How much in passive cryptocurrency income can you pocket over a month? From this guide, you’ll learn all about exact amounts and interest rates. Also, you’ll find out if this kind of activity is right for you. Because – maybe not?

There are several passive income streams in crypto, and we’ll talk about some of them in detail down below: lending, staking, liquidity mining, yield farming, and crypto funds.

Keep in mind, however, that the niche is constantly developing and changing. Every now and then, something new arises, so make sure to monitor the market pretty much all the time. The lineup of passive income strategies includes but is not limited to locked staking, DeFi staking, ETH 2.0 staking, liquidity farming and swap farming. Here, we’ll cover the most popular options to earn passive income.

Lending in crypto

What is it?

Lending your funds to a person, to a service or to smart contracts (hello, future) is one of the most popular ways to generate passive crypto income today. Normally, the process involves two to three parties: a lender, a borrower, and a DeFi or CeFi platform. Now, there are three main ways to do crypto lending: Peer-to-Peer Lending, Centralized Lending and newly-emerged lending types such as flash loans and collateralized loans.

- Peer-to-Peer Lending

Peer-to-Peer Lending (P2P Lending) is a type of crypto lending where you interact with another respective individual to borrow or lend digital assets. As a lender on a P2P lending platform, you have an option to decide on the amount that you want to lend and the interest rate, so that later the platform will match you with a borrower of your funds. Normally, this kind of lending falls within the realm of DeFi, or decentralized finance. However, there are certain centralized platforms offering these services, too.

- Centralized Lending

Centralized lending services in crypto are the platforms that allow investors to deposit crypto funds almost as you deposit them to traditional banks. So if you’re one of those crypto enthusiasts who prefer to HODL your assets, why not HODL them for an interest over a certain period of time?

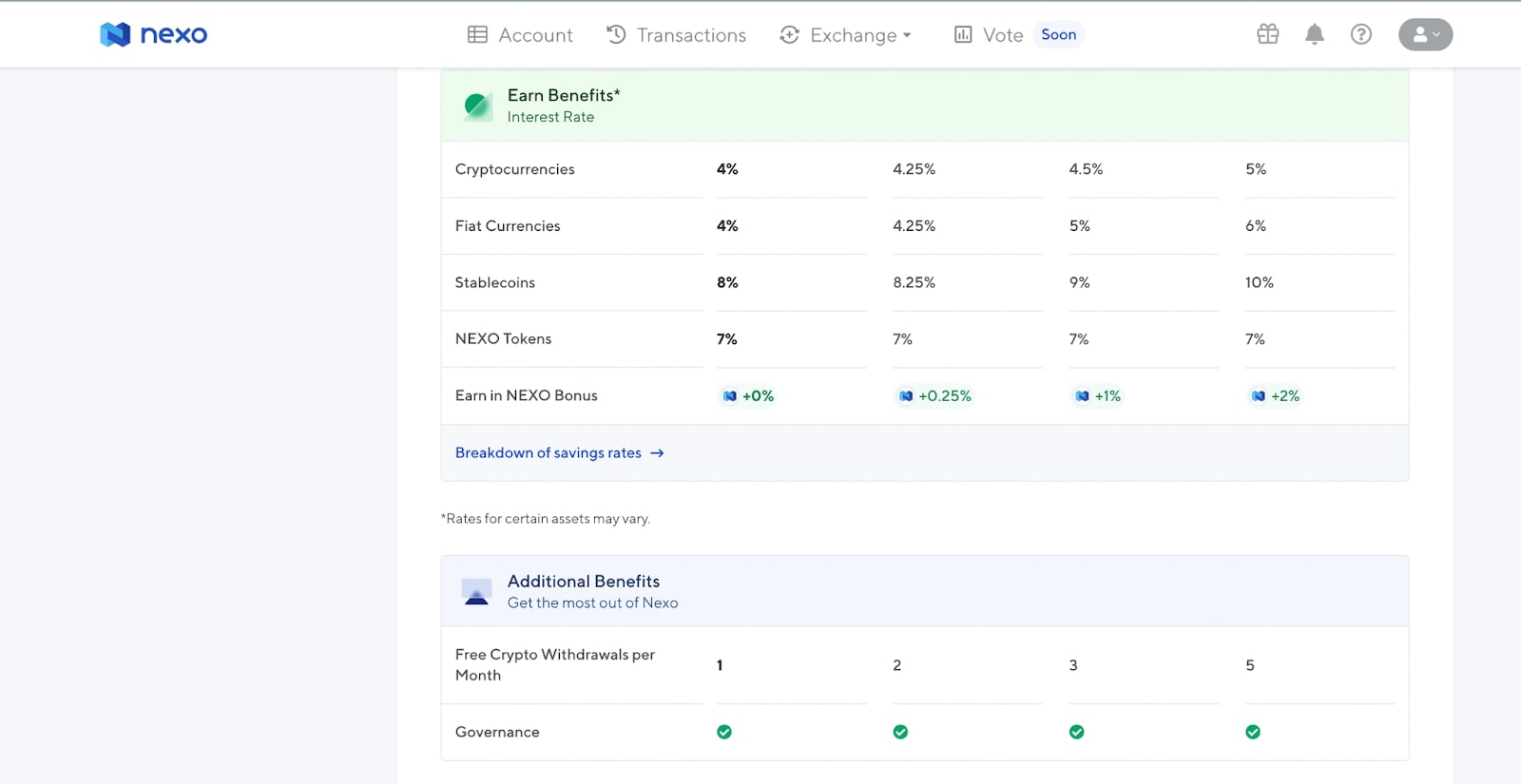

On the centralized crypto platforms, like Nexo, the interest rates are often fixed and lock-up periods are either fixed or flexible. The fixed lock-up periods normally generate a greater income. Just transfer a certain amount of money into your account and start generating passive income now.

