Stellar trading bot

Stellar (XLM) trading bot is a piece of software built to streamline the process of crypto trading and give advantages to individual traders over each other.

Set up bot

How to launch bot for Stellar (XLM)?

The real present question is, why should you include the XLM bot in your trading arsenal? Just like a soldier cannot go to war without being armed, professional crypto traders use different risk-management strategies and automation tools to improve their positions and reduce the risks.

In comparison to the long-established markets where corporations use high-speed algorithms, in the crypto markets, as an individual, you still can leverage the power of algorithms since institutions haven’t yet come to the market -- this will give you a competitive advantage.

While using an XLM crypto bot, you can increase your trading volume, be “present” in the market 24/7 and free up time for your family.

In addition to that, while using an XLM bot, you can use your own trading strategy, there is no need to open and close deals manually. Also, you can use technical indicators to detect the right entry and exit points and make use of risk-management strategies, such as stop-loss .

Stellar (XLM) trading

With an all-time low price of $0.0012 (Nov 14, 2018), an all-time high of $0.93 (Jan 4, 2018) and a current price of $0.1, you can see that XLM is a perfect asset to start learning about trading as a matter of actual practice.

The price is low, of course, but you can work with actual coins, not the fractions of coins, which makes it slightly easier for a newbie. But on the other hand, we all know that cryptocoins are volatile, and if the market plummets, you might lose the money.

Are you not a newbie anymore? Maybe you should give a try to XLM margin trading. These services are offered by DELTA, Bitfinex, Huobi Global, Kucoin etc.

Stellar (XLM) trading platforms

Depending on what is your situation, you can use this or that trading platform. For example, if you want to buy XLM for USD, most likely, you’ll have to convert USD to BTC first.

However, if you want to do this most easily, you can go to the Kraken exchange and make your purchase for USD.

In general, Stellar (XLM) is one of the top dogs in terms of market cap but not so easy to find on top of several major crypto exchanges. The list of exchanges supporting the coin includes Binance, Huobi, OKX, HitBTC, Bybit, Kraken, and FTX.

Also, you can give a try to automation tools for free. We understand that learning new tolls is stressful, so it’s only fair to let you see first if this is something you’re looking for.

