- What Are Crypto Futures Contracts and How Do They Work?

- Understanding Crypto derivatives: Perpetual, Standard, and physical delivery

- Where to Invest in Crypto Futures

- Trading Bitcoin Futures

- The risks of trading futures: margin and leverage

- Conclusion

Crypto spot markets are like your traditional market where commodities, currencies, stocks, and bonds are bought and sold instantly. For example, Bitcoin trading in the spot market happens when traders match buy and sell orders.

A futures market is like an auction market where traders buy and sell crypto futures contracts for delivery on a specified date in the future.

Crypto futures are financial derivative contracts that bind two parties to trade an asset at a predetermined price and date in the future. In crypto futures trading, the buyer or seller must buy or sell the underlying cryptocurrency at the set price regardless of the asset’s current spot price at the contract’s expiring date.

Futures contracts specify the quantity of the underlying asset and are standardized to make futures trading easier. Cryptocurrency futures markets play an important role in how we value cryptocurrencies.

Here’s what you must take away from this:

- Crypto futures are a type of crypto derivatives in which the buyer agrees to buy digital assets at a predetermined future date and price.

- An investor can speculate on the direction of a security, commodity, or financial instrument using a futures contract.

What Are Crypto Futures Contracts and How Do They Work?

Traders can speculate on the spot price of bitcoin using crypto futures. These contracts have set prices, and expiration dates known in advance and usually identified by their expiration month. For example, an August Bitcoin futures contract this year expires in August 2021.

A real-world example is the best way to explain futures contracts. Let’s say the price of 1 Etheruem (ETH) is currently 2,000 USDT. John — an avid crypto trader — speculates that ETH’s value will rise, and then he decides to purchase five futures contracts. The position now has a value of 10,000 USDT.

John was correct, and each contract now has a value of USDT 4,000. Now he can sell the five contracts for a total of 20,000 USDT, earning 10,000 USDT in profit.

The buyer of a futures contract is obligated to purchase the underlying digital assets (or their cash equivalent) at the expiration date and not before.

Pros of crypto futures trading

- Crypto futures contracts may only require a fraction of the contract’s value to be deposited with an exchange. This is known as the margin

- Active traders can boost their profit margins from trading drastically by speculating on the price movements of cryptocurrencies.

Cons of crypto futures trading

- Because futures use leverage, there’s a great risk of losing more than the initial margin amount.

- Margins are a double-edged sword that can amplify your gains and also your losses. This is especially risky in the volatile crypto market

When you buy or sell contracts representing the value of a specific cryptocurrency in the futures market, you do not own that crypto.

In simpler terms, buying a bitcoin futures contract is not the same thing as buying bitcoins. Instead, you own a contract that obligates you to buy or sell a specific cryptocurrency at a particular time in the future.

If you think a token’s value will rise, you buy a futures contract to go long, and if you think it will fall, you sell to go short. The outcome of your prediction determines whether you make a profit or a loss.

Cryptocurrency exchanges like Binance Futures make it easier to trade cryptocurrency futures. Derivative exchanges, like spot exchanges, are open 24 hours a day, seven days a week.

Understanding Crypto derivatives: Perpetual, Standard, and physical delivery

Perpetual Futures Contract

A perpetual contract, unlike traditional futures contracts, does not have an expiration date. As a result, traders can stay in a position for as long as they want. In addition, perpetual contract trading is based on an underlying Index Price. The Index Price is the average price of an asset calculated using major spot markets and relative trading volume.

Perpetual contracts are often traded at prices that are equal to or very similar to spot markets. The mark price may differ from the spot market price in extreme market conditions.

Physical Delivery

The buyer of a physical delivery future must purchase the underlying asset from the seller at the expiration date. This means that the seller must own the underlying asset in order to deliver said asset to the buyer. Bakkt and CoinFlex are two examples of exchanges that require physical delivery.

A physically delivered bitcoin futures contract is a derivative contract to buy (“long position”) or sell (“short position”) a specified amount of bitcoin at a specific time in the future for a specific price (“contract price”) at a particular location.

The delivery process begins following the last trading day. At this time, holders of open positions must’ve submitted a notice of intention to make/take delivery of the bitcoin. The clearing organization then assigns delivery and receipt obligations to holders of open positions.

Inverse Contracts

Inverse contracts use BTC/ETH/EOS/XRP as the base currency. Traders need to confirm traded quantity in USD (Quoted currency) and then use their base currency (BTC, ETH) to calculate margin, profit, and loss.

