The world of crypto is truly fascinating: it is possible to find almost any kind of project one can imagine, even “the fastest blockchain in the world and the fastest growing ecosystem in crypto”. Yes, today we will talk about Solana and will try to understand whether this coin, as well as its blockchain, has a prominent future that you should support with your investments, and why Solana might become an “Ethereum killer”.

Why Solana is up in 2024

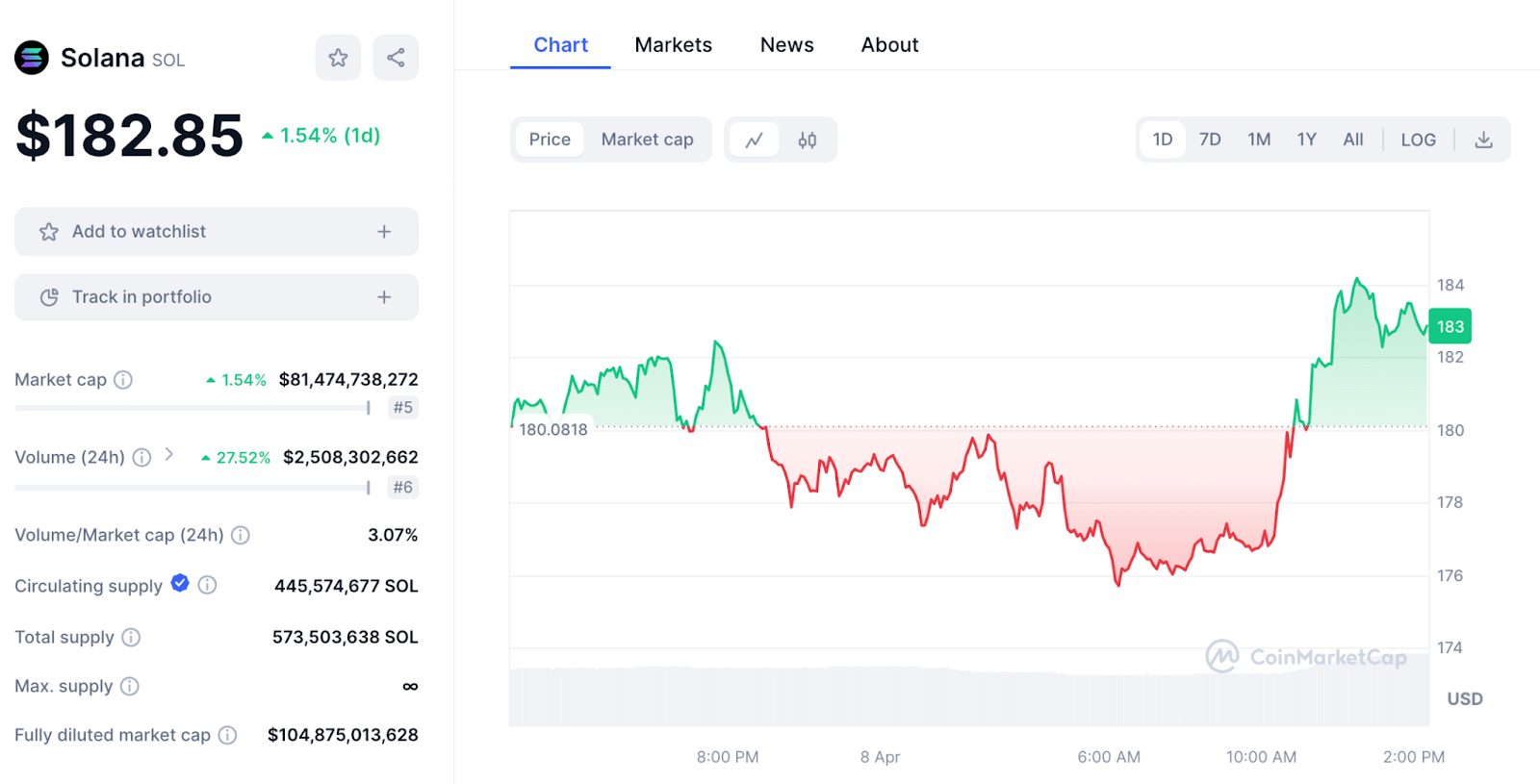

This year, Solana has been on a tear, surpassing Bitcoin’s growth. On March 18th, SOL reached its highest price since December 2021, hitting the $205 mark. As of the time of writing, April 8th, 2024, SOL was trading at $182 and had a market capitalization of $81,473,877,070, making it the fifth largest cryptocurrency by market capitalization, behind only the established industry leaders.

