In the fast-paced world of cryptocurrency trading, staying ahead of the curve is essential. The Aroon Indicator, a powerful technical analysis tool, offers traders valuable insights into identifying early trends in the volatile crypto market. By understanding how to use the Aroon Indicator effectively, traders can gain an edge, making informed decisions and maximizing their profit potential. This article will provide a comprehensive explanation of the Aroon Indicator, empowering crypto enthusiasts to navigate the ever-changing landscape with confidence.

What Is the Aroon Indicator?

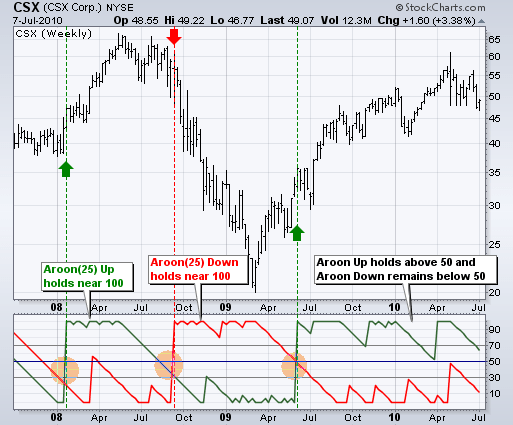

The Aroon Indicator is a technical analysis tool that measures the strength and direction of a trend in a financial asset, including cryptocurrencies. It consists of two lines: the Aroon Up line and the Aroon Down line. The Aroon Up line calculates the number of periods since the highest high within a given timeframe, while the Aroon Down line calculates the number of periods since the lowest low within the same timeframe.

The Aroon Indicator helps traders identify the emergence of new trends or the continuation of existing ones. When the Aroon Up line is above the Aroon Down line, it indicates a bullish trend, suggesting a potential buying opportunity. Conversely, when the Aroon Down line is above the Aroon Up line, it suggests a bearish trend, indicating a possible selling opportunity.

By understanding the Aroon Indicator and its readings, traders can make more informed decisions about entering or exiting positions in the crypto market, potentially improving their trading strategies and increasing their chances of success.

The Aroon Indicator is typically displayed in a separate window alongside price charts. It consists of two dynamic lines known as the Aroon Up and Aroon Down lines. These lines provide valuable insights into the strength and direction of a trend.

- Aroon Up Line: This line fluctuates between 0 and 100 and indicates the number of periods since the highest high within a specified timeframe. It helps identify the strength and duration of the upward trend.

- Aroon Down Line: Similar to the Aroon Up Line, the Aroon Down Line also oscillates between 0 and 100. It measures the number of periods since the lowest low within the specified timeframe and provides insights into the strength and duration of the downward trend.

Source: Bybit Learn

By observing the fluctuations and the relationship between these two lines, traders can gain insights into the strength and potential direction of trends in the cryptocurrency market, helping them make informed trading decisions.

Characteristics of an Aroon Indicator

The Aroon Indicator possesses several key characteristics that make it a valuable tool for technical analysis:

- Trend Identification: The Aroon Indicator helps identify the presence and strength of trends in the market. By analyzing the relationship between the Aroon Up and Aroon Down lines, traders can determine whether the market is exhibiting a bullish or bearish trend.

- Early Trend Spotting: One of the primary benefits of the Aroon Indicator is its ability to spot trends early on. By detecting changes in the Aroon lines, traders can identify potential trend reversals or the emergence of new trends, allowing them to enter positions at the early stages of a price movement.

- Oscillating Range: The Aroon Indicator’s lines oscillate between 0 and 100. This range helps provide a visual representation of the strength of a trend. Higher values indicate a stronger trend, while lower values suggest a weaker trend.

- Customizable Timeframe: Traders can adjust the timeframe for calculating the Aroon Indicator based on their specific trading preferences and strategies. Shorter timeframes may be used for day trading or scalping, while longer timeframes can be suitable for swing or position trading.

- Confirmation Tool: The Aroon Indicator is often used in conjunction with other technical analysis tools to confirm trading signals. Traders may look for alignment between the Aroon Indicator’s readings and other indicators or chart patterns to increase their confidence in a particular trading decision.

- Applicability to Various Markets: While the Aroon Indicator is commonly used in the cryptocurrency market, it can be applied to other financial markets as well, including stocks, forex, commodities, and more. Its versatility makes it a useful tool for traders across different asset classes.

By considering these characteristics, traders can effectively utilize the Aroon Indicator to gain insights into trends, identify potential trading opportunities, and make more informed decisions in the dynamic world of trading.

Aroon Indicator Formula

The Aroon Indicator consists of two lines: the Aroon Up line and the Aroon Down line. The formula for calculating these lines is as follows:

Aroon Up = ((Number of periods – Number of periods since the highest high) / Number of periods) * 100

Aroon Down = ((Number of periods – Number of periods since the lowest low) / Number of periods) * 100

To calculate the Aroon Up line, you need to determine the number of periods since the highest high within a specified timeframe. Similarly, to calculate the Aroon Down line, you need to determine the number of periods since the lowest low within the same timeframe. The “Number of periods” refers to the specified timeframe you are using for the calculation.