If you want to trade a BTCUSD contract, you’ll have to use BTC as your base currency. For example, when BTCUSD is at $40,000, entering a long position of 80,000 BTCUSD contracts is equivalent to holding a 2 BTC long position.

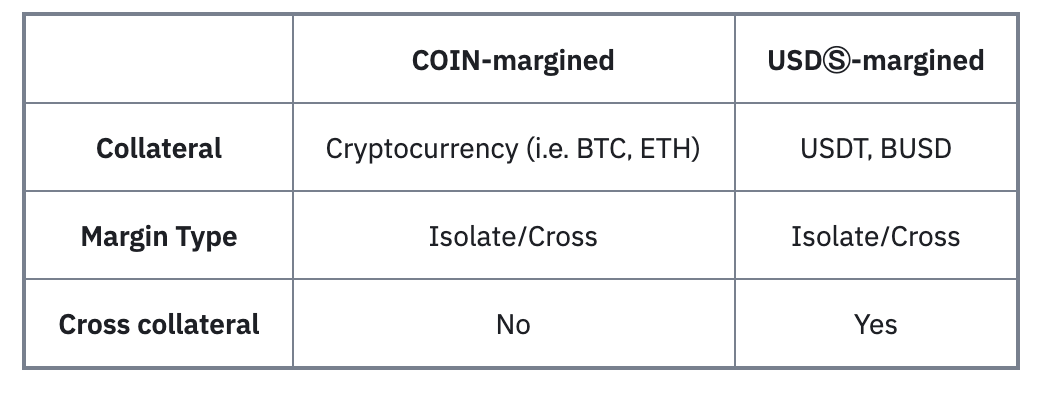

USD-margined Futures Products

Most crypto derivatives exchanges offer both USDⓈ-margined Futures and COIN-margined Futures products. For example, USDT-margined contracts on Binance offers the following:

Settled in USD-pegged assets: contracts are settled in USDT or BUSD.

Expiration: Perpetual and Quarterly.

Clear pricing rules: Each futures contract specifies the quantity of the base asset delivered per “Contract Unit.”

Advantages: In USDT or BUSD settlement, you can easily calculate your returns in fiat. This simplifies USDⓈ-margined contracts. For example, if you gain 1000 USDT, you can easily estimate that your profit is worth $1000, as 1 USDT is closely tied to 1 USD.

COIN-margined Futures products

Settled in cryptocurrency: contracts are settled in the underlying cryptocurrency, eliminating the need for holding stablecoins as collateral.

Contract Multiplier: Each BTC futures contract represents 100 USD, while each ETH futures contract represents 10 USD. For example, 1,000 USD of BTCUSD Quarterly 1225 equals 100 USD x 10 contracts, and 1,000 USD of ETHUSD Quarterly 1225 equals 10 USD x 100 contracts.

Expiration: Perpetual, Quarterly, and Bi-Quarterly

Advantages: This option is ideal for miners or HODLers. Because contracts are settled in cryptocurrency, and you can add the profits to your long-term stack. Also, as prices rise, your collateral’s value rises. It’s also a great way to increase your cryptocurrency holdings.

Where to Invest in Crypto Futures

Top 3 Exchanges for trading crypto derivatives

According to CoinMarketCap, these are the top cryptocurrency derivatives exchanges by trading volume.

1. Binance (Volume: 2,514,058 BTC)

Binance offers a broad range of crypto derivative instruments, including:

- USD-Margined Futures Contracts: Supports perpetual and delivery contracts and settled in USDT.

- Coin-Margined Futures Contracts: Supports perpetual and delivery contracts settled in cryptocurrency.

- Binance Leveraged Token: allows traders to gain increased exposure to a specific crypto asset without worrying about liquidation risks.

- Binance Options: – simplifies options trading for retail users.

2. OKX (Volume: 372,198 BTC)

OKX currently offers leverage of up to 100x, depending on the type of financial instrument. Here are the different crypto derivatives offered at OKX.

- Coin-Margined and USD-Margined Futures contracts: These futures contracts can be traded weekly, bi-weekly, quarterly, bi-quarterly at OKX. But before trading them, you’ll have to set your margin parameters by selecting either cross-margin mode or the fixed-margin mode.

- Perpetual Swaps: OKX has made Perpetual Swaps available for 23 different cryptocurrencies.

3. ByBit (Volume: 365,564 BTC)

ByBit is one of the fastest-growing cryptocurrency derivatives exchanges. They offer:

- Inverse perpetual contracts (BTCUSD, ETHUSD, XRPUSD, EOSUSD),

- Llinear perpetual contracts (BTCUSDT, ETHUSDT, BCHLINK, LINKUSDT, LTCUSDT, XTZUSDT, ADAUSDT, DOTUSDT, UNIUSDT),

- Inverse futures contracts (BTCUSD quarterly).

