DCA Bot vs Grid Bot

Differences Between DCA Bots And Grid Bots

DCA trading bot

The DCA bot places the first buy order followed by extra buy orders if the price goes in the opposite direction of the strategy chosen. The price of take profit and the volume are recalculated with every new buy order. The crypto trading bot takes the average buying price, adds the TP percentage to it, and places the sell order for all parameters.Grid trading bot

The Grid bot places the first buy order and buys more coins with extra orders if the price goes down, just like DCA. The main difference is that the Grid trading bot places sell orders for each order instead of one for all purchases in DCA.

The difference between the two trading bots is as follows:

| DCA bot places one take-profit for all orders. | Grid bot places take-profits for every order separately. |

| DCA bot reduces the risk of purchasing high by investing at consistent intervals. | Grid bot works best when any particular pair is in a range with no clear up or down trend in a longer period or a sideways market. |

| The DCA bot helps you average token buying, so you will have bought a lot of coins for a good price over a certain period. | Grid trading bot lets you profit from the market fluctuations without having to hold a lot of tokens. |

Do you want to start trading using Grid and DCA bots? Join TradeSanta! Our Grid and DCA trading bots will buy and sell crypto on your behalf. Don't hesitate, start your automated crypto journey with us today!

What Is Grid Trading?

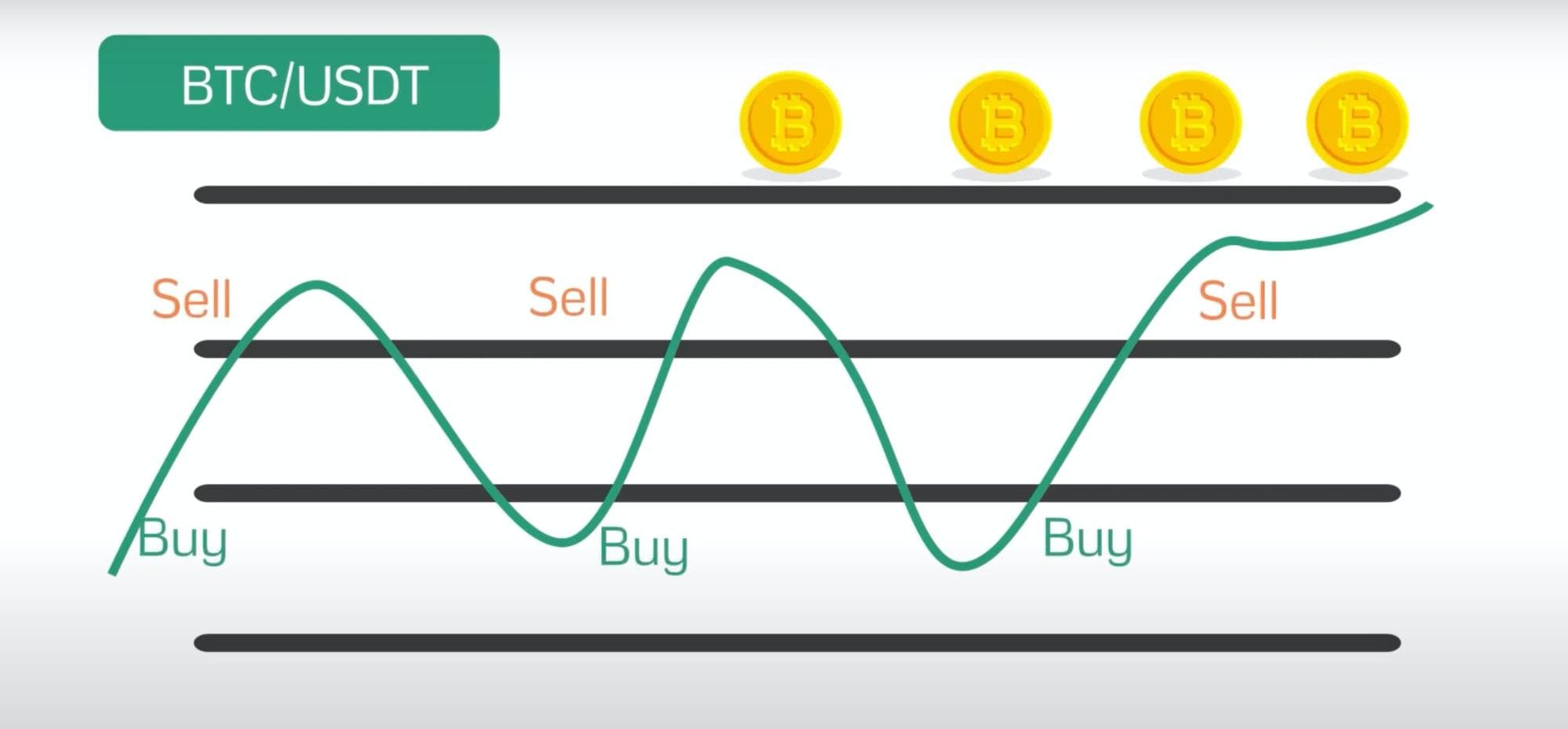

The grid bot is a crypto trading bot designed to help traders execute the grid trading strategy. Unlike most trading strategies, the grid trading strategy works best in a ranging sideways market with no clear direction. It profits from the highs and lows of a market's price movement and is most effective when there is no discernible up or downtrend for an extended period. The greater the frequency and magnitude of price fluctuations, the more profitable the grid strategy. Simply put, grid trading strategies create a grid-like formation by scheduling or setting up buy and sell orders in a predefined price range. First, you decide on a price range for the strategy, followed by the number of "grids" you want to include. You can split your price range into multiple smaller ranges (grids) to increase the likelihood of triggering trades.How Grid Trading Bot Works?

