Success of any trading (crypto or not) heavily depends on the technical analysis you conduct. It is a cornerstone of getting results consistently rather than on a luck basis. The key tools traders use in the analysis are of course different charts and graphs that for the most part represent the dynamics of either price or volume defined parameters. With this article we want to cover the most common cryptocurrency charts you will see on exchanges and tools crypto traders use in their work.

Line price chart

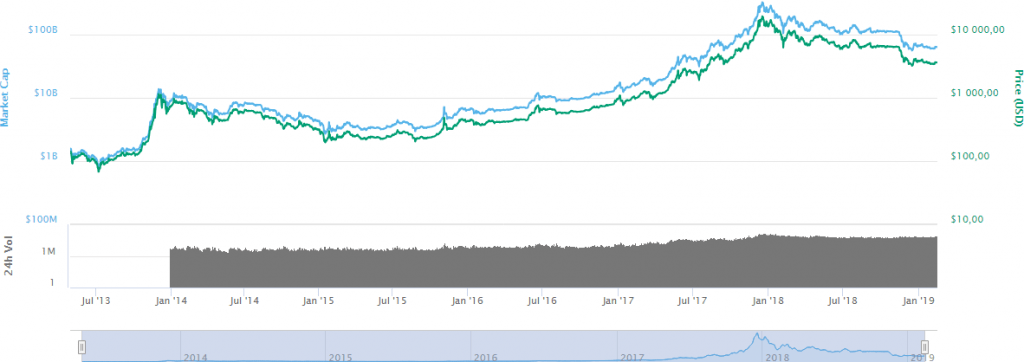

The most basic price chart in technical analysis is a line chart. This type of chart is used to get an insight on crypto price changes over a given period of time represented by a line. The price chart is based on the close cryptocurrency price of the day. Line charts may also have two scales: linear and logarithmic. In the linear chart, price scale is divided into equal pieces. In the log chart, crypto price is scaled according to percent changes, so if two price changes are different in absolute value yet equal in percentage they will both be represented by the same vertical shift on the log scale. With linear chart you can better judge the speed of price change whereas log charts are more obvious in terms of seeing the trend and cryptocurrency traders look at both.

Linear Chart (Bitcoin price)

Logarithmic Chart (Bitcoin price)

Often, you can also see the volume indicator displayed at the bottom of the cryptocurrency chart. Volume shows the amount of coins that have been traded for the set period, don’t mistake it for a market cap. Volume is considered to be the most basic indicator of crypto price direction in technical analysis, and it is also helpful in trying to understand where the price will go next. For example, if the price of a coin increases with maximum volume, it means that many traders have started to make moves. In this case, the price will probably keep on increasing. When the volume is low and the price decreases, then not many people are buying or selling cryptocurrency.

Candlestick chart

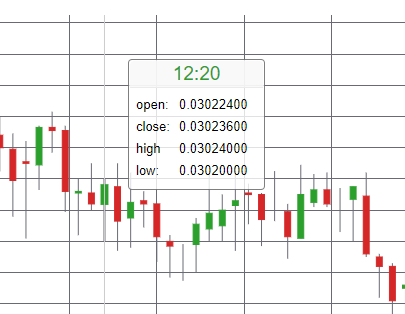

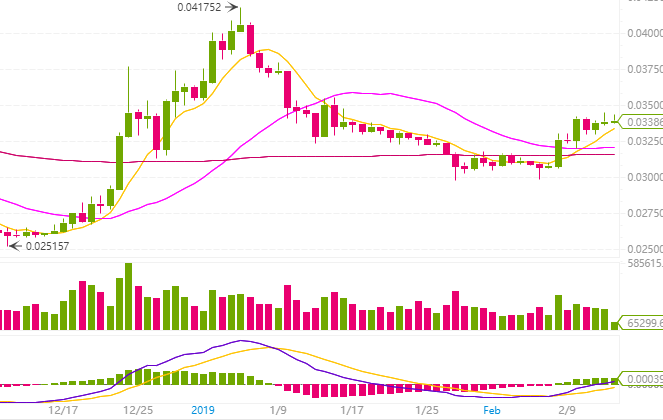

Candlestick charts is another way of representing crypto price moves. It contains more information as it not only shows price change based on the close market price but its movements within a certain period of time: each candle shows what was the highest and lowest price, what was open and close price. That is why this type of charts gained popularity amongst crypto traders all over the world and is preferred over line charts.

Let’s see how the candlestick crypto chart is built. Each candle consists of three parts: the upper tail, the lower tail, and the body. The upper tail indicates the highest price traded while the lower tail shows the lowest price. However, sometimes there are no upper or lower tails, because opening/closing price of cryptocurrency is almost the same as lowest or highest price.

The body is usually colored green or red. The color depends on whether it was a “bullish market” or a “bearish market”, i.e. whether the closing price was higher than the opening price (green, bullish), or lower (red, bearish) at some specific period of time within the selected time frame. (For example, TradeSanta platform provides users with six time frame options from min. 6 hours to max. 1 week).

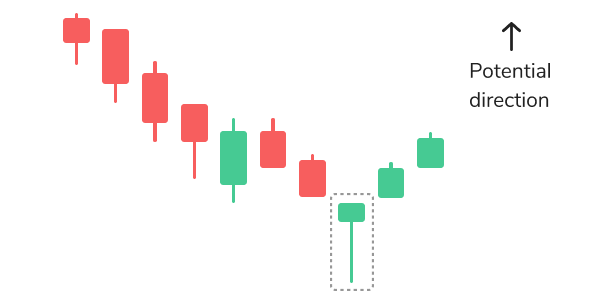

Various shapes of candles and their combinations in technical analysis give crypto traders info about trends and their changes. There are more than 10 types of candlestick patterns, but in this article we will try to cover the most frequently occurring ones. The first one is hammer candlestick pattern which belongs to bullish patterns. It represents a short body with a lower tail, such pattern can be seen at the bottom of the downward trend. Inverse hammer also belongs to bullish patterns, and it implies that buyers are being in control of the crypto market.

