The rapid growth and increasing popularity of cryptocurrencies have transformed the investment landscape, prompting investors to seek novel ways to participate in the digital asset market. One such avenue is through crypto index funds, which provide a diversified and passive investment approach. In this comprehensive article, we will delve into the concept of crypto index funds, exploring their similarities to and differences from traditional index funds.

What are Traditional Index Funds?

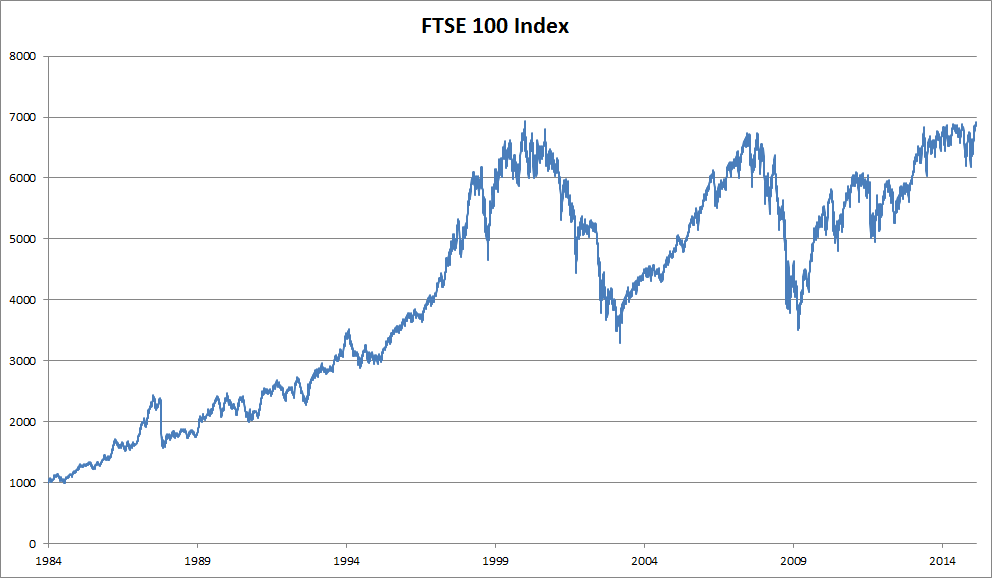

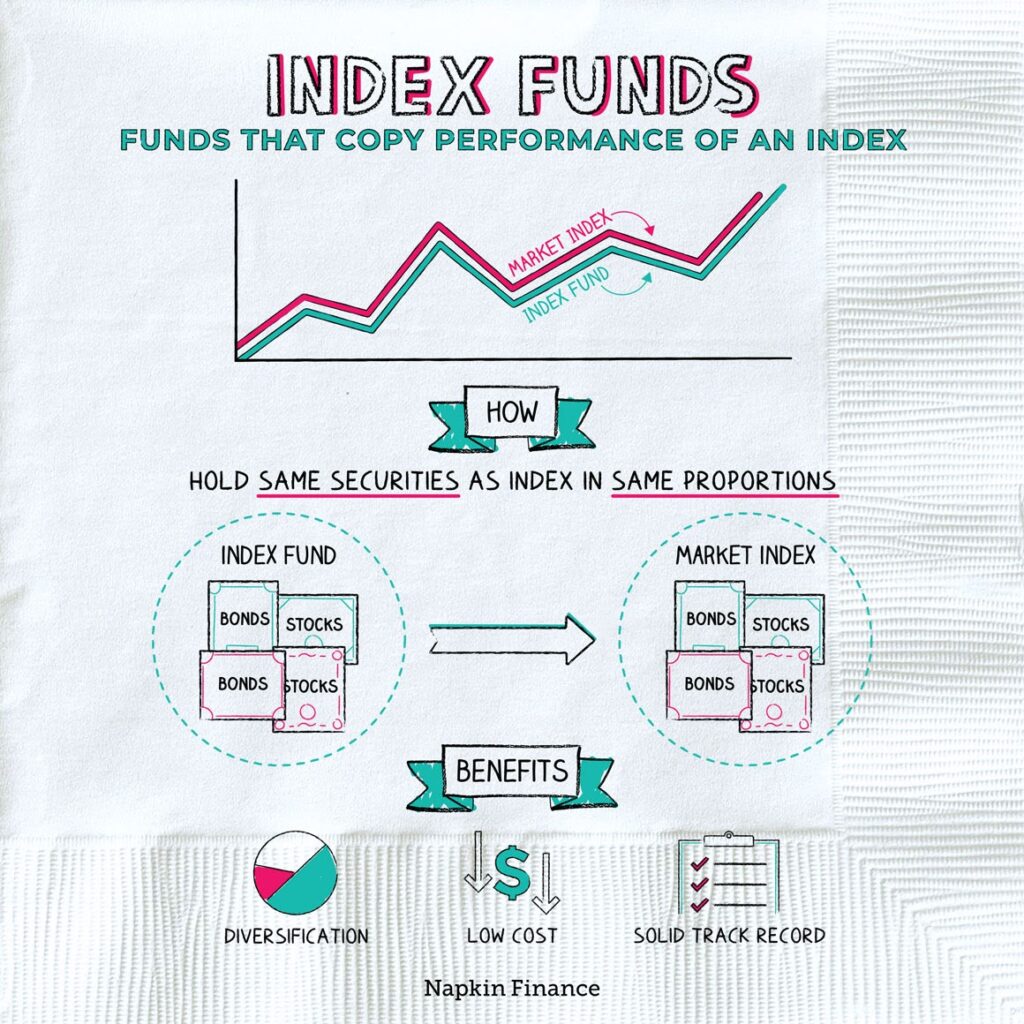

Traditional index funds are investment vehicles designed to mirror the performance of a specific market index, such as the S&P 500, the Dow Jones Industrial Average or the FTSE 100. These funds consist of a diversified portfolio of stocks or other assets replicating the index’s composition and weightings. The primary objective of a traditional index fund is to deliver returns that closely align with the underlying index rather than aiming to outperform it. Let’s delve into the meanings of these prominent indices:

- S&P 500: The S&P 500, short for the Standard & Poor’s 500, is a market index that tracks the performance of 500 large-cap companies listed on U.S. stock exchanges. These companies represent a diverse range of sectors and industries, making the S&P 500 a comprehensive barometer of the U.S. stock market’s performance. It is often considered a benchmark for evaluating the overall health and direction of the U.S. economy.

- Dow Jones Industrial Average (DJIA): The Dow Jones Industrial Average, commonly referred to as the Dow, is one of the oldest and most widely recognized stock market indices in the world. It tracks the stock prices of 30 large, publicly traded companies representing various sectors of the U.S. economy. The Dow is price-weighted, meaning that the index value is influenced by the stock prices of its components rather than their market capitalization.

- FTSE 100: The FTSE 100, also known as the Financial Times Stock Exchange 100 Index, is a market index that tracks the performance of the 100 largest companies listed on the London Stock Exchange (LSE). These companies represent a significant portion of the UK stock market and cover various sectors, including finance, healthcare, energy, consumer goods, and more.

Key features of traditional index funds include:

- Diversification: Traditional index funds provide investors with exposure to a broad range of securities across different sectors, industries, and market capitalizations. By holding a diverse mix of assets, these funds help mitigate the impact of individual stock performance, reducing the portfolio’s overall risk.

- Passive Management: Index funds follow a passive investment strategy, meaning they do not rely on active management decisions to select or time investments. Instead, they aim to replicate the holdings and weightings of the target index, allowing investors to capture the overall market performance.

