Volatility and cryptocurrencies go hand in hand, that much is obvious. However, there is a unique class of cryptocurrency that is meant to provide a constant price and serve as a safe haven of “stability” in the harsh world of crypto, and this class of cryptocurrency is called stablecoins. But what are they and how do they work? Let’s find out!

Understanding stablecoins

To put it simply, a stablecoin is a type of cryptocurrency that is designed to maintain a fixed value over time. A stablecoin’s value is typically pegged to a certain fiat currency, most frequently the US dollar, but it can also be pegged to, say, precious metals like silver or gold (e.g. Tether Gold), or backed by another cryptocurrency. This is the main difference between stablecoins and cryptocurrencies like Bitcoin or Ethereum: since stablecoins always have assets they are pegged to, they do not experience severe price fluctuations like other cryptocurrencies. Still, in rare cases even stablecoins may face unforeseen consequences – TerraUSD plunging still haunts both its creators and its holders.

The value of the majority of stablecoins is pegged to the value of either a currency (fiat or crypto) or a particular commodity. The word “pegged” means the price is fixed, but how does it actually work? Let’s take a look at the ways stablecoins can keep their value.

Fiat-Backed Stablecoins

The most popular way of keeping stablecoin’s price fixed is known as fiat-backing, and this approach typically refers to the ratio of the total number of stablecoins in circulation to the total number of the backed fiat currency. The amount of fiat collateral must always be equal to the number of stablecoins in circulation and is kept in reserve by a central issuer.

A stablecoin is backed 1:1 if for every stablecoin in circulation, there are assets worth an equivalent amount backed by it. So, if we look at stablecoins backed by USD, for instance, then they secure their value as long as they can be exchanged for the US dollar. Thus, a correctly functioning fiat-backed stablecoin pegged to the dollar should always be worth $1.

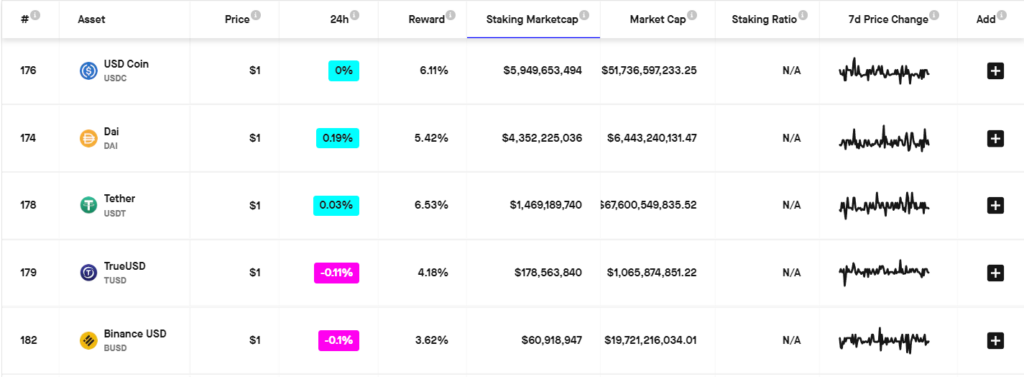

The most well-known stablecoins are the ones that are pegged to the US dollar: USDT, BUSD, USDC, TUSD, etc.

Commodity-Backed Stablecoins

Stablecoins that are backed by commodities, unlike fiat-backed ones, use other types of assets—usually precious metals, but can technically be backed by oil, real estate, or any other valuable commodity. However, each and every one of these commodities is subject to price fluctuations, which could cause them to lose value, making these kinds of stablecoins riskier than fiat-backed ones.

With commodity-backed stablecoins, a third party has ownership of a specific asset and distributes an equal value of stablecoin to those who are willing to buy stablecoins. At any moment, a holder of those stablecoins has the option to return their stablecoins for the underlying asset at the asset’s new price.

Examples of commodity-based stablecoins are Tether Gold (XAUT), Digix Gold Token (DGX), and Goldario (GLD).

Crypto-Backed Stablecoins

A crypto-backed stablecoin, instead of being pegged to fiat currencies, is backed by cryptocurrencies and operates without a central issuer, thus making them decentralized and on-chain.

