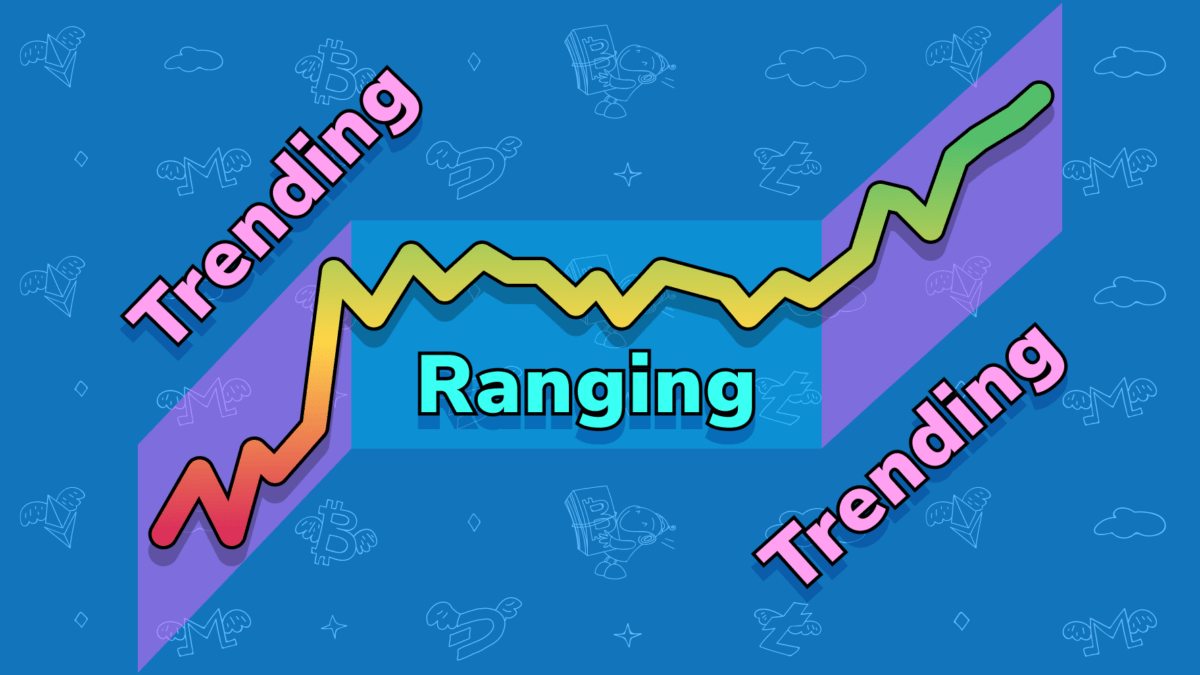

While traders often focus on capturing trending movements, range-bound trading focuses on capitalizing on price oscillations within defined trading ranges. This article provides an introduction to range-bound trading in the crypto market, exploring the techniques, strategies, and considerations that can help traders make the most of these market conditions. By mastering the art of range-bound trading, traders can unlock potential profits even when markets lack clear trends.

What is Range-Bound Trading?

Range-bound trading is a trading approach that focuses on capitalizing on price movements within a specific range or channel. It is characterized by a market condition where the price of an asset fluctuates within well-defined upper and lower boundaries, without establishing a clear upward or downward trend. In this scenario, the price tends to oscillate between support and resistance levels, creating a trading range.

Traders who employ range-bound trading strategies aim to profit from the predictable price behavior within this range. Instead of attempting to ride larger price trends, they seek to identify buying opportunities near the lower boundary (support level) and selling opportunities near the upper boundary (resistance level) of the range.

Range-bound trading requires careful observation of the price action and the ability to identify the established boundaries of the trading range. Traders use various technical analysis tools, such as support and resistance levels, trendlines, or chart patterns, to determine the range’s upper and lower limits. These tools help them define the range and make informed decisions about entering and exiting trades.

When the price reaches the support level, traders may consider buying the asset with the expectation that it will rebound towards the resistance level. Conversely, when the price approaches the resistance level, traders may consider selling or taking profits, anticipating a potential price reversal towards the support level. The goal is to capture the smaller price movements within the range rather than predicting or relying on larger market trends.

Range-bound trading can be a viable strategy in markets that lack clear directional momentum or during consolidation phases. Traders who successfully implement range-bound trading techniques can profit from the repetitive price patterns and market inefficiencies that exist within the established trading range.

How does Range-Bound trading work?

Range-bound trading works by capitalizing on price movements within a well-defined trading range. Here’s a step-by-step breakdown of how range-bound trading works:

- Identifying the Range: Traders use technical analysis tools and indicators to identify the support and resistance levels that define the trading range. These levels are typically established based on previous price highs and lows or areas where the price has encountered significant buying or selling pressure.

- Buying at Support: When the price approaches the lower boundary or support level of the range, traders may consider buying the asset. This is based on the assumption that the price is likely to bounce off the support level and move towards the upper boundary of the range.

- Selling at Resistance: As the price approaches the upper boundary or resistance level of the range, traders may consider selling or taking profits. The expectation is that the price will reverse and move back towards the support level.

- Repeat the Process: Traders continue to monitor the price action within the range and repeat the buying and selling process as the price reaches the established boundaries. The goal is to capture the smaller price movements within the range and accumulate profits over time.

- Risk Management: Effective risk management is crucial in range-bound trading. Traders set appropriate stop-loss levels to limit potential losses if the price breaks out of the range and moves against their position. Additionally, take-profit levels are set to secure profits when the price reaches desired targets within the range.

