In the fast-paced and unpredictable world of cryptocurrencies, investors face various challenges, one of which is the notorious “bull trap.”

In this article, we will provide a concise overview of bull traps in cryptocurrencies, offering valuable insights on how to identify and avoid these deceptive market patterns. By understanding bull traps, investors can better protect their investments and make informed decisions in the volatile cryptocurrency market.

What is a Bull Trap in Crypto?

A bull trap in the world of cryptocurrencies refers to a deceptive market situation where the price of a cryptocurrency gives the appearance of a significant upward trend, leading investors to believe that a bullish market is emerging. This temporary price surge attracts traders to enter or hold their positions, expecting substantial profits. However, the upward movement is typically short-lived and followed by a sudden reversal, causing the price to plummet. This abrupt shift in direction leaves investors trapped in positions they believed would be profitable, resulting in unexpected losses. A bull trap can be seen as a false signal that misleads investors into making ill-timed or misguided investment decisions based on the temporary price increase.

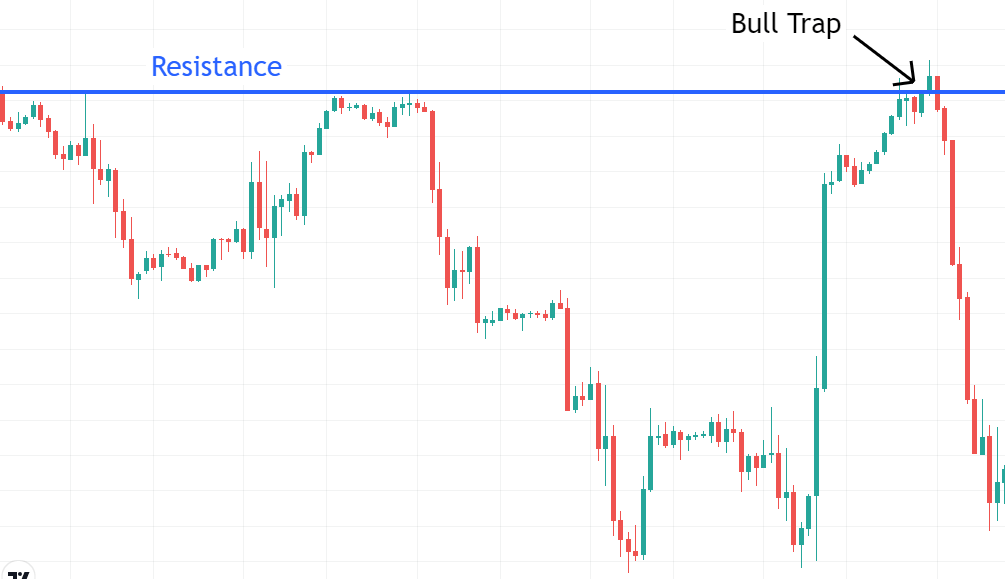

A bull trap typically follows a recognizable pattern in the cryptocurrency market. Here’s a general outline of what a bull trap may look like:

- Initial Upward Trend: The price of a cryptocurrency starts to rise, often accompanied by increased trading volume. This upward movement generates optimism among investors, leading them to believe that a bullish trend is underway.

- Breakout and Confirmation: The price surpasses a key resistance level or a significant technical indicator, triggering a breakout. This breakout may be interpreted as a strong confirmation of a bullish trend, further fueling investor enthusiasm.

- FOMO (Fear of Missing Out): As the price continues to climb, the fear of missing out on potential profits intensifies. Investors who were initially hesitant start to enter the market, and existing holders may increase their positions.

- Sudden Reversal: Just as optimism reaches its peak, the price experiences a sudden and sharp reversal. The bullish momentum abruptly halts, catching investors off guard.

- Price Decline: The price rapidly declines, erasing a substantial portion of the gains made during the initial upward movement. Panic selling may ensue as investors rush to exit their positions, exacerbating the downward pressure on the price.