Solana’s ambition to reach its ATH of 2021 began back in December 2023 amid increased Ethereum gas fees. And while they’ve declined since then, this has unintentionally drawn attention to Solana’s more user-friendly transaction costs.

The so-called Ethereum killer entered 2024 buzzing loudly, announcing one of the largest token airdrops in its history on Jan. 31, when Jupiter, a decentralized trading aggregator based on Solana, released its native token JUP. The event distributed roughly $700 million worth of JUP tokens to nearly a million wallets.

Also, in late January, blockchain developer Solana Mobile announced its second crypto-enabled smartphone model. The demand for the new device, called Chapter 2, was so high that it got 30 thousand pre-orders within a day.

The next big thing was the February integration with Filecoin in an effort to improve the blockchain’s reliability, security, and scalability with decentralized data storage.

Formally consolidating the success of the Solana token became possible by winning the nomination “Cryptocurrency of the Year” according to the CoinMarketCap website. “Solana has once again exploded as the trendiest crypto asset amongst traders with new meme tokens popping nearly every minute,” ContentFi Labs COO Nick Ruck told CoinDesk.

The most noticeable reason behind Solana’s hype was the active trading of memecoins issued on the Solana blockchain, which has already been dubbed “meme coin mania.” “Solana has once again exploded as the trendiest crypto asset amongst traders with new meme tokens popping nearly every minute,” ContentFi Labs COO Nick Ruck told CoinDesk.

This excitement around memecoins fueled a surge in activity, with DeFi applications in the Solana network surpassing their counterparts in the Ethereum ecosystem in terms of turnover at the end of March. Thousands of new tokens appear daily on the Solana blockchain, their prices hyped several times over by speculators.

Solana’s low fees have made it a popular blockchain for running meme coins. Users typically just need to download a Solana-enabled wallet (like Phantom) and use SOL tokens for transactions.

Memecoins themselves carry no inherent value or practical use. Anyone can create their own crypto-token on Solana or any other blockchain if they wish. Launching a memecoin requires some technical knowledge to create a smart contract, some funds to provide initial liquidity, and marketing efforts to attract buyers.

What do experts say about Solana’s potential?

Benjamin Stani, director of business development at analyst firm Matrixport, noted that Bonk (BONK) and Dogwifhat (WIF) tokens on the Solana blockchain became the first meme coin cryptocurrencies outside of Ethereum to reach a billion-dollar capitalization.

Viral meme coin projects can fuel speculative interest in the native tokens of the underlying blockchain network. For example, Solana’s competitor, BNB Chain, is even offering a $1 million reward to attract meme coin developers to its well-established blockchain (Tier 1 blockchain).

As a result, the recent surge in Solana-based memecoins is closely tied to the network’s total value locked (TVL) boom. It has grown 70% in 2024 to 23.78 million SOLs as of April 3, indicating strong underlying demand for SOL tokens.

Max Shannon from CoinShares, an asset manager specializing in digital assets, believes Solana remains an investor favorite. Even after a five-hour network failure in early February, when the Solana blockchain stopped processing new transaction blocks as a result of overloading, the SOL token remains among the favorites among investors, the analyst believes. The Solana token fell 4% on news of the network outage but has since climbed back above $110.

The expert predicts further growth of the Solana cryptocurrency. He considered several successful airdrops and the efforts of validators, including Firedancer, to strengthen the reliability of the Solana network as the main factors of success. Shannon also noted that Solana is developing a blockchain-based order book that will strengthen it in competing with Ethereum.

