Paying taxes from your crypto profit is as much an important part of your trading routine as choosing the relevant strategy or picking a suitable trading pair. Depending on your country, however, some of the matters that are related to crypto taxes may vary. Still, even though this article focuses on the U.S, similar concepts are applied in most other countries.

We will discuss the topic of taxes, including such questions as how to report crypto on your taxes and when you have to pay them.

The Basics Of Cryptocurrency Taxes

In the USA, the Internal Revenue Service (IRS) treats cryptocurrencies as property for tax purposes. So what does that mean? Should you pay taxes for simply holding a cryptocurrency?

Not at all. Simply owning and holding cryptocurrencies does not expose you to tax liabilities. However, when your crypto investment increases in price and you sell them to gain a profit, or you perform any other kind of investing activity (e.g. staking or lending), then this kind of income is subject to taxes just like any other form of income.

Imagine if you bought Ethereum for $1,000 and then, three months later, you sold it for $2,500. That leaves you with a $1,500 capital gain, and it must be reported on your tax return.

But what if your crypto trading activities resulted in a loss rather than a profit? Should you still report this loss on your tax return?

The answer is yes, you must do that. Reporting on your capital losses may actually be beneficial for you since they lower your taxable income and, thus, depending on your capital losses, the total amount that you should pay in taxes will be decreased. Still, trading crypto is not the only activity that is taxed.

To sum up, IRS highlights these activities to be a subject to taxes:

- Trading cryptocurrency to fiat money

- Trading cryptocurrency for another cryptocurrency

- Purchasing services and goods using cryptocurrencies

- Earning cryptocurrency as your income (including mining, staking, lending, etc)

When don’t you need to pay taxes?

- Buying and holding cryptocurrencies

- Transferring crypto from one wallet to another

In most cases, the tax year in the United States coincides with the calendar year, and starts on January, 1st. The difference is that the fiscal year lasts 12 consecutive months, but ends on the last day of any month except December: a tax year varies from 52 to 53 weeks but does not have to end on the last day of a month. The US citizens should file their taxes until April 18th, unless they ask for a six-month extension. Keep in mind that an extension of time to file is not an extension of time to pay!

Another important consideration is tax rates, which vary depending on your tax bracket and the type of gain, whether long-term or short-term. We will cover the tax rate topic down below.

Crypto tax rates: How are crypto taxes on capital gains determined?

The time length of your cryptocurrency holdings is the main factor that determines how your crypto activity will be taxed. Keep in mind that your holding period starts on the day of acquiring a cryptocurrency.

Basically, there are three types of capital gains: long-term, short term or ordinary income. Let’s take a closer look at each one of them.

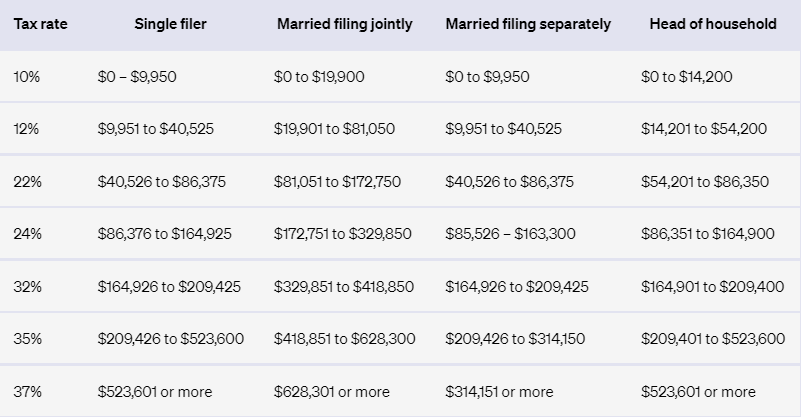

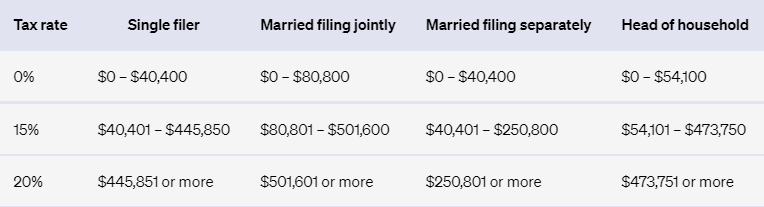

Ordinary income refers to cryptocurrency that has been earned via staking or mining. Ordinary income gain tax rates range from 10% to 37%, thus making it the type of gain with the highest tax rates.

