You’ve probably heard that there are two types of crypto exchanges out there: centralized ones and decentralized ones. Even though major CEXs such as Binance and Coinbase are clear winners in terms of user base and trading volume, decentralized exchanges, which rely solely on blockchain technology and smart contracts, allow investors to trade directly with one another without the need for a middleman.

Today, we will take a look at two different types of exchanges and will try to figure out their differences, as well as their strengths and weaknesses. So let’s dive in!

CEX & DEX. What are they?

Unlike traditional markets where all trading is done on centralized exchanges, crypto traders have a choice of two types of crypto exchanges: centralized (CEX) and decentralized (DEX) ones.

Even though both CEXes and DEXes provide functionality for crypto trading, they are different in the way they function. To dive deeper, let’s start with their short description:

CEX (Centralized Exchanges)

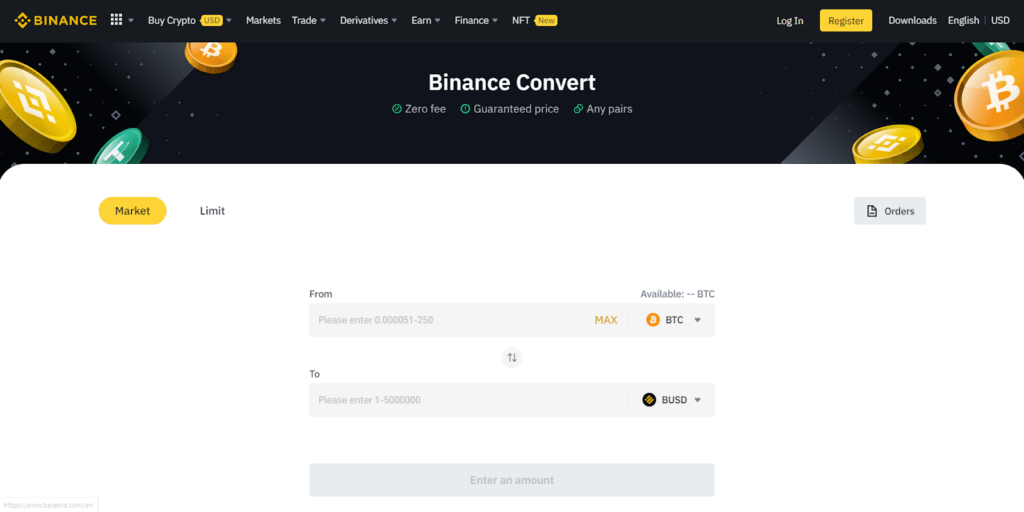

As obvious as it might be from the name, centralized exchanges are crypto exchanges that are run and controlled by centralized organizations. The entity that runs an exchange serves as the middleman between buyers and sellers, and they commonly (but not always) operate under regulatory supervision. Such exchanges like Coinbase, Binance, Kraken, and OKX are some of the most well-known CEXes.

CEX utilizes the Order Book to conduct transactions. The order book records and authenticates every buy and sell order.

The order book is the list of all open orders that are currently available on an exchange for a specific trading pair. An open order is basically another trader saying he or she is willing to buy or sell a digital asset for a certain price.

A trader comes to the order book and places an open order. That open order will remain on the order book until the trader who placed the order either cancels the order or someone else agrees to take the offer.

Placing an order does not guarantee that someone else will agree with the price. If some other trader on the CEX places a much better offer, then the better offer will be taken first.

There are two basic types of orders you can see in CEX’s order books: market orders and limit orders.

Market orders are orders that are intended to be executed as soon as possible at the current market price. In general, market orders give traders a better chance that their order will be executed instantly.

Limit orders refer to orders where you set the maximum or minimum price at which you are willing to make the transaction, whether it be a sell or buy one.

Before using the services provided by the centralized crypto exchanges, customers are typically required to authenticate themselves, i.e., undergo KYC (“know your customer” procedure). In other words, exchanges have to make sure that the people using them are who they claim to be, and thus prevent criminal activities, such as money laundering. And for many crypto believers, it can be a deal breaker, as one of the key values of the blockchain and crypto movement is anonymity. Still, some exchanges allow their customers to use their services without the need to go through the process of full verification (e.g. Binance, ByBit, KuCoin), although in such cases, users won’t have access to some of the services and might be limited in terms of trading deals and amounts of withdrawn funds.

