Buying the dip in crypto may seem as simple as it looks: the price has dropped, so you buy an asset to sell it later, when the price will go up again. However, just like with everything in the crypto world, it’s not that simple, as there are so many details that remain hidden. When is the right time to buy the dip? Moreover, is buying the dip actually a good trading strategy?

In this article, we will guide you through the process of buying the dip and try to answer the question of how to do that like a pro. So let’s dive in!

What does “Buy The Dip” mean exactly?

“Buy low, sell high” is a principle that every trader should follow if he or she wants to succeed. However, every market has a bearish and bullish cycle, and when the bear kicks in and prices go down, the particular call “buy the dip” can be heard all over the crypto forums, chats and blogs.

“Buy the dip” implies the practice of purchasing a certain number of digital assets whenever a correction occurs in the crypto market. When (and if!) the price returns to its original level and above, those traders who have bought the dip can potentially make a good profit by selling those assets that they bought cheap.

The motto “buy the dip” is based on the idea that crypto price drops are temporary aberrations and should be seen as waves that make the market move and which correct themselves over time. Traders who buy the dip see that as an opportunity to buy an asset at a relative discount so that they can reap the rewards when prices rise again.

However, since crypto markets are volatile, buying digital assets during a dip is somewhat risky, especially when you’re dealing with low-cap altcoins.

While prices could return to previous levels, in some cases, they could also fall even further, and thus you would lose your investments – think of the recent FTX, and Terra’s LUNA and UST cases.

That is why you should keep in mind some crucial rules before you start buying the dip.

Rules for buying the dip

You might think that buying the dip strategy speaks for itself and is as simple as it can be. However, there are key points that you must adhere to if you wish to make this strategy profitable. Let’s take a look at the most important ones down below:

Rule 1. Understand the market trend

A general rule of thumb says that buying the dip can be profitable only when the market goes through an uptrend. That is why it is crucial to determine whether the current market goes through a bearish or bullish trend.

Bearish and bullish sentiments are used to describe the level of investors’ confidence in the current crypto market. Thus, a “bull market” refers to a market that is experiencing an uptrend with rising prices, and a “bear market” refers to a market that is experiencing a downtrend with declining prices. Simply put, both terms are typically used when a market experiences a significant price swing—at least 20% and more—or when there is a long period of an upward or downward trend.

It is crucial to keep in mind that a correction — a quick drop in an asset’s price when it rises over an acceptable level — should not be mistaken with a bear market. Such a drop typically represents at least 10% of a previously reached record high, and occasionally, a correction might start a bear market by inciting panic selling. But they are not the same thing, and they shouldn’t be confused with one another.

So buying the dip during bull markets can lead to a potential profit afterwards when a trader sells the assets he or she bought during the downtrend.

Buying the dip during the bear markets might not be so rewarding since you can never predict when the asset will dip for the last time before it starts to go up again, so there is a high chance of losing your funds. Still, it is still possible to make a profit even during the worst bear market possible if you know how to do it – check out our crypto bear market guide to learn more about it.

Rule 2. Determine why the dip happened

The downtrend usually does not start out of thin air, and it is usually preceded either by some external bad news like geopolitical crises, pandemics, wars, government intervention, etc. or by internal ones like major crypto exchange collapses (e.g., FTX, Mt. Gox) or a major crypto project losing its liquidity and investors’ trust (e.g., Terra’s LUNA, ICO bubble collapse).

So it is important to determine and understand why the dip happened: did it occur due to FUD? Or maybe the specific cryptocurrency you’re interested in was overbought and now a usual correction is happening? Or some major crypto project is facing problems and is currently on the brink of bankruptcy, and now this situation is bringing the whole market down?

Answering these questions can help you decide if you should buy the dip right now or whether you should buy it at all. If the bear market is caused by some major negative events that are not going to stop any time soon, then your best decision might be to wait a little longer before the dust settles.

