After the legendary approval of 11 spot Bitcoin ETFs, which drew nearly $2 billion into the crypto market in the first three days of trading, a logical question emerged: when will spot ETFs for other coins be available?

As Brad Garlinghouse, Ripple’s CEO, said earlier, “I think it’s inevitable that there’ll be multiple ETFs around different tokens.” Which is fair enough. Now, the industry is eyeing the next target – the approval of a spot ETF tracking Ethereum. This article focuses on spot Ethereum ETFs, exploring their potential approval timeline and how to invest in them.

What is a spot Ethereum ETF?

In our previous guide on ETFs, we discussed their definitions, different types, and how they function. If you would like to refresh your memory on the basics of exchange-traded funds, we recommend revisiting that material.

Now, let’s explore how this applies to Ethereum. There are actually two types of Ethereum ETFs being considered: spot and futures. Futures-based Ethereum ETFs are already available and traded on exchanges, offered by issuers like Bitwise, Valkyrie, VanEck, and Grayscale. However, spot Ethereum ETFs, which directly track the price of Ethereum, are still awaiting regulatory approval.

So, what exactly is a spot ETF? It is an exchange-traded fund that mirrors the price of Ethereum. Instead of directly owning and storing Ether yourself, a spot ETF allows you to participate in its price movements through a familiar investment vehicle like a stock. This eliminates the need to worry about secure storage and simplifies the investment process.

When will Ethereum ETF be approved?

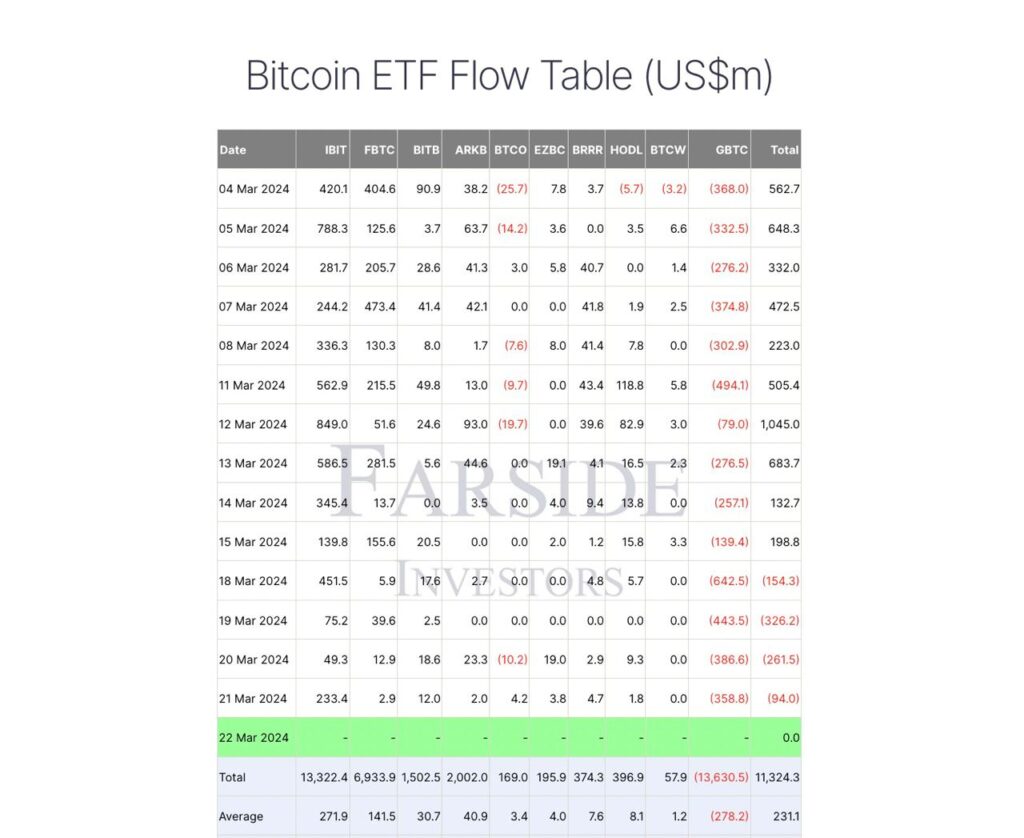

Fueled by the explosive success of Bitcoin ETFs, which have generated over $23 billion since their January debut and helped BTC top a record-breaking $73,000 in March, all eyes are now on Ethereum.