Kel Eledje from Messari, a market intelligence company focused on the digital asset ecosystem, thinks that the growth of the SOL token is fueled by airdrops and applications developed on the Solana platform, such as the NFT DRiP issuance platform and the Helium decentralized wireless network project, which recently migrated to Solana. The Helium platform also collaborates with Solana’s Saga mobile device, whose owners periodically receive airdrops such as BONK in December 2023.

Eledge also pointed to new entrants to the network, including Firedancer, Sig, and Agave, that could attract new users.

Raul Pal from Real Vision predicts that Solana will become the third most important cryptocurrency

In a February interview with SkyBridge Capital hedge fund co-founder Anthony Scaramucci, Pal said the price of Solana will rise to between $750 and $1,000. “The Solana cryptocurrency has surpassed Bitcoin in terms of growth,” he noted.

Solana price forecast 2024-2025-2030

Market participants expect the upcoming Bitcoin halving in mid-April to boost not just Bitcoin, but also other cryptocurrencies, particularly SOL, similar to past halving events. Cryptocurrency educator and YouTube host Guy Turner expects the Solana native token to reach its all-time high of $300 after the BTC halving event.

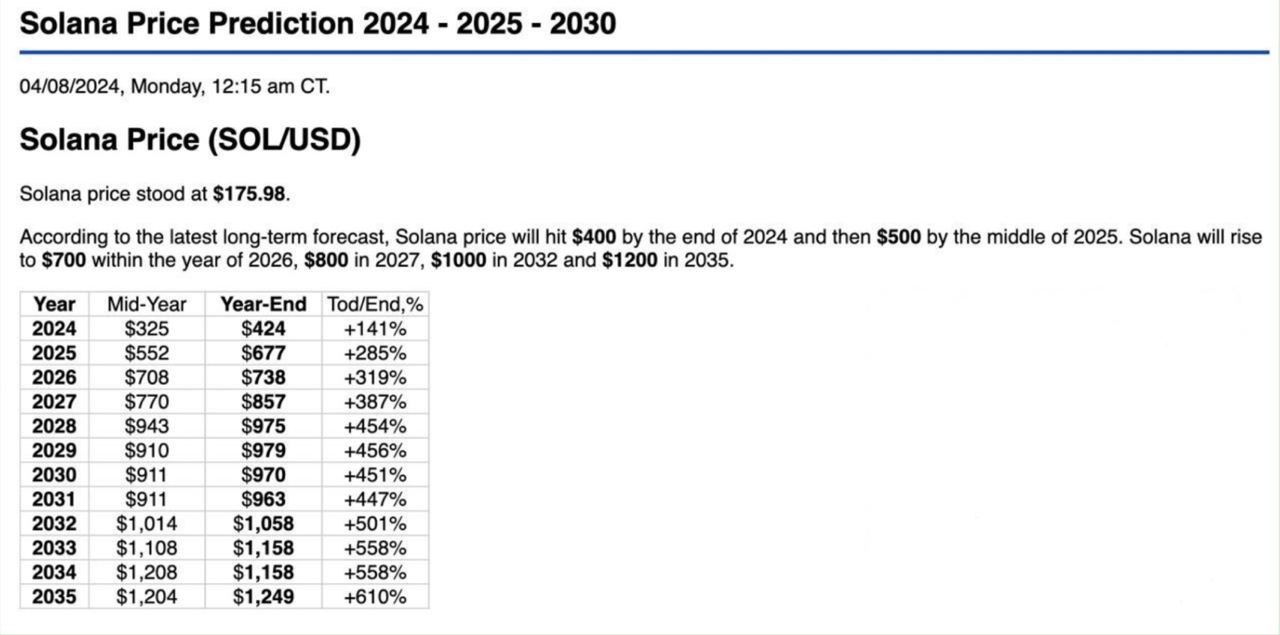

Coin Price Forecast is one of those predictors that tend to believe Solana has a very bullish future. In their opinion, SOL will meet the end of 2024 with a price of $424 per coin and then will rise to $552 by mid-2025. By the end of 2025, SOL has a chance to reach $677 level. The following years are expected to be extremely good for the SOL price: $708 by the mid-year of 2026 and $738 at the end of the year; 2027 might be the year when we’ll see SOL cost $770 and then $857. Finally, in 2030 the price might fluctuate between $911 and $970. So in the next three years, Coin Price Forecast believes we can expect to see a super jump in SOL price, climbing up from $325 at the end of 2024 to $970 by the end of 2030.

