Can you code an algo for a winning crypto trading strategy yourself? Actually, yes, but there are a lot of dragons to slay along the road. After reading this article, you’ll at least know what books can come in handy in this endeavor.

What makes trading algorithmic?

Before developing an algorithmic trading strategy on your own, let’s learn what algorithmic trading is. Algorithmic trading is a process of executing buy and sell orders with the use of pre-programmed trading instructions. These instructions might take into account such variables as price, timing, volume, technical indicators, etc.

There are providers like TradeSanta in the crypto market that have already automated the most common trading strategies for you. So you don’t have to code the algorithm with your hands, and just use time-proven strategies without writing a single line of code.

But if you’re still willing to try and build an algo of your own, here’s a lineup of books to use while doing so. These are all books on developing algorithms for the traditional stock market, however the same principles apply for crypto algos as well. So, tune in!

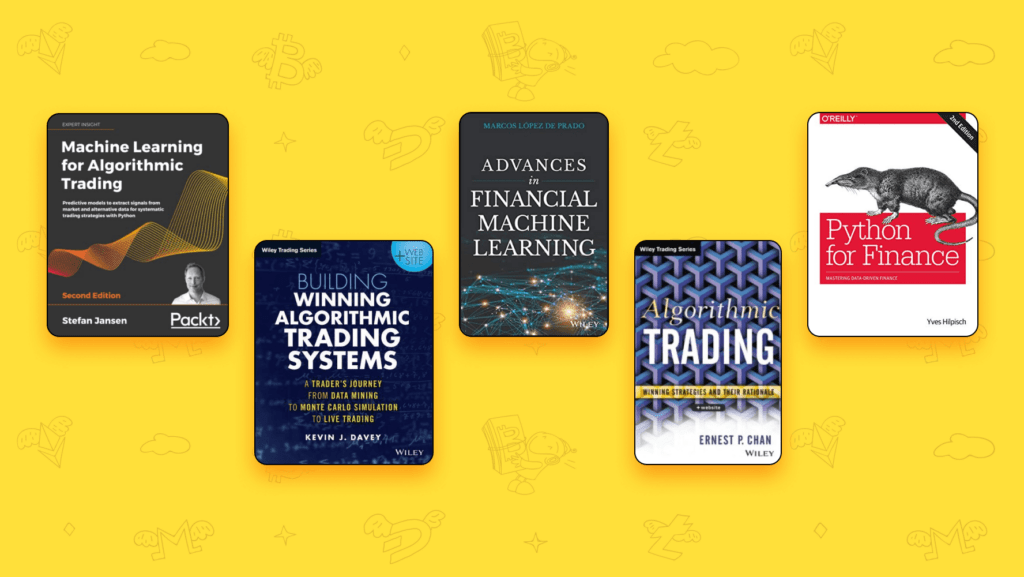

Top 5 books on algo trading

Building Winning Algorithmic Trading Systems

By Kevin J Davey

If you’re not ready to jump right into a very tight and technical read filled with challenging concepts that will likely make your brain work to an extreme or intense degree, out of all algorithmic trading books existing out there, this one would be a very natural warm-up for this next challenging step. Kevin J Davey has written his book as if he was writing a diary on all of his trials and tribulations over the past twenty years in trading. Spoiler alert: compared to the other books on the list where you have to work hard on every page, this one is simply an interesting and entertaining read that slowly introduces you to trading and programming concepts.

The essential seven parts of the book cover: A Trader’s Journey (1), Your Trading System (2), Developing a Strategy (3), Creating a System (4), Considerations before Going Live (5), Monitoring a Live Strategy (6), Cautionary Tales (7), and more.

In the very first part of the book, Davey shares the most common mistakes for every trader that he has also made at the start. Then he focuses on primary ways to test any trading system, for example, he talks about Monte Carlo simulation as a type of analysis to see if the performance of the trading system was successful. Deeper into the book, Davey details the process he currently uses to design and develop winning algorithmic trading systems. Before designing a system, he recommends, for instance, that you have specific, attainable and relevant goals, a way to measure your progress on the goals, and a deadline for creating such a system.

Python for Finance

By Yves Hilpisch

Python for Finance: Mastering Data-Driven Finance

There’s a plethora of programming languages out there, and while it is possible to use C++ while writing an algorithm, it’s not the only option. That said, here is where Python enters. Why Python, then?

First of all, it has a great support system when it comes to AI/ML frameworks and big data – you’re going to need those sooner or later while developing an algo. Also, if you’re just a beginner and don’t know how to write code, you should know that Python has the reputation of the easiest language to start learning programming with.

The book by Yves Hilpisch is second on our list of top algorithmic trading books because it’s time for you to get familiar with basic programming concepts, without which it’s simply not possible to write any trading algorithm. Also, Hilpisch focuses on Python in finance as you’ve probably already understood, which in itself will be very useful for your further studies. Here’s a quick look at the content table of this book: Why Python for Finance (1), Mastering the Basics (2), Financial Data Science (3), Algorithmic Trading (4), and Derivatives Analytics (5).