Depending on the tax brackets you fall under, you will have to pay a certain percentage of tax on your capital gain. There are seven tax brackets for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Keep in mind that for the year 2022 the taxes will differ from those in 2021!

Short-term capital gains refer to gains on assets held for less than 12 months. Short-term capital gains tax rates range from 10% to 37%, so they are taxed just like ordinary income.

Long-term capital gains refer to gains on assets held for 12 months or more. The long-term capital gains tax rate ranges from 0% to 20%, depending on your income level.

Ordinary income vs. Capital gains. How to distinguish?

We’ve already mentioned the capital gains events above. Thus, trading crypto for fiat, trading crypto for crypto and using crypto to buy services and goods refer to capital gains events. But what about ordinary income?

The following events fall within ordinary income:

- Getting cryptocurrency as an airdrop

- Paycheck received in cryptocurrency

- Mining and yield from staking

- Receiving cryptocurrency as a referral bonus

- Yield from lending crypto

How to calculate your crypto taxes?

When calculating capital gains and losses from your crypto activities such as trading, earning, or selling, you must apply this formula:

Fair Market Value – Cost Basis = Capital Gain/Loss

Let’s look at these components in details, as well as accounting methods below:

Fair market value

Fair market value refers to the value of a cryptocurrency at the time of selling it on the market. Typically, fair market value is calculated in USD.

Cost basis

The cost basis is the amount of money spent on purchasing a cryptocurrency.basis includes not only the purchase price but also other expenditures, such as fees (e.g., the Ethereum “gas fee”).

For instance, if you used $1,500 USDT to swap for 1 ETH on Sushiswap, and had to pay $50 in “gas fee,” then this fee can be added to your ETH’s cost basis, and thus it will be equal to $1,550.

Accounting methods for crypto tax

When dealing with crypto, the IRS allows taxpayers to choose specific identification accounting they will use each year. Each of these methods can produce a different tax basis and different gains and losses. So why does the accounting method matter here?

The answer is that, when chosen appropriately, the accounting method can help you reduce your crypto tax. Let’s take a look at the 3 most common accounting methods.

FIFO (First in, first out): Assets purchased first are sold first

First in, first out stands for the first coin that you acquire is the first one that is counted for a sale.

For instance, you buy 1 BNB on September 1st for $350. Then, on September 10th, you buy another BNB for $450. Three weeks later, on October 1st, you sell one BNB for $600.

If we apply the FIFO method here, then the purchase price of the BNB that you sold in October would be $350, and that would be your cost basis.

Keeping that cost basis in mind, when you sell at the price of $600, your capital gain would be $250 in this case. Thus, you would have to pay the tax on that sum of $250.

LIFO (Last in, first out): Assets purchased last are sold first

Last in, first out means that the last coin that you purchase will be the first one that you sell.

We can use the abovementioned example to better understand LIFO here.

When applying LIFO, your cost basis would be $450 since that was the price of the BNB coin that you bought last. That means the capital gain would be $150, and thus you’ll have to pay a lesser tax due to the smaller capital gain in case you decide to use the LIFO method.

HIFO (Highest in, first out): Highest price assets are sold first

Highest in, first out method refers to selling the cryptocurrency with the highest cost basis first.

If we look at our example above, then applying the HIFO method would lead to the same total gain as the LIFO method.

This kind of accounting method might be useful when you have dozens, even hundreds of trades, and selling the highest-cost basis cryptocurrency first might help you with tax savings.

HIFO is also called a “tax minimization” method as using it as your accounting method can lead to the largest capital losses and the largest capital gains.

As you can see, the most simple and conservative method is FIFO. However, HIFO and LIFO can be more helpful to you in terms of tax minimization.

Certainly, you are in no way forced to use only one accounting method for the rest of your life, as you are allowed to change them from year to year. However, if you pick one specific accounting method, then you’ll have to uphold it until the next tax year starts.

What data do you need for accounting methods?

