If you’ve been around in crypto for some time, you’ve definitely heard about pump and dump schemes. The idea behind it is pretty straightforward, since the name speaks for itself: a group of interested people buy some digital asset, usually one with a small capitalization, “pump” its price by promoting it everywhere possible to draw more investors’ attention using misleading information, and then sell these assets when the increased activity has driven the price sky high, leaving everyone else with almost a worthless coin and lost investments. However, even though it might look simple, there are many details and misinterpretations that remain hidden from an average trader.

Today, we will dive deep into one of the most notorious fraud schemes out there in the crypto space!

Pump and dump in the stock market. The roots of the scheme

Pump and dump scheme is not something new, and it wasn’t born in the crypto space. In fact, this phenomenon of price manipulation is quite old, and takes its roots in the stock market. Let us briefly turn to history here.

The very first documented pump and dump scam happened in 1720, and is known as the South Sea Bubble.

This hoax was centered around the South Sea Company, which was founded in 1711 to trade (mainly slaves) with Spanish America. It was doing great for years, and the company’s stock, with a guaranteed interest of 6%, sold well at that time. In fact, the faith from investors was so great that even King George I of Great Britain decided to become a governor of the company in 1718, thus adding even more confidence in the company, and soon it started paying 100% interest. The stock price rose dramatically, from £128 in January to more than £1000 in August.

Things were doing so well that the company proposed to the British Parliament to take over the national debt, and this proposal was accepted. All that led to a massive rise in stock prices, and soon many of those who wanted to buy them just couldn’t do that since the price was ridiculously high. However, the company’s promoters managed to persuade new investors to dive deep into debt and spend whatever they could on the company’s stock.

They did that by spreading false rumors that the Spanish government had opened all their ports for British ships, while in fact only 3 ships per year were allowed to dock to Spanish ports. However, everything changed in 1720.

In September 1720, the market collapsed, and three months later, by the end of 1720 South Sea shares were down from more than £1,000 to £124, thus bringing down all the investors’ money and the company’s bank. In 1750, most of its rights were sold to the Spanish government.

It is worth noting that, in fact, the founders of South Sea Company never intended it to end up a scam, at least not in the way it happened. They wanted it to stay successful, while skimming profits for themselves.

In the end, after the bubble burst most of the company’s directors fled the country, and the company’s secretary Sir John Blunt was sent to jail.

Stating the exact numbers of how much the interested people have made on that pump and dump here might be a challenge, since Blunt was giving bribes left and right. Still, some sums are very well known. For instance, John Aislabie, chancellor of the exchequer, was granted with £77,000 in stocks, which he sold for nearly double that sum. In today’s currency, that would be around 22 million in USD.

You might’ve thought that the grim fate of South Sea Company and its directors would’ve served as an example to potential investors and traders of how you should not do business. Unfortunately, it did not, and this cycle continues nowadays.

Pump and dump scam in the modern era

You’ve probably seen Martin Scorsese’s movie “The Wolf of Wall Street”, right? The story of Jordan Belfort and his Stratton Oakmont company is just one of the many other examples of how pump and dump schemes work. In the 1990-s, Belfort and his company were selling cheaply purchased stocks to gullible investors using misleading positive statements, pumping their price and then cashing out at the time when price hit record height. Belfort was sentenced to jail and spent 22 months in prison.

Another example of a modern pump and dump fraud scheme was performed during the dot-com bubble. A 15-year-old Jonathan Lebed was profiting from buying penny stocks and then promoting them on numerous message boards, thus increasing their value to sell them for profit in the end. He allegedly made around $800,000 before the U.S. Securities and Exchange Commission (SEC) filed a civil suit against him. Lebed was sentenced with fraud, and had to pay a $285,000 fine.

There are numerous other cases of pump and dump that happened in the stock market, like the Park Financial Group case or Morrie Tobin’s fraud scheme. However, since there are strict regulations regarding the stock market’s pumps and dumps scheme (e.g. Rule 10b-5 of the Securities Exchange Act) that can force criminals to be brought into the courtroom, such cases usually end well in terms of justice. Certainly, it won’t bring back the investments that are gone, but at least the responsible people face trial. Unfortunately, in the world of crypto the situation is much more complicated.

