Name any prominent crypto exchange, and most likely it will have an order book. Let’s take a look at a few examples of those order books to see if all of them are different or have something in common.

But first things first…

What’s an order book?

An Order book is an important part of stock and cryptocurrency exchanges organized as an electronic list by price level.

It traditionally consists of two blocks of red and green colors. Buyers in the green wall place “bids”, or prices they’re willing to pay for the specified coin, and sellers in the red wall place “asks”, which are prices they offer this asset for sale.

An éminence grise behind the curtain, the exchange’s engine, matches bids and asks, which results in a trade.

Depending on the crypto exchange, order books might consist of different pieces of information.

Normally, they comprise a Price, Amount and Sum, where Price is a price of an asset, Amount identifies the volume of each separate order offered for this Price, and Sum is the cumulative amount of crypto realized for this price.

But again, as you will see down below, that it might differ from one exchange to another.

Order books don’t necessarily show all the orders filled, but rather demonstrate all the open orders. That’s how they might be useful in a way that they reflect where traders think the price is potentially moving, how much money is locked in open orders at certain price levels and if there are any probable support and resistance levels.

So how are order books useful?

- If there are more buyers or sellers in the order book, we can observe a trend. A significant number of sell orders may suggest an area of resistance, whereas the bulk of buy orders might imply support levels.

- By analyzing them you can get essential details on the value of the crypto asset, its availability, depth of trade, and who started the transactions.

- Also, they get updated in real time and demonstrate if a coin (e.g. Bitcoin) has a high liquidity, so you can get a quick answer on whether you will be able to buy or sell it quickly.

You can find order books on top of nearly all prominent cryptocurrency exchanges, such as Binance, Coinbase Pro, Huobi Global, etc. Let’s examine a couple of their order books.

Order books on top of different crypto exchanges

Honestly speaking, the order books on top of most exchanges might strike you as being very similar. For example, the one on top of Binance puts in mind Huobi Global and Coinbase Pro. So the differences between order books’ structures shouldn’t be significant.

Let’s take a look.

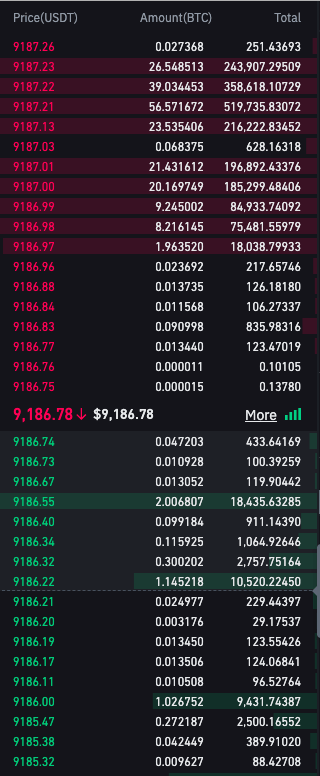

Source: A BTC/USDT order book on the Binance exchange

On the left, there is a price of one BTC in USDT; in the middle, we can see the sum of all the orders at this price level presented in BTC; and on the right, there is the same amount of money as in the middle but in USD. Are all of those orders filled? No, It’s just a list of orders placed.

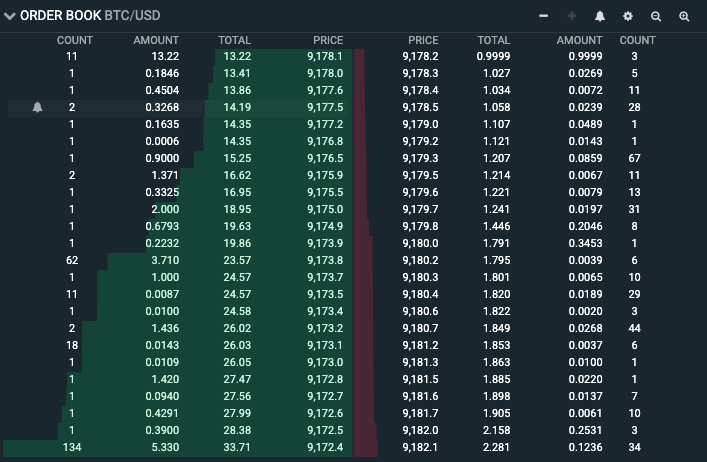

Here is another order book’s structure that looks more informative and is presented on top of Bitfinex.

Source: A BTC/USDT order book on the Bitfinex exchange

As you see, this order book consists of the Bid side colored green on the left and the Ask side on the right colored red.

The leftmost and the rightmost columns of the order book are called Count and represent the total number of orders at that level.

A count of 11 on top of the green wall means that there are 11 orders to buy Bitcoin at the price of $9,178.1. A count of 3 on top of the red wall means that there are 3 orders to sell Bitcoin at the price of $9,178.2.

This is different from the Amount value, which defines how many Bitcoins were sold or bought at this price.

But what does the string Total mean? This is the cumulative amount of coins that traders want to buy or sell at this price or better.

So let’s deconstruct the very first string of the order book’s green wall. The total amount of Bitcoins that are offered to the sellers at the price of $9,178.1 are 13.22 Bitcoins. And all of them are sold at this price to 11 sellers.

Based on this particular image presented above, we can say that the trend is positive, since there are a lot of buyers, and the situation feels as though the price will break a new support level.

Summary

Now, it’s fair to say that most prominent crypto exchanges have order books that consist of buyers in the green wall, or “bids”, and sellers in the red wall, also known as “asks”.

Generally, order books give you an idea about the amount of money locked in a list of orders, the liquidity of the coin, and probable support and resistance levels.

You can generally say that order books present you with the same kind of information, but some might give you more information and, thus, a deeper understanding of what’s going on in the market.

FAQ

What do you mean by order book?

An order book is an important part of stock and cryptocurrency exchanges organized as an electronic list by price level. It traditionally consists of two blocks of red and green colors. Buyers in the green wall place “bids”, or prices they’re willing to pay for the specified coin, and sellers in the red wall place “asks”, which are prices they offer this asset for sale.

How do you use an order book?

–If there are more buyers or sellers in the order book, we can observe a trend. A significant number of sell orders may suggest an area of resistance, whereas the bulk of buy orders might imply support levels.

–By analyzing them you can get essential details on the value of the crypto asset, its availability, depth of trade, and who started the transactions.

–Also, they get updated in real time and demonstrate if a coin (e.g. Bitcoin) has a high liquidity, so you can get a quick answer on whether you will be able to buy or sell it quickly.