Centralized exchanges might be a much better place for trading for amateur traders/investors and those who do not have too much experience with crypto trading, since CEX can be easier to navigate and understand, as it is just you placing the order without much need to understand how it works under the hood.

Moreover, every CEX has its own built-in crypto wallet, so you don’t have to download an additional one if you don’t want to, since you can store your funds there (though as we all know, storing funds on a crypto exchange is not the most secure approach as you do not own the private keys to the wallet where the funds are).

However, one of the CEX’s traits, which might be disappointing for those investors who are early adopters and prefer to invest in crypto projects during presales or at launch, is that CEXes have a limited number of listed coins and tokens. It may not be a disadvantage, depending on your attitude: yes, DEXes have more tokens and coins, but there are no regulations, and anyone can list their coin there.That quite often leads to failed projects and scams, so you should see it as a double-edged sword.

Since CEXes have their reputation on the line as well as potentially have the risk of losing their license (if they did obtain one), they usually have a strict system of listing new coins, and they list new cryptocurrencies only when they can be sure that they won’t end up being a scam.

Still, even major cryptocurrencies are not protected from force majeure, and sometimes they have to delist the currencies that end up a failure (e.g. Terra Luna and UST).

DEX (Decentralized Exchanges)

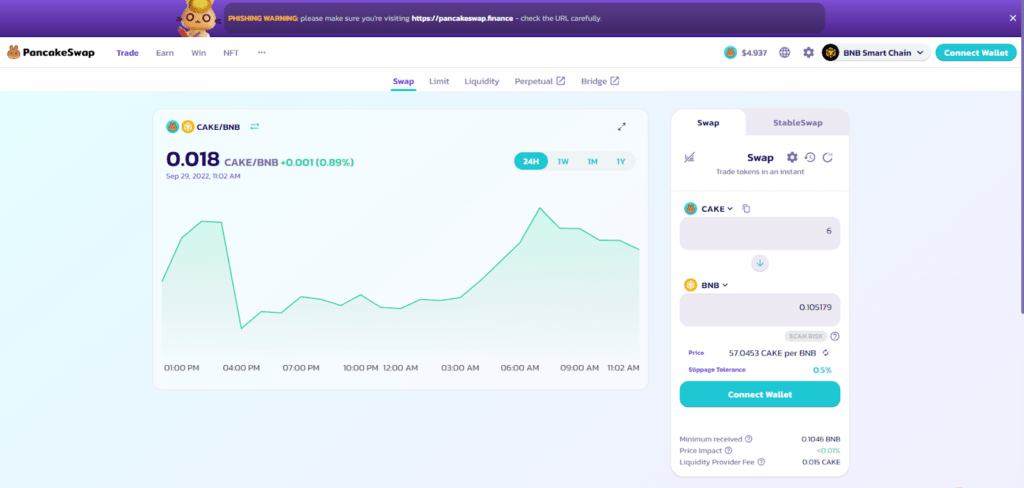

Decentralized exchanges, as their name suggests, are basically exchanges where no entity runs order execution. Decentralized exchanges fully rely on smart contracts and dapps to automate transactions and trades. Some of the most well-known DEXs are PancakeSwap, Uniswap, and SushiSwap.

So how does the decentralized exchange operate then? The answer is either via an AMM (Automated Market Maker) or a conventional order book model.

We’ve already mentioned how order books work in CEX. However, with DEX, this method works a bit differently since there is no middleman in charge, and this process fully relies on algorithm.

A token owner places an order to swap an asset for another asset that is available on DEX. The token’s owner decides how many units must be sold, how much it will cost, and the time limit for accepting bids for the assets. Other traders can offer bids by putting in a purchase order after the selling order has been made. When the sellers have chosen the time, they evaluate and execute the offer.

It is worth noting that most of the DEXes operate via the AMM model. Let’s take a peek at how it works.

In the AMM Model, an asset’s liquidity and its swap pair liquidity are pooled in a smart contract. Those who provide funds for the pool are eligible to receive the fees generated from the swaps in the pool. In the event that a trader wishes to perform a swap in the pool, the balance of digital assets in the pool is automatically rebalanced to a 50/50 value, and the price of the tokens changes to reflect the new supply. If there is not enough liquidity in the pool, and a trader wishes to perform a significant swap, then the trader will have to face high slippage issues, which means that the lack of liquidity will result in an above-market purchase price. In such cases, a trader either has to agree to pay a much higher price for an asset, or wait until the liquidity increases.

