One of the most important questions a crypto trader can (and should!) ask is how do crypto trading pairs work and how to choose them? In this article, we will be discussing this topic, as well as the difference between crypto trading pairs, the most popular currencies and we will give you some examples of such pairs, so you could start your trading journey right away!

What is a cryptocurrency trading pair?

The term “trading pairs” refers to the asset pair being traded in cryptocurrency, usually one cryptocurrency for another. Cryptocurrency pairs compare the value of one currency to another, specifically the base currency vs. the second one, the so-called quote currency. It informs you how much of the quote currency you’ll need to buy one unit of the base currency, so such pairings help to determine the value of your assets when you’re trading them for other assets.

Traders can exchange their assets for other cryptocurrencies, most commonly BTC, which is still the market leader in terms of market capitalization, or for stablecoins such as USDT, UST, or USDC, which are basically crypto pegged to the US dollar.

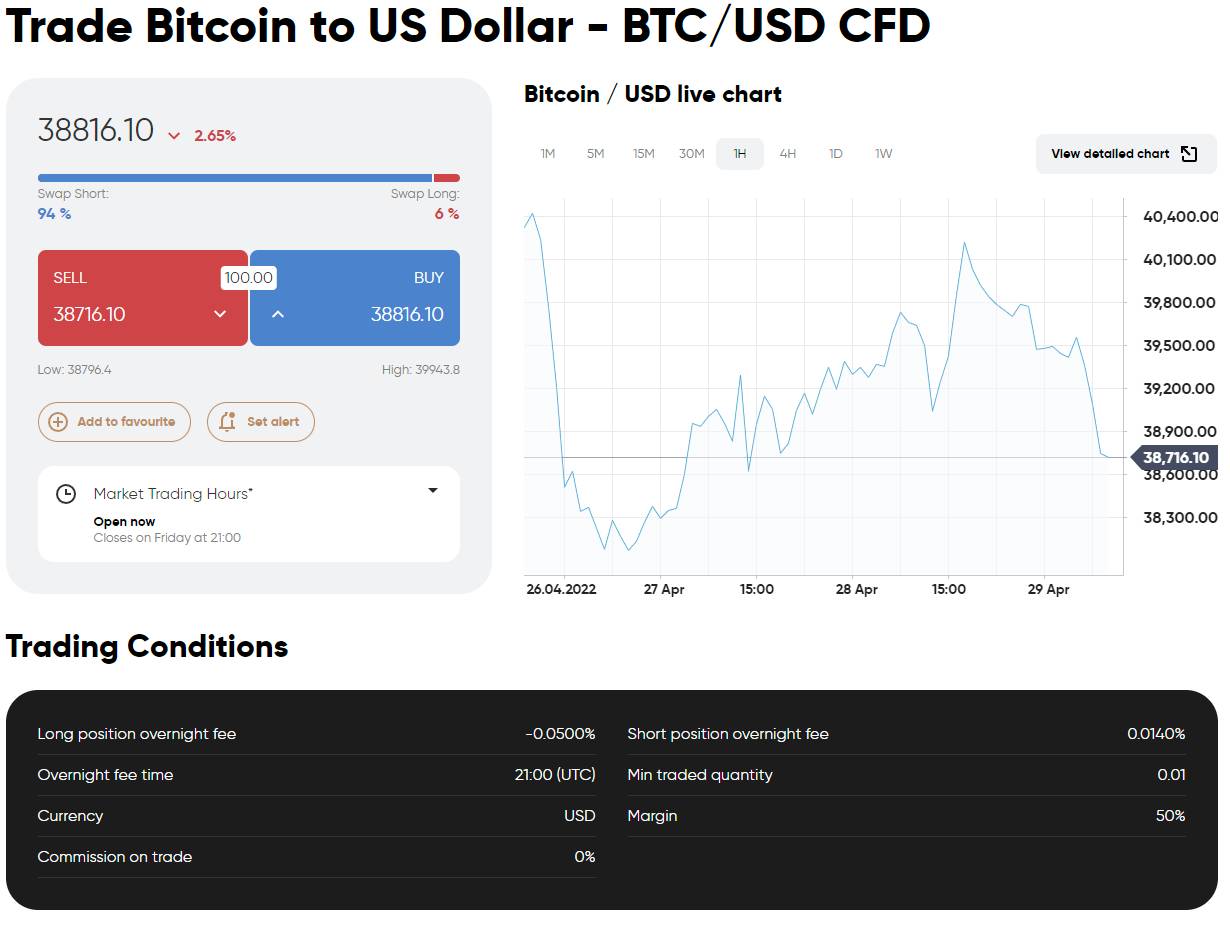

Crypto traders can also trade cryptocurrencies against USD or any other fiat currency on well-known exchanges, like Binance or Coinbase. The process will be pretty much the same as for trading one cryptocurrency against another, with the exception that digital assets will be exchanged for fiat currencies like USD, EUR, GBP, etc.