- Adaptation to Market Conditions: Range-bound traders need to adapt their strategies to different market conditions. They may adjust their approach based on the volatility within the range, changes in trading volume, or other factors that can influence price behavior. Flexibility and the ability to recognize shifting market dynamics are essential for successful range-bound trading.

- Monitoring for Breakouts: While range-bound trading primarily focuses on profiting within the established range, traders should also remain vigilant for potential breakouts. If the price convincingly moves beyond the established boundaries, it may indicate the start of a new trend. Traders need to be prepared to adjust their strategy or exit their positions to avoid potential losses.

Range-bound trading requires a thorough understanding of technical analysis, the ability to identify and interpret support and resistance levels, and the discipline to execute trades based on the established trading range. By capitalizing on the repetitive price patterns within the range, traders aim to generate profits even in markets lacking clear trends.

When Should You Use a Range-Bound Trading Strategy?

A range-bound trading strategy is most suitable in specific market conditions where the price of an asset is consolidating within a well-defined trading range. Here are some scenarios in which range-bound trading can be effective:

- Low Volatility: Range-bound trading is particularly useful when the market experiences low volatility, with the price oscillating within a relatively narrow range. During periods of reduced price fluctuations, range-bound strategies allow traders to profit from the predictable price movements within the established boundaries.

- Consolidation Phases: When a market undergoes a consolidation phase, with the price moving sideways and lacking a clear trend, range-bound trading can be an advantageous approach. Traders can take advantage of the price bouncing between support and resistance levels, capitalizing on the repetitive nature of price action within the range.

- Established Trading Ranges: Range-bound trading works best when there is a well-defined and stable trading range. Traders can identify this range using technical analysis tools, such as support and resistance levels, trendlines, or chart patterns. The more times the price has respected these boundaries, the stronger the range becomes.

- Mean Reversion Strategies: Range-bound trading aligns well with mean reversion strategies. Mean reversion assumes that prices tend to return to their average or mean value after deviating from it. In a range-bound market, traders aim to profit from price movements toward the mean or the opposite boundary of the range.

- Shorter Timeframes: Range-bound trading can be particularly effective in shorter timeframes, such as intraday or swing trading. In these timeframes, traders can identify and exploit multiple price swings within the trading range, potentially generating more frequent trading opportunities.

It is important to note that range-bound trading may not be suitable in highly trending markets or during significant market events that can trigger strong price movements. During trending phases, range-bound strategies may result in missed profit opportunities as the price breaks out of the established range.

Let’s consider an example to illustrate the application of a range-bound trading strategy:

Imagine you’re a cryptocurrency trader observing the price of a particular coin, let’s call it “ABC Coin.” After analyzing the price chart and using technical analysis tools, you identify a clear trading range between $50 and $60. The price has repeatedly bounced off the $50 support level and encountered resistance near the $60 level.

As a range-bound trader, you would look for buying opportunities near the support level and selling opportunities near the resistance level. Here’s how the strategy might play out:

- Buying Opportunity: When the price of ABC Coin reaches $50, indicating a test of the support level, you decide to initiate a buy trade. You expect the price to rebound from this support level and move toward the resistance level at $60. You set a profit target at $58, aiming to capture a portion of the price movement within the range.

- Price Reversal: As predicted, the price of ABC Coin bounces off the $50 support level and starts to rise. It reaches your profit target of $58, triggering the sale of your position. You have successfully capitalized on the upward movement within the established range.

- Selling Opportunity: Over time, the price of ABC Coin retraces back towards the support level of $50. You monitor the price closely, and as it approaches the resistance level at $60, you decide to sell your position. You set a profit target at $55, anticipating the price to reverse again within the range.

- Repeat the Process: The price reaches your profit target at $55, and you lock in your profits. Now, as the price approaches the support level again, you consider buying ABC Coin once more, restarting the range-bound trading cycle.

Throughout this example, you have employed a range-bound trading strategy by buying near the support level and selling near the resistance level within the established range of $50 to $60. By capitalizing on the repetitive price movements within the range, you have generated profits from the oscillations of ABC Coin, even in the absence of a clear market trend.

Final thoughts

Range-bound trading is a strategy that aims to profit from price movements within a well-defined trading range. By identifying support and resistance levels, traders can strategically enter and exit trades, capitalizing on the predictable price behavior within the range. Range-bound trading is most effective in low volatility environments and during consolidation phases when the market lacks clear trends.

The perks of range-bound trading include the potential for consistent profits within the established range, clear entry and exit points based on support and resistance levels, and the ability to adapt to different timeframes and markets. However, the effectiveness of range-bound trading depends on market conditions, the trader’s skill and experience, range selection, and adaptability. Market conditions with high volatility or strong trends may limit the effectiveness of this strategy. Traders need to continuously refine their skills, employ proper risk management, and stay adaptable to changing market dynamics to enhance the effectiveness of range-bound trading.

FAQ

What is the purpose of range-bound trading?

The purpose of range-bound trading is to profit from price movements within a well-defined trading range. Traders aim to buy near the support level and sell near the resistance level, capitalizing on the repetitive price behavior observed within the range.

When is range-bound trading most effective?

Range-bound trading is most effective in low volatility environments and during consolidation phases when the market lacks clear trends. It thrives when the price oscillates within a well-defined range, allowing traders to strategically enter and exit trades based on support and resistance levels.