How does pump and dump work in cryptocurrency

The cryptocurrency pump and dump does not differ much from the one seen in the stock market. A group of traders buys a relatively unknown cryptocurrency, then makes it viral on social media (especially on Telegram channels and Discord servers, where most crypto enthusiasts hang out), and waits for the word to reach gullible investors. When the price is significantly boosted, the group of traders who participate in the scheme cash out quickly, thus dumping the coin’s price, and unsuspecting traders are left without their investments.

Since the crypto world is decentralized and allows people to stay anonymous, it is nearly impossible to track down the people who are responsible for this fraud. Moreover, there is no need for brokers or middlemen here, or for time-consuming promotion via phone or email newsletter—everything can be done in a matter of hours from your phone or PC. So, whereas Jordan Belfort and his entire company had to spend days and weeks selling enough penny stocks to more and more investors, in the crypto world you could pump and dump one coin, make potentially huge returns, and then switch to a new coin all in the same day.So the scope has increased and the time frame has decreased. However, our story wouldn’t be complete without mentioning the crypto pump and dump groups, the ones where all the coordinated action happens.

Crypto pump and dump groups

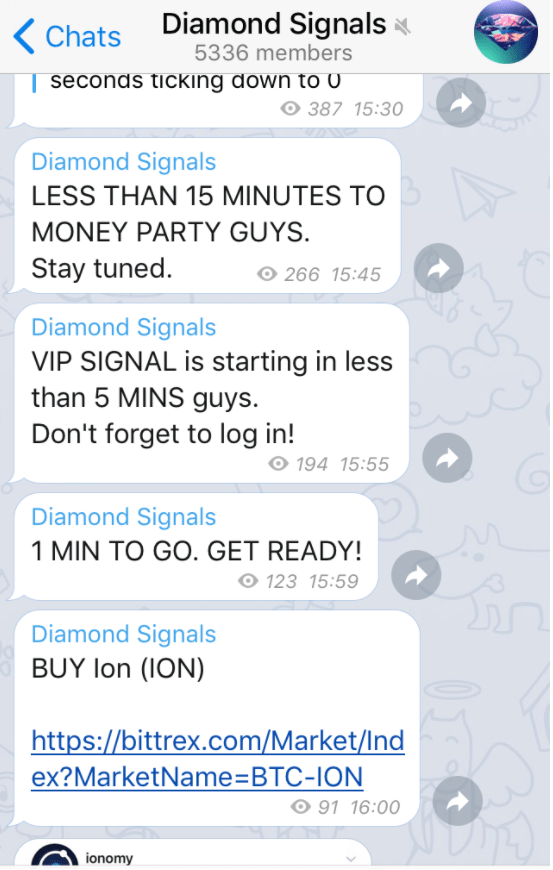

There are numerous so-called “signal” groups out there in Telegram and Discord: Galactic Pump, Voyager Pump, Diamond Signals, you name it. Some of them are free to enter, but there are groups which can charge up to $1,000 for membership, meaning that the people behind the group make money regardless, and other members of the group just gambling and must hope that their internet speed won’t let them down at the right moment. Moreover, some groups have ranking systems that are based either on the “donation” you’ve made or on how many friends you have brought into the group.

Those who achieve high ranks may get the “signal” (coin’s name and contract) a few seconds or minutes earlier than the rest of the group members. So the chances that you’ll be able to make money are really slim, but that doesn’t stop naive traders from participating in this scam. Sad truth is, even those who get the VIP access and get the information sometime before the “pump”, cannot be considered as true winners, since the coins have already been purchased by the admins of the group. That means, the organizers make money on everyone regardless of their status.