If you’re curious what would be the value of any cryptocurrency if they’d reach Bitcoin’s market cap, you can use a tool to compare market cap. For example, Ethereum would be worth $3,662 if it would have Bitcoin’s current the market cap.

Now, let’s take a look at what the terms “quote” and “base” currencies imply.

Base and Quote Currencies

In trading pairs, be it crypto-to-fiat or crypto-to-crypto, you always refer to one of them as the “base” currency and the other one as the “quote” currency. For instance, if we want to trade ETH/BTC, ETH on the left side will be the base currency, and BTC on the right side will be a quote currency. Currently, as of 06.05, the pair is trading at 0.073923, so that means that on the crypto market you’ll have to pay 0.074765 of BTC for 1 ETH.

That is, when you place a buy order for an ETH/BTC trading pair, you’ll spend BTC to buy ETH, and when you place a sell order for that pair, you’ll sell ETH and get BTC in return.

Typically, BTC, ETH, USDT, BNB, or LTC are some of the most popular ones as they have high trading volume, high liquidity, and they are available on almost every crypto exchange.

Certainly, you are in no way limited to trading only ETH and BTC, since there are a variety of trading pairings to choose from, and major exchanges can provide a lot of different trading pairs, so you can always find a pair that would be suitable for your trading needs.

Fiat-to-Crypto and Crypto-Cross Pairs

It is important to distinguish the two types of trading pairs, since you can both trade crypto for fiat money and trade one cryptocurrency for another one.

Crypto-cross pairs refer to the pair with two digital assets, like the above mentioned ETH/BTC pair. When you have BTC, ETH, BNB, Ripple or some other major cryptocurrency in your trading pair, then you can be sure that this trading pair will have a high trading volume and attract lots of liquidity on crypto exchanges.

On the contrary, if you decide to trade some less-liquid altcoins, then you’ll face wide spreads and low trading volume due to their lower market capitalization and because of their lesser popularity on the crypto market.

Fiat-to-crypto pairs are more popular among those traders who are only starting their journey into crypto trading, and who still have some difficulties in reading crypto-cross pairs. In this pair, one of the sides will contain a digital asset and a fiat currency (e.g. USD, EUR, etc).

An overwhelming majority of fiat-to-crypto pairs have USD as their base currency, since the United States Dollar is used as a benchmark currency for the whole crypto market.

How to choose a crypto trading pair?

When choosing a trading pair, you should always think about the advantage that it can offer to you, because you want to make a profit, and not to lose money. Here is a list of simple, yet important steps you should take when choosing a crypto trading pair:

Pick your crypto exchange and make sure this exchange supports your coins

You should choose a crypto exchange that is reliable, secure and has a good reputation: Binance, Coinbase, HitBTC, OKX, Huobi – all of them have the above mentioned features.

Keep in mind that while centralized exchanges like Binance or Coinbase allow you to buy cryptocurrencies with fiat money, decentralized exchanges (DEXs) like PancakeSwap or Uniswap do not have that feature, and thus the only way to trade there is using crypto-cross pairs, or trade against stablecoins that are pegged to US dollar, like USDT, UST or USDC. Moreover, even major centralized exchanges do not have an option to purchase certain altcoins (e.g. Neo or Ravencoin) with fiat money, and you can do that only with BTC, ETH, USDT and other major cryptocurrencies.

You should check if a crypto exchange you’ve picked allows you to trade your selected currencies and if you can use that one specific currency as a base one. In case the latter one doesn’t allow you to use your chosen cryptocurrency as a base, you should reconsider switching to BTC/ETH/BNB or any other that can be used for that matter. You can also look at another exchange, in case it has more options that can satisfy your needs.