Hilpisch starts with a brief history of Python and quickly shifts to its application in finance, focusing on the language’s infrastructure, syntax, efficiency and productivity. In the next part, he proceeds to basic programming concepts and shows how to use them in order to do data analysis. At this point, you start working towards algorithmic trading quicker and quicker by learning all about how to retrieve data, implement trading strategies, run neural networks. simulate financial models and ultimately start building winning algorithmic trading systems.

Machine Learning for Algorithmic Trading

By Stefan Jansen

The reason why this book is the third one on the list is because it covers all the essentials and technicalities you need to get familiar with before proceeding with more difficult books of this category on the web. Stefan Jansen is not only focusing on separate aspects of machine learning, trading stocks, or coding algorithms – he combines it all. You will have to use external sources a lot to understand what the author is talking about but if you power through, this work will make it easier for you to absorb information from the other books that are written even in a more difficult language.

Say you’ve ultimately decided to spend a few months meticulously studying the material – and it’s a lot of material, namely, 820 pages, – what will you learn? The book has four parts that address different challenges. It introduces you to data sourcing (1), model optimization (2), natural language processing (3), and deep and reinforcement learning (4).

In the first part of his book, Jansen shows how to use Python to access and manipulate trading and financial statement data. Then, he introduces you to the range of supervised and unsupervised ML models and teaches you how you can apply them to trading. There’s a part in the book that is dedicated to processing natural languages for extracting alternative data. Also you’ll learn how to adapt deep reinforcement learning and, in general, model an agent that interacts with the financial market.

Algorithmic Trading: Winning Strategies

By Ernie Chan

Algorithmic Trading: Winning Strategies and Their Rationale 1st Edition

Algorithmic Trading is definitely the read for those of you who already have experience in creating algorithmic trading strategies. According to the author, “the level of mathematics needed in the trading of stocks, futures, and currencies is far lower than that needed in derivatives trading, and anyone familiar with freshman calculus, linear algebra, and statistics should be able to follow my discussions without problems.”

The 200-page printed version of this work consists of 8 chapters: “Backtesting and Automated Execution”, “The Basics of Mean Reversion”, “Implementing Mean Reversion strategies”, “Mean Reversion of Stocks and ETFs”, “Mean Reversion of Currencies and Futures”, “Interday Momentum Strategies”, “Intraday Momentum Strategies”, “Risk Management”.

In the very first part, the author spends much effort convincing you that you should backtest every strategy that comes your way before trading it. Then he proceeds to Mean Reversions showing how you can profit from them every so often. And last but not least, Chan focuses on building and testing momentum strategies giving a lot of use cases on futures, ETFs and commodities. But you will be able to apply those to digital coins, too.

Advances in Financial Machine Learning

By Marcos Lopez de Prado

Advances in Financial Machine Learning

The last book on our list of top algorithmic trading books is one of the most difficult reads in the realm of this article. It would be a nice fit for those who already know how to implement statistical data analysis techniques, time series analysis, machine learning, portfolio management and Python.

The printed version of this book consists of 353 pages and five parts: “Data Analysis”, “Modeling”, “Backtesting”, “Useful financial features”, and “High-performing computing recipes”.

A course at Cornell University is based on this textbook and lasts for several months.

Throughout the book, the author of the book, Marcos Prado, discusses data types, such as market data, alternative data, shows how to use meta-labeling, goes deep into labeling and backtesting, processes data with ML for optimal results, addresses the best ways to use supercomputers in financial algorithms, and more. However, the must-read chapters are chapters on backtesting pitfalls, hierarchical risk parity, deflated Sharpe ratios, explosiveness tests, entropy estimators, and microstructural features.

Conclusion

But how can you do all of that? Technically, you can try and develop a trading algorithm from scratch on your own. If you do decide to do so, the algorithmic trading books listed can be of help and show you how to source data, code your first viable agent, backtest it and finally put it to action.

However, if you decide not to learn algorithmic trading and develop an algo yourself, you can always use the platforms on the market that offer their automated algos. TradeSanta is one of those platforms, it gives you an opportunity to trade based on the algorithm using a powerful trading bot integrated with such exchanges like Binance, OKX, Huobi, Bybit, HitBTC, FTX, Kraken and Coinbase Pro and other prominent crypto exchanges.

Still have questions? Shoot them on Facebook, Telegram, or Twitter!

FAQ

Which algorithm book is best for beginners?

Everything depends on the level of your expertise. If you’re a beginner, you may start with learning basic programming concepts in Python for Finance by Yves Hilpisch and then slowly move to all the other books, such as Building Winning Algorithmic Trading Systems by Kevin J Davey.

Is algo trading profitable?

Yes, algo trading might be profitable if your algorithm is developed, backtested and applied correctly.