“Nothing is TOO safe in crypto”, a popular algo-trader Nico commented for TradeSanta, “it’s a new maturing space and you always have to be cautious. With that being said, there are some places that are offering a more “safe” bet. Things like NEXO seem safer than some random DeFi platform that offers 200% APY, NEXO offers WAAY lower APY (~12% on stables).”

- Margin Lending

The term margin lending probably speaks louder than many explanations. It falls with the realm of centralized lending when you lend your money to margin traders, or, in other words, traders who are interested in leveraging their positions. Once the lock-up period is over, they return your finds to you and pay you an extra fee for borrowing them. In case you feel like there’s more to the subject, yes, you’re right. Margin trading is not for everybody, read more in this piece about it. However, as a margin lender, you’re relatively safe, if, of course, your service provider is not hacked, attacked, or exploited.

- Collateralized Loans

A collateralized loan, being a part of the newly-emerged DeFi paradigm, is a loan where you borrow money from a lending platform and pledge a collateral in return. A good example is MakerDAO, a popular choice among most investors, because it gives you a chance to use a wide array of different cryptos you can pledge your collateral in. On such a popular platform with high liquidity, the LTV value (the loan-to-value ratio) might also be lower than on other services, say, 50%, for example.

It means that if you want to borrow $5,000 of Dai, you will have to pledge $10,000 of Ether as collateral. Once your collateral falls beneath $10,000, the platform will require to top up your balance. Once your collateral falls 40%, you’ll be liquidated. But if everything goes right, it’s a way to stake your money on a platform like Compound or Aave and generate passive income.

- Flash Loans

Flash loans, also being a part of the vibrant decentralized finance (DeFi) niche, are a unique form of loans where you borrow and return funds without pledging a collateral within one transaction. You kind of have to be techie to use these loans. For example, on Aave, writing your own smart contract is required.

Take a look at how it works.

Say, there’s a liquidity pool on SushiSwap where a BUSD token is trading for $1. However, on Uniswap, in another pool, respectively, the same coin is trading for $1.05. You don’t have money to buy tokens from SushiSwap in order to sell them on Uniswap, so you borrow the funds from a third party and, then, go and write a smart contract for a flash loan that helps you buy and sell within one transaction in different pools, making $0.05 in profits. How does that sound for a source of passive income?

Top Crypto Lending Platforms

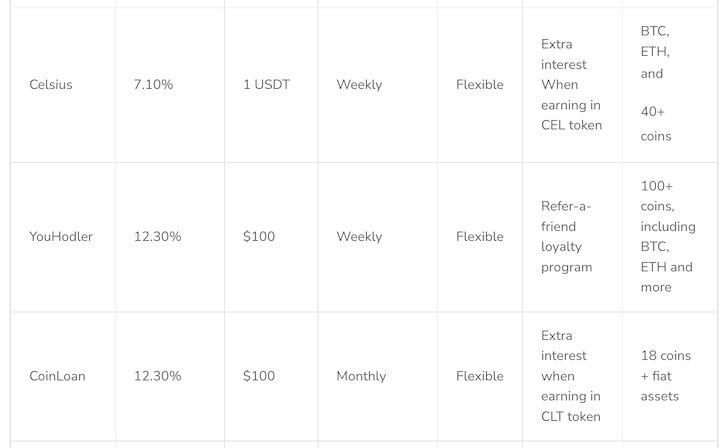

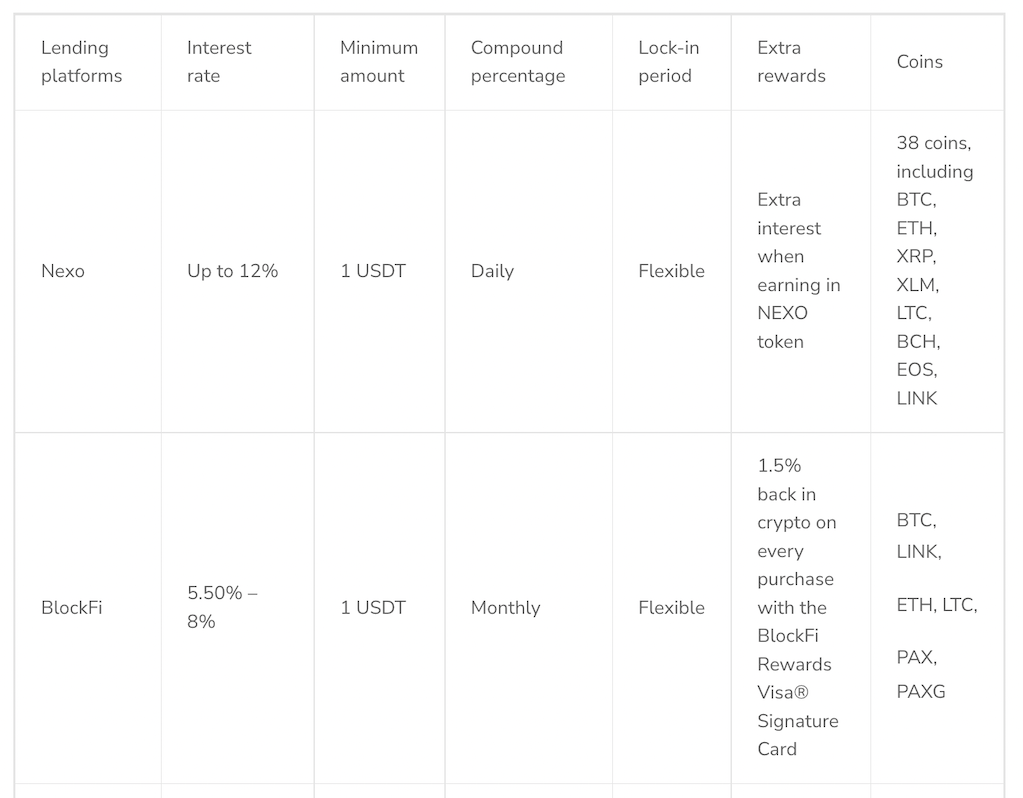

Here’s a list of some popular centralized and decentralized service providers that offer crypto lending options. Choose the one that is right for you!