In order to be protected from the unpredictably volatile nature of the cryptocurrency market, many decentralized crypto-backed stablecoins (e.g. MakerDAO’s DAI) are over-collateralized, with most requiring a 200% collateralized ratio. So, if we take DAI as an example, then for every $100 of DAI you would like to borrow, you must back it with $200 worth of ETH. This allows ETH to maintain its peg even when the crypto market goes through volatility.

However, if a user wishes to borrow DAI, he or she must lock cryptocurrency into a smart contract called a collateralized debt protocol (CDP) via the MakerDAO ecosystem. Once a user locks cryptocurrency into the CDP, they will then receive a proportionate quantity of DAI. When it’s time to withdraw the original collateral amount, the user must put the initial amount of DAI, plus interest, back into the smart contract.

Currently, it’s hard to find reliable algorithmic stablecoins on the crypto market. The case with UST and Terra Luna showed that algorithmic-backed stablecoins are not perfect, and if something happens to stablecoin’s market maker, depegging can happen in a moment’s notice, and it will destroy the coin’s future and its value extremely fast.

Collateralized vs. Non-Collateralized Stablecoins. Pros & Cons

Someone who is not very familiar with stablecoins might think that since the coin is called “stablecoin,” it has zero risks and can be safely used for trading or storing your funds. However, as we’ve already mentioned above, depending on the nature of stablecoin, it might have its own strengths and weaknesses. Let’s take a look at them:

Collateralized Stablecoins. Pros

- Price stability. Stablecoins, especially those collateralized by fiat are likely to behave independently of cryptocurrency trends, and thus they usually do not experience severe price fluctuations.

- Availability and ease of use. Most stablecoins (e.g. USDT, USDC, DAI) are available on every major cryptocurrency exchange, as well as decentralized exchanges like PancakeSwap or Uniswap. That might be especially helpful for those investors who simply want to move their funds into crypto, or for those traders who are willing to use stablecoin in their trading pairs.

- Make staking less risky. Staking stablecoins can minimize the risk of impermanent loss due to volatility. Certainly, they may not grant you as much profit as some other cryptocurrencies, but due to a lack of severe price fluctuations, your passive income may be much more stable.

Collateralized Stablecoins. Cons

- Centralization and off-chain. The holder of both kinds of fiat and commodity-backed stablecoin must put their trust in a third party’s assurances that they have the means to sustain the coin because it is completely centralized. Holders of such stablecoins usually cannot govern the way the project moves, so you have to rely on a third party completely and hope that they know what they are doing.

- Risk of insufficient reserves. The reserves that support a stablecoin are a crucial component of the stablecoin ecosystem. Without them, the coin issuer cannot guarantee the value of a stablecoin with full confidence. In case a stablecoin does not have sufficient reserves, then the stablecoin may face the risk of depegging from its price. For instance, one of the most well-known stablecoins UDST regularly gets attacked by some of its investors for lacking transparency regarding the stablecoin’s reserves. USDT developers, in turn, constantly try to convince their investors that they have enough reserves to back their stablecoins.

- Security issues. Since we’re talking about physical collateral here, we should always keep in mind that it may be stolen by third parties and even by the provider itself, and no one can guarantee you any security in this matter.

Non-Collateralized Stablecoins. Pros

- No third parties or middlemen. Algorithmic stablecoins do not have to rely on collateral, unlike fiat or commodity-backed stablecoins. That means more independence and fewer risks that are applied to collateralized stablecoins, e.g. risks of insufficient reserves.

- Fixed price, just like with collateralized ones. Both kinds of stablecoin do not get influenced by overall market sentiments, so their prices usually remain stable regardless of other cryptocurrencies’ prices.

- Transparency and governance. Since algorithmic stablecoins do not have a third party that possesses collateral, they, in general, provide an opportunity to propose and vote on different improvements to sustain a project in a proper condition.

Non-Collateralized Stablecoins. Cons

- Risk of reducing demand. The nature of the algorithmic system means that there must be a constant demand for the stablecoin to succeed, and of course, no one can guarantee that, and if the demand goes down completely, so does the stablecoin’s value.

