If you’ve been around crypto for some time at least, you’ve definitely heard about staking. And just like any other concept in crypto, staking might be a complicated idea or a simple one for you, depending on the way you’re looking at it. In any case, every investor and trader knows that staking could be a good source of passive income in crypto. That is why today we will look at the process of staking, how it works, and what you should do if you want to make a profit with it. So let’s dive in!

What is staking?

Staking offers cryptocurrency owners an opportunity to put their digital assets to work and earn passive income without the need to sell them. The process of staking cryptocurrencies involves “locking up” your crypto assets so they can be used to confirm transactions and support a blockchain network, and in exchange for that you get rewards, or “interest”.

Staking might just be considered a less resource-intensive option to mining, a base trait of a traditional Proof-of-Work mechanism. Staking is possible only via a proof-of-stake consensus mechanism, and you must first understand the principles behind proof-of-stake (PoS) in order to better comprehend what staking is. Let’s briefly discuss what PoW and PoS are.

Proof of work is a consensus mechanism that is used to confirm and record cryptocurrency transactions, or blocks, which requires a vast amount of computer engineering that is contributed by miners around the globe when they solve math “puzzles” by generating a long string of characters, known as “hash”, that matches the target hash for the current block.Those who become the first ones to complete this task are rewarded with a certain amount of cryptocurrency. Proof-of-work is a necessary part of adding new blocks to the Bitcoin blockchain, for instance.

Proof of stake is a consensus mechanism that uses a competitive validation method to confirm transactions and add new blocks to the blockchain. PoS requires a network of investors; these investors, or “stakeholders,” contribute their cryptocurrency to create new blocks on the blockchain. That is why it is called “proof of stake.” This act of contribution is called “staking.” Investors who stake their cryptocurrency earn a reward in proportion to the size of their stake: the more you stake and the longer you keep digital assets in the pool, the more rewards you will get.

Just like the proof-of-work mining algorithm, the proof-of-stake mining algorithm helps create new blocks on the chain, but in another way. To put it simply, the main difference is that you need to stake in order to create new blocks, but there are some details that should be mentioned. In proof-of-work, miners prove they have capital at risk by expending energy. In proof-of-stake, validators explicitly stake capital in the form of their cryptocurrencies into a staking pool. The staked cryptocurrency then serves as collateral that can be destroyed if the validator behaves fraudulently or carelessly.

Unlike mining, which requires quite an expensive rig and a lot of electrical power, staking does not require anything of that, and it is open to literally anyone who is willing to participate.

How to stake cryptocurrencies?

We’ve already covered the fact that it is only possible to stake those coins that use the Proof-of-Stake consensus mechanism. Now, let’s take a look at the whole process of staking and how it looks.

Those who are willing to participate in staking must first pledge their cryptocurrencies to the crypto protocol. Then, this protocol picks validators from all these participants to confirm blocks of transactions, and those who contributed the most, become validators, while others can continue their part in the staking process. The pools typically operate on a two-tier system: an administrator oversees the work of the validators and ensures things run as they should. When rewards are earned, they’re split between both the pool operator and pool delegators. In order to become a validator, you must contribute a significant amount of coins. The more coins you pledge, the greater the chances that the protocol will choose you as a validator.

One validator is randomly selected to be a block proposer in every slot. This new block must be created and distributed to other network nodes by this validator. A committee of validators is also selected at random for each slot, and their votes are used to determine whether or not the block being presented is genuine.

You usually have control over your cryptocurrencies even when you stake them. Basically, you’re putting them to work, and in most cases, you’re free to unstake them when you decide that you want them back in your wallet. However, sometimes the unstaking process may not be immediate since with some cryptocurrencies and/or staking pools, you’re required to stake coins for a minimum amount of time.

There is more than one way of staking your cryptocurrency: staking through exchanges, staking by joining staking pools and staking by being a validator.

Staking by being a validator

Validators’ main goal is to verify transactions to keep the network safe. They stake coins and are selected randomly to validate the transactions. To become a validator, you have to stake a certain number of coins to get a chance of being randomly selected for the role. The required minimum amount of coins depends on the cryptocurrency in general, and can vary massively. However, the chances of being selected depend not only on how many coins a validator has staked, but also on the size of the active set and how many validators are waiting in the pool.

However, being a validator is a much more complicated process when compared to the other two methods that will be discussed below. Being a validator requires not only to make a huge initial investment (e.g. 32 ETH on Ethereum network) and have knowledge of how to build your own staking infrastructure, but also to be accountable for the stakes of your current nominators. Moreover, a validator must be able to handle technical issues, which he or she has to tackle themselves.