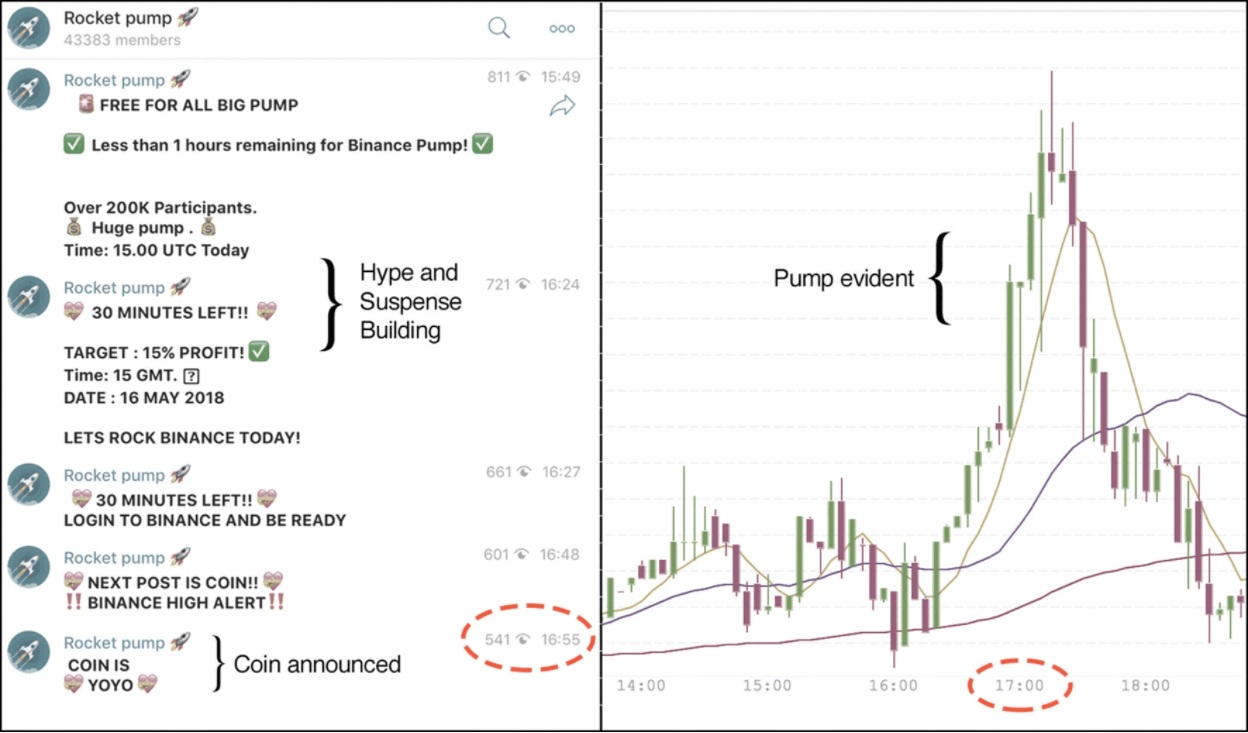

Here’s an example of how Rocket Pump was able to increase volume by utilizing its members. Take a look at how the price increases just before the announcement (due to “VIP” members and probably the organizers) and then skyrockets within 5 minutes of the announcement.

How to spot pump and dump schemes (and avoid them)

