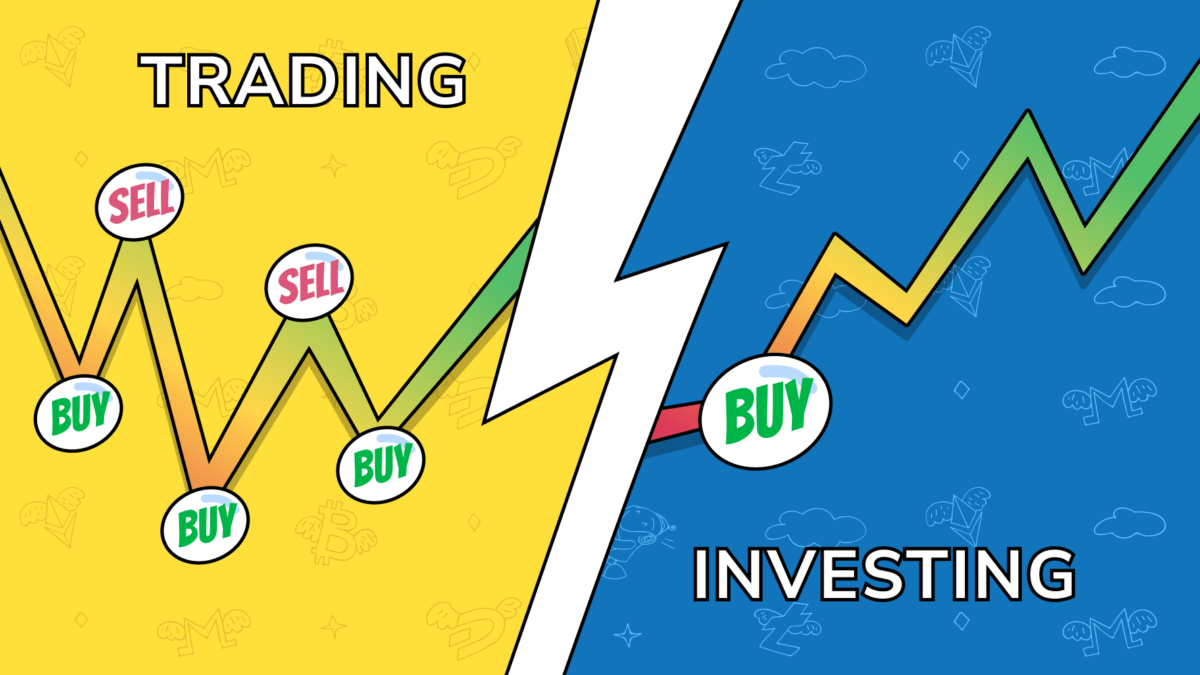

When it comes to crypto, the terms “trading” and “investing” are often used interchangeably, leading to confusion among newcomers to the space. While both trading and investing involve buying and selling assets, they are fundamentally different activities that require different approaches, goals, and strategies. In this article, we will explore the key differences between trading and investing in crypto and provide insights into the tools and strategies used by each.

What is Trading?

Trading refers to the practice of buying and selling assets with the aim of making a profit from short-term price movements. When it comes to cryptocurrencies, trading usually involves buying and selling digital coins on a cryptocurrency exchange with the goal of profiting from fluctuations in the price of the coins.

Crypto traders rely on technical analysis to identify trends and patterns in the market that could signal changes in the price of a cryptocurrency. They may also use fundamental analysis to evaluate the potential value of different cryptocurrencies. Traders often use a variety of technical tools, such as charting software, to help them analyze market trends and make informed trading decisions.

What is Investing?

Investing, on the other hand, involves purchasing assets with the intention of holding them for an extended period of time in order to generate returns over the long-term. In the context of cryptocurrencies, investing typically involves purchasing digital coins and holding onto them for years, with the expectation that their value will increase over time.

Crypto investors rely on fundamental analysis to evaluate the potential value of different cryptocurrencies. They consider a range of factors, such as the size of the market, the strength of the development team behind a coin, and the potential use cases for a cryptocurrency.