Staking by joining staking pools

A staking pool refers to a group of coin holders who combine their resources to maximize their chances of validating blocks and thus receiving interest. They merge their staking power and share the rewards proportionally to their contributions to the pool.

When joining a staking pool, you can earn interest when staking with other participants. You can find a specific staking pool for a particular coin: for instance, when staking Solana, the most popular staking pools would be Marinade or Socean Stake Pool; for Cardano, your best bet would be Cardanians, and so on.

In case you don’t have a particular coin to stake, you can make your own research and find a staking platform that suits your needs: thus, Aqru would be a perfect platform for newcomers and those who are only starting their journey in staking due to simple-to-read website and lack of complicated jargon; MyCointainer has one of the best staking rewards on the market and offers a variety of staking solutions to earn interest; Everstake is the biggest decentralized staking provider with an enterprise-level hardware, etc.

Staking via exchange

Staking via exchanges is somewhat similar to staking by joining staking pools, although it is a more convenient and even less demanding process, since with exchanges you usually do not need to think about security or reliability.

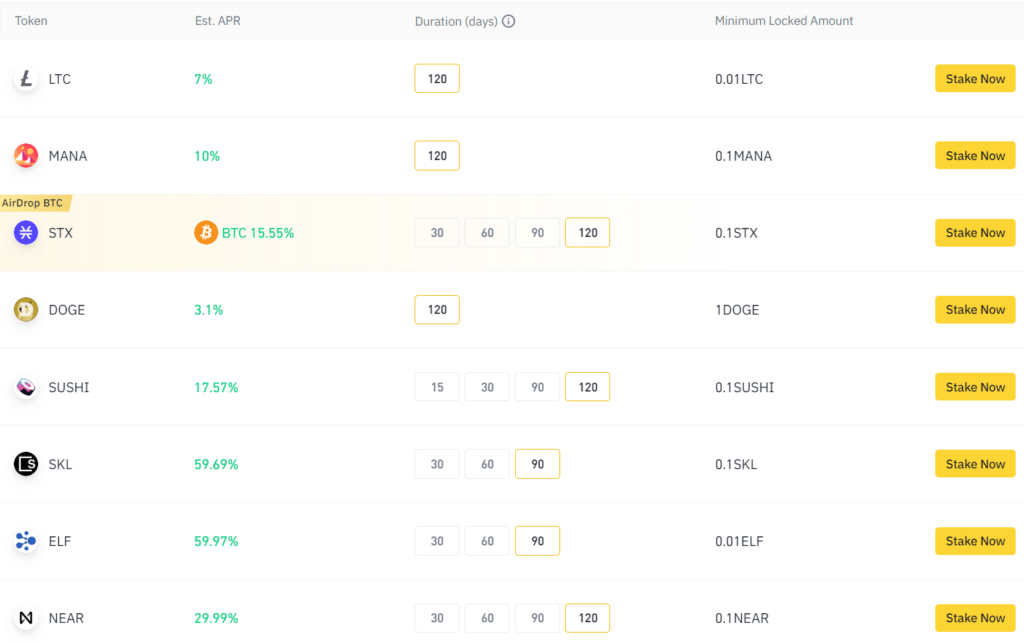

Major crypto exchanges, such as Binance or Coinbase, allow their customers to stake cryptocurrencies in return for rewards. The exchanges typically stake cryptocurrencies on behalf of their customers. Most of the exchanges charge commission on users’ staking rewards but also provide high yields. Staking via exchanges might be the most convenient way. However, the downside is that the exchanges usually have a limited number of supported coins for staking, so if you want to stake a somewhat rare coin, you’ll have to look elsewhere. Another problem is that when staking on exchanges, you won’t be able to choose the lock-in period for some coins, since they might have only one option. For instance, currently on Binance you can lock-in Litecoin (LTC) for 120 days, and not a day less.

How to pick a suitable staking pool?

When picking a staking pool, it is important to do some research and find the most appropriate staking pool that will satisfy your needs and see for yourself if this pool is actually worth it. You can look for pools that allow you to stake only one cryptocurrency (for example, Ethereum or Polkadot), or pools that allow you to stake dozens of coins, depending on your preferences.However, there are some general indicators you should consider when deciding to join a pool. So what should you be looking at when picking a stake pool?

- Stability. It is hardly possible to earn any interest in case your staking pool’s servers are always down or cannot work properly. Find the one that has an uptime as close to 100% as possible and that has a long history of operating on the market.