Once you have these values, you can apply the formulas to obtain the Aroon Up and Aroon Down values. These values are then plotted on a chart to visualize the Aroon Indicator and analyze the trend strength and potential trend reversals.

It’s worth noting that different charting platforms and technical analysis software may have built-in functions to calculate the Aroon Indicator automatically, eliminating the need for manual calculations.

How to Interpret the Aroon Indicator

Interpreting the Aroon Indicator involves analyzing the relationship between the Aroon Up and Aroon Down lines as well as their values. Here are a few key interpretations:

- Bullish Trend: When the Aroon Up line is above the Aroon Down line, it suggests a bullish trend. This indicates that the recent high within the specified timeframe is relatively recent compared to the recent low. Traders may consider this a potential buying opportunity or a signal to hold onto existing long positions.

- Bearish Trend: Conversely, when the Aroon Down line is above the Aroon Up line, it indicates a bearish trend. This suggests that the recent low within the specified timeframe is relatively recent compared to the recent high. Traders may interpret this as a potential selling opportunity or a signal to hold onto existing short positions.

- Trend Reversal: The Aroon Indicator can also provide insights into potential trend reversals. When the Aroon Up line crosses below the Aroon Down line, it may indicate a shift from a bullish to a bearish trend. Conversely, when the Aroon Down line crosses below the Aroon Up line, it may suggest a shift from a bearish to a bullish trend. These crossovers can be considered possible reversal signals.

- Trend Strength: The values of the Aroon lines can provide an indication of trend strength. Higher values (closer to 100) suggest a stronger trend, while lower values (closer to 0) indicate a weaker trend. Traders can use this information to assess the potential reliability and durability of a trend.

It’s important to note that the Aroon Indicator is best used in conjunction with other technical analysis tools and indicators. Traders often combine it with other indicators, such as moving averages or oscillators, to confirm signals and enhance their decision-making process.

What Other Indicators Best Paired with the Aroon Indicator?

Pairing the Aroon Indicator with other complementary indicators can provide traders with a more comprehensive view of the market. Here are a few indicators that are commonly used in conjunction with the Aroon Indicator:

- Moving Averages: Moving averages, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), can be used alongside the Aroon Indicator to confirm trend signals. When the Aroon Indicator suggests a bullish trend (Aroon Up above Aroon Down) and the price is above the moving average, it can provide additional confirmation for a potential buy signal. Conversely, when the Aroon Indicator indicates a bearish trend (Aroon Down above Aroon Up) and the price is below the moving average, it can enhance the validity of a sell signal.

- Relative Strength Index (RSI): The RSI is a popular oscillator that measures the overbought and oversold conditions of an asset. When the Aroon Indicator suggests a bullish trend and the RSI is in oversold territory, it can strengthen the buy signal. Similarly, when the Aroon Indicator indicates a bearish trend and the RSI is in overbought territory, it can reinforce the sell signal.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator. When the Aroon Indicator generates a bullish signal (Aroon Up above Aroon Down) and the MACD line crosses above the signal line, it can provide confirmation for entering a long position. Conversely, when the Aroon Indicator generates a bearish signal (Aroon Down above Aroon Up) and the MACD line crosses below the signal line, it can strengthen the sell signal.

- Bollinger Bands: Bollinger Bands consist of a middle band (typically a moving average) and upper and lower bands that represent volatility levels. When the Aroon Indicator signals a bullish trend and the price breaks above the upper Bollinger Band, it can confirm a potential buying opportunity. Conversely, when the Aroon Indicator suggests a bearish trend and the price falls below the lower Bollinger Band, it can reinforce a sell signal.

Final Thoughts

In conclusion, the Aroon Indicator is a valuable technical analysis tool that helps traders identify trends and potential trading opportunities in the cryptocurrency market. By examining the relationship between the Aroon Up and Aroon Down lines, traders can gain insights into the strength and direction of trends, as well as potential trend reversals.

However, it’s important to acknowledge the limitations of the Aroon Indicator. It is a lagging indicator that may not provide timely signals in fast-moving markets. It also lacks price context and may generate false signals, particularly in choppy or sideways markets. Traders should use it in conjunction with other indicators and analysis methods to enhance its effectiveness and minimize its limitations.

To make the most of the Aroon Indicator, traders should practice using it on historical data, experiment with different timeframes, and incorporate other technical indicators for confirmation. Additionally, proper risk management and a comprehensive understanding of market conditions are essential for successful trading.

Remember that no single indicator can guarantee accurate predictions or eliminate all risks. It’s important to combine multiple tools, consider fundamental analysis, and exercise sound judgment when making trading decisions in the dynamic and unpredictable world of cryptocurrencies.