The more grids you create, the higher the trade frequency due to the reduced grid width. But the profit earned on each order will decrease.

Whenever a buy order is triggered, the grid trading bots place a new sell order (at take profit level). Also, what the TradeSanta bot does is if the price continues to go down after the buy order was executed, the bot will place another buy order and separate sell order for it. These extra orders work like safety orders. Even if the market goes against your expectations and takes sideways movement later, you will be able to continue trading and executing take-profit orders for those extra buys.

The grid strategy involves selling a little when the price goes up and buying a little when the price goes down as long as the price stays within the set range.

The more grids you create, the higher the trade frequency due to the reduced grid width. But the profit earned on each order will decrease.

Whenever a buy order is triggered, the grid trading bots place a new sell order (at take profit level). Also, what the TradeSanta bot does is if the price continues to go down after the buy order was executed, the bot will place another buy order and separate sell order for it. These extra orders work like safety orders. Even if the market goes against your expectations and takes sideways movement later, you will be able to continue trading and executing take-profit orders for those extra buys.

The grid strategy involves selling a little when the price goes up and buying a little when the price goes down as long as the price stays within the set range.

DCA Strategy

What Is Dollar-Cost Averaging?

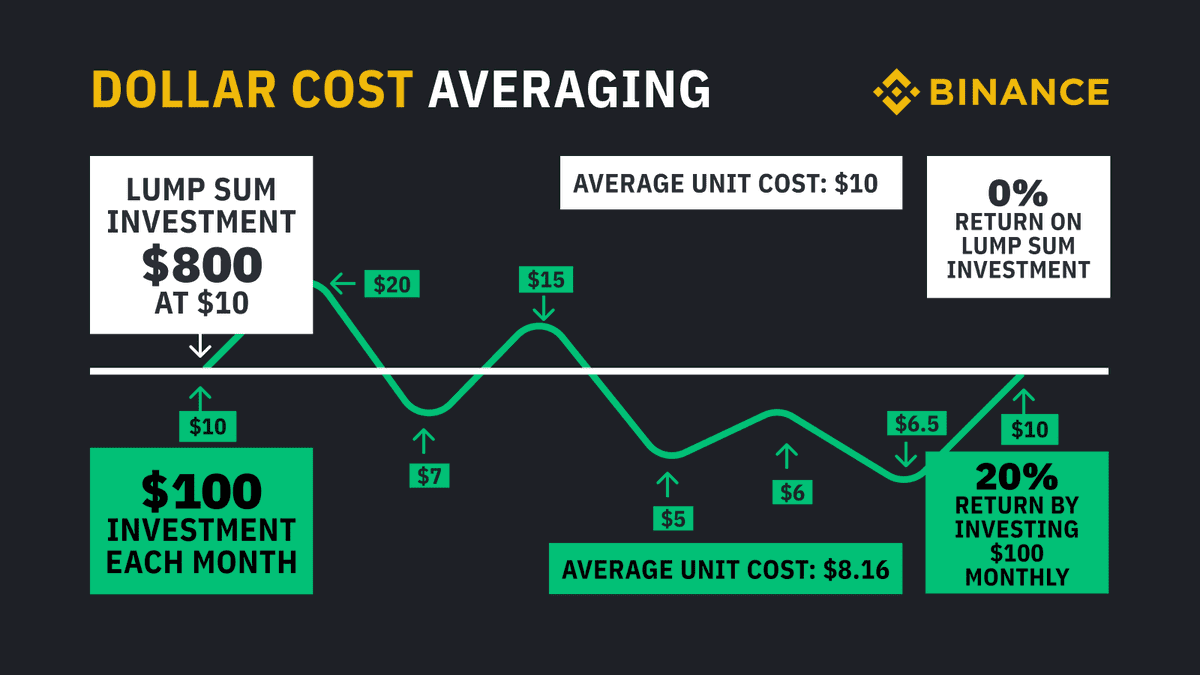

DCA strategy is an investing strategy that can help you save money and reduce risk by lowering the amount you pay for investments. It allows you to buy an asset in smaller amounts rather than buying all at once.