Nexo is a digital assets platform that offers instant crypto loans, daily earnings on assets and an exchange functionality. It provides its services in 40+ fiat currencies as well as more than 200 jurisdictions.

BlockFi is basically a centralized hub for the different financial services ranging from taking out a loan, holding cryptocurrency, or managing credit card expenditures using the BlockFi credit card. But be very careful since BlockFI Interest Accounts (BIAs) are no longer offered to new clients who are U.S. persons or persons located in the United States.

According to their website, Celsius is a regulated, SEC-compliant, lending platform that enables users to receive interest on deposited cryptocurrencies or take out crypto collateralized loans. Celsius attracts users by returning yields on their deposits while maintaining fee-less transactions. For existing crypto investors wishing to take out a loan, Celsius provides an opportunity to receive dollars without cashing out of cryptocurrency holdings.

YouHodler is a crypto lending platform located in Switzerland. It provides minimal interest loans to users if they pledge cryptocurrency as collateral. It is a crypto-backed loan service provider, and it is established on the idea that the users HOLD their cryptos during down markets and sell them when the market goes up.

CoinLoan was established in 2017, and it is a P2P lending platform located in Estonia. It allows the users of the platform to borrow funds for a short-term period as well as for a long-term timeframe. The duration of the loans varies from 30 days to 3 years.

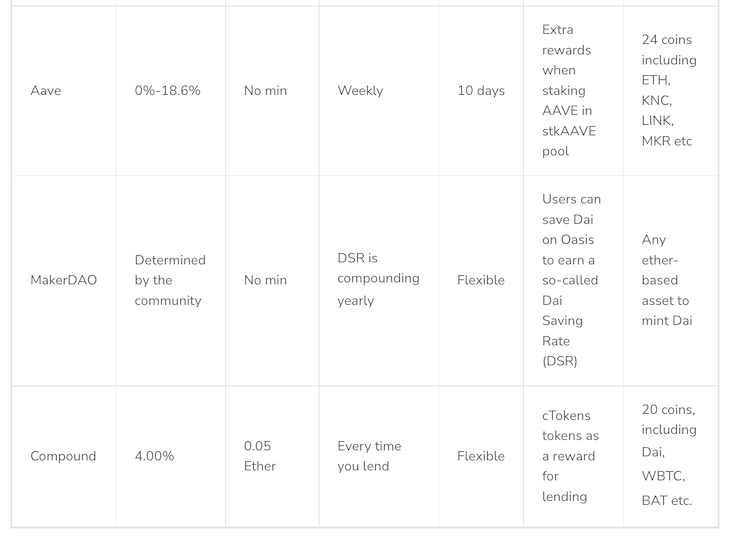

This last part of the table is dedicated to the DeFi niche where every platform focuses on services without a third party involved.

While using Aave, lenders deposit funds into a pool from which other users borrow. While borrowing, you will need to pledge collateral that is larger than your DeFi loan and pay either stable or algorithmically based variable interest fees. While lending or depositing collateral, you’d be given aTokens that will allow you to earn interest.

As to MakerDAO, it’s protocol worth a lot of words since it’s not easy to understand from the get-go. In short, you have to supply 150% of Ethereum value to generate 100% Dai, which is a collateral-backed stablecoin that maintains a soft peg to $1.

Borrowers and lenders in the Compound platform obtain COMP tokens as a reward for borrowing and lending. Moreover, each time you interact with the platform by supplying, borrowing, withdrawing, or repaying an asset, COMP will be automatically transferred into your wallet, if you’ve accrued at least 0.001 COMP; at any time, you can manually withdraw all undistributed COMP.

Staking in crypto

What is it?

Just like the proof-of-work mining algorithm in Bitcoin, staking (the proof-of-stake mining algorithm) helps create new blocks on the chain, but in another manner and without burning as much electricity as the whole country of Honduras. The key takeaway is that you create new blocks by putting your money on the line (staking) for a chance to become a validator.

When blockchain stakers validate transactions, the fees generated as a result of approval go to them and other stakeholders. Plus, they have transaction fees, too. The main advantage of staking is those transaction fees. In some cases, you even earn 10% to 20% per year, so it might be a very successful way to invest money. To do it, you only need to find a blockchain that uses a proof-of-stake model.

Here’s a few coins you can consider for staking: Ether, Algo, Cosmos, Cardano, Solana, Polkadot and many more. You can always check out the CoinMarketCap list to compare trading volumes, circulating supply and price of different coins.

To compare different coins’ return rates against each other as well as different ways of staking, check out the StakingRewards website. To ultimately choose the coin to stake, you can select an amount you want to invest, a lockup period, and a staking type.

