is a good idea, since diversifying a portfolio is a standard strategy. However, the number of digital assets and projects out there is enormous, and it might be a challenge to find the best altcoins to invest in. That is why you should do your homework and always ask yourself the above-mentioned questions.

The basic rules

There are some things you should consider before you start investing into altcoins. Here are the basics that should get you covered before you start you journey into the altcoins’ market:

- Always double check a project that is heavily promoted all over social media. If you ever come across a project that does not have anything behind it but only aggressive marketing, then there is a high chance that something is fishy about it. It could be a potential scam, or it can be a last attempt of reviving a nearly-dead coin (possibly with the following rug-pull scam). Always do a thorough study before investing your funds into any project, especially anything that promises you X10, X100 and so on.

- Only invest what you can afford to lose. Indeed, that is a simple and obvious, yet very important rule. Cryptocurrencies like Bitcoin and Ethereum are highly volatile, but due to their market capitalization and number of holders, their price swings might not be as painful for traders and investors as the ones that are experienced by other altcoins. Some of the projects never get back to their previous ATH after going through a correction or after the bear trend. That means that you should be ready to lose some of your funds because you will lose them occasionally, and it better not be your rent money or bank loan.

- Remember that the crypto market is driven by sentiments. No matter how solid and reliable the project you’ve invested in, the price will fluctuate along with the whole market. So when you see that the price of your selected cryptocurrency falls down because the market entered a bear trend, do not panic sell: sentiment can change very quickly from pessimistic to optimistic.

- Look for coins with technical capabilities and real use cases. Some altcoins, like Solana or Ripple, have gained popularity and investors’ trust because they could provide a somewhat revolutionary technology and unique features. The more use cases and technical capabilities an altcoin has, the better the chances that it will thrive.

- Learn from mistakes and protect your funds. It is possible that you will face scams, rug pulls, fraud, or simply failed projects that make you lose your investments. If so happens, do not be discouraged by your losses. Learn how to protect yourself and how to invest wisely. Create secure passwords, enable two-factor authentication, and use only trusted apps and websites. It takes time to gain experience, and you can’t become rich overnight. Learn from your mistakes to avoid making bad decisions again.

Where and how to buy altcoins?

Depending on which altcoin you wish to purchase it may be a bit complicated. Certainly, major coins can be found on most of the exchanges. But what about other, not-so-popular projects, especially those with small capitalization?

Some inexperienced traders and investors may find it complicated to purchase certain altcoins, since major crypto exchanges like Binance or Coinbase are very thorough and picky when it comes to listing new coins (which can also be a good way to determine whether the coin is worth it and how risky it will be). And since there are thousands of projects out there on the market, there is a chance that you won’t find some upcoming projects there. In that case you can try to look for them on DEX’s, or decentralized exchanges. So what does this process look like?

Firstly, you should download a crypto wallet, like Trust Wallet or Metamask, since they have a very good protection, they are reliable and their functionality can cover all your trading needs.

Secondly, you should exchange fiat currency for crypto and then send it to your wallet. Some of the crypto exchanges, like Binance, support buying crypto via credit card, so that would be the easiest way to do this. Depending on which blockchain network your desired cryptocurrency is operated on, you should consider purchasing BNB, ETH, and/or USDT in the first place. These three digital assets are the most commonly used currencies when it comes to trading on DEX’s. Some DEX’s like Uniswap operate on Ethereum network, so they only accept ERC-20 standard tokens.

Thirdly, pick the DEX you would like to use for swaping. We highly recommend using only those DEX’s that are reliable and have a good reputation, such as PancakeSwap, Uniswap, 1inch or Sushiswap.

Fourthly, when you’re done with the previous three steps, connect your wallet with a preferred DEX and then choose the input and output tokens. After that, you can swap your digital asset for a selected cryptocurrency.

How to trade altcoins? Tips and strategies

Just like with Bitcoin, you can apply long-term investment or trading strategies:

Long-term investment strategies

This strategy refers to buying cryptocurrencies and then holding them for some time, then selling them when the price has increased. Long-term strategy is relatively easy, since all you have to do is wait for the right moment, and the only tool you need is patience. You do not need to spend a lot of time glued to your PC or smartphone looking at the chart, but rather check the price movements from time to time to see how your investments are doing.

A long strategy isn’t limited by time boundaries, and it doesn’t have to be implemented over a really long period of time, say 2-3 years. It’s more of a word indicating that you started the trade by purchasing first and then selling at a greater price later.

A long-term approach might be a good strategy if you want to build a diversified portfolio, so you could come back to it later in the hope that some of your investments have increased in value.

However, when dealing with altcoins, you should stay on high alert since their value can decrease dramatically pretty quickly due to high volatility, and they may never get back on the “mooning” track.

One of the best tools that you can use when trading altcoins is crypto bots. Try it with TradeSanta today, and see for yourself the potential of automated trading!

Trading strategies

Short-term trading strategies are more complicated and include quite a few different approaches: scalping, day trading, dollar-cost averaging and more. The specific strategy depends on what kind of trader you are, of your experience and goals. They also have their own strengths and weaknesses as well.

Day trading refers to the approach when traders buy and hold cryptocurrencies for a short period of time, say hours or even minutes, before selling them for a potential profit.

Day trading can be useful and profitable if you are 100% sure that the price of a particular altcoin will rise soon. However, since we are talking about notoriously volatile assets, their prices can double or even triple very quickly, but at the same time, they can fall to the bottom just as swiftly.

Dollar Cost Averaging, or DCA, is the method of breaking your reserve funds into smaller portions and trading with them several times over time.

Assume you have $300 in your emergency savings account. Divide the money into three $100 tranches or possibly ten $30 tranches and trade with those smaller amounts.

Because it is impossible to predict if a cryptocurrency has already reached its ATH or bottom price (depending on the trend), investing all of your money in one go may not be a good choice. Instead, you could be better off buying in smaller increments each time the asset’s price falls.

Final thoughts

Altcoins are different from Bitcoin, and thus it is crucial to learn everything you can about them, including their technology, overall market capitalization, dev team’s previous projects, as well as different trading strategies and potential risks. Yes, that is a lot to cover in one go, so you should spend some time studying before diving into them.

Altcoins continue to grow in popularity, and even though it is doubtful that any of them will dethrone Bitcoin, some of them can provide you with potential profit. They can be a good addition to an investor’s portfolio, and you never know which of them may change the crypto market’s landscape in the future.

All you have to do is keep in mind all the risks that they bear and invest smart, not hard.

FAQ

What are Altcoins?

Alternative coins, or “altcoins,” refer to any type of cryptocurrencies other than Bitcoin. They started to appear on the crypto market shortly after Bitcoin’s introduction as an alternative to the most well-known cryptocurrency.

What are stablecoins?

Stablecoins can be seen as an island of tranquility in the highly volatile crypto market. Their value is pegged to some much less volatile asset, be that other cryptocurrencies, fiat currencies, or precious metals.

What are Meme coins?

Meme coins speak for themselves: they are a type of altcoin that is driven by the community and not much else. Meme coins, in their turn, pop up on the crypto market by the dozens every single day, have zero functionality, and do not have anything to offer to serious investors. Nevertheless, some of the meme coins, such as Dogecoin and Shiba Inu, have achieved major success. So even meme coins can sometimes end up being the “next big thing.”