Tether trading bot

Tether trading bot is a crypto trading bot built to automate the process of trading, open and close several deals simultaneously, make the most out of fluctuations 24/7 and give you a competitive advantage over other traders.

Set up bot

How to launch bot for Tether (USDT)?

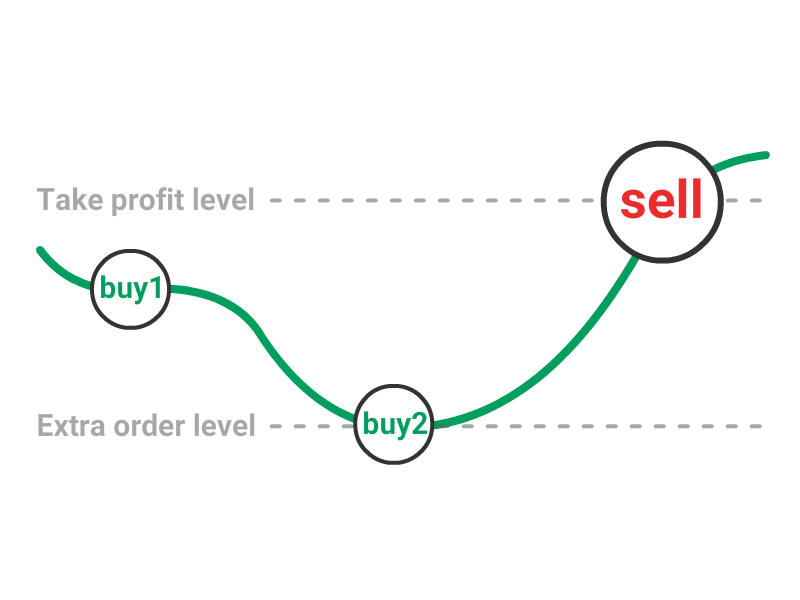

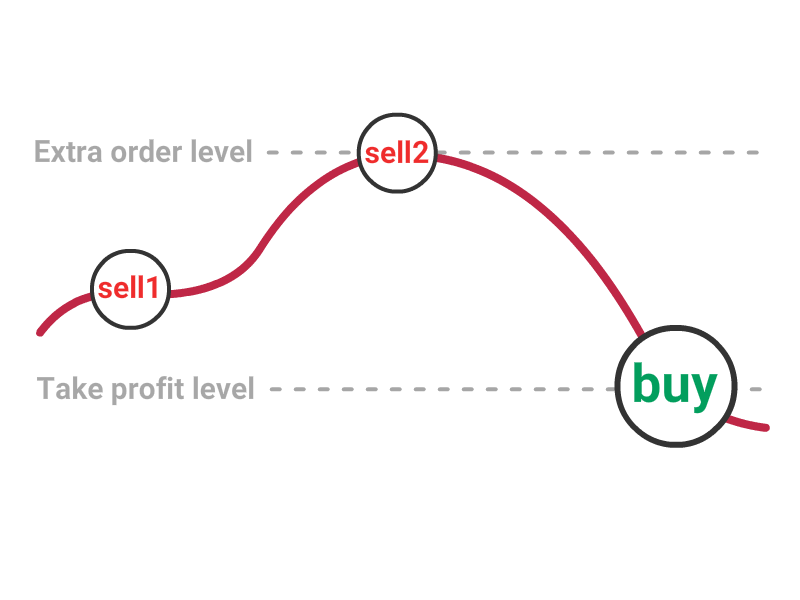

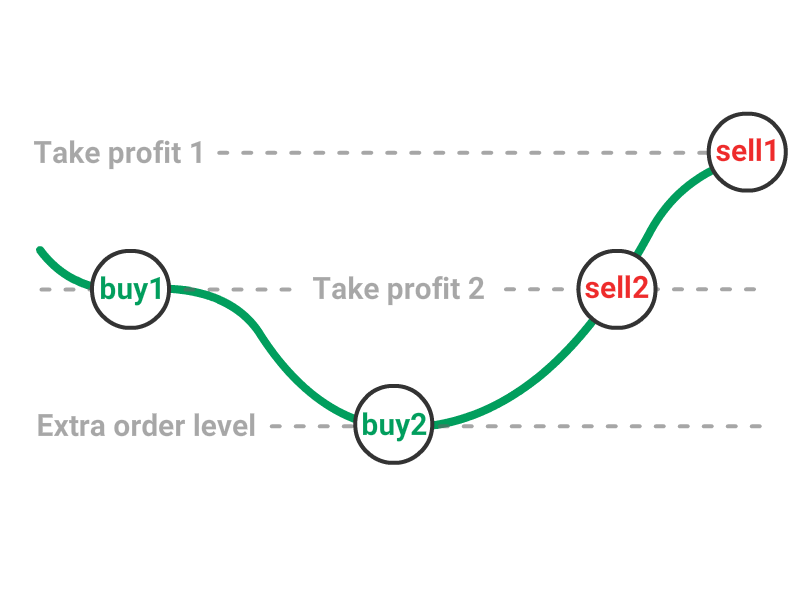

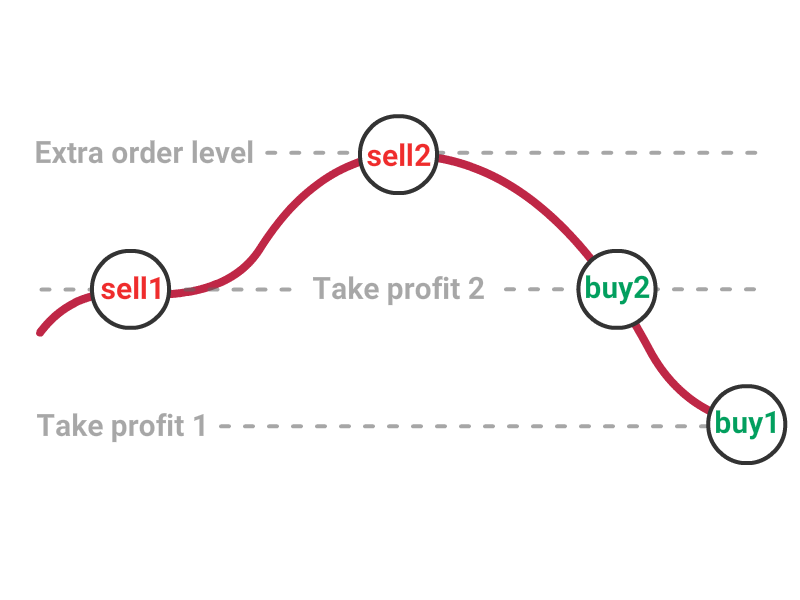

Did you know that there are different types of trading strategies out there and these strategies can be automated? If you’re a proponent of buying when the price is low and sell when it gets higher, then a long strategy might be a good fit for you. On the other hand, if you prefer to sell when the price is high in order to buy back when it plummets, then a short strategy sounds like an option.

All these strategies can be programmed into your bots in addition to many more of them - as a result we have a whole bot family: coin lending bots, market making bots, signal bots, arbitrage trading bots and many more.

On top of TradeSanta, you can run DCA and GRID bots that will place extra orders in case the price starts moving in the wrong direction and reduce your losses.

It’s understandably hard to give a try to something new, especially when it comes down to your personal savings, that’s why we at TradeSanta offer our clients a free package where you can endlessly run up to 2 bots for free if your volume is less than $3K/month. No need to buy before you get familiar with what exactly you’re buying.

Tether (USDT) trading

Just like many other cryptocurrencies, Tether (USDT) is a coin based on the blockchain technology. However, the difference between Tether and, say, Ether is that Tether is a stablecoin and backed by traditional currencies, such as Euro, Dollar and Japanese yen.

As of writing, the price of the asset is $0.999618, with the total market cap of $9 billion, which places the Tether to the third place of the CoinMarketCap ranking.

Let’s look at the most significant dates in the history of the coin. USDT saw its all-time high price of $1.21 riding the wave of 2017’s hype. Interestingly, it’s all-time law price was $0 in 2018.

So, what are advantages and disadvantages of trading Tether?