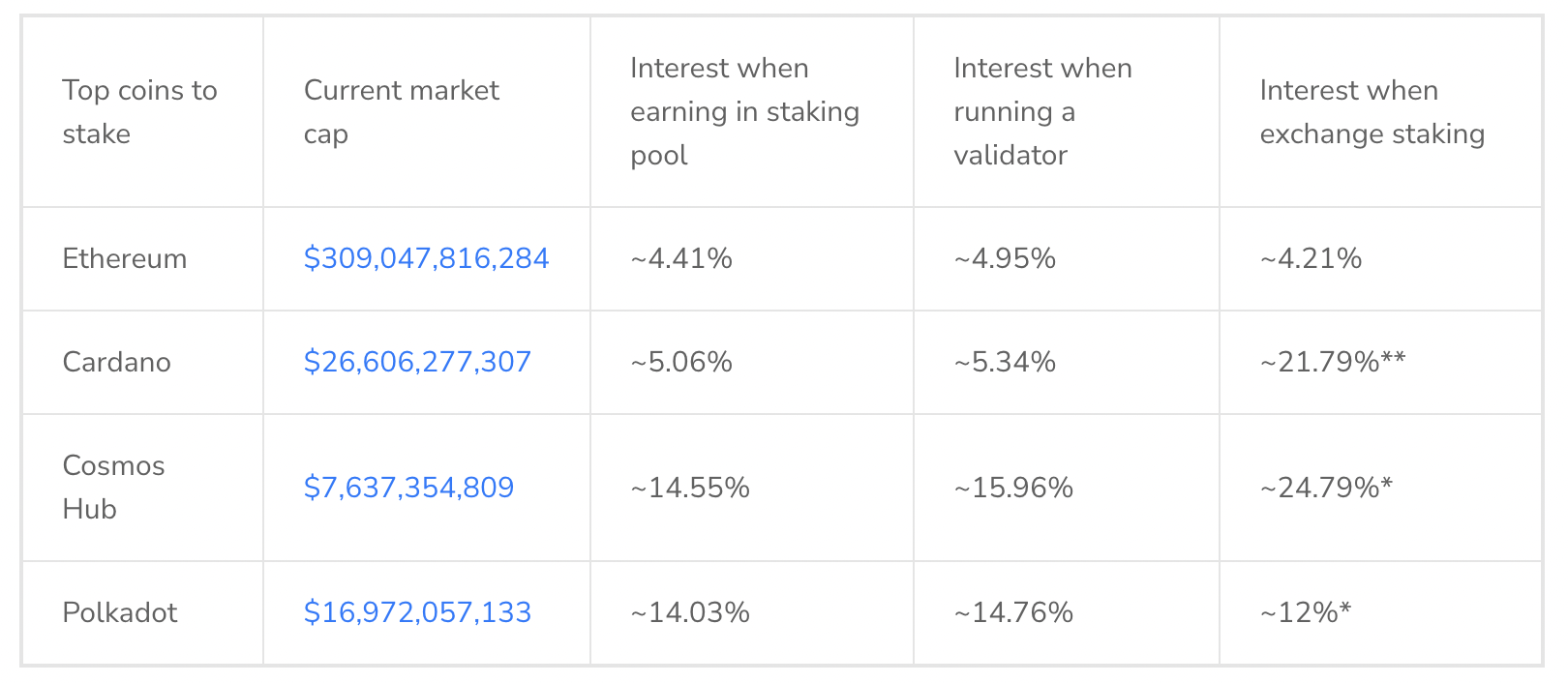

Take a look at the table down below with an exemplary amount of $1k invested and a 12-month lockup period. In the table down below, you can compare interest returns when staking in different ways. But first, let’s deal with definitions.

These are the ways you can stake your coin:

- In a staking pool. You can earn interest when staking with other participants in a chosen pool. The most popular staked cryptocurrency is probably ether, so, for ether, it could be poolin.me, ethermine.org etc. However, there are many other coins available. For solana, the most popular staking pools are Marinade, Socean Stake Pool and more. For Cardano – Goat Stake or Cardanians.io, etc.

- When running a validator. You make a certain amount of money being a validator. But if we’re talking about ether, you already have to have at least 32 ETH in your node wallet.

- When exchange staking. Generate an interest when staking coins through third-party platforms, such as Binance, Gemini, Coinbase etc. HitBTC has also recently added the long-awaited staking functionality, so now you can stake PVM, ALCX, DYDX, HBTC, ONT, SNX, UST, GLEEC and IQN there. Even though not all cryptocurrencies are available for this type of staking, this can be the easiest way to stake since you will not have to learn all about pools and validators and can use a familiar interface of your favorite exchange.

Coins to stake in 2022. Data: StakingRewards.com, Kraken.com. Binance.com

*Data from Binance

**Data from Kraken

“Stables are getting a lot of traction during this “bear” market, mostly UST that offers ~20% over Anchor protocol”, Nico says, referring to the question about coins that he is staking. So do your due diligence on the platform where you stake as well as the current market trends before going for this activity. Because all opinions expressed are opinions, not guarantees.

Liquidity Mining

What is it?

Did you know that you can also capitalize on your assets by providing them for liquidity to the DEXes?

DEXes, or decentralized exchanges, are exchanges with a very specific engine — automated market maker (AAM). An AAM determines the price of the assets in a pool based on the amount of assets held there and the amount of liquidity providers. For these DEXes to be able to execute trades, they need liquidity, This is where so-called liquidity providers come into place. Just as the name suggests they provide liquidity to the DEXes pools.

In return for providing liquidity, liquidity providers get LP tokens as well as fees on each trade every user facilitates in this liquidity pool. It depends on a particular platform and activity levels, but usually the fee is around 0.2-0.3%.

So, how much money will you return as a liquidity provider? It depends on your share in the pool as well as the amount of the total value locked there.

At this point, you’re probably wondering where you can go to provide liquidity. There are a number of decentralized exchanges, such as Uniswap, PancakeSwap, dYdX, SpookySwap, SushiSwap and many, many more – check the list on CoinMarketCap, to see all the platforms.

