In the landscape of cryptocurrencies, market corrections are inevitable. These sudden downturns can be unnerving, but they are a natural part of the market cycle. Understanding what a market correction is and knowing how to respond when it happens is crucial for any crypto investor. In this article, we unravel the concept of market corrections in the cryptosphere and offer practical tips on how to weather the storm and seize opportunities during these challenging times. Whether you’re a seasoned trader or a beginner, buckle up as we explore the ins and outs of crypto market corrections and equip you with the knowledge to navigate through turbulent waters with confidence.

What Is a Market Correction in Crypto?

A market correction in crypto refers to a significant and temporary decline in the prices of various cryptocurrencies after a period of sustained growth. During a market correction, the market experiences a sharp reversal from an uptrend, leading to a decrease in asset prices. This correction can be caused by various factors, including speculative trading, market sentiment shifts, regulatory news, macroeconomic events, or simply a natural cooling off after a period of excessive optimism and price appreciation.

It’s essential to differentiate between a market correction and a bear market. A correction is a short-term phenomenon, typically lasting a few days to a few weeks, and is considered a healthy and necessary process in any market to stabilize prices after rapid gains. On the other hand, a bear market signifies a more prolonged period of declining prices and pessimism, often lasting several months or even years.

Market corrections offer both challenges and opportunities for investors. While they can be nerve-wracking, they also present a chance to buy cryptocurrencies at discounted prices before the market potentially resumes its upward trajectory. For this reason, having a solid risk management strategy and a long-term investment perspective is crucial for those involved in the crypto market.

Why does a market correction happen?

Market corrections happen for various reasons, and they are a natural and healthy part of any financial market, including the cryptocurrency market. Here are some common reasons why market corrections occur:

- Overvaluation: One of the primary reasons for a market correction is when asset prices become overinflated due to excessive speculation or irrational exuberance. When prices deviate significantly from their intrinsic value, a correction brings them back to more sustainable levels.

- Profit-taking: After a prolonged period of price appreciation, investors may decide to take profits by selling their holdings. This increased selling pressure can trigger a correction as the demand decreases.

- Fear and Uncertainty: Negative news or events, such as regulatory crackdowns, security breaches, or economic uncertainties, can lead to fear among investors, causing a sudden sell-off and resulting in a correction.

- Market Manipulation: In the relatively young and less regulated crypto market, market manipulation can play a role in triggering corrections. Large holders or groups may coordinate efforts to drive prices up and then sell off their holdings, causing a price decline.

- Trading Algorithms: Automated trading algorithms and bots are prevalent in the crypto market. When specific technical indicators or price levels are breached, these algorithms can trigger a cascade of selling or buying, intensifying market movements.

- Liquidity Squeeze: In times of volatility, liquidity can dry up as traders become hesitant to enter the market. This reduced liquidity can exacerbate price swings and lead to a correction.

- Sector Rotation: In the crypto market, different coins and tokens may go through phases of popularity and interest. When investors shift their focus and capital from one sector to another, it can cause corrections in specific assets.

It’s important to note that market corrections are a natural part of market cycles and are not necessarily a sign of a failing market. Instead, they provide an opportunity for the market to find a balance between supply and demand and allow for healthier, more sustainable growth in the long run.

How Long Does a Correction Last?

The duration of a market correction can vary significantly depending on the specific market, the underlying factors driving the correction, and the overall market sentiment. There is no fixed timeframe for how long a correction will last, as market conditions are influenced by a complex interplay of factors.

In general, a market correction in the cryptocurrency market typically lasts for a few days to a few weeks. It is a short-term event aimed at readjusting prices after a period of rapid growth or overvaluation. During this time, prices may experience a moderate decline, often ranging from 10% to 20% from their recent highs.

However, it’s crucial to note that corrections can sometimes be more prolonged, especially in cases where the underlying issues are more significant or where there is increased uncertainty and fear in the market. In some instances, a correction can last for several weeks or even extend to a couple of months.

The term “correction” implies that the market is self-correcting and finding a new equilibrium. Once the market stabilizes and buyers re-enter the market, prices may start to rebound, signaling the end of the correction phase. However, it’s important to keep in mind that corrections are just one part of the larger market cycle, and they can be followed by periods of both consolidation and continued growth.

Market Correction vs. Bear Market: Differences

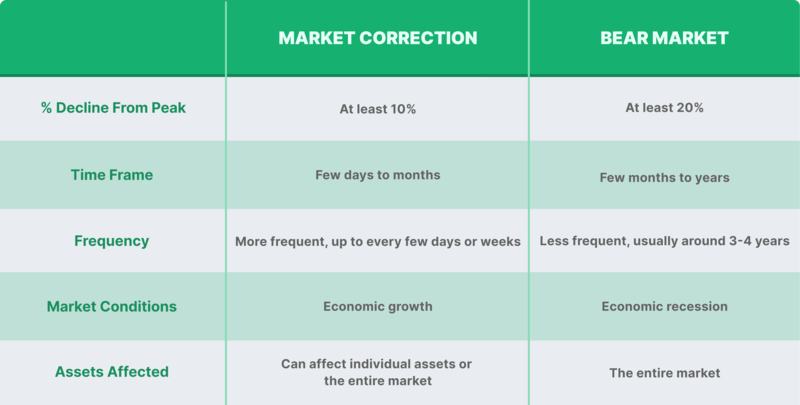

Market corrections and bear markets are both periods of declining prices in financial markets, including the cryptocurrency market, but they differ in terms of duration, magnitude, and overall market sentiment. Here are the main differences between a market correction and a bear market:

- Duration:

- Market Correction: A market correction is a short-term phenomenon, typically lasting a few days to a few weeks. It is a temporary pullback in prices after a period of sustained growth or overvaluation.