- Ponzi scheme. There is a chance that algorithmic stablecoin might end up being a Ponzi scheme, when new tokens are only created via new users depositing collateral. The term “ponzi scheme” describes a type of financial fraud that pays out returns to old investors using money from new investors and eventually collapses when the new participants stop investing. All that can lead to the fact that the value of these assets can quickly implode in case new users stop coming.

- Broken peg. We’ve already covered Terra’s UST case in our blog, so we won’t go much into details here. This might be the worst case scenario for an algorithmic stablecoin, since in addition to losing its price, it also adds suspicion from investors towards other cryptocurrencies, and not only stablecoins. And when the price goes down, there is a high chance that it won’t go back up, since the faith in this coin is shattered, and its holders will try to get rid of it as soon as possible.

How can you use stablecoins?

There are quite a few ways stablecoins can be used during your crypto journey, and some of these ways might not be so obvious. Let’s take a closer look at stablecoin usage:

Alternative to fiat money on exchanges

Using stablecoins might be a convenient way for investors and traders to buy other cryptocurrencies on the exchanges. It is not always possible to use fiat money via credit card, so stablecoins might come in handy in such situations. Furthermore, buying crypto with stablecoins may help you avoid fees because, unlike fiat money, from which exchanges typically derive their percentages, crypto-to-stablecoin and vice versa purchases are commission-free.

Staking and lending

The process of staking refers to “locking up” your crypto assets so they can be used to confirm transactions and support a blockchain network, and in exchange for that you get rewards, or “interest.” Staking offers cryptocurrency owners an opportunity to put their digital assets to work and earn passive income without the need to sell them. Staking stablecoins might be less profitable than staking “traditional” cryptocurrencies that can go through price rallies. However, the latter are less trustworthy, and you may end up losing more than you earned.

Lending refers to the process of depositing the desired amount of stablecoins, which the company or exchange or any other entity you pick then uses to make secured loans to other parties. At the end of the agreed period, you get your deposit back and, in addition, you get the interest accrued over time.

Using stablecoin in your trading pair

When picked for quote currency in your trading pair, stablecoins can provide you the stability of a US dollar (if we talk about fiat-backed ones) with the agility of trading crypto to crypto. They can make it easier to develop a trading strategy as well as help your savings process. Trading in accordance with your plan and technical analysis tools is easier with stablecoins than with other volatile cryptocurrencies.

One of the best tools that you can use when trading using stablecoins is automated crypto bots. Try it with TradeSanta today, and see for yourself the potential of automated trading! TradeSanta supports every well-known stablecoin that is listed on the supported crypto exchanges.

Storing funds

Stablecoins are largely considered as the most secure option to invest in the cryptocurrency industry. We’ve all seen how major cryptocurrencies can lose significant portions of their value in a matter of days, leaving investors with devastating financial losses. Stablecoin investment, on the other hand, can therefore be a good choice if you want to invest in the cryptocurrency market but are not interested in making large, quick profits or if you simply want to diversify your portfolio.

Final thoughts

Stablecoins can provide some of the stability that most of the other cryptocurrencies lack, thus making them an almost necessary addition to an investor’s portfolio. However, investors who use stablecoins should be aware of the risks involved. Each of the backing approaches has advantages and disadvantages, demonstrating to us that stablecoins are still a developing crypto technology. That is why it’s always wise to investigate a stablecoin before investing.

When researching a stablecoin, always look into what it is backed by. Some stablecoins have different collateral, while others technically don’t have any collateral at all. The more stable the collateral, the more stable the coin. Therefore, it’s critical to ascertain precisely what your selected stablecoin is backed by in order to evaluate its reliability.

In any case, the golden rule of DYOR (Do Your Own Research), which is a must to comply with when dealing with cryptocurrencies, also must be implemented when dealing with stablecoins.

FAQ

What are stablecoins?

To put it simply, a stablecoin is a type of cryptocurrency that is designed to maintain a fixed value over time. Stablecoins were created in response to the notorious instability of the cryptocurrency market to provide a reliable coin for buying, selling and storing crypto assets.

Are stablecoins a good way to store your funds?

Stablecoin investment can be a good choice if you want to invest in the cryptocurrency market but are not interested in making large, quick profits or if you simply want to diversify your portfolio.