Though, Ethereum has also shown positive dynamics since the beginning of the year. On March 12, it reached a record price, crossing $4,000 for the first time since 2021. In addition to the Dencun update, the strong performance is also attributed to the expectation of the launch of exchange-traded funds in the United States.

As of today, several companies have already submitted applications for launching such ETFs, including industry leaders BlackRock and Fidelity with the biggest daily average inflows in March, as well as Ark Invest/21Shares, VanEck, Grayscale, Hashdex, and Invesco/Galaxy.

In March, the SEC already delayed decisions on applications for Ethereum ETFs from BlackRock and Fidelity. The deadline for one of the applications is set for May 23, but Bloomberg analyst Eric Balchunas believes the likelihood of such a launch is low. He sees a mere 35% chance that these spot ETFs will be approved in May. Balchunas, known for his accurate predictions regarding the January approval of Bitcoin ETFs, is concerned about the SEC’s regulatory silence and the agency’s apparent skepticism about cryptocurrencies. This lack of communication suggests a low likelihood of Ethereum ETF approval anytime soon.

On top of that, political forces may also slow down the adoption of institutional cryptocurrency investments. For example, Democratic Senators Jack Reed and Laphonza Butler have called on the head of the U.S. Securities and Exchange Commission to hold off on approving new cryptocurrency exchange-traded products, specifically those that track Ethereum.

Their concerns are based on worries for investors who could be exposed to risks associated with poor disclosure by brokers and the low liquidity of major cryptocurrencies.

But is this a problem for the industry that has shown remarkable patience amid a nearly decade of spot BTC ETF rejections?

What are the predictions for Ethereum after ETF approval?

Moving on to a key question: Will the approval of an Ethereum ETF mirror the impact observed with a Bitcoin ETF?

Analysts at Standard Chartered predict the US SEC may approve Ethereum-based ETFs on May 23 this year. They predict that within the first 12 months after approval, up to $45 billion will be invested in them, which in turn, could lead to an increase in the price of ETH to $8,000 by the end of 2024.. Experts also believe that by 2025, the ETH to BTC price ratio will return to 2021-2022 levels, with Ether potentially reaching $14,000 if Bitcoin approaches $200,000.

Fortune’s survey also reveals optimism among experts. They estimate a 60-75% chance of approval in May, potentially pushing Ethereum’s price above its November 2021 peak of $4,878, mirroring Bitcoin’s rise after spot ETF approval. However, experts anticipate inflows into Ethereum products to be lower compared to their Bitcoin counterparts.

Frank Corva, a cryptocurrency writer and analyst at Finder.com, a financial product comparison platform, agrees that the SEC’s silence makes an Ether ETF approval unlikely in the near future. He also told TradeSanta: “If investors begin to believe that even a fraction of the amount of money that has flown into the spot bitcoin ETFs will flow into spot ETH ETFs, then many will likely begin to pile into the long ETH trade, just as they did with the long BTC trade”.

Frank also noted that competitors like Solana and Avalanche are gaining traction in the current bull market. If this trend continues, and if the SEC approves ETFs for other smart contract platforms’ native assets, ETH’s price growth might be limited compared to Bitcoin due to increased competition.

Should you invest in a spot Ethereum ETF?

An Ethereum ETF could act as a short-term catalyst, boosting ETH’s price further by attracting new institutional investors, similar to what we’ve witnessed with Bitcoin. However, long-term success hinges more on Ethereum’s ability to deliver on its ambitious adoption roadmap. A smooth execution of key development milestones could solidify Ethereum’s infrastructure and justify higher valuations.