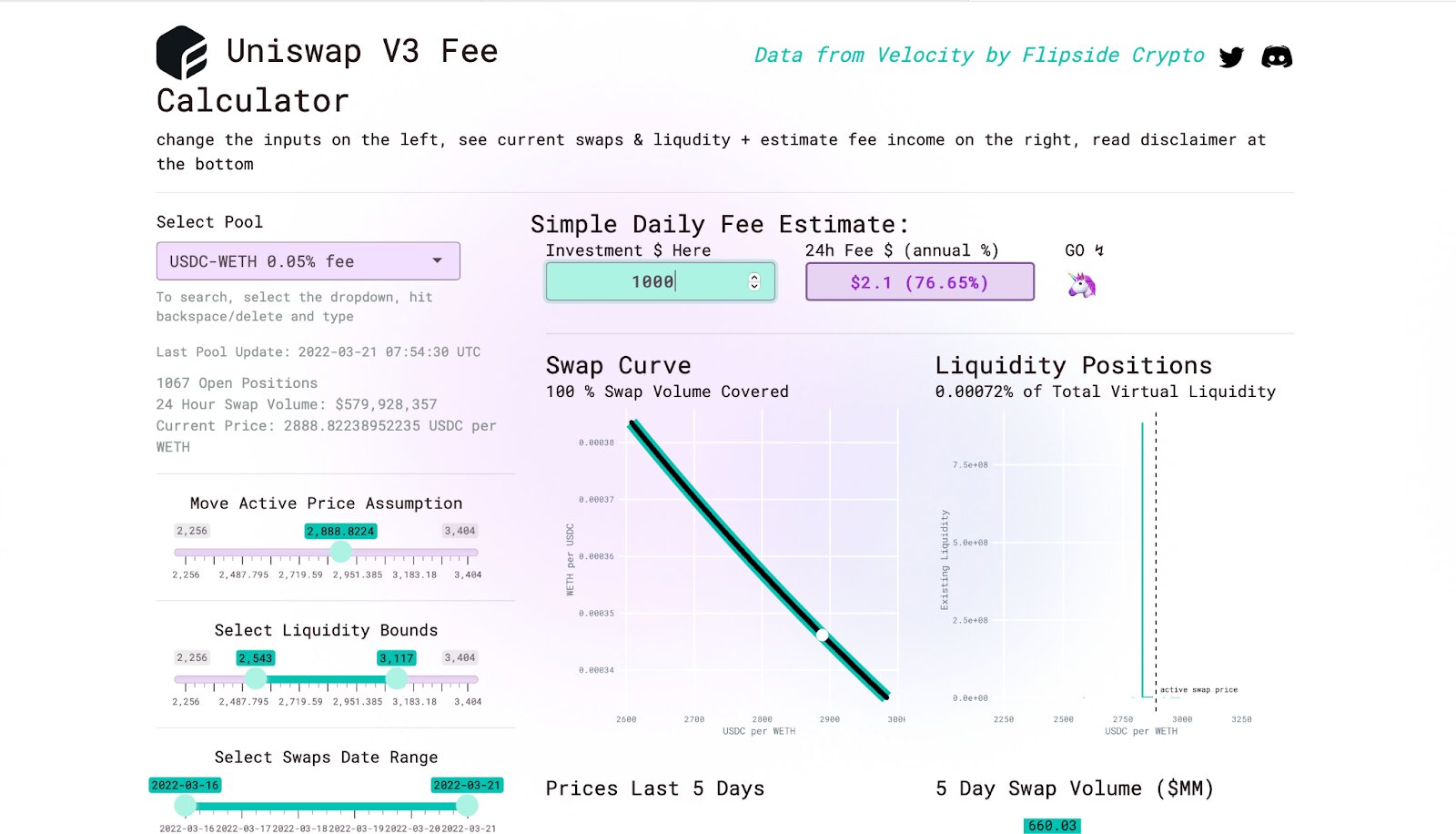

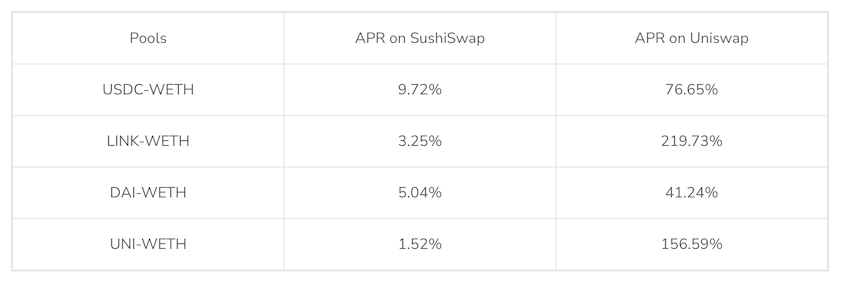

Let’s compare some pools on two popular exchanges, Uniswap and SushiSwap to give you a more nuanced picture. For updated data, click here for Uniswap and here for SushiSwap.

Why so WETH? OK, joking apart, the WETH asset is simply one of the most popular assets on DEXes, so don’t be surprised that the markets compared on Uniswap and SushiSwap are mostly WETH markets.WETH liquidity pools on Uniswap and SushiSwap in 2022

Yield Farming

What is it?

We’ve just talked about providing liquidity to liquidity pools on DEXes, so let’s presume that now you’ve got LP tokens as a reward for your activity on DEXes. No need to keep them in a closet, let them work for you, too.

Yield Farming is a way to accumulate yield on your LP tokens if you already have them. To farm yield, you will need to stake those tokens on specific “farms”. For that, you will return a fraction of the farm’s award pool.

The rewards normally pay out on a regular basis, daily, weekly, monthly etc. So if you stake 10% of the farm’s assets, which is huge, you will generate 10% off the reward pool.