- Pool size. Smaller pools are less likely to be selected to validate blocks, but when they are selected, they can pay higher rewards because they don’t have to split rewards between a large number of participants. On the other hand, a pool that is too small might potentially fail. So that means that for most investors, mid-size pools might be their best bet.

- Fees. Most staking pools have a small fee that is deducted from the staking rewards. The fees depend on a particular staking pool and your chosen coin, however the most common fees range from 2% to 5%.

- Track record. Among other things, there is also a question of reliability: multiple blocks plus multiple epochs can both indicate that a pool is doing fine and is reliable. In addition, it is worth checking a pool’s registered date to make sure that this particular pool has been on the run for a long time. You can also check the reviews from other stakers and see if they are positive or negative.

Off-Chain or On-Chain Staking?

Knowing whether you will be initiating the process on-chain or off-chain is another crucial part of cryptocurrency staking. On-chain staking, as the name suggests, is staking your tokens on the specific blockchain network directly. This is its most basic version.

On-chain staking requires you to download the entire blockchain ledger to your computer and after that you must connect to a node via a supported wallet. Even though this method can offer you a direct interaction with the blockchain, on-chain staking is more suitable for those investors who have more advanced cryptocurrency knowledge and expertise.

Choosing an off-chain staking provider is a much more preferable option if you are a total newbie or if you want to keep things simple. Getting started on the platform that offers off-chain services doesn’t require any prior knowledge. This is because your agreement is with the staking platform itself rather than the blockchain network. And as such, once you have picked your staking platform, cryptocurrency, and desired lock-up period – there is nothing else needed for you to do.

What are the best cryptocurrencies for staking?

First of all, you should remember that not every cryptocurrency can be staked, and only the ones that run on the PoS protocol are eligible for that purpose. Generally, it is better to stick to those coins that are relatively stable, meaning those that have a decent market capitalization, number of holders, and reputation. Remember, when you’re staking, you’re locking your coins for a certain number of days, and you need to be sure that during this period your chosen coin will not bleed out due to poor market conditions or because its development team made some bad decisions.

Another important thing to consider when picking a cryptocurrency for staking is its supply. If a coin has a fixed supply, it is possible that the price will rise constantly due to scarcity and rising demand. Staking coins with limited circulation might be profitable in the future.

Last but not least, it is better to stick to coins that have a real use case. Thus, if a project is used in the real world, the demand for it will remain high, and thus its price will increase over time.

So, which cryptocurrency should be your focus? Let’s take a look at some of the cryptocurrencies that might be a good choice for staking:

Ethereum (ETH)

Ethereum, which formerly used a PoW method, is now switching to PoS. Ethereum is the second most famous cryptocurrency in the world, and the Ethereum platform is known as a blockchain with numerous dApps built on top of it. If you want to be a validator, you’ll have to stake at least 32 ETH. Currently, as of 21.07, you can earn up to ~4.2% APR, according to the Ethereum website.

Solana (SOL)

Solana, a blockchain designed exclusively for hosting decentralized apps, or dApps, is comparable to other well-known blockchains like Ethereum or Cardano in this regard. Solana managed to get investors’ attention due to its fast operation with low transaction fees. Solana can process around 50,000 transactions per second, compared to Ethereum’s 15, although the upcoming ETH 2.0 upgrade is promised to change that. As of time of writing, you can stake SOL on Socean Stake Pool for 6.30% APY.

Cardano (ADA)

Just like Ethereun, Cardano is known as a smart-contract platform. And just like Solana, Cardano was designed with a goal to solve scalability and sustainability issues, and be able to process several hundred transactions per second (for now, Cardano can process about 250 transactions per second). Currently, Binance offers 15.79% APR for staking ADA for 120 days.

Polkadot (DOT)

Polkadot represents a next-generation blockchain protocol that enables cross-blockchain transfers of any type of data or asset, and not just tokens. Moreover, by processing numerous transactions simultaneously, interoperability protocols like Polkadot can overcome the so-called bottleneck that occurs on conventional networks that handle transactions one at a time. As of writing, Bybit offers 3.52% APY for staking DOT on their exchange.

USDC

A stablecoin like USDC is probably the best choice for you if your main goal while staking cryptocurrency is to generate a passive income without the volatility of other cryptocurrencies.

Despite the fact that many other stablecoins can be staked, you can invest in USDC with confidence because Coinbase is behind it. According to data from Staking Rewards, staking USDC can grant you 6.23% of annual rate.