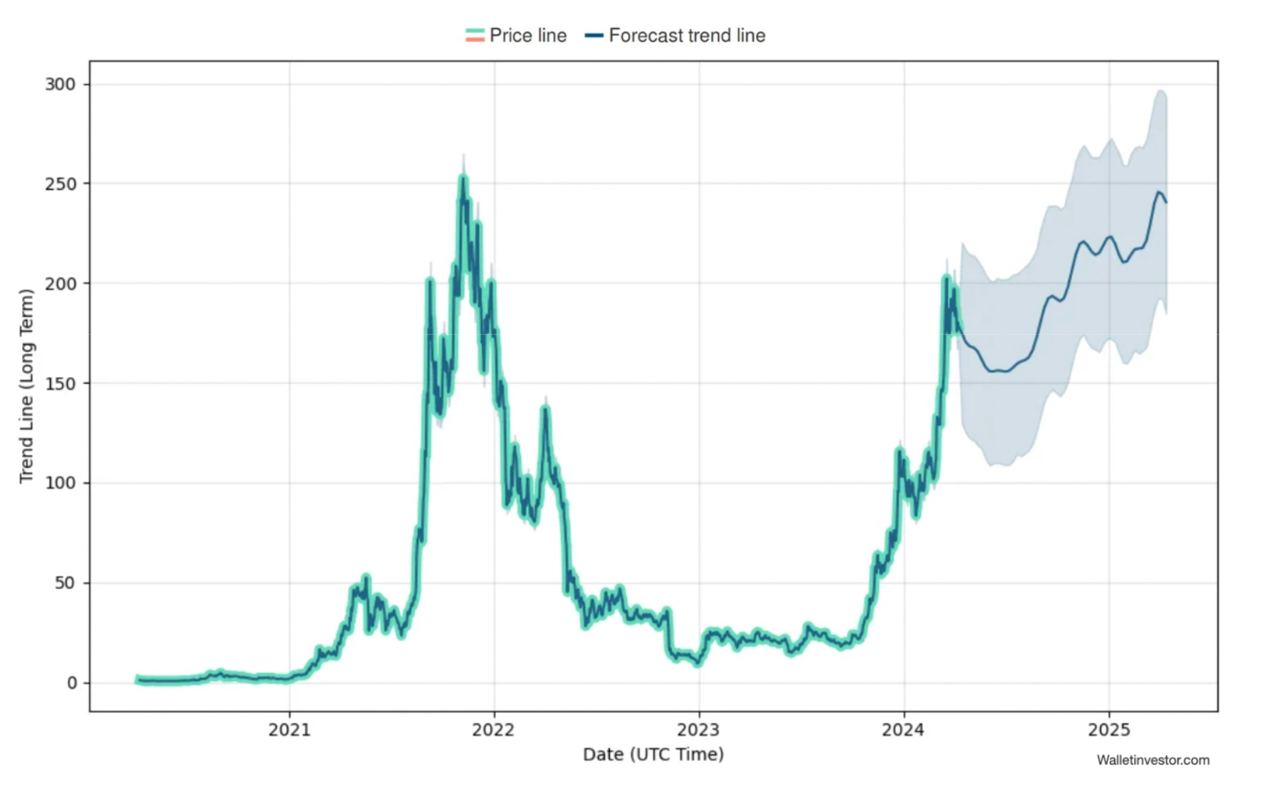

Wallet Investor, in turn, are also optimistic about SOL’s future, although they tend to be more down to earth. According to them, SOL’s price during 2024 is expected to be around $167, and by mid-year, it has the chance to break a $207 level.

In the following year 2025, it is predicted that the Solana coin will continue to strengthen, and by the end of the year, the price might reach a $360 level.