Just like with any other cryptocurrency, you’re the only person responsible for the safety of your funds, and if something goes wrong, you will not be able to reimburse your losses.

However, compared to other crypto coins, stablecoins, such as Tether, are less volatile and can serve as a store of value.

As we’ve mentioned in our article on a new safe-haven asset type, according to a pseudonymous crypto researcher Hasu, the total market capitalization of stablecoins has increased up to $8 billion in the period of the crisis triggered by Covid.

Tether exchanges

Tether (USDT) is currently the third most popular coin in the world, no wonder you can buy this asset on top of almost any major crypto exchange, such as Binance, Huobi, OKX, HitBTC, Bybit, Kraken, and FTX.

Let’s look at the most popular options. If you’re logged in to Binance, you will be able to buy the asset with a credit card. You can also buy or sell it directly from other users on their P2P platform. Additionally, there are very many third-party companies presented on the website at your convenience as well as dozens of pairs on Binance’s spot and margin trading platforms.

On top of Bittrex, you can trade USDT for Bitcoin and Ethereum as well as for manifold alts, such as ADA, BCH, XRP, NEO and a dozen more.

As for Huobi Global, there are even more pairs with USDT, so you can trade buy and sell the stablecoin for LTC, TRX and many more alts not to mention such top dogs as BTC and ETH.

TradeSanta strategies

DCA strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Grid strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Frequently Asked Questions

What is trading bot?

Crypto trading bot is a software program, which automatically executes trades according to a predetermined strategy. Basically, the trading bot places buy and sell orders on your behalf on the crypto exchange.

How does TradeSanta work?

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set. For the first order crypto bot buys the amount of base currency indicated in the settings by the user.

What settings are the best?

There is no "best strategy" for automated cryptocurrency trading, it is not a money making machine. You may use one of the templates to start and adjust them according to your needs after. To get the best results you should conduct your own research and make your strategy, according to your trading volume, market situation, chosen cryptocurrency pair and etc.