Return on Investment (ROI) is a vital metric for evaluating the profitability and performance of investments, including investments in cryptocurrencies. Calculating ROI helps investors gauge the success of their crypto ventures and make informed decisions. This article aims to provide a detailed guide on calculating ROI in the cryptocurrency market, incorporating relevant formulas and practical examples.

What is ROI?

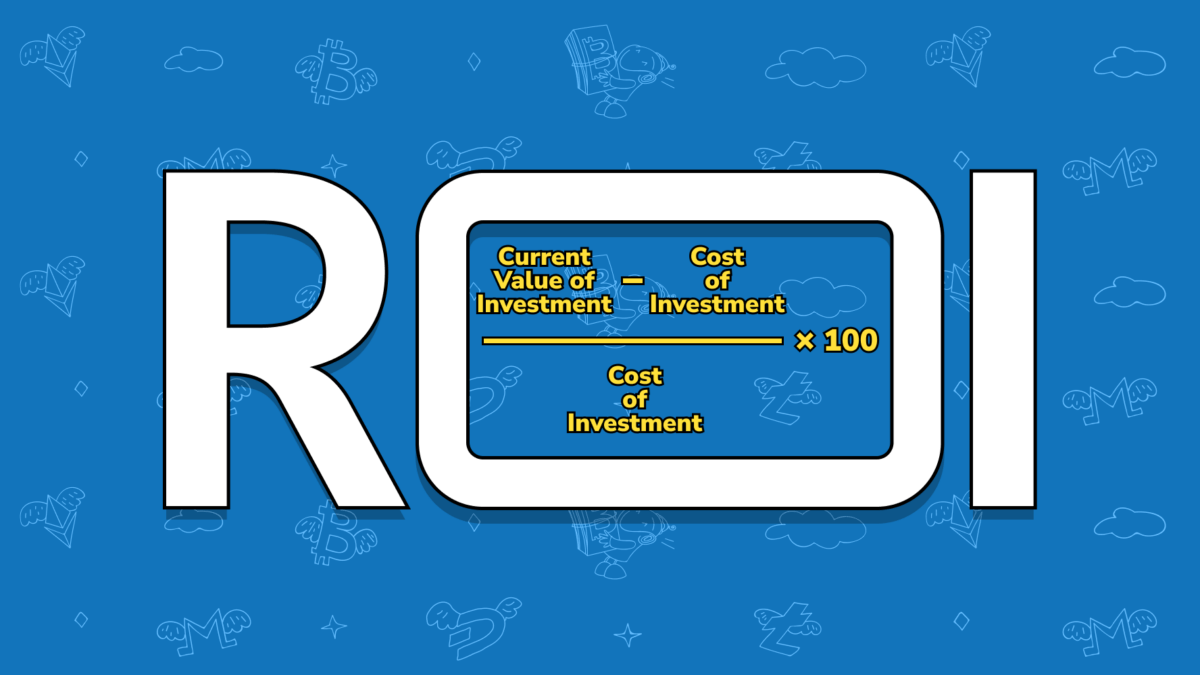

ROI, in its simplest form, is a measure of the return generated on an investment relative to the initial cost of the investment. It is typically expressed as a percentage. The formula for ROI is as follows:

ROI = (Current Value of Investment – Cost of Investment) / Cost of Investment * 100

To calculate ROI accurately, it’s essential to determine the initial cost of your investment. This includes any fees, commissions, or expenses incurred during the purchase and sell of cryptocurrencies. It is crucial to consider the total cost involved, as it affects the accuracy of the ROI calculation.

The current value of your investment refers to the present worth of your cryptocurrency holdings. To determine this value, multiply the number of coins/tokens you own by their current market price minus the fees. Several platforms provide real-time cryptocurrency prices, such as CoinMarketCap, CoinGecko, or exchanges.

Transaction costs, such as trading fees and withdrawal fees, can impact the ROI calculation. It’s essential to account for these costs when determining the cost of investment and current value. Subtracting transaction fees from the total value of the investment helps achieve more accurate ROI calculations.