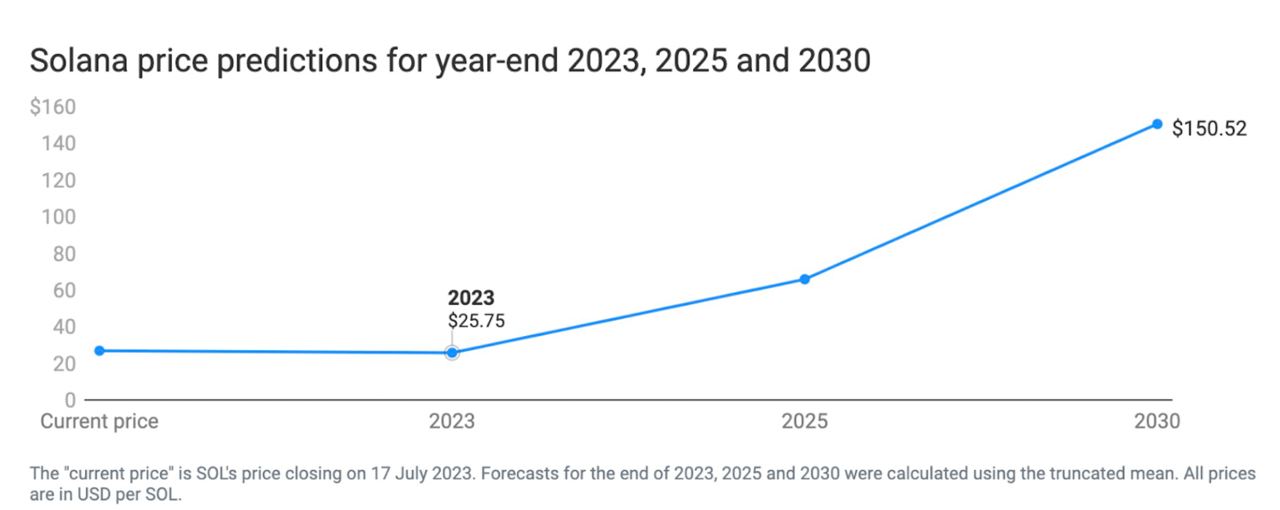

Solana price prediction 2030

As always, making such long-term predictions is difficult, especially when it comes to cryptocurrency, even one as promising as Solana. But let’s take a look at the predictions for 2030.

According to crypto exchange platform Changelly, the SOL coin price can reach a $2,146 level in case Solana continues to show its worth and if it stays in the list of Top cryptocurrencies on the market.

Finder’s crypto experts are not so bullish on SOL and see it at just $150 in 2030. While in 2021 their prediction was as much as $5,000 by 2030.

VanEck, a spot ETF provider, estimates Solana could reach $3,000 or fall to $10 by 2030 based on their analysis of SOL token demand. Their scenario suggests a value of $335 by 2030. However, VanEck analysts noted that this could be much higher if Solana can surpass rival Ethereum and become the leading network in decentralized finance (DeFi) at that time.

However, all these forecasts are merely speculations. Investors should always remember that the cryptocurrency market is highly volatile, and literally anything can happen by 2030, so no one can say for certain what the SOL coin market position will look like.

What is Solana?

And before you decide whether to invest in SOL in 2024, let’s go over what the blockchain is and what makes it so unique.

Solana is a blockchain that was specifically created for hosting decentralized applications, or dApps, similar to other popular dApp blockchains like Ethereum or Cardano. Its internal cryptocurrency is called SOL. Solana is an open-source blockchain project run by the Solana Foundation, a company based in Geneva. It gained significant attention because it offered something no other blockchain could before fast operation with low transaction fees. Solana can process around 650,000 transactions per second, while its white paper claims a theoretical 710,000 TPS at a 1-gigabit-per-second network connection.

On its official website, the project states that both developer and user fees do not exceed $0.0025, making them very affordable (typically under $0.0025) compared to other options in the cryptocurrency market. Solana works on a combination of proof-of-stake and proof-of-history protocols, which is not only a much faster solution but also a much “greener” and eco-friendly alternative to the proof-of-work protocol used in Bitcoin, for instance. Let’s take a closer look at the inner workings of Solana’s blockchain to understand how it achieves this impressive speed and efficiency.

What makes Solana so special?