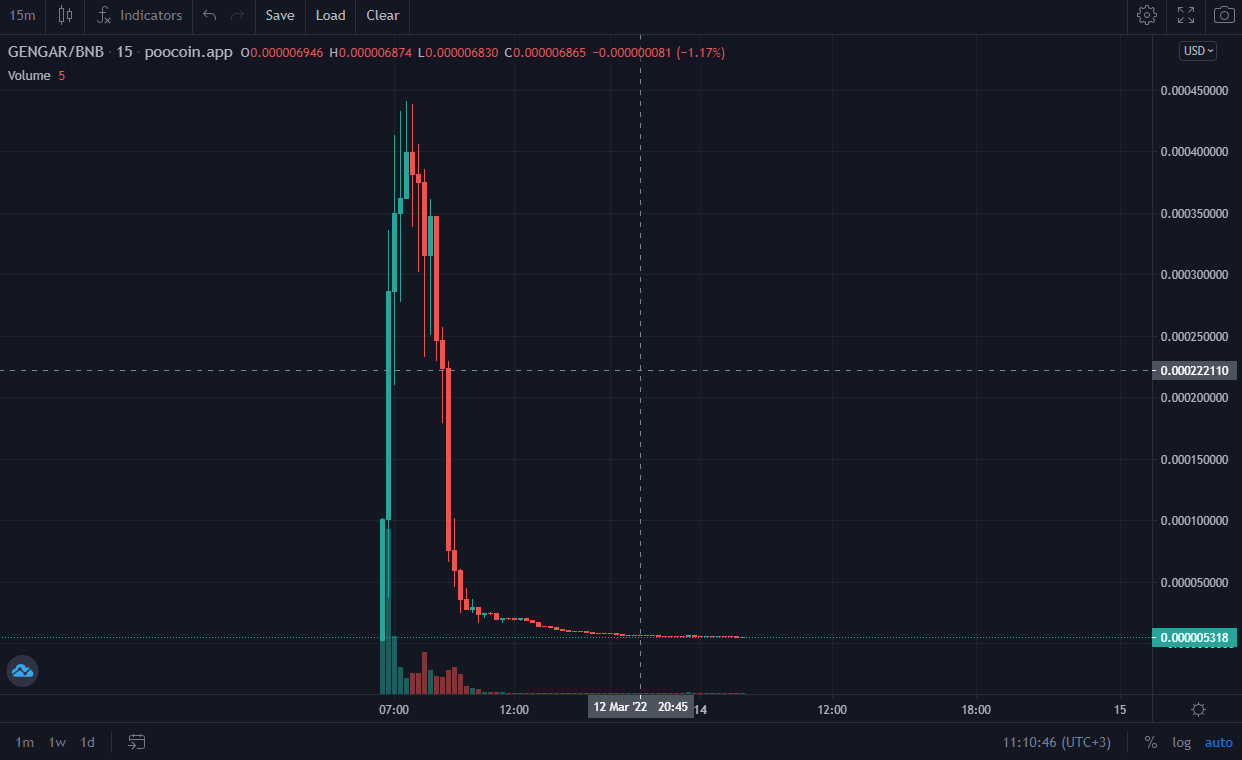

When you see a chart like the one below, you can easily point a finger and say “Aha, this one is a pump and dump scam”. However, it won’t help you much when the scam has already happened and you’re left with peanuts instead of large gains. To avoid it, a trader should be able to tell beforehand if the coin he is planning to invest in has the signs of a potential pump and dump scam if he or she doesn’t want to lose the investments. So what can you do to prevent yourself from being dragged into a fraud?

First of all, DYOR, or Do Your Own Research. This golden rule should be applied to almost every step that is taken when you deal with digital assets. However, crypto investors must be on high alert when dealing with online frauds like pump and dump. That means, when you see someone is promoting some shady and unknown “hidden crypto gem” on social media, don’t just blindly rush to buy it. Read the whitepaper first (if there is one, of course), check the social media accounts, find out who is behind it and what goals these people are trying to achieve. Ask yourself if this coin has long-term potential.

Secondly, if you follow some crypto influencers or so-called “call groups” and they suddenly begin to promote a cryptocurrency that is promised to give you huge returns, then that’s a big red flag. Why all of a sudden are these people promoting this coin? What are they after? Remember, if the project is solid and destined to be successful, it does not need aggressive marketing and hard promotion to gain as much attention as possible in a short period of time.

Thirdly, always check the trading volume first. If you can see a huge buy wall that happened recently, but now there is only a thin volume pushing the coin up, then this is another red flag. A solid project has a solid trading volume when entering or exiting, which does not move the whole chart up and down.

Last but not least, it might be a good idea to stick to major exchanges like Binance, OKX, Coinbase, or Huobi, to name a few. The major crypto exchanges look after their reputations and do whatever they can to not list suspicious and thinly traded coins with small capitalization, the ones that are commonly used in pump and dump schemes. Certainly, no one can give you a 100% guarantee, but sticking to major and well-known exchanges can minimize the risk.

Is pump and dump illegal in crypto?

While pump and dump is strictly illegal and punishable by law in stock markets, the same thing cannot be said about crypto.

From the legal standpoint, there are still no strict frameworks and regulations, so the answer to this question is “no” rather than “yes.” However, even though the SEC still hasn’t implemented the same rules for crypto as it has already implemented for the stock market, we might see the crypto market start self-regulating itself. Because let’s be honest, regulated or not, it is a scam.

Michael Jackson, Mangrove Capital’s General Partner believes the crypto market will move to self-regulate and crypto exchanges will make sure traders act “in certain ways and with good procedure”, just like the stock exchanges do.

The idea of self-regulation has long been discussed on every possible level: let the crypto handle it, since the traditional agencies simply do not have any expertise or tools to control it. Still, it might take years from now on before we see some steps and first achievements in that area.

FAQ

Is crypto a pump-and-dump scheme?

The cryptocurrency pump and dump does not differ much from the one seen in the stock market. A group of traders buys a relatively unknown cryptocurrency, then makes it viral on social media (especially on Telegram channels and Discord servers, where most crypto enthusiasts hang out), and waits for the word to reach gullible investors.

Is crypto pumping illegal?

While pump and dump is strictly illegal and punishable by law in stock markets, the same thing cannot be said about crypto. From the legal standpoint, there are still no strict frameworks and regulations, so the answer to this question is “no” rather than “yes.”