Day trading or Swing trading? Which one is more profitable? Which one of them is more suitable for beginners and which one is better for seasoned traders?

There are quite a few questions that might arise when picking either one strategy or a mix of these strategies.

In this article, we will take a look at both of these strategies, their key elements and try to understand their pros and cons. So let’s dive in!

What is Day trading?

In a typical stock market – from which the term “day trading” actually was carried out – a day trader typically gets up to start their trading just as the market opens; however, since we’re talking about crypto, there are some peculiarities – because as we all know it, crypto never sleeps.

Nevertheless, the term “day trader” is still used in the cryptocurrency industry, which refers to several important characteristics.

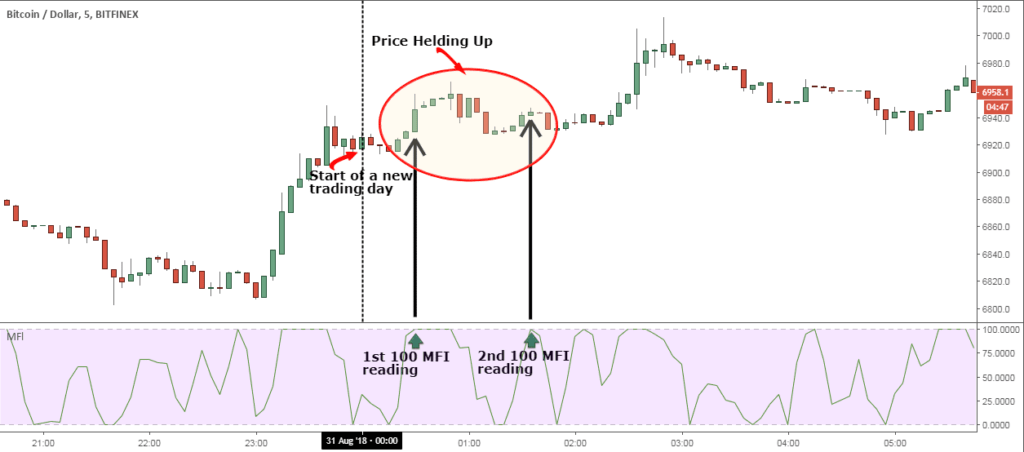

When someone talks about day trading in cryptocurrencies, they are referring to a method that is different from long-term trades like buy and hold strategies. Much like its name implies, day trading involves making dozens of trades in a single day. The goal of a day trader is to make small profits on a large number of trades and limiting losses on failed trades. Day traders aim to profit from even the smallest price changes and market volatility.

There is a misconception, however, especially among inexperienced traders, that day trading and scalping are pretty much the same thing. In fact, that is not correct.

Unlike day trading, scalping is one of the most difficult trading strategies because it requires traders to use the shortest time frames, which puts them under a lot of pressure.

Scalpers open and close a number of positions throughout a single day in an effort to profit on minor fluctuations in price.

Day traders might open no more than just several positions per day because their focus is on the best opportunities, as opposed to scalpers, who can place dozens of trades in a single day under the assumption that insignificant price changes are easier to profit from.

Day traders, as opposed to scalpers, typically hold positions for several hours but less than one full trading day.

Pros of day trading

- Profit-making potential. Day traders take advantage of short-term price movements, which can potentially yield quick profits.

- Instant results. Unlike holders, day traders control their trading decisions during the day, so they don’t have to wait until their given cryptocurrency will drastically rise in price to deliver 10X or 100X. Trading happens here and now, and so does the result.

- More control. Since day traders choose when they want to enter or exit deals, they potentially can avoid negative impacts that might come with external factors. Thus, if the market is heavily bleeding due to some external factors, day traders might choose not to trade that day in case they feel uncertain about making profit in such circumstances.

- Fixed schedule, no overnight risk. Day traders don’t expose themselves to systematic risks, particularly those related to economic news and geopolitics, because they close their positions at the end of each trading day and don’t leave them open overnight.

Cons of day trading

- No long-term focus. Day trading strategy is focused on short-term price movements and thus it eliminates longer-term trends, whilst in some cases holding would be much more profitable than trading.

- Time-consuming. Constantly monitoring the market in order to find the best entries and exits can be very time-consuming. So day trading must either be a full time job, or you should think about using automation tools like for example crypto trading bots, which can be very handy in this trading strategy.

- Limited profit. Depending on the cryptocurrencies being traded, there may be limited profit potential because the price of some coins may not change significantly over the course of a single trading day.

What is Swing trading?

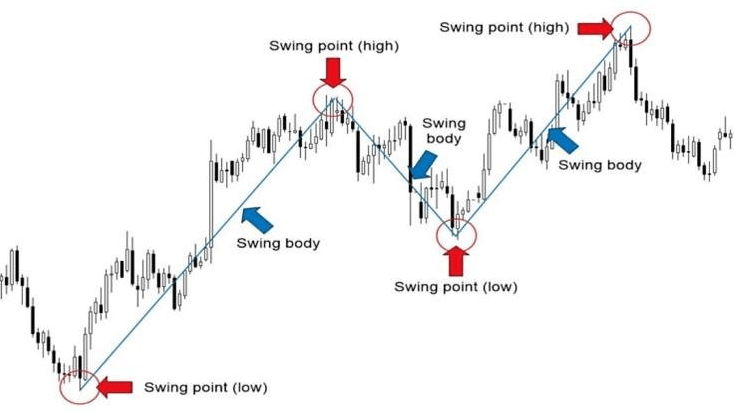

Another strategy that is popular among groups of traders attempting to capture gains is swing trading. This strategy involves leveraging a position, holding it for a short period of time while waiting for price swings, and then profiting off the outcome of the position.