Moreover, it is also important to keep an eye on the news, and not just the crypto ones. As you may know, bad news can provoke a correction to go deeper, while good news could result in a quick turnaround.

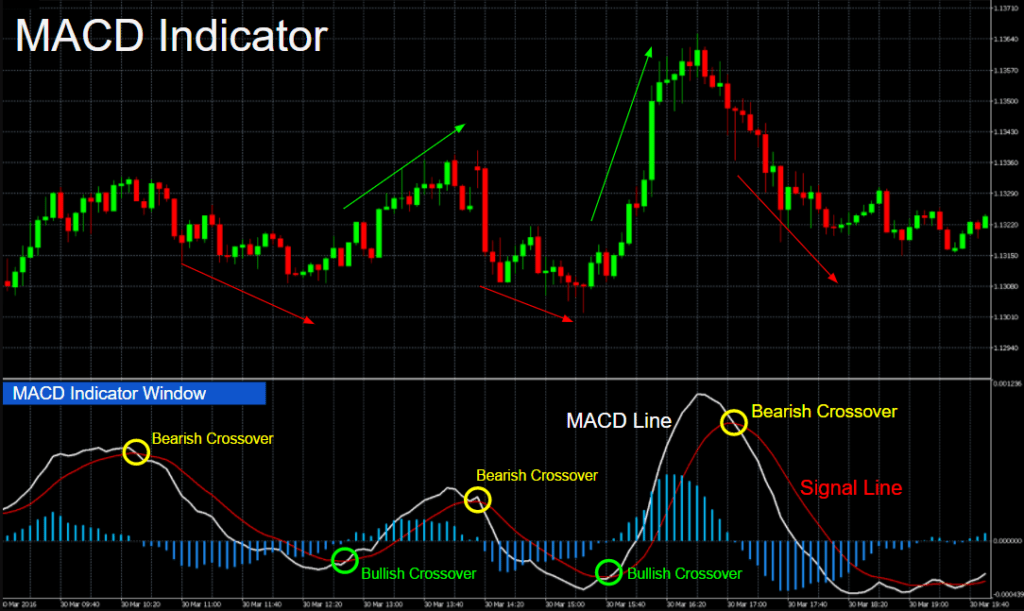

Rule 3. Use technical indicators like MACD or RSI

Technical tools and indicators can help you understand the underlying trend that is currently reigning in the crypto market. For example, the Moving Average Convergence Divergence Indicator (MACD) or Relative Strength Index (RSI) can help you pick the right time to buy the dip.

MACD is a momentum oscillator that shows the relationship between two moving averages of an asset’s price. It is made up of two lines: a longer-period moving average line and a shorter-period signal line. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result of that calculation is the MACD line. A nine-day EMA of the MACD is called the “signal line,” and it is plotted on top of the MACD line, which can function as a trigger for buy and sell signals. When MACD crosses above the signal line, it’s time to buy, and vice versa: when the MACD line crosses below the signal line, then it is time to sell.

RSI is a momentum oscillator that calculates the recent price movements of an asset in the range of 0 to 100. The calculation is based on Losses and Average Gains. The closer RSI is to the edge the higher is the asset’s movement magnitude.

The RSI shows if an asset is overbought or oversold. Usually, an asset is considered overbought if its value is over 70 and oversold if its value is below 30. RSI may also remain near the edges during strong downtrends and uptrends.

RSI is helpful for spotting chart patterns that may not be visible on the asset’s chart, such as double tops and trend lines. Traders can spot signals by looking at divergences between the RSI chart pattern and the price trend line. RSI can help you spot the bottom price: the RSI line should be close to or into the oversold area on a larger time frame to signal a strong reversal opportunity.