If you address to the official IRS Guide, then it will tell you that you need the following data for your accounting methods:

- The time and date of each unit’s purchase

- Cost basis and fair market value of each asset at the time they were purchased

- Time and date each asset was sold or disposed

- The fair market value of each asset when sold or disposed, and the amount of money/value of property received for each asset

In the “traditional” financial market, you can ask your exchange to issue a Form 1099-B to report non-employment income to the IRS. This form particularly reports capital gains and capital losses from trading stocks, options, and other types of securities, so this could make your tax reporting easier. However, even though some of the crypto exchanges may issue this form, it is still mostly uncommon in the crypto world, and thus you’re the one who is responsible for tracking all your activities with cryptocurrency and keeping a record of all the relevant data.

How to lower your crypto taxes?

There is a certain way of reducing your crypto taxes by applying tax-loss harvesting practices. Tax-loss harvesting refers to selling a capital asset at a loss to offset a capital gains tax liability.

The IRS allows you to deduct up to $3,000 in capital losses from your ordinary income each year. If your net losses exceed $3,000, then they can be carried over into future years. However, keep in mind that capital gains can only be offset with the same type of losses; that is, short-term losses are used to reduce short-term gains, and long-term losses are used to reduce long-term gains.

How to report your crypto taxes?

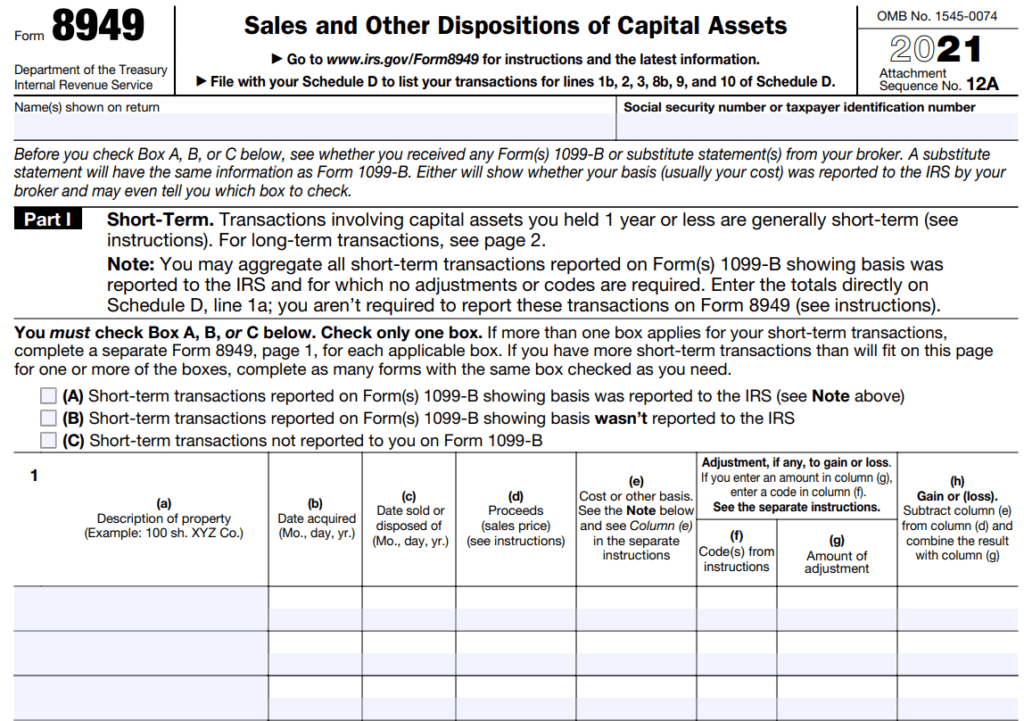

To report all your crypto disposals, first you should use the IRS Form 8949. Remember, you must report both your capital gains and losses, since every taxable activity and event is a subject to report to the IRS.

