Cryptocurrencies have become a hot topic in recent years, with various innovative concepts and technologies emerging within the space. Reflection tokens have gained popularity for their unique mechanism of rewarding holders with additional tokens for simply holding their investment. In this article, we’ll delve into the world of reflection tokens, exploring what they are and how they work.

What Are Reflection Tokens?

Reflection tokens, also known as reflective tokens, are a type of cryptocurrency that employs a tokenomics model designed to reward holders with additional tokens. Unlike traditional cryptocurrencies, where rewards are typically gained through mining or staking, reflection tokens offer passive rewards to holders based on their token balance. These rewards are distributed automatically and directly to the holders’ wallets.

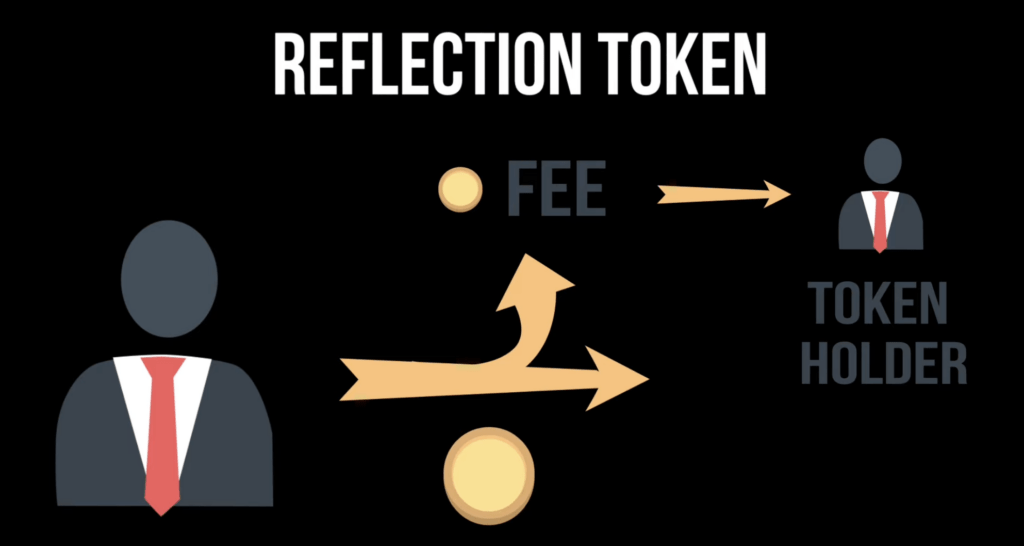

The functioning of reflection tokens is made possible through an automated token distribution mechanism known as “reflection.” This mechanism utilizes smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts eliminate the need for intermediaries and allow for secure and automatic token distribution.

Reflection tokens leverage a specific feature of smart contracts known as a reflection fee or redistribution fee. When a transaction occurs within the reflection token’s ecosystem, such as buying or selling tokens, a small percentage of that transaction is charged as a fee. This fee is then divided among all token holders based on their proportional ownership. Consequently, the more tokens a holder possesses, the greater their share of the reflection fee.

The distributed fees are typically awarded in the form of additional tokens, which are automatically reflected in the holders’ wallets. This process incentivizes long-term holding, as holders can see their token balance increase over time without needing to actively participate in additional actions like staking or mining.

Benefits of Reflection Tokens

- Passive Income: Reflection tokens offer a passive income stream to holders. By simply holding the tokens in a compatible wallet, investors can earn additional tokens without any active participation.

- Increased Token Value: As holders accumulate more tokens through reflection, the overall token supply decreases, which can contribute to an increase in the value of each individual token.

- Community Engagement: Reflection tokens often foster a strong sense of community among holders. The shared interest in maximizing reflection encourages collaboration and the formation of long-term partnerships.

- Liquidity Pool Support: Some reflection tokens allocate a portion of the reflection fees to a liquidity pool, which provides stability and enhances the token’s liquidity.

Are Reflection Tokens Worth Investing In?