Since the time period usually isn’t fixed, it can vary anywhere from days to weeks and even months. Most swing traders end up in this bracket as they rely on short, secondary trends.

Swing traders can either buy or sell a specific cryptocurrency and wait for the profit. Because of this, trading is more passive and not dependent on a fixed time schedule, and thus, unlike day traders, swing traders might not end up making crypto trading their full-time job.

Cryptocurrencies’ prices do not move in a linear trend but rather are punctuated by instances of short-term price pullbacks that are called price swings. Swing traders merely monitor the crypto market and look for price swings. By examining historical patterns, keeping an eye on the news, or following current affairs, one can predict the price point and timing of the swing. When a trader is certain of their position, they will hold it until the prescribed end of the swing.

Swing traders enter and exit the market sporadically based on current opportunities. Since their positions are open longer than those of day traders, they often use both fundamental and technical analysis.

The main challenge for all swing trading strategies is identifying when to enter and exit a trade, so using technical indicators such as RSI, MACD or Bollinger Bands is vital when it comes to catching the right trend.

Pros of Swing trading

- Requires less daily commitment. Unlike day traders, swing traders do not have to constantly look for the best entry and exit points, thus making this strategy less time consuming.

- More beginner-friendly. Swing trading can be suitable both for beginners and experienced traders, since being glued to the monitor and constantly checking charts is not a necessity here, making it less intense and more user-friendly strategy.

- Potential larger profit margin. Due to the fact that positions are held for longer periods of time, swing traders may potentially benefit from larger price movements, and thus gain bigger profits.

- Lower costs. Unlike day traders who have to open multiple trades throughout the day, swing traders can open only just a few trades, making this strategy less costly.

Cons of Swing trading

- Risk of losing funds. Holding an asset for too long might result in the loss of funds, since literally anything can happen with a given crypto project, even in a short period of time. The recent Terra’s LUNA case is just one example of such a risk.

- Timing the market can be a challenge. It requires patience and a cool head to hold a position and sell it at the right time. However, holding an asset for too long can make a trader feel attached to it and unwilling to sell it in an attempt to wait for a bigger profit, which might never come.

- Requires more capital. Because a trader’s capital is locked for a longer period of time and cannot be rotated as it is in day trading, swing traders frequently require more starting capital.

Day trading vs. Swing trading: Key Differences

Since we’ve covered both day trading and swing trading strategies, let’s highlight their key differences.

Holding period

Perhaps the most notable difference between these two strategies is the holding period. A day trader can hold for as little as a few minutes or as long as a few hours without closing the deal. However, this limit must never go beyond the market’s opening and closing hours.

A swing trader, on the other hand, is bound by the length of the trend or swing. They may have to hold their positions for days or weeks.

Trading frequency

The next difference between these two strategies lies in the frequency of trades. Day traders can make numerous trades each day, frequently involving different assets. This strategy is intended to profit from small price fluctuations throughout the day.

On the other hand, swing traders typically have just a few deals that can be open for several weeks.

Risk exposure

Day traders are unlikely to be impacted by systemic risks, since their trades almost never last longer than a few minutes or even seconds and are never open overnight.

In contrast to day traders, swing traders are subject to systemic risks because their trades can be left open for days or even weeks. During this period, any kind of geopolitical event or simple FUD could significantly impact the asset’s price.

Commitment

Unless you use automated crypto trading bots, day trading is like a full-time job that requires extra commitment, patience and time. Day traders have to monitor their trades in real time to look for best opportunities to buy and sell their assets.

Swing traders are not burdened by the need to regularly monitor their trades. They don’t have to be concerned about short-term market volatility because they hold their positions for a period of time ranging from a few days to weeks. Most commonly, swing traders simply set their profit as well as stop loss targets and only check them up occasionally.

Final thoughts. Which one should you pick?

Each of these two strategies entails particular dangers and yields particular benefits.

Day traders execute multiple trades in a single day, which provides a route to potential short-term profits.

Swing traders, on the other hand, hold onto their positions for longer periods of time and potentially have a better chance of making more profit from their trading deals since crypto’s price commonly goes higher in the long run than during one day.

Day trading is a more adrenaline-filled, fast-paced trading strategy, while swing trading, on the other hand, is a somewhat more methodical and hasty approach.

So picking either of these strategies will depend not only on your profit goals but also on your personality and the amount of time you are willing to spend on your crypto trading activities.

FAQ

What is day trading?

When someone talks about day trading in cryptocurrencies, they are referring to a method that is different from long-term trades like buy and hold strategies. Much like its name implies, day trading involves making dozens of trades in a single day.

What is swing trading?

Another strategy that is popular among groups of traders attempting to capture gains is swing trading. This strategy involves leveraging a position, holding it for a short period of time while waiting for price swings, and then profiting off the outcome of the position.