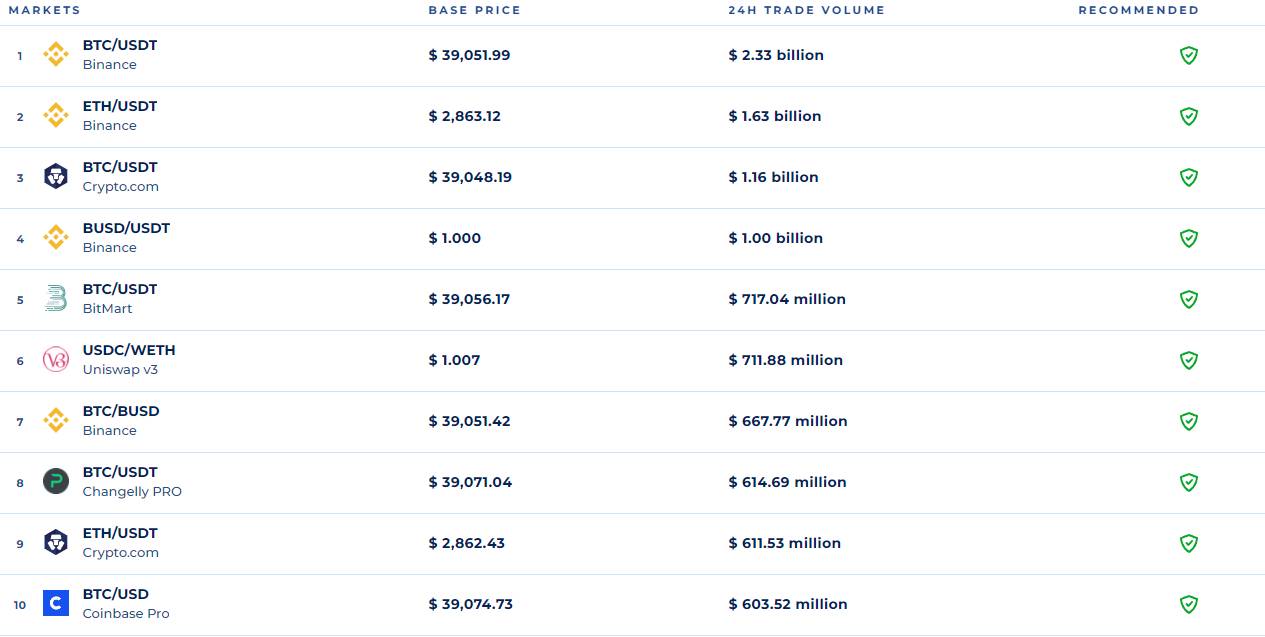

Look at the trading volume

In case you chose a trading pair with low trading volume, then you can be sure that it will take a lot of time before you would be able to close a deal. That is why trading low cap altcoins might not be profitable, since they usually do not have as much activity as the most popular coins with large market cap.

Pay attention to liquidity

A coin with high liquidity will have tight bid-ask spreads, allowing you to sell it at the current market price. On the other hand, when dealing with an illiquid asset, it would be hard to sell it, at least at a current price, since no trader is willing to make such a deal. In that case, you will have to either lower the price or wait when the liquidity will increase.

Check the volatility

It is obvious that the higher the volatility of your chosen trading pair, the higher the risks. On the other hand, the higher the volatility the more trading deals you can execute in a given amount of time, and let’s be honest – volatility is the trader’s best friend if approached with right risk management. In case you are not quite sure about your trading abilities, then instead of choosing highly volatile trading pairs among freshly-made altcoins, it might be wise to stick to the cryptocurrencies that’ve been around on the crypto market for some time already, have a large number of holders, trading volume, and market cap.

Certainly, if you are sure about your chosen trading pair and feel quite confident that you can trade them with a profit and not with a loss, then you have nothing to be worried about. However, if you don’t have enough experience yet, then sticking to coins with relatively lower volatility might be a wise decision.

Let’s say Top 100 would be more than enough to cover your trading needs.

TradeSanta crypto trading bots can be especially helpful in your trading routine, and it can give you an insight on some of the most popular coins for trade. Moreover, TradeSanta has a list of top-trading pairs that you can use when choosing which coins you should take a look at.

In case you are struggling in choosing which trading pair you should stick to, you might check resources like Coinranking.com and see which trading pairs by far have the biggest trading volume.

FAQ

What is a cryptocurrency trading pair?

The term “trading pairs” refers to the asset pair being traded in cryptocurrency, usually one cryptocurrency for another. Cryptocurrency pairs compare the value of one currency to another, specifically the base currency vs. the second one, the so-called quote currency.

What is a Crypto-cross pair?

Crypto-cross pairs refer to the pair with two digital assets, like the above mentioned ETH/BTC pair. When you have BTC, ETH, BNB, Ripple or some other major cryptocurrency in your trading pair, then you can be sure that this trading pair will have a high trading volume and attract lots of liquidity on crypto exchanges.

What is a Fiat-to-Crypto pair?

Fiat-to-crypto pairs are more popular among those traders who are only starting their journey into crypto trading, and who still have some difficulties in reading crypto-cross pairs. In this pair, one of the sides will contain a digital asset and a fiat currency (e.g. USD, EUR, etc).