“Scalping” sounds pretty gruesome, but it is a straightforward strategy you can apply in traditional and crypto trading.

Here’s a bit of background to this financial concept, plus how you should put it into practice.

Scalping in traditional trading

Scalping is most often used by Forex traders and involves seemingly low-risk profiles, it requires a lot of discipline and intensive trade processing.

A scalper wouldn’t be holding positions overnight. The goal of scalping is to exploit predictable price movement en masse over the course of the day. This is necessary, since the per-trade profits are almost guaranteed to be small.

Two common approaches in scalping are arbitrage and spread scalping. Arbitrage trading involves finding a discrepancy between the bid and ask prices that are large enough between two different brokers and buying from one and selling to the other for a locked-in profit. Spread scalping involves exploiting the same kind of price differences but with the same broker. Note that in many cases brokers ban this practice.

Scalping in conventional markets has fundamentally different characteristics to cryptocurrency trading, as we’ll explain.

Implementing scalping in crypto trading

As you can see from the Forex example, scalping is very intricate at times and requires skill and effort. Like above, a scalper in the crypto market would take advantage of small price fluctuations to lock in small gains.

Here is an example scalping trade and the thinking behind it.

In a big bull run and when optimism in the crypto market is running high, relatively speaking, investment turns to altcoins, leading to a price pump, often with choppy downswings en route.

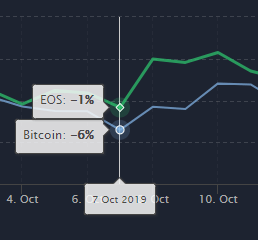

An enterprising investor might spot an upward horizontal trend in a given alt, and use a trading pair, e.g. Bitcoin (BTC) and random altcoin (ALT), which hedges against downswings in the upward price of the given altcoin.

The scalping investor spots an upward trend in the alt, goes long on ALT and short on BTC, and has an exit strategy of selling back to BTC as soon as the trade is actualised with a profit, as opposed to normal trading where an investor might “let the profit run” for a longer period.

In the event that the trade has not gone to plan, a firm exit strategy is needed. If, in the example above, a Bitcoin jump left the trader out of pocket, the trader must use a strict and tight stop-loss setup to take the beating and exit. This is extra important in scalping strategy, where a long streak of small gains can be wiped away with one large loss. It is for this reason that scalpers often impose a daily loss limit on themselves after which they throw in the towel for the day.

It involves technical analysis of the crypto market to figure out the channels in the price and then thereafter trading against price opportunities that fall outside that range. A scalper can buy e.g. an excessively underpriced asset and then sell immediately for a marginal gain. Essentially, the cryptocurrency trader is taking advantage of increasing trade volume to net small gains in a few seconds.

Scalping trading is difficult to get rich from in crypto but the market volatility makes it very possible. The pitfalls are that bad things can happen, and although the scalper is not exposed to lose too much on a single trade, they could incur heavy losses if a large number of these trades go South.

Is scalping trading for you?

Even when run correctly, scalping is time-consuming. You need to monitor the prices of many crypto assets (e.g. Bitcoin, Ethereum, XRP) if you’re using the strategy fully, you need to be able to execute trades quickly, and you need a big enough bankroll.

As you can imagine, there is a huge amount of technical knowledge needed for this. Anybody can get started and since one’s potential losses are mostly capped, it is therefore a useful practice to use to help learn technical analysis too, just don’t expect to make much profit.

If you still want to give this strategy a try, first of all, make sure you factor fees into your profitability estimation. Next, you can scalp on any exchange that allows for fast enough trading.

Also, keep in mind that it is often practical to use more trading tools to help with your technical analysis: multicoincharts, RSI Hunter, TradingView and BitsGap.

FAQ

Is scalping profitable in crypto?

Scalping trading is difficult to get rich from in crypto but the market volatility makes it very possible. The pitfalls are that bad things can happen, and although the scalper is not exposed to lose too much on a single trade, they could incur heavy losses if a large number of these trades go South.

What is the best time frame for scalping crypto?

A scalper wouldn’t be holding positions overnight. The goal of scalping is to exploit predictable price movement en masse over the course of the day. This is necessary, since the per-trade profits are almost guaranteed to be small.

When should you set up a stop-loss?

Unlike a limit order, which aims to profit from the current trends, a cryptocurrency trader will use a stop loss order to limit potential losses to no more than they are able to take on.