- Cost Efficiency: Traditional index funds generally have lower expense ratios compared to actively managed funds. They require less research and trading activity, resulting in reduced expenses for investors. The cost efficiency of index funds can have a positive impact on long-term returns.

What are Crypto Index Funds?

Crypto index funds (e.g. Nasdaq Crypto Index, Grayscale, Fidelity), much like their traditional counterparts, are investment vehicles designed to track the performance of a specific index. However, instead of comprising stocks, bonds, or other traditional assets, crypto index funds consist of cryptocurrencies or digital assets. These funds provide investors with exposure to the crypto market without the need to actively manage individual assets.

Key characteristics of crypto index funds include:

- Diversification across Cryptocurrencies: Crypto index funds offer investors exposure to a diversified portfolio of cryptocurrencies. The composition of these portfolios is often based on market capitalization, trading volume, or other predetermined criteria. By holding a mix of cryptocurrencies, investors can potentially benefit from the growth of the overall crypto market while reducing exposure to the risks associated with individual coins.

- Passive Investment Strategy: Similar to traditional index funds, crypto index funds generally adopt a passive investment strategy. They aim to replicate the performance of a specific crypto index, such as the Crypto20 or Bitwise 10 Large Cap Crypto Index. The fund’s holdings are periodically adjusted to maintain alignment with the index’s composition and weightings.

- Professional Management: Crypto index funds are typically managed by professionals or investment firms specializing in digital assets. These managers conduct in-depth research, monitor market trends, and rebalance the fund’s holdings to ensure they accurately reflect the index’s composition. Their expertise adds value by providing investors with professional management of their crypto investments.

Features of Crypto Index Funds

While crypto index funds share similarities with traditional index funds, several factors distinguish them:

- Limited Accessibility: Traditional index funds are widely accessible through various brokerage platforms and investment firms. However, the availability of crypto index funds may be more limited, as they cater specifically to investors interested in the crypto market. This restricted accessibility is due to the relatively nascent stage of the crypto market and the specialized nature of crypto investments.

- Higher risks due to a lack of regulation: Traditional index funds operate within well-established regulatory frameworks, subject to scrutiny from financial authorities. On the other hand, crypto index funds operate in a relatively new and evolving regulatory landscape. Regulations surrounding cryptocurrencies vary by jurisdiction, impacting the operations and potential investor protections of crypto index funds. It is essential for investors to consider the regulatory landscape and the level of investor protection provided when evaluating crypto index funds.