We'll cover the DCA bot for long strategy, which first buys cryptocurrency and later sells it at a higher price. For the short trading bot, the first order would be a sell order, and the TP order would be a buy order at a lower price.

The dollar-cost averaging bot places the first buy order and extra orders if the price goes in the opposite direction of the strategy chosen. For all the buy orders it placed previously, it places only one take profit order. The price of taking profit is recalculated with every new buy order so that the profit for all the orders places would equal the TP parameter you set.

DCA strategy is an investing strategy that can help you save money and reduce risk by lowering the amount you pay for investments. It allows you to buy an asset in smaller amounts rather than buying all at once.

We'll cover the DCA bot for long strategy, which first buys cryptocurrency and later sells it at a higher price. For the short trading bot, the first order would be a sell order, and the TP order would be a buy order at a lower price.

The dollar-cost averaging bot places the first buy order and extra orders if the price goes in the opposite direction of the strategy chosen. For all the buy orders it placed previously, it places only one take profit order. The price of taking profit is recalculated with every new buy order so that the profit for all the orders places would equal the TP parameter you set.

How The DCA Bot Works (Long Strategy Example)

- The trading bot places First Order (buy order) as a limit order.

- After the First Order is executed bot places the Take profit (TP) order and Extra order at the price lower than the First order based on the percentage drop you set.

- If the Extra order is executed, the crypto bot takes the Take profit order of the first order off the exchange and places a new TP order (sell order for long strategy, buy order for short strategy) with the recalculated price based on the average buy price for 2 buy orders and Take profit percent you set. The bot also places a second Extra Order below the First Order Price. When the second Extra Order is executed, the same cycle is repeated. No more than one buy and one sell orders are on the crypto exchange simultaneously.

How To Create A DCA Bot

Let's go through the process of creating a DCA bot on TradeSanta.- To start, you'll need a previously set up access with the API Keys entered. Once that is done, go to DCA BOTS in the menu section on the left and click create bot.

- Select an access point, then decide on a pair you want to trade and strategy: whether you want to long or short a coin. You always receive profit in the quote currency, displayed as the second currency of the pair.

- Once you select the pair, the trading view graph appears, and the data will help you decide on the bot’s settings.

- The take profit box indicates the percentage of a price increase at which the bot will sell the coins and close the trade.

- The step of extra order indicates the percentage of price fall at which bot will place another order to average the buying price.

- Max count of extra orders defines the maximum number of orders placed in one trading cycle.

- When specifying your order size, pay attention that Order volume is larger than the minimum order size of your exchange.

- The next field specifies the number of successful deals completed after which the bot will be turned off. Leave this field blank, and the bot will run continuously.

- You may increase the precision of the entry point by turning on Signals and technical indicators. TradeSanta provides opportunity to use signals based on Bollinger, MACD, RSI indicators. Preset TradingView Signals that are based on TradingView Screener, as well as custom TradingView signals (that you can connect from your TradingView account to bots on TradeSanta via webhooks) are also available for traders to use as deal entry signals.

- Martingale is a multiplier for each new order placed and is a high-risk option for experienced traders only.

- Max order price is an optional field that sets a limit above which bots won't start a new trading cycle. You may enable the stop-loss option to close the position with a certain amount of loss reached.

- The calculator indicates if you have enough coins on your balance to execute a trade according to your settings. The bot name is generated for you, so all that is left to do is save and turn on your DCA bot.

How To Create A Grid Bot

- To start, you'll need a previously set up access point with the API Keys entered. Once that is done, go to grid bots in the menu section on the left and click the create bot button.

- Select an access point, then decide on a pair you want to trade, whether you want to long or short a coin. You always receive profit in the quote currency, displayed as the second currency of the pair.

- Max order price is an optional field that sets a limit above which bots won't start a new trading cycle.

- Take profit value defines how much profit you will receive from each trade. Take profit is the percentage of price increase at which the bot will close the trade.

- Step of extra order is the percentage of price fall at which bot will place another order.

- Max count of extra orders defines the maximum number of orders that can be placed in one trading cycle.

- When specifying your order, keep in mind that order volume should be larger than the minimum order size of your exchange.

- You may enable the stop-loss option to close the position with a certain amount of loss reached.

- TradeSanta technical indicators serve to ensure the crypto trading bot will enter the market at the optimal point. TradeSanta provides opportunity to use signals based on Bollinger, MACD, RSI indicators. Preset TradingView Signals that are based on TradingView Screener, as well as custom TradingView signals (that you can connect from your TradingView account to bots on TradeSanta via webhooks) are also available for traders to use as deal entry signals.

- The calculator indicates whether you have enough coins on your balance to execute a trade according to your settings.

- Enter a bot name and save your grid bot to start trading.