- Bear Market: A bear market, on the other hand, is a more prolonged period of declining prices, lasting for several months or even years. It is characterized by a prolonged period of pessimism, negative sentiment, and an overall market downturn.

- Magnitude of Price Decline:

- Market Correction: During a correction, prices usually decline by a moderate amount, often in the range of 10% to 20% from their recent highs.

- Bear Market: In a bear market, prices experience a more significant decline, typically exceeding 20% from their recent highs. In some severe cases, assets can lose more than 50% or even 80% of their value during a bear market.

- Market Sentiment:

- Market Correction: While market corrections may cause some unease among investors, they are generally seen as a healthy and necessary part of market cycles. Many investors view corrections as opportunities to buy assets at discounted prices.

- Bear Market: Bear markets, on the other hand, are characterized by widespread fear, pessimism, and a lack of confidence in the market’s ability to recover. Investors may become more risk-averse, leading to further selling pressure and prolonged declines.

- Purpose:

- Market Correction: Corrections serve as a natural way for the market to reset after periods of excessive optimism and price appreciation. They help to bring asset prices back to more sustainable levels and prevent bubbles from forming.

- Bear Market: Bear markets are more indicative of deeper-rooted issues in the market, such as economic downturns, regulatory concerns, or structural weaknesses. They can significantly impact investor portfolios and may require more strategic adjustments to investment approaches.

Understanding the differences between these two phases is essential for investors to adjust their strategies and make informed decisions based on current market conditions.

Best trading strategies during Market Correction?

During a market correction, the following trading strategies can help you navigate the heightened volatility and potentially capitalize on opportunities:

- Buy the Dip: Look for assets that have strong fundamentals and have experienced significant price declines during the correction. Buying the dip at discounted prices can be a profitable strategy if you believe in the long-term potential of the asset.

- Dollar-Cost Averaging: Instead of investing a lump sum, consider using a dollar-cost averaging approach. Invest a fixed amount at regular intervals during the correction. This strategy can help mitigate the impact of short-term price fluctuations.

- Focus on Quality: Concentrate on high-quality assets with strong use cases, active development teams, and solid community support. During corrections, weaker projects may suffer more, so focusing on quality can reduce risk.

- Employ Stop-Loss Orders: Implement stop-loss orders to protect your capital from significant downturns. Define the maximum loss you are willing to accept and set stop-loss orders accordingly.

- Avoid Emotional Decisions: Stick to your trading plan and avoid making impulsive decisions based on fear or greed. Emotional trading can lead to costly mistakes.

- Use Technical Analysis: Utilize technical indicators and chart patterns to identify potential entry and exit points. Look for signs of a potential trend reversal or support levels that may indicate a bounce-back.

- Watch Market Sentiment: Pay attention to market sentiment and sentiment indicators to gauge the overall mood of traders. Extreme fear or extreme optimism can signal potential turning points in the market.

- Stay Informed: Stay updated with the latest news and developments in the cryptocurrency space. News can have a significant impact on market sentiment and prices during a correction.

- Practice Risk Management: Limit the size of your trades and avoid overleveraging, especially during volatile periods. Always manage your risk to preserve your capital.

- Be Patient: Corrections can take time to play out fully. Be patient and avoid trying to time the market perfectly. Focus on long-term trends rather than short-term price movements.

- Monitor Volume: Pay attention to trading volume during a correction. Increasing volume during a price decline may indicate strong selling pressure, while decreasing volume could signal a potential price stabilization.

Remember that no trading strategy is foolproof, and the cryptocurrency market can be highly unpredictable. Be prepared for unexpected price movements and be willing to adapt your strategies based on market conditions. It’s essential to continually educate yourself, learn from your trading experiences, and be disciplined in your approach to trading during market corrections.

Final Thoughts

Navigating market corrections in the cryptocurrency space requires knowledge, discipline, and a long-term perspective. Prioritize risk management, stick to your trading plan, and avoid emotional decisions. Corrections are opportunities to buy assets at discounted prices, but be aware of the market’s high volatility. Continuous learning and adaptation are essential for success in the ever-changing crypto world. Finally, trade with money you can afford to lose and stay patient with your investments. Happy trading and investing!

FAQ

What is a market correction in crypto?

A market correction in crypto is a decline in the prices of various cryptocurrencies often in the range of 10% to 20% from their recent highs after a period of sustained growth.

How long does a market correction last?

There is no fixed timeframe, as market conditions are influenced by a complex interplay of factors. The duration can vary depending on the specific market, the underlying factors, and the overall market sentiment.