Grid Trading Bot: What Is it?

Table of content:

GridBot overview

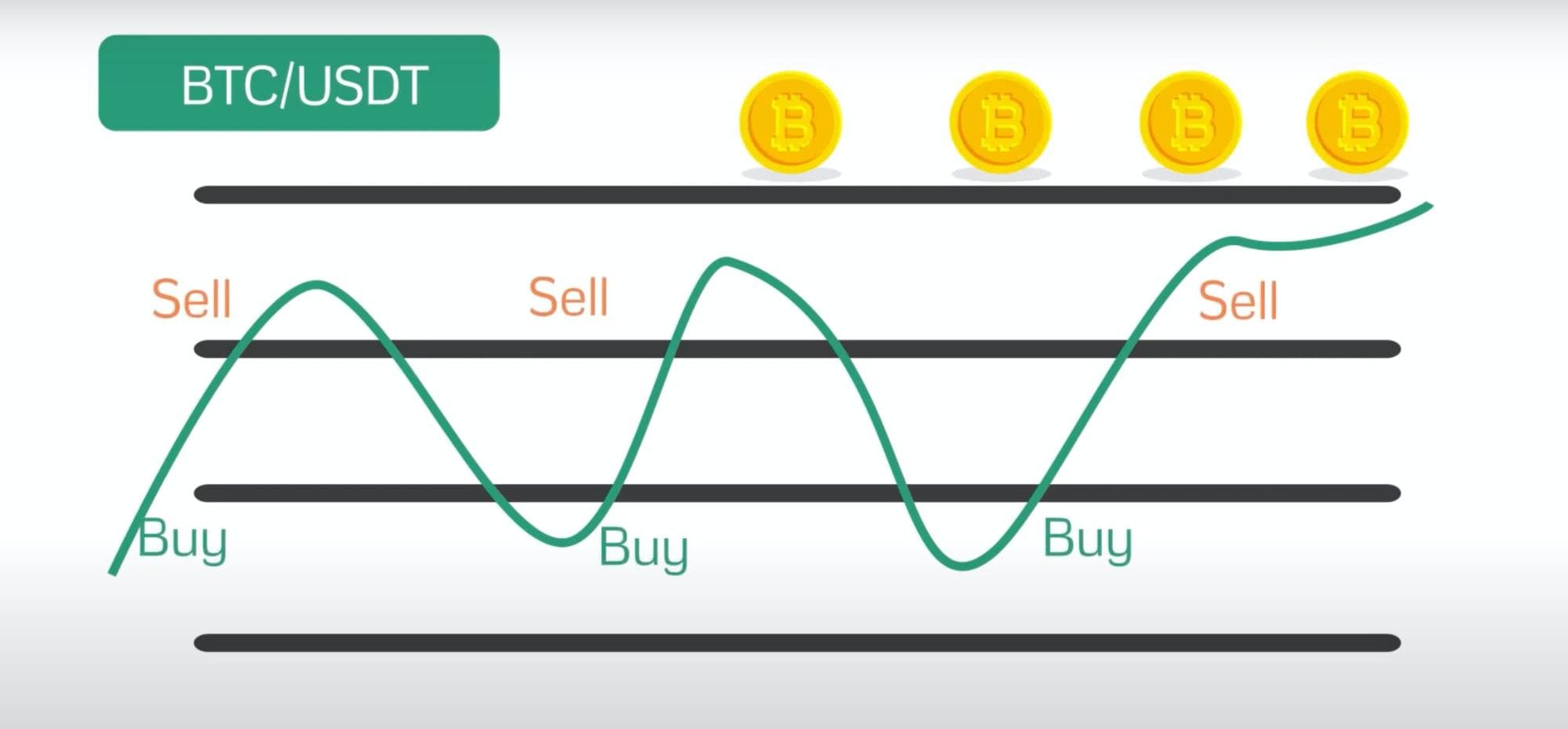

The main principle of the Grid bot is the same as with DCA bot. The crypto bot places the first buy order, and extra orders if the price goes in the opposite direction. The main difference is that the take profit order is placed for every buy order separately unlike DCA bot where the bot places one TP order for all buy orders executed.