How to calculate ROI?

Let’s illustrate the ROI calculation using an example:

Suppose you invested $5,000 in a cryptocurrency and incurred $100 in transaction fees. After a specific period, the current value of your investment is $9,000.

Cost of Investment = $5,000 + $100 = $5,100 Current Value of Investment = $9,000 – 150 (fees).

ROI = ($9,000 – $5,100) / $5,100 * 100 = 76.47%

In this example, your ROI is 76.47%.

ROI calculations can be further refined by factoring in the time frame of the investment. By considering the holding period, investors can evaluate the performance of their investment over a specific duration. This approach is especially useful for long-term investments, where price fluctuations may have a substantial impact.

Annualized ROI

Annualized ROI helps standardize returns over different time frames. It is useful for comparing investments with varying durations. To calculate the annualized ROI, use the following formula:

Annualized ROI = [(1 + ROI)^(1 / Number of Years)] – 1

Let’s continue with the previous example and assume the investment lasted for two years. Using the ROI from the previous example (76.47%), the calculation is as follows:

Annualized ROI = [(1 + 0.7647)^(1 / 2)] – 1 = 0.3662 or 36.62%

The annualized ROI for this investment is 36.62%.

Analyzing and Interpreting ROI

After calculating the ROI, it’s crucial to interpret the results in the context of the investment strategy, market conditions, and personal financial goals. Comparing the ROI with other investments or market benchmarks helps assess the performance of the cryptocurrency investment. Here are some key points to consider when analyzing and interpreting ROI:

- Comparison: Compare the calculated ROI with other investments or relevant market benchmarks to determine the relative performance of your cryptocurrency investment. This allows you to assess whether your investment has outperformed or underperformed the market.

- Investment Strategy: Evaluate whether the ROI aligns with your investment strategy and objectives. Different strategies may yield varying levels of ROI. For example, long-term investors may have a lower ROI but seek stability and potential growth over time, while short-term traders may aim for higher ROI but with increased volatility.

- Market Conditions: Take into account the overall market conditions during the investment period. Cryptocurrency markets can be highly volatile, with price fluctuations impacting ROI significantly. Understanding market trends and dynamics provides valuable context for interpreting your ROI.

- Risk Assessment: Consider the level of risk associated with your investment and whether the ROI justifies the risk taken. Higher ROI often implies higher risk, and it’s important to assess whether the returns adequately compensate for the potential volatility and uncertainty of the crypto market.

- Time Horizon: Reflect on the duration of your investment. Shorter-term investments may generate a higher ROI due to market volatility, but they also carry higher risks. Long-term investments may yield a lower ROI but offer more stability and potential growth.

- Portfolio Diversification: Evaluate how the ROI of your cryptocurrency investment contributes to your overall investment portfolio. Diversifying your investments across different asset classes can help mitigate risks and optimize returns.

Conclusion

Calculating Return on Investment (ROI) is crucial for assessing the performance and profitability of cryptocurrency investments. By accurately determining the cost of investment, considering transaction costs, and calculating the current value of investment, investors can quantify their returns. Additionally, annualizing the ROI and analyzing the results in the context of investment strategy, market conditions, and risk appetite provides valuable insights. Remember, ROI is just one metric, and it should be considered alongside other factors to make well-informed investment decisions in the dynamic world of cryptocurrencies.

FAQ

How do I calculate ROI for my cryptocurrency investment?

To calculate ROI, use the formula: ROI = (Current Value of Investment – Cost of Investment) / Cost of Investment * 100. Determine the initial cost of your investment, including fees, and subtract it from the current value. Divide the result by the initial cost, multiply by 100, and you’ll have the ROI percentage.

How can I annualize the ROI for my cryptocurrency investment?

To annualize ROI, use this formula: Annualized ROI = [(1 + ROI)^(1 / Number of Years)] – 1. Calculate the ROI using the previous formula. Then, consider the holding period in years, plug the values into the formula, and you’ll obtain the annualized ROI as a percentage.