As the demand for cryptocurrency trading platforms grows, nested cryptocurrency exchanges have emerged, providing users with the convenience of accessing multiple platforms from a single interface. However, crypto nested exchanges come with inherent risks and complexities that can compromise the security of your digital assets. This article aims to provide a thorough understanding of nested exchanges in cryptocurrency, explore the associated risks and dangers, discuss alternative solutions for safer trading experiences, and outline best practices for secure trading.

What is a Nesting Exchange in Crypto?

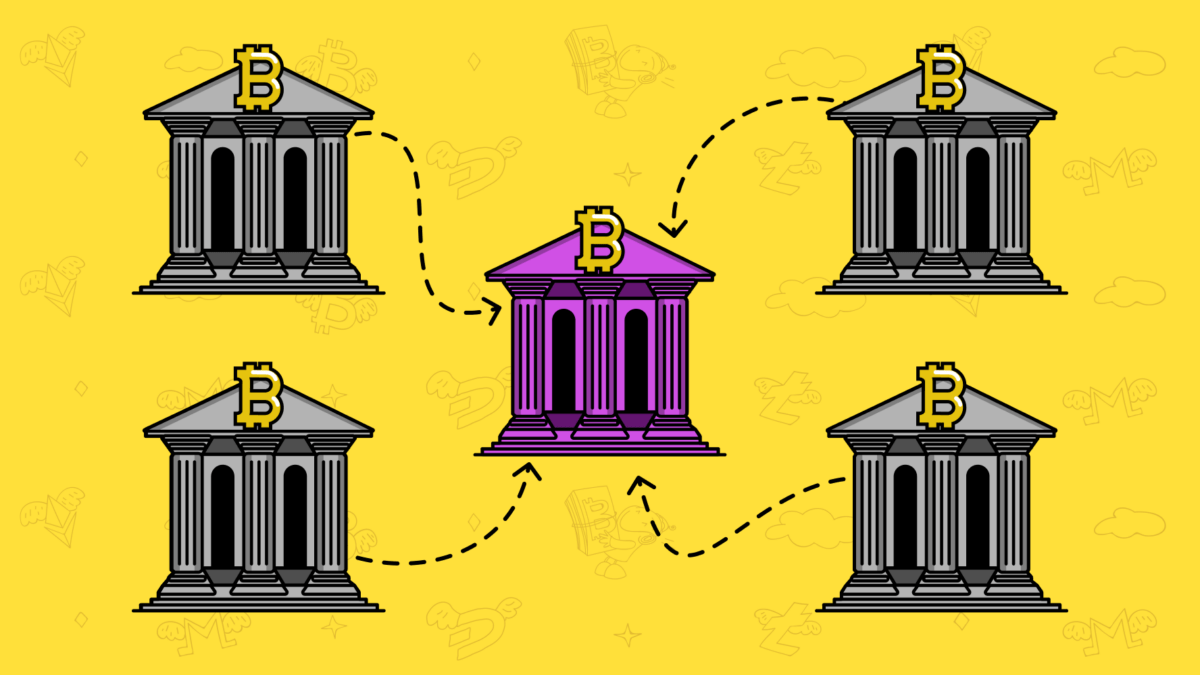

Nesting, in the context of cryptocurrency exchanges, refers to the practice of connecting multiple exchanges or liquidity pools through an intermediary platform. This consolidation of liquidity and order books enables users to access a wider range of trading pairs, better liquidity, and potentially lower fees. Nested exchanges offer several benefits, including consolidated liquidity, expanded trading options, potential fee reduction, streamlined user experience, and enhanced market depth. By integrating multiple exchanges into a single platform, nesting aims to provide a comprehensive trading solution for cryptocurrency enthusiasts.

Perhaps the most notorious example of a nested exchange is the Suex exchange, which was the first ever crypto exchange to be identified and sanctioned by the U.S. Government for its role in the ransomware payment chain.

3 Dangers of Nested Exchanges

While nested exchanges offer convenience and expanded trading options, they also introduce significant risks to your digital assets. Understanding the dangers associated with nested cryptocurrency exchanges is crucial for protecting your investments. Let’s delve into them:

- Increased Security Vulnerabilities: Nested exchanges expand the attack surface, exposing your funds to potential security breaches. Each additional exchange integrated into the nested system represents an additional point of vulnerability. If the intermediary platform or any of the connected exchanges are compromised, it puts all linked exchanges and users’ funds at risk. Cybercriminals often target centralized points of control, making nested exchanges attractive targets.

- Lack of Transparency and Auditability: Nested exchanges often obscure the underlying infrastructure and order execution process. This lack of transparency makes it difficult to assess the fairness and reliability of the trading process. It becomes challenging to track and verify the execution of trades across multiple exchanges, potentially leaving users unaware of any manipulation or fraudulent activities. Without proper audibility, users may face difficulties in identifying potential issues or discrepancies in their trades.

- Compromised Privacy: Using a nested exchange requires users to expose their personal information, trading history, and account details to multiple platforms. This increases the risk of data breaches or unauthorized access, potentially compromising users’ privacy. The interconnected nature of nested exchanges requires users to trust multiple platforms with their sensitive information, heightening the exposure to privacy risks.

Conclusion

Nested exchanges in cryptocurrency provide convenience and access to a wider range of trading options. However, they also introduce risks such as increased security vulnerabilities, lack of transparency, and compromised privacy. Understanding these risks is crucial for protecting your digital assets.

By considering alternative solutions such as established exchanges, decentralized exchanges (DEXs), all-in-one platforms, and custodial services, along with adopting best practices like thorough research, enabling 2FA, using hardware wallets, regularly updating software, practising cold storage, being cautious of phishing attempts, diversifying investments, and staying informed about security best practices, you can enhance the security of your cryptocurrency trading.

Remember, prioritizing security and implementing robust measures are essential for protecting your digital assets and navigating the cryptocurrency market with confidence. Secure trading practices will help maximize your potential returns while minimizing the risks associated with cryptocurrency trading.

FAQ

What is a nested exchange in cryptocurrency?

A nested exchange in cryptocurrency refers to the practice of integrating multiple cryptocurrency exchanges or liquidity pools into a single platform. This consolidation allows users to access a wider range of trading pairs, better liquidity, and potentially lower fees from within a unified interface.

What are the risks associated with using nested crypto exchanges?

Using nested exchanges comes with several risks, including increased security vulnerabilities, lack of transparency, and compromised privacy. The interconnected nature of nested exchanges exposes users’ funds to potential security breaches, and the lack of transparency makes it difficult to assess the fairness and reliability of the trading process. Additionally, using nested exchanges often involves sharing personal information with multiple platforms, which heightens privacy risks.