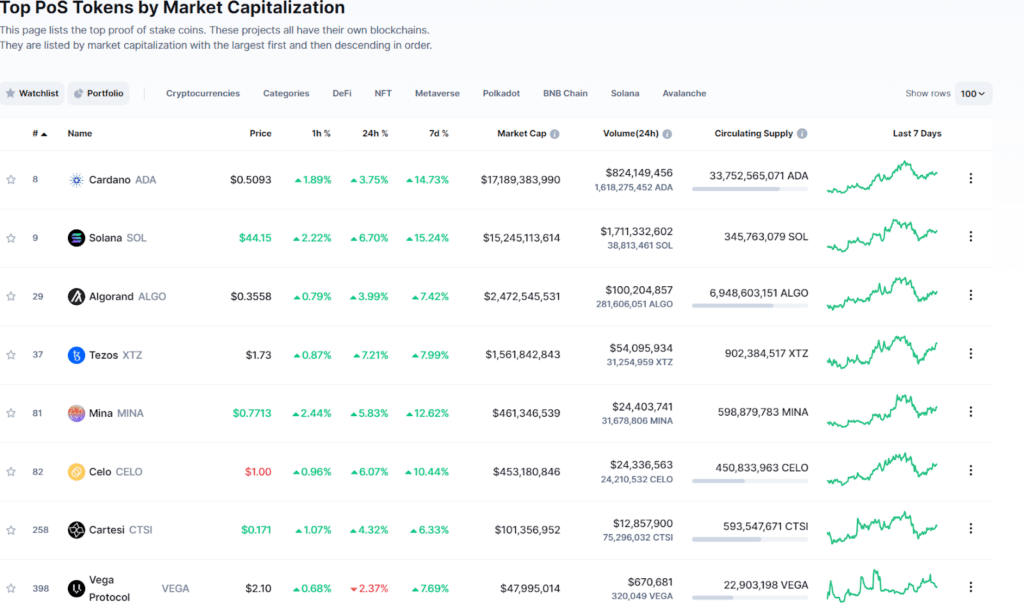

Certainly, this is not the full list of all cryptocurrencies that can be staked. You can always check the PoS cryptocurrencies by market capitalization on CoinMarketCap website and pick the one that you think will serve you best.

Pros and cons of crypto staking

There are quite a few benefits you can get from staking. However, just like any other crypto activity, staking bears some risks and downsides that you should always keep in mind before you start staking. Let’s take a look at some of the most vivid pros and cons of staking:

Pros

- You can increase your stash of coins or tokens. Certainly, the amount of rewards can vary dramatically depending on a number of factors, however the main idea stays the same: you’re locking your coins in exchange for reward.

- Staking is less energy-intensive and more investor-friendly. Mining is not for everyone, and that is because you need to have a powerful mining-farm and a lot of cheap electricity so that mining would pay off. Staking does not require you so much resources, and thus it has a much lower entry barrier.

- Staking may grant you voting rights. Staker’s involvement in a certain ecosystem or blockchain network may offer them more authority over what happens to a particular coin in the future. Think of that as about having a company’s voting stock.

Cons

- Crypto is volatile. As you already know, crypto is notorious for its volatility, and price swings occur on a regular basis. Moreover, the coin you’re staking might lose its value over the time of staking, so in the end, you might not get as much reward as you were hoping for.

- Remember about lock-up periods. In case you lock up your funds for months or even years, you won’t have access to your coins for that period of time. Certainly, in some cases you can unstake your funds, but sometimes it is simply not possible and you’ll have to wait until the lock-in period is over.

- Fees are still there. If you think that staking does not involve paying fees, then you’re wrong. Depending on the platform or exchange where you stake, you’ll have to pay a certain fee in the end.

FAQ

What is staking?

The process of staking cryptocurrencies involves “locking up” your crypto assets so it can be used to confirm transactions and support a blockchain network, and in exchange for that you get rewards, or “interest”.

How to pick up a suitable staking pool?

It is important to look at these three criteria: pool size, fees and reliability. After finding a pool, stake your cryptocurrency there using your wallet, and start staking.

What is better: a staking pool or exchange?

Exchanges, especially the major ones, can provide top-notch security and an extra layer of reliability, plus they are easy to use. Staking pools, on the other hand, can provide better rewards and more flexible locking periods.

Can you lose crypto by staking?

That is possible. The coin you’re staking might lose its value over the time of staking, so in the end, you might not get as much reward as you were hoping for.