TradeSanta strategies

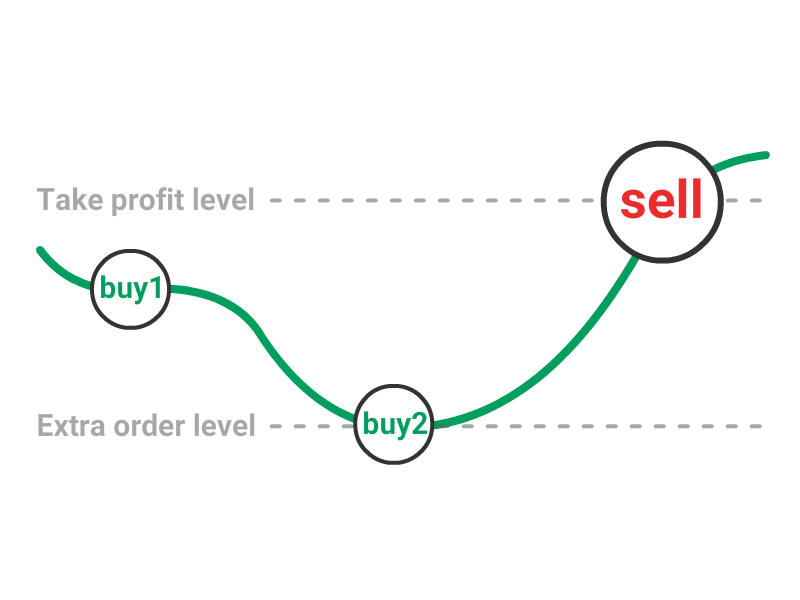

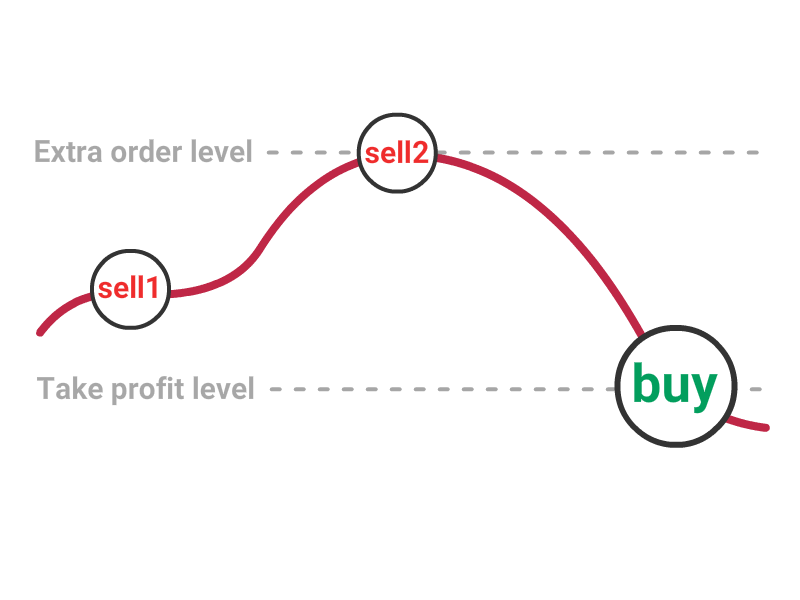

DCA strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

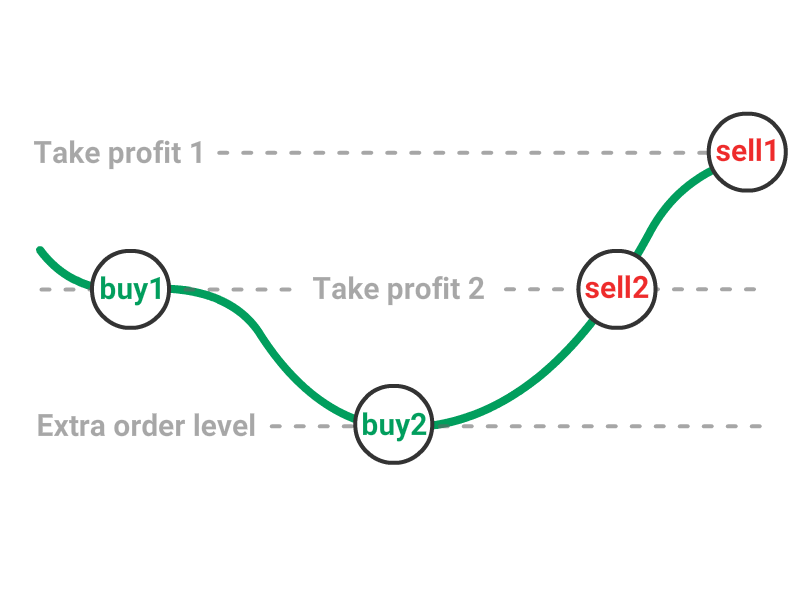

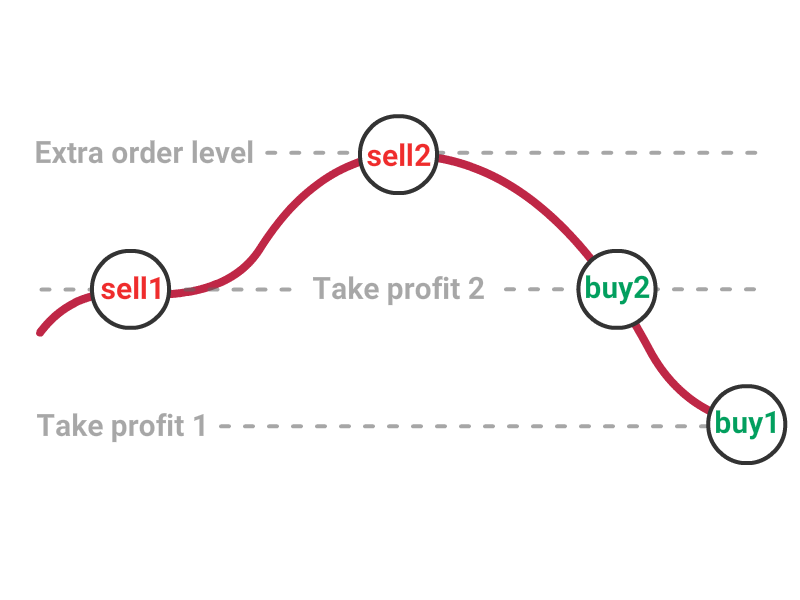

Grid strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Frequently Asked Questions

What is trading bot?

Crypto trading bot is a software program, which automatically executes trades according to a predetermined strategy. Basically, the trading bot places buy and sell orders on your behalf on the crypto exchange.

How does TradeSanta work?

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set. For the first order crypto bot buys the amount of base currency indicated in the settings by the user.

What settings are the best?

There is no "best strategy" for automated cryptocurrency trading, it is not a money making machine. You may use one of the templates to start and adjust them according to your needs after. To get the best results you should conduct your own research and make your strategy, according to your trading volume, market situation, chosen cryptocurrency pair and etc.