When trading with a Gridbot a sell order is placed for each buy order. If you have 1 first order and 3 extra orders, 4 sell orders in total will be placed. However, no more than 2 orders (1 buy order, 1 sell order) are on the exchange simultaneously. If the bot executes any order partially it will place take profit order for that part.

Grid bot has a continuous working cycle. In other words, as soon as the bot closes all sell orders, it places a new buy order and starts a new cycle.

Do you want to start trading using Grid trading bots? Join TradeSanta! Our Grid trading bots will buy and sell crypto on your behalf. Don't hesitate, start your automated crypto journey with us today!

How to set up a Grid bot?

You have to specify an access point, a trading pair, the volume of the first and extra order, take the profit percentage and step of the extra order. Max Order Price field is optional. Max Order Price - you set the maximum price for bit to enter the position. If the current price is 10100 and you set the maximum price of 10000, the bot will wait until the price drops to the level you set to start trading.

You may use Bollinger, RSI and/or MACD indicators to signal the bot a start of the deal. If you don’t use any signals, the bot places orders continuously and starts new trading cycle as soon as the last sell order is executed. You see trading pairs in format as you see it on exchanges BaseCurrencyQuoteCurrency - so if you see pair XRPETH, that means you will use ETH to buy XRP with it, and will get profit in ETH.

You can set up stop loss when creating a trading bot. Stop loss will be activated when Unrealized loss will reach the value you set in the stop loss field, and the bot will sell unsold coins at market price. After stop loss is executed the bot will stop. For example, if you buy XRP with BTC and set stop loss to be 1BTC, stop loss will be activated if your unrealized profit& loss value in this cycle will be -1BTC.

How grid bot works?

1. Bot places the First Order (buy order) as a limit order.

2. After the first order is executed bot places Take profit order and an Extra order based on the First order price execution.

3. If the First Extra order takes place and is executed, the bot takes the Take profit order of the first order off the exchange (yet saves all of its parameters to set it again when the time comes), places TP order (sell order) for the executed extra order and places second extra order two steps (specified Step of Extra Order) below First Order Price. When the second Extra Order is executed, the same cycle is repeated. No more than 1 buy and 1 sell orders are on the exchange simultaneously.

4. The bot does not have deals as you are used to with the current bots you use, it runs non-stop. If you stop the bot, all active orders on the exchange will be cancelled, and the bot position (the number of extra orders executed, the number of coins bought) will be saved. When you turn it on again, all the previously cancelled orders will be placed again.

Grid bot's analytics

On the right part of the page you may see the main trade parameters that will help you track the bot’s performance.

Total traded volume is a sum of all buy orders in quote currency traded by the bot. Trades show t the number of buy and sell orders executed on the exchange (it is like trade history that you see on exchange). Please, be advised that the bot counts partially filled orders separately (each part is a trade). Let’s say you have an order volume of 50 USDT and the bot executed the first order partially for 30 USDT and then bought 20 USDT.

In the Trades section it will be displayed as 2 buy trades although both trades were executed to match a single 50 USDT order at a certain price level.

Bot progress table shows Unsold volume, Unrealised profit/loss and Current rate as well as the chart that shows where the latest Buy and Sell orders are placed.

- Unsold volume is the total value of your position in base currency. It equals the sum of the First order and Extra Orders you’re currently holding for which Sell orders haven’t been executed.

- Realised profit - is the profit you received after sell orders were executed for the whole cycle.

- Unrealised profit/loss (liquidation profit/loss) shows you how much you will gain or lose from the total investment you made in this cycle if you exit the position right now. Unrealised profit/loss is calculated as realised profit gained during the bot's operation + (the quote you will receive if you sell coins now - quote you spent initially on buying those coins at the time of purchase) - trading fee.

Be aware that if you have realised profit but you have an unrealised loss (i.e. unrealised profit parameter is negative) that means that if you exit position right now you will actually have a loss.

Active Orders table shows orders that were placed but not executed, but no more than 2 orders simultaneously (it is like an open orders table on the exchange).

Trade History shows all orders that have been filled fully or partially (i.e. like the trade history you see on the exchange). Be advised that trade is not equal to order in the sense that if the order was executed in 3 parts, it will be shown as 3 trades in this table.