Key Differences Between Trading and Investing

There are quite a few key differences between crypto investing and crypto trading. Let’s take a look at them below:

- Time Horizon: The biggest difference between trading and investing is the time horizon. Investing in cryptocurrencies usually involves holding the coins for a longer period, often years, with the aim of realizing substantial profits over the long term, and not paying any attention to price swings.

Trading, on the other hand, involves buying and selling cryptocurrencies over shorter time frames, often days, hours, or even minutes, with the aim of making smaller profits in a shorter amount of time. - Risk Tolerance: Trading and investing also differ in terms of risk tolerance. Trading tends to be riskier than investing, as traders aim to take advantage of market fluctuations that can occur rapidly and unpredictably. This can result in higher potential profits but also higher potential losses.

Investing, on the other hand, tends to be less risky, as investors aim to hold their cryptocurrencies over a longer period without the need to look for the best time to sell it, since he or she believes that an asset’s price will grow in the long run despite uptrends and downtrends. - Strategy: The strategies used in trading and investing also differ. Investors often employ a buy-and-hold strategy, where they invest in cryptocurrencies that they believe have strong long-term potential and hold them for a significant period of time. Traders, on the other hand, use a range of strategies, such as shorting and swing trading, in order to try to capitalize on short-term price movements.

- Tools and Resources: Traders and investors may also use different tools and resources. Traders may use trading bots, technical analysis tools, and charting software to help them identify short-term trading opportunities. Investors may use fundamental analysis, news sources, and long-term price charts to help them identify cryptocurrencies with strong long-term potential.

- Goals: Finally, trading and investing differ in terms of goals. Traders aim to make profits over a short period, often within a day or a few hours, maximizing profit on every possible price swing, while investors aim to realize significant profits over a longer period, often several years. The goals of traders and investors can also be different in terms of risk tolerance, with traders often willing to take on higher levels of risk to achieve their short-term goals, while investors may be more risk-averse and focus on long-term stability and growth.

Strategies for Investors

Investors in cryptocurrencies typically adopt a long-term buy-and-hold strategy, aiming to capitalize on the potential growth of the market over time. Some of the key strategies used by investors include:

- HODLing: This strategy involves buying an asset and holding it for a prolonged period with the expectation that it will increase in value over time. This strategy is suitable for investors who believe in the long-term potential of the cryptocurrency and are willing to withstand short-term market volatility.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency’s price thus averaging the price of the assets bought. Dollar-Cost averaging can help traders avoid buying at market highs and selling at market lows.

- Diversification: This strategy involves investing in multiple cryptocurrencies to spread risk and reduce exposure to any single cryptocurrency. Diversification can help investors reduce risk while still allowing them to benefit from the growth potential of the cryptocurrency market.

- Value investing: This strategy involves investing in cryptocurrencies that are undervalued relative to their intrinsic value. Value investors typically look for cryptocurrencies that have strong fundamentals but are trading at a discount due to temporary market conditions or other factors.

Strategies for Traders

Traders in cryptocurrencies typically adopt a range of different strategies depending on their level of experience and risk tolerance. Some of the most popular trading strategies include:

- Day trading: Day trading is a trading technique that involves buying and selling financial assets within the same trading day. The primary objective of day trading is to generate quick profits from short-term price movements in the market. To achieve this goal, day traders rely heavily on technical analysis tools, such as charts and indicators, to identify potential trading opportunities. By capitalizing on these short-term price fluctuations, day traders aim to make profits quickly, without holding positions overnight or for an extended period.

- Momentum Trading: This strategy involves buying cryptocurrencies that are gaining momentum and selling those that are losing momentum. Momentum traders use technical analysis and other tools like RSI to identify cryptocurrencies that are likely to continue moving in the same direction.

- Swing Trading: This strategy involves buying and holding cryptocurrencies for a short period, usually a few days or weeks, and then selling them when they reach a predetermined price target. Swing traders use technical analysis and other tools to identify short-term price movements and capture profits.

- Arbitrage: This strategy involves buying a cryptocurrency on one exchange and selling it on another exchange where the price is higher. Arbitrage traders take advantage of price differences between different exchanges to make a profit.

