XRP trading bot

Ripple trading bot is a piece of software developed to automate the process of Ripple trading. Such bot gives advantages to a trader who owns it over other traders who don’t own the bot and trade XRP manually.

Set up bot

How to launch bot for XRP?

Before diving deep into detail, let’s quickly deconstruct the term "Ripple trading bot".

The advantages of Ripple trading bots include but are not limited to several things. Bots buy and sell based on market calculations and analytics; they are certainly not affected by emotional swings and fatigue. In addition, they work faster than when a trader manually clicks to place an order.

There are different bot types out there that you can use with manifold cryptocurrencies, Ripple (XRP) including, such as: long and short bots, DCA and GRID bots, arbitrage trading bot, coin lending bot, trend trading bot, market making bot, signal bot and many more.

If you want to run a bot, you will normally have to buy a package allowing different options, such as different bot types, different trading volume etc. Good news is that with TradeSanta, you can endlessly run up to 2 bots for free if your volume is less than $3K/month.

Ripple (XRP) Trading

Listed on top of 140 cryptocurrency exchanges, Ripple (XRP) is one of the most popular coins to trade, along with Bitcoin (BTC).

However, XRP trading differs in the context of the coin’s initial purpose. The project was developed with the goal to become a payment network for cross-border money transfers and compete with SWIFT, a network that enables financial institutions worldwide to send and receive information about financial transactions.

One of the reasons Ripple trading might look attractive to crypto investors is its volatility. Also the coin is listed on top of 140 cryptocurrency exchanges, meaning that the question of liquidity shouldn’t be a problem.

There are downsides to the coin, too, of course. The company controls the financial health of XRP and can pause programmatic sales altogether if they want to. In fact, they have already done it at least once.

Also, just as any other crypto coin, Ripple (XRP) has got an uncertain legal status. Ripple Labs makes an effort to throw their case out of the U.S. District Court and prove that their asset is not a security.

Ripple (XRP) Trading Platforms

While talking about trading Ripple (XRP), just like with any other altcoin, you should decide where you want to start. You can go with online exchange offices also known as exchangers’ monitors, crypto trading platforms to quickly swap from one crypto to another one or with a cryptocurrency exchange.

A list of exchanges to start with is presented on the company’s website, so your job is to choose the one that you love the most.As we’ve already written in our article on how to trade Ripple (XRP), you can trade Ripple (XRP) on Binance, Huobi, OKX, HitBTC, Bybit, Kraken, and FTX. Create an account, undergo the KYC procedure and deposit your funds.

Ripple (XRP) Margin Trading

While talking about margin trading, no matter what asset it concerns, there is a whole spectrum of options out there that we’ve already covered in the article about margin trading. To name a few popular options, you can trade XRP with leverage on top of Binance, Kraken, Delta, Poloniex and BitMEX.

As we’ve already covered in this article, the marginable pairs on Binance, for example, are XRP/BTC, XRP/USDT, XRP/ETH, and your leverage depends on your balance as well as your level, which is automatically defined by the exchange.

With Kraken, these pairs are XRP/BTC, XRP/USD, XRP/EUR, and you can leverage up to 5X.

Also, you might want to visit Huobi Global and trade XRP for USDT with the 5X leverage.

In short, the leverage might differ with every new exchange.