Apart from capital gains and capital losses, you should also include the following information:

- Description of property (i.e. crypto)

- The date you acquired the property

- The date you sold/disposed the property

- Proceeds (sales price)

- Cost basis for purchasing the property

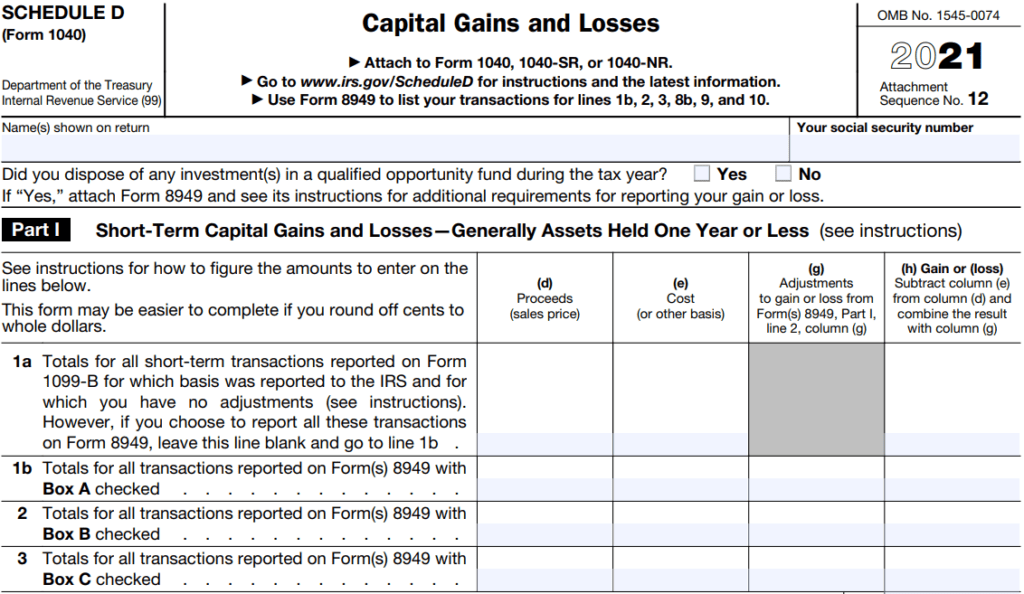

Once you’re done with filling the form 8949, you should transfer your total net gain or net loss from form 8949 on Schedule D, Form 1040. In this Form, you can report capital losses and capital gains from all your sources.

In case you earn cryptocurrency income from staking, mining, referral bonuses or as paycheck, then you should also fill additional forms:

Schedule C, form 1040 is used when you earn cryptocurrency as payment for a job, or if you have a mining farm.

Schedule 1, form 1040 is used when you earn your cryptocurrency via forks, airdrops or as your hobby. This should be reported as other income.

Schedule B, form 1040 is used when you earn cryptocurrency via lending or staking.

Tax reporting for automated trading bots users

It might be exhausting to put together all the data regarding your trade history and report all your crypto transactions and deals to the IRS if you use algorithmic trading, especially if you do that on a variety of exchanges. However, there is a way to make things easier.

The vast majority of crypto exchanges allow you to export a CSV file that has the records for every transaction and trade that you made throughout the year. Once you’ve retrieved this data, you can put all your trades together in one spreadsheet and do all the needed calculations either by yourself or via cryptocurrency tax software.

So, if you are an active trader with hundreds of trades and multiple wallets and/or exchange accounts, you might need some crypto-focused tax software programs to make your life easier. You can learn more about such software here!

What if you don’t report your crypto taxes?

If you intentionally choose not to report your crypto gains, income and losses to the IRS, then you’re committing tax fraud.

The IRS can conduct a criminal investigation, and depending on your situation, you may incur penalties ranging from a fine of up to $100,000 to five years in prison.

Even though the crypto industry is still young and continues to evolve, the situation in 2022 is different than it was, say, in 2013. The IRS is keeping an eye on the cryptocurrency market, and tax dodging will definitely get you into trouble.

So the best thing you can do is to keep all the records and data and pay your taxes on time, especially since this process is pretty much clear and straightforward.

FAQ

How to calculate your crypto taxes?

When calculating capital gains and losses from your crypto activities such as trading, earning, or selling, you must apply this formula: Fair Market Value – Cost Basis = Capital Gain/Loss

How to lower your crypto taxes?

There is a certain way of reducing your crypto taxes by applying tax-loss harvesting practices. Tax-loss harvesting refers to selling a capital asset at a loss to offset a capital gains tax liability.

The IRS allows you to deduct up to $3,000 in capital losses from your ordinary income each year. If your net losses exceed $3,000, then they can be carried over into future years.