All popular DEXes, such as PancakeSwap and SushiSwap, have their own farms, but there are also autonomic solutions like Aave, Compound, MakerDAO etc.

Because you’re operating in a very volatile market, crypto market, the prognosis is a lowly craft. If the coin rises, the return can go up to 10-20%. But don’t forget that you can also lose a lot.

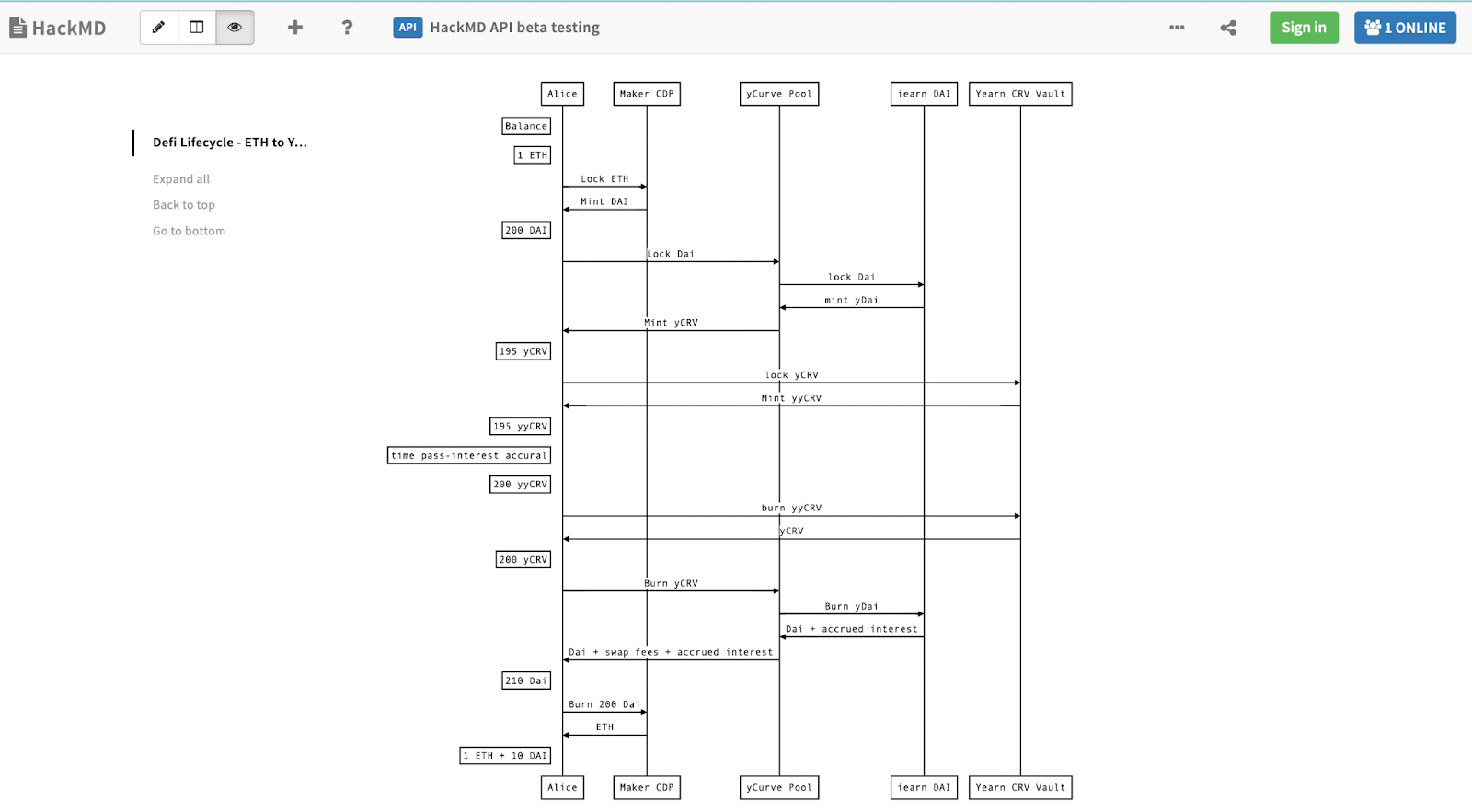

Example:

You lock 1 ETH on a platform such as MakerDAO and receive other tokens for locking the initial token – 200 Dai tokens. You take 200 Dai tokens, lock them on another platform, iearnDai, and receive 200 yDai. You take your 200 yDai, go to yCurve Pool and receive 195 yCRV. You lock 195 yCRV in the CRV Vault and receive 195 yyCRV.

Time goes by. Time flies fast. You wait. Your investment grows from 195 yyCRV up to 200 yyCRV – because you’ve locked your tokens long enough, and it’s your reward.

You burn 200 yyCRV, 200yCRV and 200yDai one after the other and mint 210 Dai where 10 Dai is the interest rate. Now, return your Dai to MakerDAO and receive your ETH back. Now, you’ve earned your 10 dai, but you will probably have to burn them in fees, so be careful while calculating your fees and returns!

This is a famous graph describing investors’ possible engagement levels:

Overall, yield farming proves to burn a lot of money in fees and is now even considered dangerous by some prolific traders. Our trading expert Nico says that he mostly does yield farming on stablecoins: “Being paid on a random coin over a bear market could not be as profitable as it sounds since the coin you are paid on gets devalued as well as the staking portion”.

Pros

- large interest rates per annum,

- independence from centralized exchanges

Cons

- due to high volatility you can be left with billions of worthless tokens,

- a simple bug can lose your crypto holdings forever

Crypto Funds

What is it?