This brings us to the question of whether you should invest in an Ethereum ETF. The answer depends on your risk tolerance and investment goals. To learn more about how to trade relative to your risk tolerance, you can read our article about the risk/reward ratio.

Let’s take a look at a breakdown of some factors to consider when deciding:

Potential benefits

- Easier access: ETFs offer a regulated and familiar way to invest in Ethereum compared to directly buying cryptocurrency.

- Diversification: Adding an Ethereum ETF can diversify your portfolio and potentially improve returns.

- Potential growth: Ethereum is a major player in the blockchain space with potential for future growth.

- Staking benefits: Some Ethereum ETFs might offer staking rewards, similar to dividends with stocks.

Potential drawbacks

- Volatility: The cryptocurrency market is inherently volatile, and Ethereum’s price can fluctuate significantly.

- Regulation: The regulatory landscape for cryptocurrency is still evolving, and there could be unexpected changes.

- Fees: There may be additional fees associated with Ethereum ETFs compared to directly buying Ethereum.

While we wait for approval, use this time to research the issue, follow news updates, and consider analyst opinions. You’ll be well-prepared when it arrives.

Additional factors to consider

- Investment horizon: Consider your investment timeframe. If you’re looking for short-term gains based on the ETF launch hype, be prepared for potential volatility. For long-term investors, Ethereum’s technological advancements and adoption are more crucial.

- Alternatives: Explore other ways to invest in Ethereum. Compare the pros and cons of directly buying Ethereum versus futures-based ETFs (already available) or other smart contracts platform tokens like Solana or Avalanche.

- Tax implications: Research the tax implications of investing in ETFs versus directly holding cryptocurrency. This can vary depending on your location.

Conclusion

The potential arrival of a spot Ethereum ETF in 2024 injects excitement into the cryptocurrency market. While regulatory hurdles may delay its launch, the long-term outlook for Ethereum remains promising. Investors who leverage this waiting period to conduct thorough research and understand their risk tolerance will be well-positioned to capitalize on this potentially transformative event. As Ethereum’s technology evolves and adoption expands, its integration with traditional finance through ETFs could pave the way for a thrilling future in the digital asset landscape.

Ethereum (ETH) vs. Ethereum ETFs (ETH ETFs)

| Aspect | Ethereum (ETH) | Ethereum ETFs (ETH ETFs) |

| Direct Ownership | When you buy ETH, you own the actual cryptocurrency and have direct control over it. | ETFs provide exposure to ETH’s price movements without direct ownership of the cryptocurrency. |

| Storage and Security | Managing ETH requires a digital wallet and an understanding of blockchain security practices. | ETFs are managed by professionals and do not require investors to deal with cryptocurrency storage or security directly. |

| Market Access | Buying and selling ETH can be done 24/7 on various cryptocurrency exchanges. | ETFs are traded on traditional stock exchanges during market hours, providing a familiar framework for traditional investors. |

| Fees | Transaction fees can vary widely depending on the network congestion and exchange fees. | ETFs come with management fees, which might be higher than the direct costs of buying and managing ETH. |

| Regulatory and Legal Framework | Direct investment in ETH operates in a relatively unregulated space compared to traditional financial markets. | ETFs are regulated financial products, offering investors a level of protection and transparency. |

| Investment Strategy | Direct investment in ETH might appeal more to those comfortable with high volatility and the tech aspects of cryptocurrencies. | ETFs might be preferred by investors seeking a more regulated, less volatile way to gain exposure to the price movements of ETH. |

FAQ

When will Ethereum ETF be approved?

The deadline for one of the applications for a spot Ethereum ETF is set for May 23, but Bloomberg analyst Eric Balchunas believes the likelihood of such a launch is low.

How will a spot Ethereum ETF impact its price?

Analysts at Standard Chartered predict that within the first 12 months after approval, up to $45 billion will be invested in Ethereum, which in turn, could lead to an increase in the price of ETH to $8,000 by the end of 2024.