We’ve already mentioned the proof-of-history protocol Solana uses (more details will be provided below), but there is more to that. Because of this unique technology, Solana became the world’s first web-scale blockchain and that made a real breakthrough in blockchain development: Solana’s speed and capacity are way ahead of anything else that currently exists. So, technically speaking, Solana was designed from the beginning to be faster and more capable than any other blockchain on the cryptocurrency market.

It is a common thing to see when Solana is being compared to Ethereum, even in this article, since they are both used by developers when creating dApps. However, considering the technical advantage Solana’s blockchain has, it is safe to assume that Ethereum will have a serious competitor in the near future if it delays the ETH 2.0 upgrade. Still, we are talking about now, and as of today, Solana has all the potential to make a serious impact on the dApp ecosystem. Its blockchain solves so many issues that other blockchains have, and that helps Solana strengthen its position in the crypto market due to its scalability and cost-efficiency.

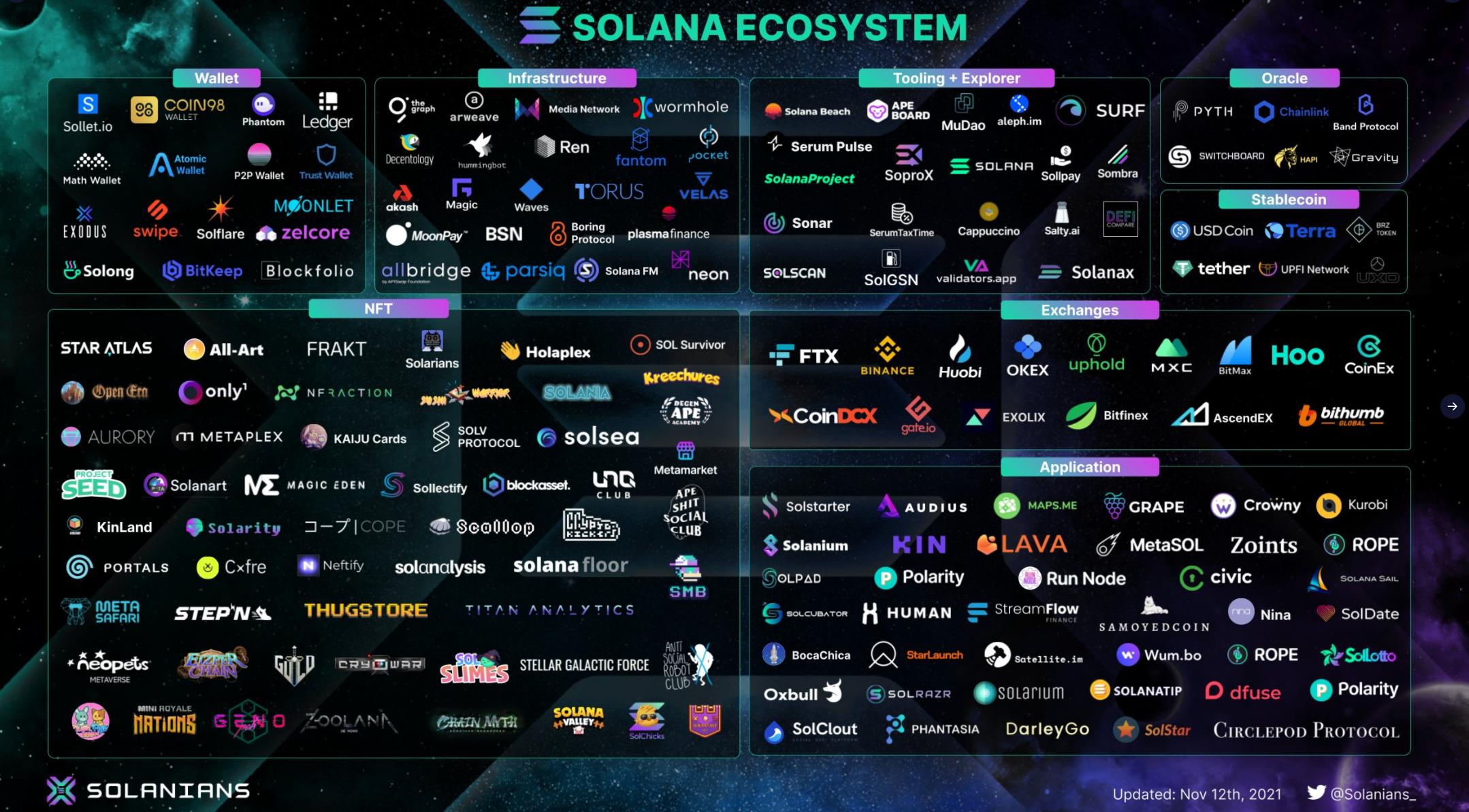

It is worth mentioning that without a constantly growing number of partners and projects, Solana wouldn’t have seen such a rise in popularity. As of today, the Solana network has more than 500 partners and projects, and the number continues to increase: Wallets, crypto exchanges, games, NFTs — you name it.

Peculiarities and analysis

Just like its competitor Ethereum, Solana is a programmable blockchain. What it means is that it can be used for deploying smart contracts that are used for building dApps. As we already know, Ethereum is still the leader in the smart contract space and the number one platform for the dApp’s developers. However, given the fact how innovative and advanced Solana’s blockchain is, Ethereum might not be the leader in the future. The reason for that is the distinctive features that make Solana so unique. Let’s take a brief look at them:

Proof of History

By introducing proof-of-history protocol, Solana somewhat managed to revolutionize the way blockchain operates. The name speaks for itself — a proof of historical events. This protocol creates a historical record that proves that an event has happened at a determined moment, and whereas other blockchains’ validators are required to come to an agreement that the specified moment has passed, Solana allows its validators to be in charge of their clock. The transaction verification process is thus reduced since every node does not need to consult with each other when making decisions, and that leads to the overall speed of transaction being much faster than in those blockchains that rely on proof-of-work protocol.

Sealevel