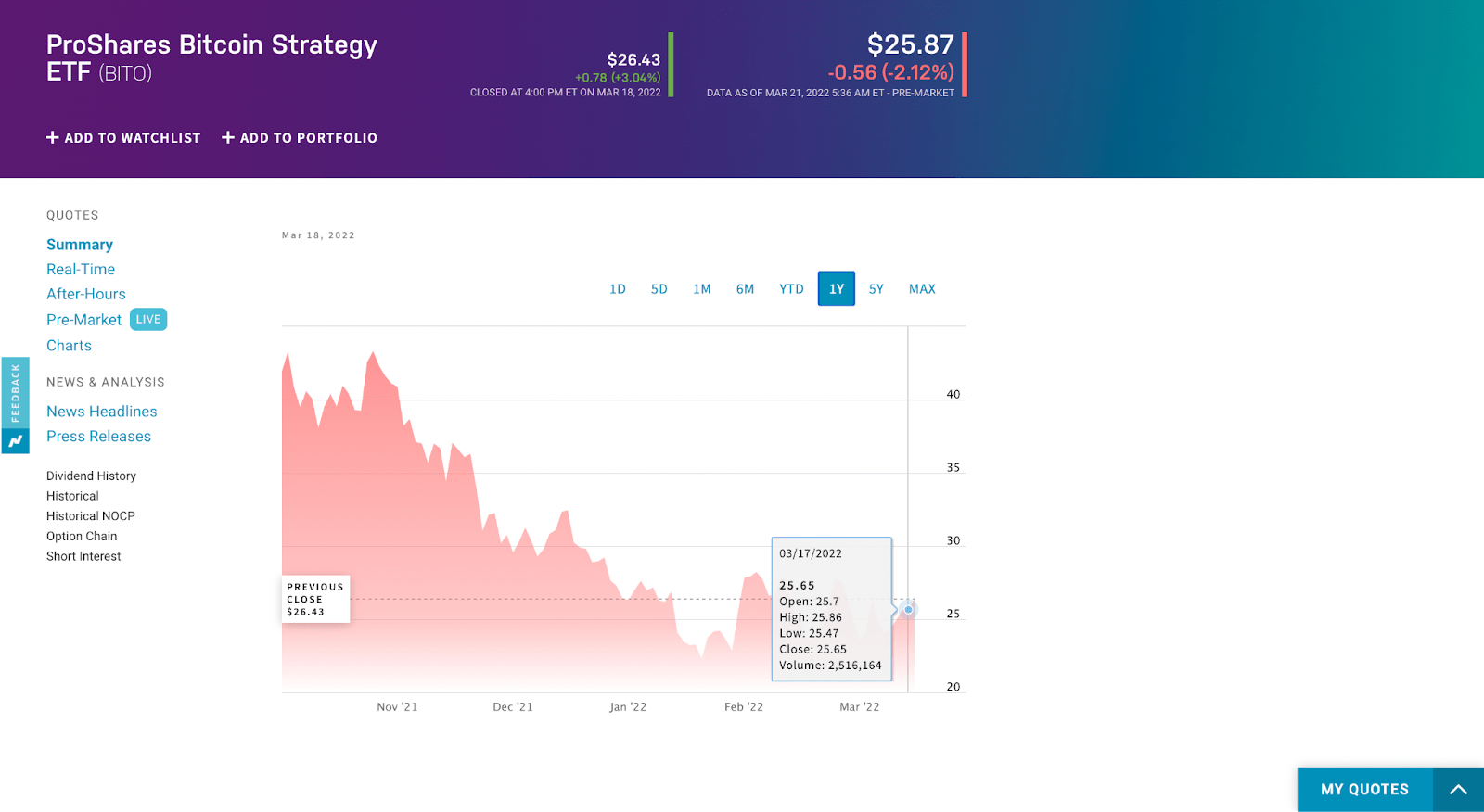

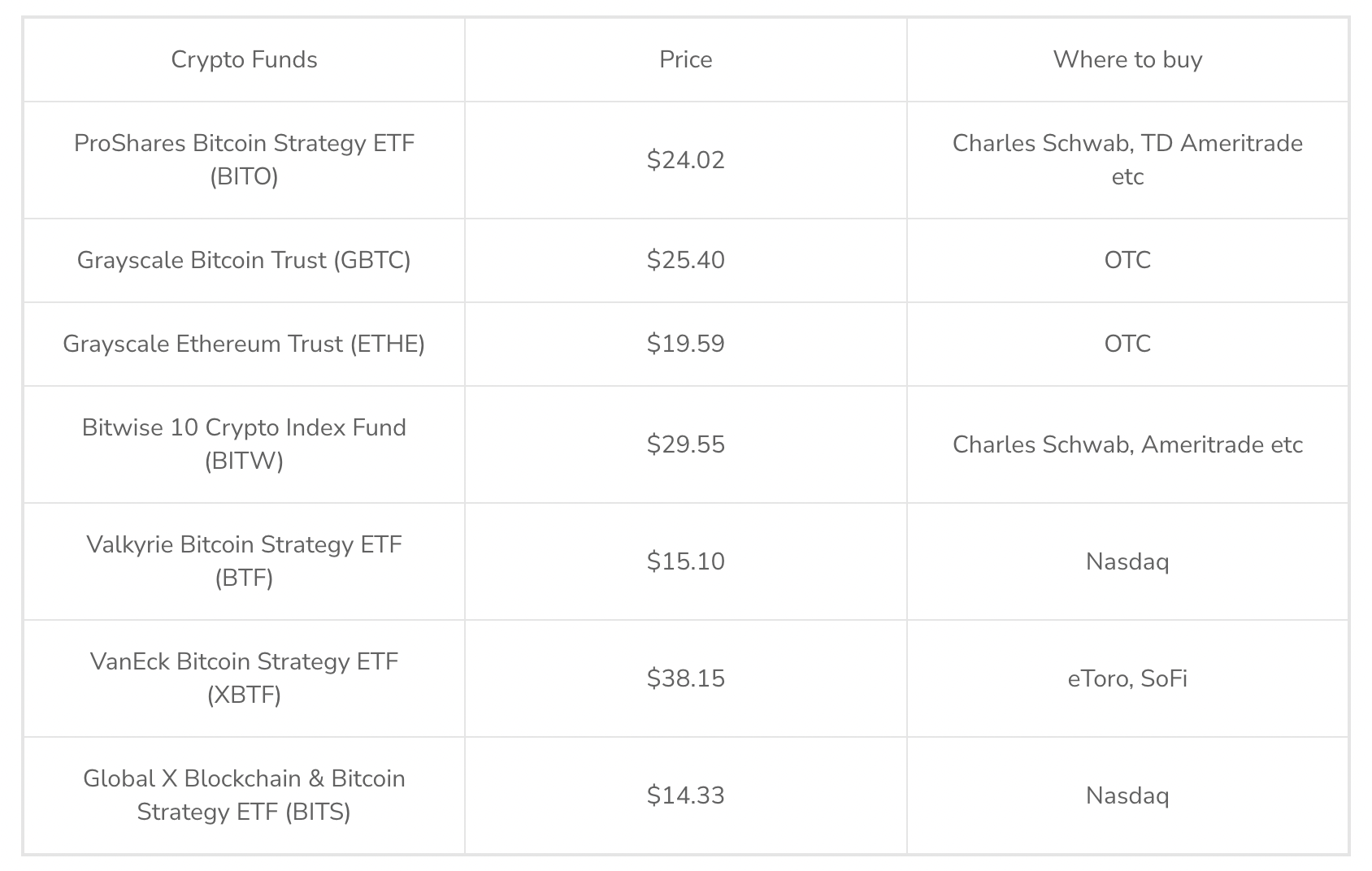

If you’re familiar with the concept of ETF, you probably will quickly learn all you need to learn about crypto funds. Just like an ETF, a crypto fund tracks a basket of crypto assets and is managed by experienced analysts. While trading it, you can track its past performance, use technical analysis and, in general, do everything you normally do while trading traditional assets.

Take a look at the list of pros and cons.

Pros

- crypto ETFs can be traded and held via traditional brokerage firms,

- you don’t need to keep your password in a safe place to buy and sell crypto ETFs,

- unlike crypto, crypto funds are actually regulated by governments which make them more secure and eligible for retirement plans

Cons

- you don’t own a crypto if you own a crypto fund,

- you don’t benefit from the decentralized financial system provided by cryptocurrencies,

- fees are considered high in comparison to regular ETFs

Summing up

That being said, there are a few ways for you to start earning passive income with cryptocurrencies: lending, staking, liquidity mining, yield farming and crypto funds.

Lending your funds to a person, to a service or to smart contracts is one of the most popular ways to generate passive crypto income today. Using centralized lending platforms, you can earn up to 12% over a period of 12 months.

When proof-of-stake validators approve transactions or propose new blocks, the fees generated as a result of approval and proposal go to them and other stakeholders. This is basically how staking works. In some cases, you even earn 10% to 20% per year.

Liquidity providers always hold a proportionate share of the pool on DEXes, decentralized exchanges, and get rewards for adding liquidity. They usually accumulate around 0.2-0.3% of the trade size in the pool and LP tokens as a reward for their activity.

Yield Farming is a way to accumulate yield on your LP tokens if you already have them. Say, you hold 10% share of the farm’s assets, which is huge. Then, you generate 10% off the reward pool. Plus, if the coin you’re staking is rising, the additional return can go up to 20%

