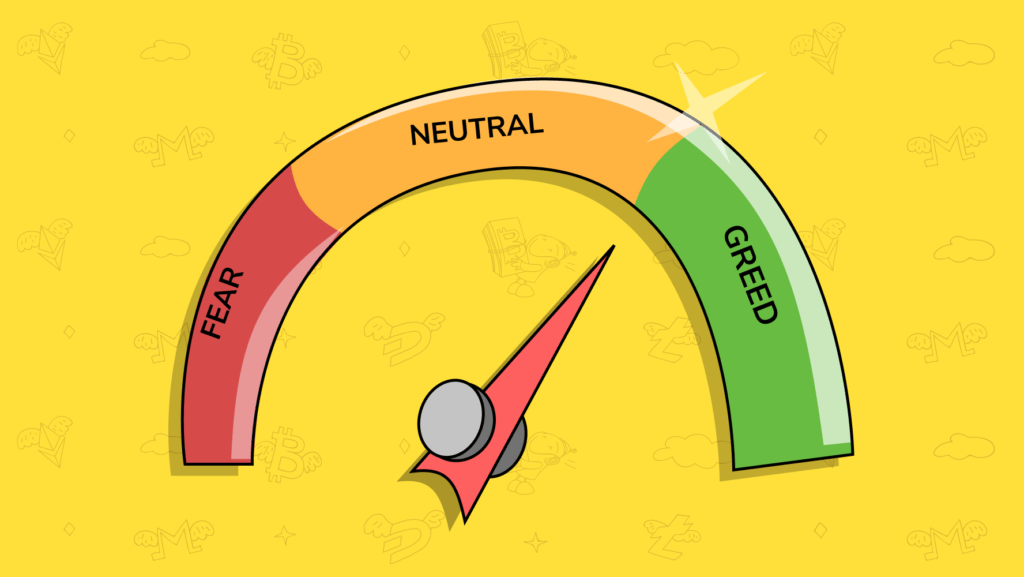

If the term “Fear and Greed Index” doesn’t speak for itself, then what does? Just like love, fear and greed have the power to affect us in a way that makes us put aside common sense.

When that happens in traditional or in crypto trading, we make mistakes. The crypto fear and greed index helps us measure the levels of psychological instability in the market here and now.

Once you know the prevailing market sentiment, you can take it into account when deciding if this is a good time to buy or sell your assets.

Learn more from the following piece.

Fear and greed index in traditional trading

One of the richest traders on the planet Warren Buffet said, “Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.”

Fear and greed have been present in the market since exchanges were born. In fact, these primary emotions are so natural for market participants that they can be viewed now as a part of behavioral economics — the discipline that studies the effects of psychological, emotional and a few more factors influencing individuals while they make investment decisions.

Keeping that in mind, CNN Money has developed the so-called fear and greed index for traditional markets. Let’s take a look at the seven indicators presented on the company’s page:

- Stock Price Momentum : the S&P 500 (SPX) versus its 125-day moving average

- Safe Haven Demand : the difference in returns for stocks versus treasuries

- Stock Price Strength : the number of stocks hitting 52-week highs and lows on the New York Stock Exchange

- Stock Price Breadth : the volume of shares trading in stocks on the rise versus those declining.

- Put and Call Options : the put/call ratio, which compares the trading volume of bullish call options relative to the trading volume of bearish put options

- Junk Bond Demand : the spread between yields on investment-grade bonds and junk bonds

- Market Volatility: The VIX (VIX), which measures volatility

All these indicators use scales from 0 to 100 where readings 0 to 49 indicate fear, and a reading from 51 to 100 shows that investors are greedy. 50 is a neutral number.

To calculate the fear and greed index, and thus a market sentiment, a computer takes an equal-weighted average of those useful indicators.

According to CNN Business, too much fear can sink stocks well below their intrinsic value, but when investors get greedy, they can bid up stock prices far above what they should be worth.

That’s why some traders consider an extremely low reading level of the index as a good buying opportunity, while a high reading level might mean that this is the right momentum to sell — which coincides with Warren Buffet’s theory.

Crypto fear and greed index

Now that you know what the traditional fear and greed index is made of, you’re probably wondering if there’s any similar useful tool to measure the crypto market’s fear and greed index. And the answer is yes, there is. The Alternative.me platform has developed the Bitcoin fear and greed index in a way that it “analyzes emotions and sentiments from different sources and crunches them into one simple number.”

Just like in the case with traditional markets, like stocks trading, this is a number from 0 to 100 that helps you understand an investor behavior and indicate when investors are too fearful or too greedy. When they are fearful, it’s a good opportunity to buy from them. And vice versa, when they are too greedy, you might want to sell because the market is due for a correction.

“With our Fear and Greed Index, we try to save you from your own emotional overreactions,” the team behind the index says. So when you want to get an idea of an overall sentiment in the crypto market, just check out their website.

But what do developers of the index take into consideration while calculating the resulting number?

- Volatility : the program marks wider fluctuations as a sign of fear

- Market volume : once buying volumes increase significantly, the greed levels rise, too

- Social media : the client monitors, gathers and counts posts on various hashtags, to see how many interactions they receive over certain time-frames

- Dominance : once Bitcoin dominance rises, it indicates an increasing level of greed, and vice versa, when the dominance shrinks, it means that people get scared to invest in BTC.

- Trends : the program pulls Google Trends data for various Bitcoin-related search queries and crunches those numbers, especially the change of search volumes

To sum up

As you see, fear and greed indices in crypto and traditional markets are quite similar on the face of it, but very different intrinsically.

The key difference between them is, of course, the markets they were designed for. The traditional crypto fear and greed index covers long-established markets and comprises parameters that simply cannot be solely applied to the index reflecting the market sentiment solely towards Bitcoin.

For example, you cannot take into account the stock price breadth indicator. As opposed to the crypto fear and greed index, this covers the volume of manifold shares trading in stocks.

The second important difference to remember about two of the indices is that Bitcoin is too volatile. This is the reason why you have to use technical as well as additional indicators.

A good illustration of that is a hustle on social media: Bitcoin dominance rates or Google trends.

That is to say, if you were a developer of a crypto or traditional fear and greed index, what would you factor in while assessing the markets?

Of course, everything made by other people cannot be considered as the ultimate truth. The more experience you have, the more indicators you’d probably use and be less satisfied with existing solutions.

Simply remember that the current services are just one more perspective on the market’s state, and you will be at peace. To have any index is better than having no index at all, isn’t it?

FAQ

Why do you need crypto fear and greed index?

The crypto fear and greed index helps us measure the levels of psychological instability in the market here and now. Once you know the prevailing market sentiment, you can take it into account when deciding if this is a good time to buy or sell your assets.

How to read fear and greed index?

Some traders consider an extremely low reading level of the index as a good buying opportunity, while a high reading level might mean that this is the right momentum to sell — which coincides with Warren Buffet’s theory.