Solana’s blockchain can handle parallel processing of thousands of smart contracts: the built-in runtime uses as many cores as there are available to the validator. This feature can save time and make Solana’s blockchain much more efficient.

Tower BFT

The BFT system, or the Tower Byzantine Fault Tolerance algorithm is interconnected with PoH protocol, and this algorithm uses PoH as the cryptographic clock that helps it reach consensus without the need to send a flood of communication between the nodes. It also helps the nodes to continue its work even after multiple failures, so when the failures occur they do not impact the entire ecosystem.

Gulf Stream

Gulfstream refers to Solana’s mempool; a mempool is a set of transactions that have been submitted, but have not yet been processed by the network. Via Gulfstream, validators can reduce confirmation time, as well as the memory load that comes with an unconfirmed transaction pool. That is due Gulfstream Solana can process 50,000 transactions per second.

Pipelining

Pipelining refers to the process of optimising the way of processing the stream of input data, that needs to be processed in sequential steps. So, in simple words, Solana allocates the input data to multiple hardwares that are involved in the network, and these hardwares validate the info blocks using the process known as pipelining.

Turbine

This component refers to the protocol that has a goal to pack data requiring transfer between the nodes into smaller data packages. According to Solana Foundation, Turbine propagation protocol is inspired by BitTorrent, and it helps to solve the blockchain scalability trilemma.

Cloudbreak

Cloudbreak is Solana’s horizontally scaled state architecture that, obviously, allows Solana to increase its scalability. It organizes the database that is capable of reading and writing transaction input. In addition, Cloudbreak works as a “garbage collector”, by collecting old invalid accounts and relinquishing memory.

Does SOL have a future worth investing in?

For now, Solana looks like a very promising project. Moreover, the sudden price jump that happened earlier this year managed to get attention from investors and crypto experts.

Its blockchain also looks like something unique and can boast features that none of the other blockchains have. With the upcoming Bitcoin halving potentially boosting SOL’s price, as seen in past events, the situation becomes more favorable for Solana’s growth. All in all, it looks like SOL has a very bright future — a future that investors might be interested in supporting with their investments.

FAQ

What will Solana be worth in 2024?

Coin Price Forecast predicts SOL will meet the end of 2024 with a price of $424 per coin and then will rise to $552 by mid-2025.

What will Solana be worth in 2030?

In the next few years, Coin Price Forecast believes we can expect to see $970 by the end of 2030.