But be careful with everything DeFi. As the expert crypto trader Nico puts it, “If the prize is too good, then I start doubting”. While mining liquidity and farming yield, don’t forget to calculate your fees and returns beforehand, and, of course, do your own research.

As for crypto funds, just like an ETF, a crypto fund tracks a basket of crypto assets and is managed by experienced analysts. In the same vein with a traditional asset on a stock market exchange, your returns depend on a market situation.

And, last but not least, there’s, actually, one more way to earn passive income and make money work for you. In the never-sleeping cryptocurrency market, crypto holders often use automated trading strategies to simplify their processes. These services are often called crypto bots and spare you time and emotional outbursts. However, while using bots, you still need to monitor them as well as the market itself.

If you’re interested in crypto trading automation, try TradeSanta for free! It offers a 3-day FREE trial of the Maximum package, which means an unlimited number of bots, unlimited trading volume, TradingView signals on Binance, Huobi, HitBTC, Coinbase Pro and many more useful features.

Still have questions? Shoot all of them on our socials: Facebook, Telegram, Twitter

FAQ

What is lending in crypto?

Lending your funds to a person, to a service or to smart contracts (hello, future) is one of the most popular ways to generate passive crypto income today. Normally, the process involves two to three parties: a lender, a borrower, and a DeFi or CeFi platform.

What is Staking in crypto?

Just like the proof-of-work mining algorithm in Bitcoin, staking (the proof-of-stake mining algorithm) helps create new blocks on the chain, but in another manner and without burning as much electricity as the whole country of Honduras. The key takeaway is that you create new blocks by putting your money on the line (staking) for a chance to become a validator.

What is Yield Farming?

Yield Farming is a way to accumulate yield on your LP tokens if you already have them. To farm yield, you will need to stake those tokens on specific “farms”. For that, you will return a fraction of the farm’s award pool.