“What cryptocurrency to trade?” is one of the most important questions when it comes to crypto trading. Selection of trading pairs plays a huge role in trader’s success, so in this article we are breaking down the process of choosing a pair.

What is important to understand when choosing the pair:

- Does your exchange trade this pair.

- Do price trends go along with your cryptocurrency trading strategy.

- Is trading volume for this pair on your exchange is enough.

- Does volatility of this pair on the exchange allow you to trade as you want.

Let’s take a look at all of these in detail.

Check the quote currencies

To start with, let’s see what is trading pair. Every pair is formed by 2 currencies, for example ETH/BTC. The first cryptocurrency (Ethereum) is called base currency and the second one (Bitcoin) is quote currency. Usually the number of quote currencies is very limited and differs on every cryptocurrency exchange. On most of them quote currencies include Bitcoin, Ethereum and Tether, but there are exceptions. So, before everything else, go to your exchange and check, which coins can be used as a quote currency. Or as an option you can check out our article to see the quote currencies on various crypto exchanges.

Determine the trends

When you have figured out the quote currencies on your exchange, it’s time to choose a pair. And the first thing you should do is determine the crypto trends. What is happening on the market at the moment? Which cryptocurrencies are going up and which are dropping? If the coin’s value is increasing at the moment, will it continue to do so or it is a peak and it will go down? Knowing the trends will help you answer these and many other questions. There are several ways to do it, but for the greater accuracy it is better to combine them.

Analyze charts

Analyzing cryptocurrency charts is probably the most obvious way to define the trends. As an example, take the top 10 pairs by trading volume over the last 24 hours on your exchange and look at their charts. Thus, you will have the overall picture. If you are not very familiar with trading charts, you can read more about them here. There are plenty of different crypto charts displaying various parameters (linear, logarithmic, candlestick charts, etc.), so it is better to check different ones. For example, with linear chart you can better judge the speed of price change, whereas logarithmic charts are more obvious in terms of seeing the trend and cryptocurrency traders look at both.

Read the cryptocurrency news

Various events have a great influence on price fluctuations, so you should always stay well informed about them. Particularly pay attention to the following:

- news about regulatory decisions or actions regarding the legal status of cryptocurrencies

- forks

- announcements from the coin issuers

- news from the major crypto holders (also known as whales).

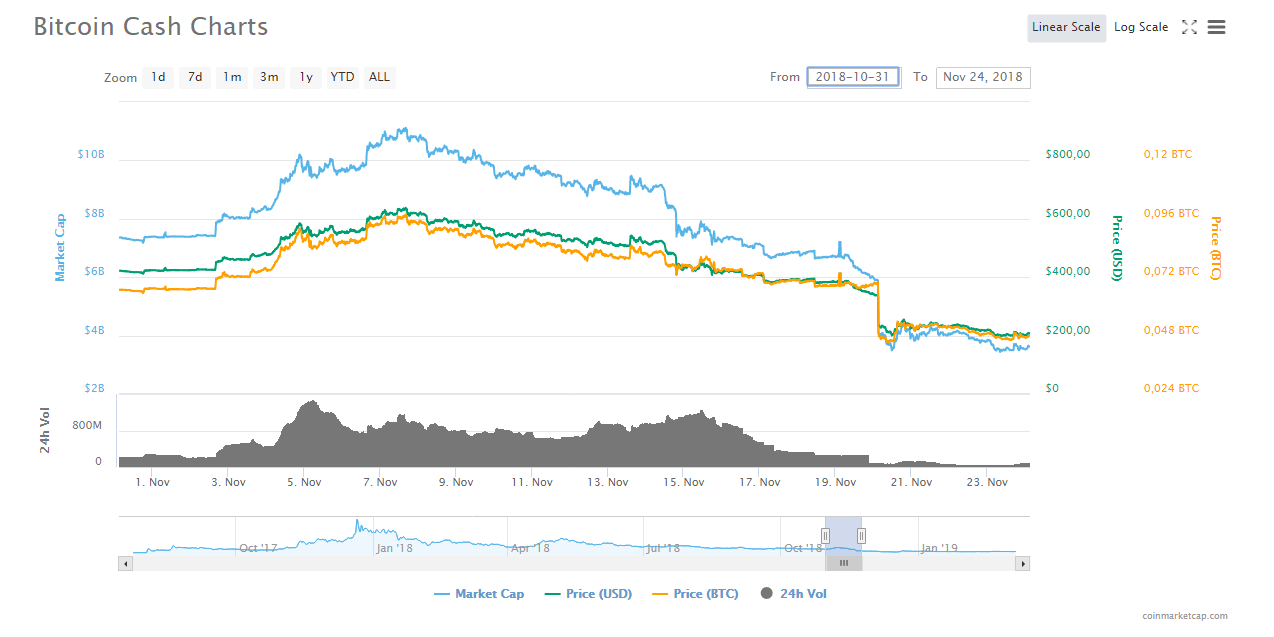

These types of news usually have the most impact on the cryptocurrency market and reading them can give you an idea of which crypto’s price can change a lot (and in what direction) in the near future. And of course it is worth considering when you choose cryptocurrency to trade. The hard fork of Bitcoin Cash (BCH) into Bitcoin Cash ABC and Bitcoin SV can be a good example. In the beginning of November 2018 (before the fork occurred on 15th of November) the price of BCH rapidly increased and then went down just as fast after the fork.

Conduct technical analysis

The next thing which will help you identify trends is technical analysis. There are many types of various technical indicators, but right now we are interested in trend indicators (they can tell you which direction the market is moving in) and momentum indicators (they tell how strong the current trend is and if there is going to be a reversal). Among the most common ones are: Moving Average Convergence Divergence (MACD) indicator, Relative Strength Index (RSI), Parabolic Stop and Reverse (SAR) and Average Directional Index (ADX).

Check the trading volume

When you are done with the trends, take a look at the trading volumes of cryptocurrency. It is easy to find 24h volumes on every crypto exchange. If the volume of the chosen pair is low, you’ll have to wait longer for your orders to be executed. Therefore, usually it is better to choose pairs with sufficient trading volumes. Moreover, you can use volume indicators to define how volume changes over time along with the price.

Check the volatility

Making profit on cryptocurrency price spreads is easier when the market is volatile and since profit is the main priority of every crypto trader, volatility is an important parameter. The idea is simple: when the price moves are substantial, volatility is considered to be high and vice versa. However, it is worth noting that high volatility means high risks. To identify, whether the trading pair is volatile or not you can once again analyze the charts or just use an indicator. The most popular volatility indicator is Bollinger Bands. Basically, it consists of a moving average and a line on each side which make up the band. If the the band is narrow the volatility is low, if it’s wide volatility is high.

We hope that after this article answering the question “What cryptocurrency to trade?” will be easier and your choice will be well thought-out. Happy trading!

FAQ

What is important to understand when choosing the pair?

Every pair is formed by 2 currencies, for example ETH/BTC. The first cryptocurrency (Ethereum) is called base currency and the second one (Bitcoin) is quote currency.

Should you analyze charts when choosing a trading pair?

Analyzing crypto charts is the most obvious way to define the trends. Take the top 10 pairs by trading volume over the last 24 hours on your exchange and look at their charts: thus, you will have the whole picture.