One of the greatest advantages of DEX is that it does not require verification, so there is no KYC. That means, unlike with CEX, with DEX you can preserve your anonymity.

Another advantage of a DEX is that there are numerous tokens and coins that you cannot find on centralized exchanges. Although this can work in both ways, since some of these projects can end up being scams of every kind of sort you can imagine, such as rug pulls, ponzi schemes, and pump-and-dumps, are part and parcel of DEX trading. So you need to DYOR even more thoroughly and carefully when investing your funds on projects found on decentralized exchanges.

A DEX can offer you an opportunity to invest in a project when it is still in the early stages of development and it hasn’t been listed on major CEXs. Thus, in theory, you might have a chance of scoring a major gain in case a project you invested in ends up a success.

It is worth mentioning that you cannot trade fiat on DEX, and this option is available only on CEX.

Another major drawback of DEXes is that no one will ever refund you your coins in case your wallet is hacked and your funds are stolen.

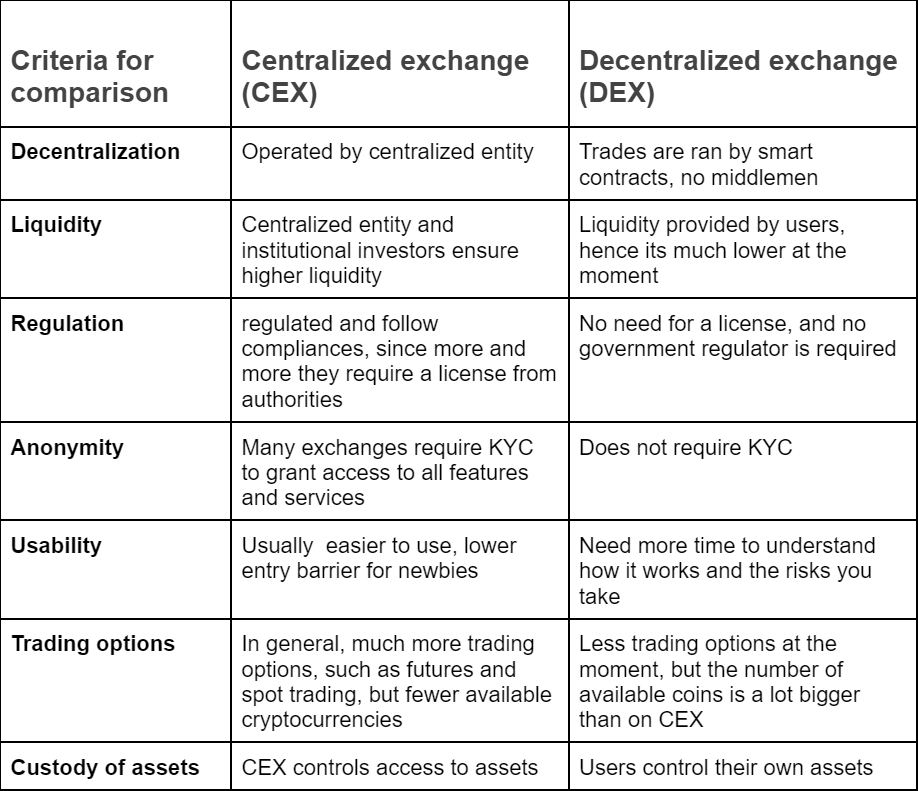

Differences between CEX & DEX

Since it might be a bit overwhelming to grasp the differences between CEX and DEX, let’s highlight these differences in the table:

CEX vs. DEX. Pros and Cons

Since we’ve covered what are DEXes and CEXes as well as their differences, let’s take a look at pros and cons of these two types of exchanges:

CEX pros

- Reliability. Every major centralized exchange does whatever it takes to gain trust and reliability from users. That is why they comply with the laws of countries they operate in and regulate their activity to avoid any kind of criminal behavior. That is why CEXs are more popular among average traders and investors.

- Support. You can always expect support from CEX employees in case you have questions or need help during your trading activity. Surely some DEXes also might have online customer service support, although with the CEX case it is one of the cornerstones that lies in their operating system.

- Liquidity. It is really simple to find buyers and sellers on centralized exchanges, especially on those who have millions of users. So you probably will never face a situation when you cannot buy or sell a digital asset for a reasonable price.

- Simplicity. At the moment CEXs are more user friendly and easy to deal with as they aim at an average trader, who might not know every other small detail about crypto trading, but instead just wants to stick to day-trading or long-term investing.