The most common bearish candlestick patterns are hanging man and shooting star. The hanging man has the same form as a hammer, but it can be found at the end of the upwards trend. It means that buyers managed to increase the price of cryptocurrency again.

The shooting star is shaped the same way as the inverse hammer, but is formed in the upwards trend. The shooting star pattern might indicate that the uptrend is over and it is time for a bear market.

When there is no change in the cryptocurrency market, then you can see so-called continuation candlestick patterns. Dojis form when the market’s open and close prices are equal, and it’s shape is similar to a cross, but with a bigger body.

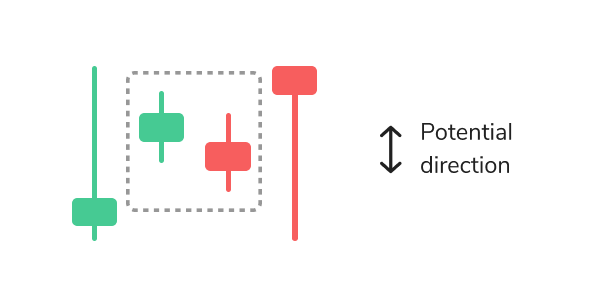

When you get familiar with these basic patterns, you will start paying attention to their combinations, such as two- or three- candlestick patterns, which will help you to predict the further direction of the coin’s price.

When you get familiar with these basic patterns, you will start paying attention to their combinations, such as two- or three- candlestick patterns, which will help you to predict the further direction of the coin’s price.

What is more, when you start exploring charts on crypto exchanges, you can also see several colored lines:

These lines in technical analysis are known as Moving Averages indicators, they are based on the average price of a coin based on its value for the past period of time. Usually exchanges show 3 moving averages: based on the close prices for the previous 7, 25 and 99 days. This indicator is one of the tools to determine trends and signals for entering and exiting position.

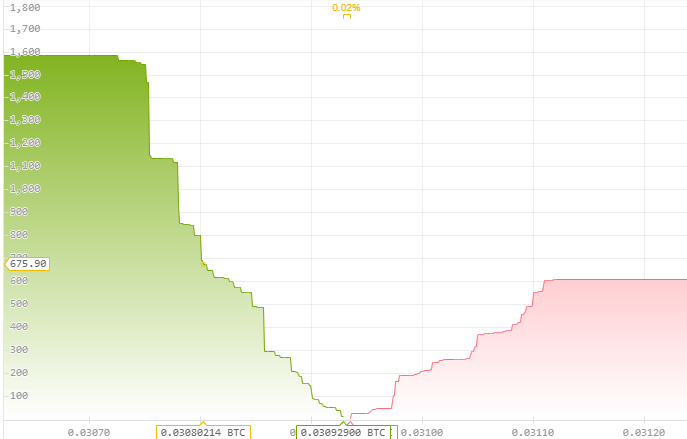

Market Depth chart

Market depth chart gives you an idea about Supply and Demand situation on the crypto market. You can determine sell (red) and buy (green) orders without any difficulty. The green side shows a total number of coins that have buy orders at the current price, while red side shows the amount of cryptocurrency with sell orders at the current price. The centre, where two lines meet each other, represents the current market price. If you place the cursor on any point on the green or red line, you will see how much exactly you could buy or sell (vertical axis) at some specific price (horizontal axis).

You should note that slopes and walls change very rapidly, capturing how things would happen at the time a buy or sell order occurs. Market Depth chart reflects whether the price of crypto will most probably increase or decrease. If buy orders exceed sell orders then the price will go up.

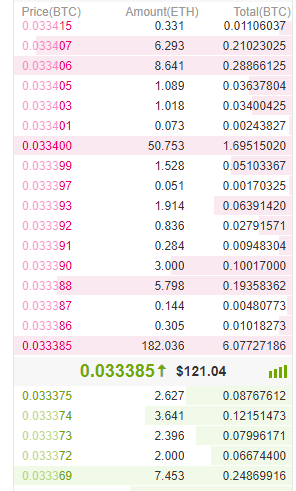

Next to the Market Depth chart, you can see the Order Book, which represents a real-time list of buy and sell orders.

The buy-side is usually displayed in green while sell-side in red. Event though it may look a bit different on various cryptocurrency exchanges, the principle remains same. The buy-side shows open buy orders below the last traded price (known as “bid”) and the sell-side shows all current sell-orders above the last traded price (known as “ask”).

The buy-side is usually displayed in green while sell-side in red. Event though it may look a bit different on various cryptocurrency exchanges, the principle remains same. The buy-side shows open buy orders below the last traded price (known as “bid”) and the sell-side shows all current sell-orders above the last traded price (known as “ask”).

Conclusion

Reading cryptocurrency charts is an essential skill that every trader needs to gain. The basic charts and explanations covered in this article, hopefully, will help you to get an overview about crypto exchanges and to realize that reading charts is not complicated as it may seem at first.

FAQ

What is line price chart?

The most basic price chart is a line chart, since this kind of chart is used to get an insight on crypto price changes over a given period of time represented by a line.

What is candlestick chart?

Candlestick chart contains more information as it not only shows price change based on the close market price but its movements within a certain period of time: each candle shows what was the highest and lowest price, what was open and close price.

What is market depth chart?

Market depth chart gives you an insight on Supply and Demand situation on the market. You can determine sell (red) and buy (green) orders without any difficulty.