TradeSanta strategies

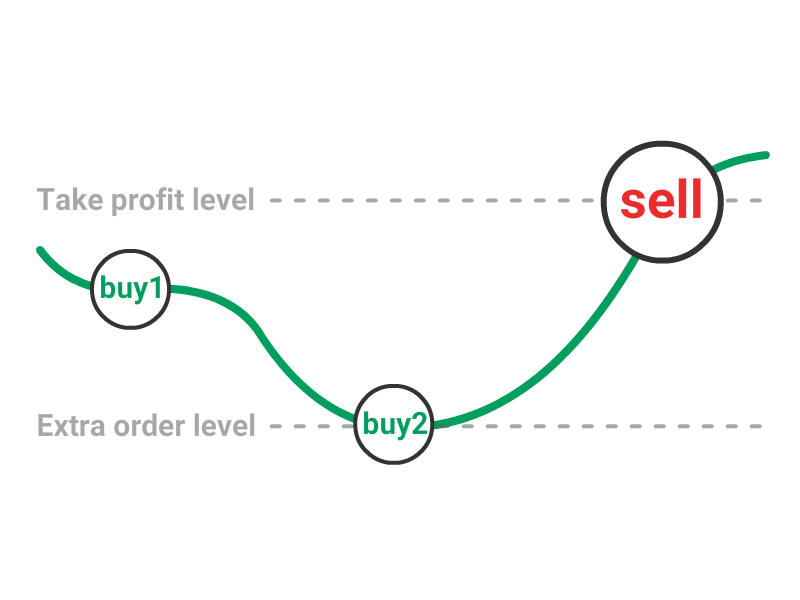

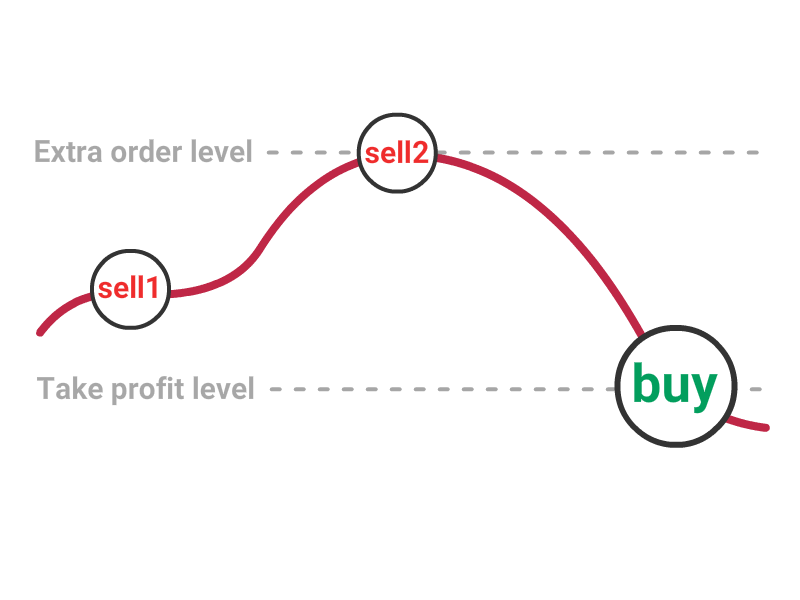

DCA strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

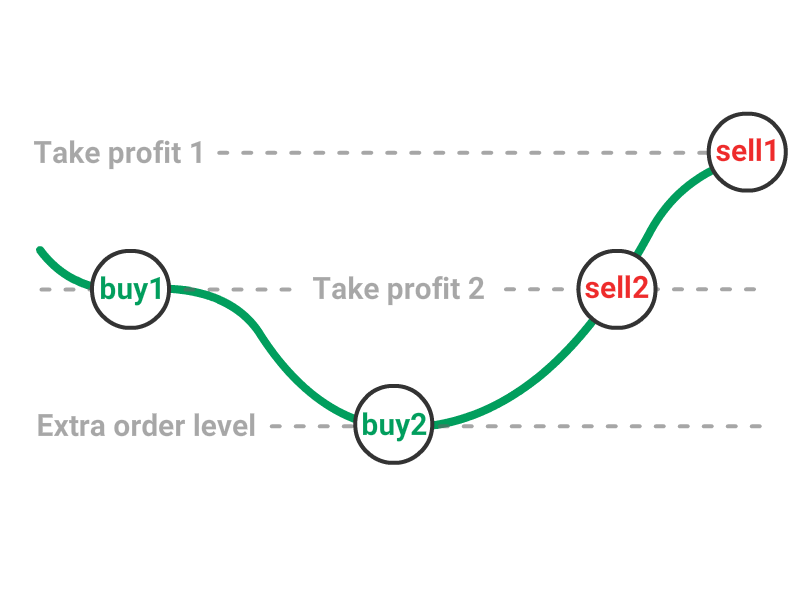

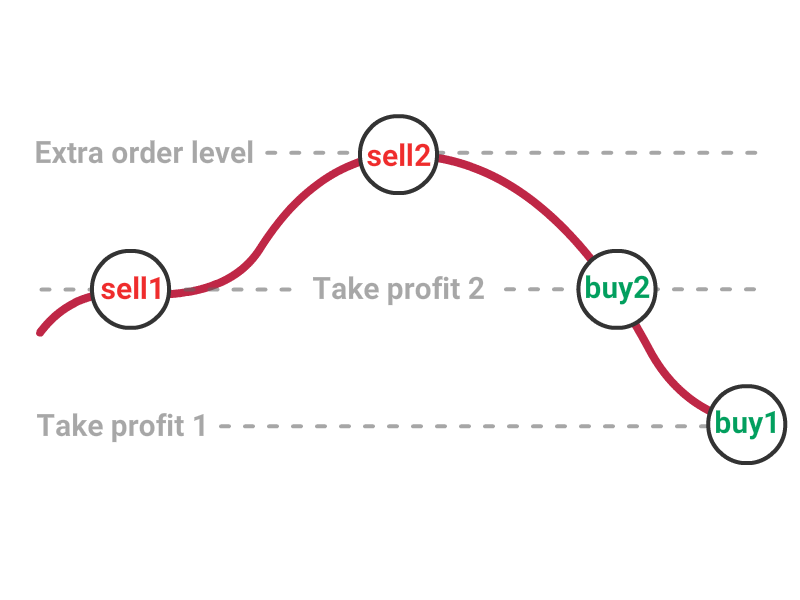

Grid strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Frequently Asked Questions

What is trading bot?

Crypto trading bot is a software program, which automatically executes trades according to a predetermined strategy. Basically, the trading bot places buy and sell orders on your behalf on the crypto exchange.

How does TradeSanta work?

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set. For the first order crypto bot buys the amount of base currency indicated in the settings by the user.

What settings are the best?

There is no "best strategy" for automated cryptocurrency trading, it is not a money making machine. You may use one of the templates to start and adjust them according to your needs after. To get the best results you should conduct your own research and make your strategy, according to your trading volume, market situation, chosen cryptocurrency pair and etc.