Tools for Traders and Investors

Crypto traders and investors use different tools to analyze the market and make informed decisions about which assets to buy and sell. However, some tools work both for trading and investing. Let’s take a look at them down below:

- Exchanges: Centralized (CEX) and Decentralized exchanges (DEX) allow traders to buy and sell cryptocurrencies. CEX can also provide traders with real-time market data, order books, price charts, and other features to help them make informed trading decisions. Some popular exchanges in the crypto market include Binance, Coinbase, Kraken, Pancake Swap and Uniswap.

- Crypto Wallets: Crypto wallets are digital wallets that allow traders to store, send, and receive cryptocurrencies. They are essential for traders who want to hold their cryptocurrency investments securely and access them easily. Crypto wallets can be software and hardware. Some popular crypto wallets include Trust Wallet, MetaMask and Exodus.

- Trading Bots: Trading bots are software programs that can automate trading strategies based on predetermined rules. They can help traders execute trades quickly and efficiently, even when they are not actively monitoring the markets. TradeSanta, for instance, is one of the most well-known and trusted trading bot providers on the market.

- Technical Analysis Tools: Technical analysis tools include charting software, indicators, and other tools that traders use to analyze market trends and identify trading opportunities. Some popular technical analysis tools in the cryptocurrency market include TradingView and CryptoWatch.

- News Feeds and Social Media: News feeds and social media platforms like Discord, Telegram, Twitter and Reddit provide traders with access to the latest news and updates on the cryptocurrency market. They can help traders stay informed and make informed trading decisions.

- Crypto Wallets: Just like for traders, crypto wallets are essential tools for investors to store, send, and receive cryptocurrencies securely. In the case of investors, using cold wallets is essential for storing assets for long periods of time. Some popular hardware crypto wallets for investors include Ledger and Trezor.

- Price Tracking Tools: Price tracking tools allow investors to track the price movements of cryptocurrencies over time, enabling them to make informed decisions about when to buy or sell. Some popular price tracking tools in the cryptocurrency market include CoinGecko, CoinMarketCap, and CryptoCompare.

- Portfolio Tracking Tools: Portfolio tracking tools help investors keep track of their cryptocurrency investments and monitor their performance over time. Some popular portfolio tracking tools in the cryptocurrency market include Delta and Coinigy.

- Tax Reporting Tools: Tax reporting tools can help investors keep track of their cryptocurrency transactions and generate accurate tax reports for their investments. In fact, tax reporting tools are essential for both crypto traders and investors as well. Some popular tax reporting tools in the cryptocurrency market include CoinTracker and TokenTax.

How to Determine What Suits You Best?

Deciding whether to trade or invest in cryptocurrencies ultimately depends on your personal goals, risk tolerance, and time horizon. Here are some factors to consider:

Goals. If your goal is to generate quick profits, then trading may be more suitable for you. If you are looking to build long-term wealth, then investing may be a better option.

Risk Tolerance. Trading involves taking on more risk than investing, so you need to be comfortable with the potential for large losses. If you have a low risk tolerance, then investing may be a better option.

Time Horizon. If you are looking for short-term gains, then trading may be more suitable for you. If you are willing to take a long-term view, then investing may be a better option.

Experience. Trading requires a high level of skill and experience, so if you are new to cryptocurrencies, then investing may be a better place to start.

Overall, both trading and investing in cryptocurrencies can be profitable if done correctly. However, it is important to understand the differences between the two approaches and to choose a strategy that aligns with your goals, risk tolerance, and time horizon. By conducting research, managing your risk, and staying disciplined, you can make informed decisions about which cryptocurrencies to buy and sell, and potentially achieve success in the crypto market.

FAQ

Can you trade and invest at the same time?

Yes, it is possible to both trade and invest in financial instruments. However, it’s important to carefully manage your portfolio to ensure a balance of risk and long-term growth potential.

Is trading riskier than investing?

Trading can be riskier than investing due to the focus on short-term gains and high levels of market volatility. However, investing also involves some level of risk and may not offer the same potential for high returns in the short-term.