- Trapped Investors: Those who entered or increased their positions during the bull trap now find themselves trapped in losing positions. The market sentiment shifts from optimism to frustration and disappointment.

It’s important to note that while this pattern is often observed in bull traps, market dynamics can vary, and not every bull trap will exhibit the exact same sequence of events. Therefore, careful analysis and consideration of multiple factors are necessary to identify and respond to potential bull traps effectively.

How To Identify a Bull Trap?

Identifying a bull trap in the cryptocurrency market requires a combination of technical analysis, market observation, and risk assessment. Here are some key factors to consider when trying to identify a bull trap:

- Price and Volume Patterns: Monitor the price movement and trading volume. Look for a sharp and sudden price increase accompanied by a significant surge in trading volume. A bull trap often exhibits a spike in buying activity that may appear unsustainable or disproportionate to the overall market conditions.

- Resistance Levels: Pay attention to key resistance levels or technical indicators that the price must surpass to validate a bullish trend. If the price breaks above these levels but fails to sustain the upward momentum, it could be a signal of a potential bull trap.

- Timeframe and Market Context: Consider the timeframe and broader market context. A quick and isolated price spike without solid fundamental support or broader market consensus may indicate a higher likelihood of a bull trap.

- Market Sentiment: Monitor the sentiment and behavior of market participants. Excessive optimism, irrational exuberance, or a widespread “fear of missing out” (FOMO) mentality can be indicators of a potential bull trap. Be cautious if the market sentiment becomes overwhelmingly positive without substantial underlying factors driving the price surge.

- Divergence with Fundamentals: Evaluate whether the price increase aligns with the underlying fundamentals of the cryptocurrency. If the price is rising rapidly without any significant positive developments, it could be a warning sign of a bull trap.

- Confirmation and Follow-Through: Exercise caution and avoid prematurely assuming a bullish trend. Look for confirmations through sustained price movement, healthy trading volume, and positive developments in the cryptocurrency ecosystem before fully committing to a bullish outlook.

Remember that no single indicator or method can guarantee the identification of a bull trap. It’s crucial to combine multiple analytical tools, stay informed about market trends, and assess the overall risk-reward dynamics before making investment decisions.

Bull Trap Example

One notable example of a bull trap in crypto market is the price surge of Bitcoin in December 2017. During that time, Bitcoin experienced a remarkable upward movement, reaching an all-time high near $20,000. Many investors interpreted this surge as the beginning of a long-lasting bullish trend and entered the market or increased their positions.

However, shortly after reaching its peak, the price of Bitcoin experienced a sharp and swift reversal. Within a few weeks, the price plummeted, eventually dropping to around $3,000 by December 2018. This sudden reversal trapped numerous investors who had entered the market during the peak, resulting in significant losses.

The 2017 Bitcoin bull trap serves as a reminder that even during periods of seemingly strong price increases, it’s crucial to exercise caution and consider the broader market dynamics and fundamental factors driving the price movement. It highlights the importance of conducting thorough research, applying risk management strategies, and avoiding impulsive investment decisions based solely on short-term price surges.

Final Thoughts

Navigating the cryptocurrency market requires a keen understanding of the risks and pitfalls that can impact investment decisions. The bull trap phenomenon stands as a cautionary tale, reminding investors of the need for careful analysis and prudent decision-making.

By recognizing the characteristics of bull traps and employing sound strategies, investors can reduce their vulnerability to these deceptive market patterns. Thorough research, technical analysis, and an assessment of market sentiment are essential tools for identifying potential bull traps.

Moreover, maintaining a long-term perspective and considering fundamental factors can help distinguish genuine market trends from temporary price spikes. Avoiding impulsive actions driven by FOMO and practicing disciplined risk management are vital for safeguarding investments.

FAQ

What is a bull trap?

A bull trap is a false signal that indicates a downward trend in the price of an asset.

How do you spot a bull trap in crypto?

Identifying a bull trap in crypto market requires a combination of technical analysis, market observation, and risk assessment, including monitoring the price movement and trading volume, checking key resistance levels and more.