Non-exchanges for trading crypto futures

- The Chicago Mercantile Exchange (CME)

The Chicago Mercantile Exchange (CME) is an order-driven exchange that allows traders to trade futures and options contracts on several products in key asset classes like Bitcoin, equities, metals, agriculture, energy, interest rates, and exchange rates.

The Chicago Mercantile Exchange (CME) offers cash settlement monthly for contracts. This means that the investor receives cash instead of bitcoin when the contract is settled. On December 18, 2017, the CME Group launched its Bitcoin futures platform. It also offers options on Bitcoin futures contracts.

The CME’s bitcoin futures contract is a USD cash-settled contract based on a CME reference rate. The bitcoin reference rate (BRR) is a once-a-day reference rate for the USD price of one bitcoin. Investors can trade on the exchange from 5 p.m. to 4 p.m. CST on Sunday through Friday.

Trading Bitcoin Futures

Bitcoin futures allow investors to participate in the crypto market without buying bitcoins. Bitcoin futures, like stock futures, enables you to speculate on Bitcoin’s future price. The CME Group offers cash-settled Bitcoin futures every month. Bakkt offers physical delivery of Bitcoin futures on a daily and monthly basis.

Trading Bitcoin futures rather than the bitcoin itself has several advantages.

- The contracts are traded on exchanges regulated by the Commodity Futures Trading Commission (CFTC). This regulation provides some assurance to large institutional investors.

- Because the futures contracts are cash-settled, there is no need for a Bitcoin wallet, and there is no trade of Bitcoin.

You can trade bitcoin futures on Binance, OKX, and other exchanges mentioned in the previous paragraph.

The risks of trading futures: margin and leverage

Many traders often borrow a large sum of money to trade in the futures market. This practice is the most common way to amplify small price movements and generate profits. However, borrowing money increases risk: if the prices fail to move as you speculated, you could lose what you invested much faster at small price changes.

Margin trading is a method of trading assets using funds provided by a third party (by other traders, who earn interest based on market demand for margin funds). In comparison to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions.

Collateral

Collateral (account equity) is the fund in your margin account that guarantees you’ll be able to repay your debt.

Margin call

It’s a request from your exchange to increase your collateral (deposit more funds) or reduce your loan (by repaying what you’ve borrowed), or else or your crypto positions may be forcibly closed (liquidated).

By liquidation, Binance sells your funds at market price to repay your loan. Margin call level notifications are not always guaranteed, so it’s critical to keep a close eye on your margin level.

Margin Level

Margin level indicates how “healthy” your margin trading account is. It is the ratio of your Equity to the Used Margin of your open positions, indicated as a percentage.

The margin level can be calculated like this: (Collateral/Used Margin) X 100. Let’s say John has a collateral of $10,000 and has used up $2,000 of margin. His margin level would be ($10,000/$2,000) X 100 = 500%.

John has a very healthy account. Ideally, your margin level must always be above 100%.

In Binance, the margin level is a risk level according to the borrowed funds (Total Debt) and the collateral on your margin account.

This risk level fluctuates according to the market movements, so if the prices move against your prediction, your assets can be liquidated.

Here’s how Binance calculates the margin level:

Margin Level = Total Asset Value / (Total Borrowed + Total Accrued Interest)

If your margin level drops to 1.3, you will receive a Margin Call. If your margin level drops to 1.1, your assets will be automatically liquidated.

Leverage

The borrowed money used by the trader to make up the difference between your margin and the order total is known as leverage. Greater leverage creates more potential gain, as well as more risk: A 10:1 leveraged investor can gain or lose 50% of their investment based on a 5% change in prices.

Conclusion

For the most part, many traders will find cryptocurrency futures trading to be exciting. Unlike spot trading, Futures trading provides strategic advantages and allows you to maximize profits. Futures trades can be profitable if you have the right knowledge and risk management strategies to avoid large losses. Before trading futures, you should strategize and conduct due diligence. You should also be aware of both the benefits and risks.

FAQ

What Are Crypto Futures Contracts?

Traders can speculate on the spot price of bitcoin using crypto futures. These contracts have set prices, and expiration dates known in advance and usually identified by their expiration month.

Which exchanges are the best for trading crypto derivatives?

According to CoinMarketCap, these are the top cryptocurrency derivatives exchanges by trading volume: Binance, OKX, ByBit.