- Trading options. Major centralized exchanges can offer their users a big variety of trading options: spot, futures, staking, lending, and even nft marketplaces can be easily found on CEXs like Coinbase or Binance. That means, traders can perform any kind of trading deals they want in just one place.

CEX cons

- Custody of assets. Instead of letting you store your private keys on your own digital wallet, the majority of CEXs will hold your digital asset as a custodian in their own digital wallet. Even though it is more convenient when you trade on a daily basis, there are some major weaknesses, namely the risk of CEX failing or fraud.

- Verification and KYC. Not necessarily a con, depending on how you look at it. However, those traders and investors who wish to pursue absolute anonymity while dealing with cryptocurrencies might find the verification process a huge disadvantage.

DEX pros

- Decentralization. In DEXs, there are no restrictions, no system monitoring, no guidelines and no entity that rules everything. Users are the ones that are responsible for their actions and consequences, and all the trades are regulated by smart contracts. And since there is no single entity in the middle of all processes, no one can shutdown the transactions or freeze your funds.

- Anonymity. Since DEXs are based on DeFi principles, there are no verifications required, and you are free to use them whenever you want, whoever you are. No one will ban you or discriminate against you from using specific services that are available only for users who decided to fully verify themselves. Thus, if you care about your anonymity, DEX can provide it to the fullest.

- Custody. Unlike CEX, users of DEX don’t transfer their digital assets to a third party, so you always have access to your funds since they are stored in your personal digital wallet, and you are the one and only who have private keys. You still can click a phishing link or catch a trojan virus, but that would be due to your own clumsiness.

- Fees. Almost every centralized crypto exchange charges extra fees when buying and selling digital assets. In case of decentralized exchanges, the only thing you have to pay is transaction fees, and they vary from one blockchain to another. Still, it is worth mentioning that sometimes gas fees can go sky high, and in those moments even lack of extra fees won’t help.

- More coins & tokens. In DEXs, you can find thousands of coins that are not available on CEXs. Some of them will make it there and become a success, some of them will end up a scam or failure. Investing into them might be a huge risk, but the reward might also be enormous: for instance, Shiba Inu was firstly available only on DEXs like Sushiswap and Uniswap and didn’t look much at the beginning. Nowadays it is in the top 15 cryptocurrencies by market capitalization.

DEX cons

- No trading to fiat. Unlike CEXs, you cannot trade crypto to fiat on DEXes – only crypto to crypto.

- Lower liquidity. Due to the lack of volume and number of traders that centralized exchanges usually have, on decentralized exchanges it might sometimes be difficult to find buyers and sellers, especially when you are dealing with tokens and coins with low trading volumes. Even when comparing numbers it is obvious who has an advantage: Binance has more than 90 million customers and more than 14 billion dollars trading volume (24h) and Uniswap, one of the major DEXs in DeFi space has around 4 million users and around 938 million dollars trading volume (24h).

- Slippage. Slippage is the difference in price between when a transaction is submitted and when it is confirmed on the blockchain. It can be caused in two scenarios – when liquidity is low or during high trading volume. Thus, when you set the slippage high, you will get fewer tokens for the price you pay, however, if you set the slippage low, your transaction in most cases will never be executed. Slippage is solely a DEX problem.

Final thoughts

The choice of a crypto exchange solely depends on the personal preference of a trader. As always, there are both benefits and drawbacks, and none of the two types of exchanges are perfect.

You may prefer CEXs due to their popularity, user-friendliness, and number of available features, or you can go for DEXs due to decentralization and control of your funds, anonymity, and rare coins. Still, no one restricts your choices, so you can use both types of these exchanges and thus offset the drawbacks that both DEX and CEX have.

No matter which type of exchange you decide to use, you should always DYOR and follow all the security tips that are out there.

FAQ

What are decentralized exchanges?

Decentralized exchanges, as their name suggests, are basically exchanges where no entity runs order execution. Decentralized exchanges fully rely on smart contracts and dapps to automate transactions and trades. Some of the most well-known DEXs are PancakeSwap, Uniswap, and SushiSwap.

What are centralized exchanges?

As obvious as it might be from the name, centralized exchanges are crypto exchanges that are run and controlled by centralized organizations. The entity that runs an exchange serves as the middleman between buyers and sellers, and they commonly (but not always) operate under regulatory supervision. Such exchanges like Coinbase, Binance, Kraken, and OKX are some of the most well-known CEXes.