- More Volatile and Riskier: Cryptocurrencies are known for their inherent volatility and the potential for significant price fluctuations. This volatility introduces a higher level of risk compared to traditional asset classes. Consequently, crypto index funds may experience more substantial fluctuations in value, making them potentially riskier investments. Investors need to be aware of the increased volatility and risk associated with the crypto market when considering crypto index funds.

- Immaturity: While traditional financial markets have a long history and established infrastructure, the crypto market is still relatively young and evolving. The crypto ecosystem is constantly evolving, with new projects, protocols, and tokens emerging regularly. This rapid pace of innovation and development can impact the composition and performance of crypto index funds. Investors should consider the dynamic nature of the crypto market and its potential impact on the long-term performance of crypto index funds.

Crypto vs Index Funds

| Aspect | Crypto Index Funds | Traditional Index Funds |

|---|---|---|

| Asset Class | Comprised solely of cryptocurrencies, which can be highly volatile. | Typically composed of stocks, bonds, or other traditional financial instruments. |

| Diversification | Provides exposure to a selection of cryptocurrencies, diversifying within the crypto market. | Offers broad diversification across established asset classes and sectors. |

| Volatility | Cryptocurrencies are known for their high volatility, resulting in potentially significant price swings. | Generally less volatile than cryptocurrencies, offering more stable returns. |

| Investment Approach | Typically follow a passive investment strategy, mirroring the performance of a crypto market index. | Also follows a passive strategy, tracking the performance of established market indices. |

| Historical Returns | Historically, cryptocurrencies have shown the potential for substantial gains but come with increased risk. | Traditional index funds offer more predictable and stable returns over the long term. |

| Market Hours | Cryptocurrency markets operate 24/7, allowing trading at any time. | Traditional markets have set trading hours, typically during weekdays. |

| Regulatory Framework | Subject to evolving and varied regulatory environments globally. | Governed by established financial regulations in their respective jurisdictions. |

| Custody Requirements | Requires secure digital wallet and understanding of private keys for safe storage. | Custodial services are provided by fund managers, ensuring ease of ownership. |

| Accessibility | Accessible to anyone with an internet connection and knowledge of cryptocurrency exchanges. | Accessible through brokerage accounts, mutual fund platforms, and retirement accounts. |

| Liquidity | Liquidity can vary depending on the specific cryptocurrencies in the index. | Typically provides good liquidity for investors to buy and sell fund shares. |

| Transparency | Often transparent with real-time tracking of the underlying index and holdings. | Transparency is a hallmark, with holdings and strategy disclosed regularly. |

Best Crypto Index Funds in 2023

| Index Fund Name | Description and Key Features |

|---|---|

| 1. Grayscale Digital Large Cap Fund (GDLC) | A fund that tracks a market-weighted index of the largest cryptocurrencies like Bitcoin and Ethereum. |

| 2. Bitwise 10 Crypto Index Fund (BITW) | Diversified exposure to the top 10 cryptocurrencies by market cap, including Bitcoin, Ethereum, and others. |

| 3. Crypto20 (C20) | An autonomous, tokenized index fund that tracks the top 20 cryptocurrencies by market cap. |

| 4. Invictus Capital Crypto20 (C20) | A fund similar to Crypto20, offering a passive, diversified investment in the top 20 cryptocurrencies. |

| 5. 21Shares Crypto Basket Index (HODL) | Provides exposure to a diversified basket of cryptocurrencies weighted by market cap and liquidity. |

| 6. CoinShares Crypto Index Fund (CIX100) | Tracks a market-cap-weighted index of the top 100 cryptocurrencies, providing broad market exposure. |

| 7. Huobi 10 (HB10) | An index that tracks the 10 most liquid and influential cryptocurrencies on the Huobi exchange. |

| 8. ICONOMI Crypto Strategy P (ICNX) | A fund that actively manages a diverse portfolio of cryptocurrencies, seeking to outperform the market. |

| 9. Amun Crypto Basket Index (HODL5) | Offers exposure to a diversified basket of the top five cryptocurrencies by market cap. |

| 10. Coinbase Index (CBBI) | Designed for institutional investors, it provides exposure to a broad range of cryptocurrencies on Coinbase. |

Conclusion

Crypto index funds offer investors a convenient and diversified approach to gain exposure to the crypto market. These funds provide the benefits of diversification, passive management, and professional expertise in managing a portfolio of cryptocurrencies. However, they also come with their own unique characteristics and risks due to the distinct nature of the crypto market.

As with any investment, it is crucial for individuals interested in crypto index funds to conduct thorough research, understand the associated risks, and carefully evaluate their investment goals and risk tolerance. Additionally, investors should consider regulatory factors, technological requirements, and the overall maturity of the crypto market.

While crypto index funds provide an avenue for participation in the digital asset space, investors should always seek professional advice and exercise diligence when making investment decisions to ensure they align with their financial objectives. With the right knowledge and careful consideration, crypto index funds can be a valuable tool for investors seeking exposure to the dynamic and evolving world of cryptocurrencies.

FAQ

What is a crypto index fund?

A crypto index fund is a type of investment instrument that aims to track the performance of a specific index of cryptocurrencies.

What is the difference between traditional index fund and crypto index fund?

The main difference between cryptocurrency and traditional index funds is in the types of assets they invest in.