BTC/USDT chart; Source: Medium:WolfpackBOT/TradingView

Rule 4. Consider DCA strategy

Commonly, traders think that buying the dip means doing it in one trade; however, what could also be appropriate is to use a DCA strategy. Dollar-cost averaging, or DCA, is a trading strategy which implies a trader to divide the total amount he or she wants to invest into regular intervals. The main benefits of DCA strategy is that a trader can reduce the impact of volatility on the overall purchase.

Let’s say you have $500 in your emergency fund. A decent DCA strategy would be to divide the money into five $100 tranches or perhaps ten $50 tranches and trade with those smaller amounts.

Since you can never predict if a given digital asset has reached its bottom level, spending all your funds in one trade might not be a good idea. So instead, it might work out better if you buy with smaller amounts every time the asset’s price goes lower.

Rule 5. Focus on more reliable assets

Perhaps every crypto trader has heard tales and rumors about some meme coins and other digital assets with questionable use-cases that somehow managed to deliver 100X returns and make their owners extremely wealthy. However, trading with highly volatile and shady altcoins could get you into trouble even during the bullish trend.

To make the whole process less risky, it would be wiser to stick to more reliable digital assets, the ones that have already proved themselves to recover from bearish trends and that have already gained investors’ trust, along with a decent amount of holders, trading volume, and market cap. In fact, Top 30 cryptocurrencies by market capitalization should be more than enough to cover your trading needs. In case you’re interested in currencies besides Bitcoin and Ethereum, you can take a look at other reputable coins.

Altcoins like Solana, Ripple, or Chainlink have gained popularity and investors’ trust because they could provide real life use cases and unique features. The more use cases and technical capabilities an altcoin has, the better the chances are that it will continue to draw more funds from investors, thus providing high trading volume and liquidity, and, most importantly, gaining back what it has lost.

Consider using crypto trading bots

Automated crypto trading bots might be helpful in your pursuit of potential crypto profits. Since the crypto market is notoriously volatile, it might be challenging for traders to respond immediately when necessary, since we all have a life to live, and cannot be glued to our PC and smartphones. Crypto trading bots might provide a solution here by carrying out transactions on the traders’ behalf.

Trading bots come in a variety of forms, including the above-mentioned dollar-cost averaging (DCA), arbitrage bots, scalping bots – you name it.

In fact, there are quite a few strategies that can be utilized when using a trading bot, so they can help you to be more flexible with your funds.

Trading bots may be very helpful, however, traders should keep in mind that this market is still very new, and thus it is vital to use bots only from reputable developers, such as TradeSanta, for instance. And in case you have never used a crypto bot before and are not quite sure which strategy to use, you can always follow the steps of more experienced traders thanks to copy trading.

Copy trading is a form of crypto trading strategy with which you can take advantage of the most successful trading strategies without having to invest the time and effort of your own in order to figure out which strategy can help you to gain profit.

In case of TradeSanta, the only thing you need to do is sign up, visit the Marketplace page, filter all the bots depending on the parameters you need (exchange, pair, etc), then select the bots that have the desired return on investment, push the button “Follow/Copy,” and that’s it.

Since trading bots are now much more accessible and simple, even for traders without prior experience with automated trading, you can start using them right away if you haven’t done that already.

Final thoughts

Buying the dip may appear to be a simple trading strategy at first glance; however, as with all things crypto, there are rules and details that must be followed if your funds are not to be lost.

Picking the right moment, using technical indicators, diversifying your portfolio, and, of course, doing your own research are essential parts of crypto trading. However, now that crypto trading bots are becoming more accessible and easier to grasp, you can try them out and see for yourself how they can help you in your daily trading routine.

FAQ

What does buy the dip mean?

“Buy the dip” implies the practice of purchasing a certain number of digital assets whenever a correction occurs in the crypto market. When (and if!) the price returns to its original level and above, those traders who have bought the dip can potentially make a good profit by selling those assets that they bought cheap.

What does bearish and bullish sentiments mean?

Bearish and bullish sentiments are used to describe the level of investors’ confidence in the current crypto market.