Determining whether reflection tokens are worth investing in depends on various factors and individual circumstances. Here are some points to consider when evaluating the potential worth of investing in reflection tokens:

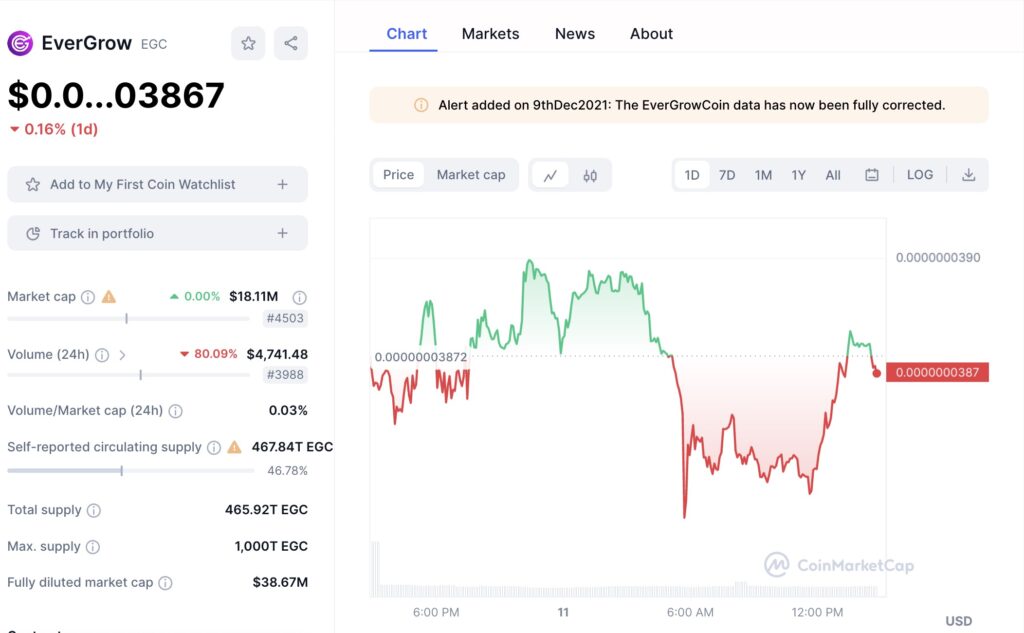

- Tokenomics and Sustainability: Assess the tokenomics model of the reflection token. Consider factors such as the redistribution fee percentage, token supply, and inflation rate. A well-designed tokenomics model should strike a balance between rewarding holders and ensuring the token’s long-term sustainability.

- Market Volatility: Cryptocurrency markets, including reflection tokens, can be highly volatile. Prices can experience significant fluctuations, which can result in both profits and losses. Consider your risk tolerance and evaluate whether you can handle the potential market volatility associated with reflection tokens.

- Community and Development: Evaluate the strength and engagement of the community surrounding the reflection token. A supportive and active community can contribute to the token’s success and longevity. Additionally, monitor the development progress of the project, as ongoing updates and improvements are crucial for sustained growth.

- Token Use Case and Utility: Assess the underlying use case and utility of the reflection token. Does it solve a real-world problem or offer unique functionality? Tokens with strong use cases and utility beyond just redistribution rewards may have more potential for long-term value.

- Competition and Differentiation: Consider the competitive landscape within the reflection token space. Are there other similar projects that offer comparable benefits? Evaluate the uniqueness and differentiation of the reflection token you are considering to determine its potential competitive advantage.

- Risk Management and Diversification: Investing in reflection tokens should be part of a diversified investment strategy. It’s generally advisable not to put all your investment capital into a single asset class. Spread your investments across various assets, including different cryptocurrencies, stocks, bonds, or other investment vehicles, to mitigate risk.

- Research and Due Diligence: Thoroughly research and conduct due diligence on the reflection token project. Examine the whitepaper, team members, roadmap, and any audits or security measures in place. Understanding the fundamentals of the project is crucial for making informed investment decisions.

- Financial Goals and Timeframe: Consider your investment goals and timeframe. Are you looking for short-term gains or long-term growth? Reflection tokens may require a longer-term investment horizon to fully benefit from the compounding effect of the reflection mechanism.

Ultimately, the decision to invest in reflection tokens should be based on thorough research, risk assessment, and alignment with your investment goals and risk tolerance.

Conclusion

Reflection tokens have emerged as a novel concept within the cryptocurrency space, offering holders the opportunity to passively earn additional tokens simply by holding their investment. By utilizing smart contracts and a redistribution fee mechanism, these tokens reward investors in a unique and automated manner. However, as with any investment, it is important to exercise caution and conduct thorough research before venturing into the world of reflection tokens. With careful consideration and understanding, reflection tokens can provide a compelling investment opportunity for those interested in the cryptocurrency market.

FAQ

What is a reflection token?

A reflection token is a type of cryptocurrency that rewards its owners with additional tokens in their wallets through the use of a tokenomics model.

What are the advantages of reflection tokens?

Reflection tokens provide passive income, increase token value through supply reduction, promote community engagement, and support liquidity pools.